Deadline to Register for Self-Assessment in the UK

- Self-Assessment Deadline UK – Key Dates to Remember

- Who Needs to Register for Self-Assessment?

- Consequences of Missing the Self-Assessment Deadline

- How to Register for Self-Assessment Online

- Tips to Stay Ahead of the Self-Assessment Deadline

- How We Can Help Your Clients Meet the Deadline

- Related Tax Deadlines You Should Know

- Frequently Asked Questions (FAQ)

- Conclusion

Accounting practices must manage multiple deadlines associated with UK self-assessment on behalf of their clients. Still, none is as critical as the deadline to register for self-assessment. 5 October is the deadline to register for self-assessment and achieving that will avoid penalties.

That’s just one; there are multiple deadlines to meet under self-assessment, such as submission and payment deadlines. Things can get confusing when handling multiple self-assessments. Therefore, you need to remember specific key deadline dates, who and how to register, the consequences of missing them, and how outsourcing can help you in staying ahead of the curve.

Let’s dive into the world of self-assessment.

Self-Assessment Deadline UK – Key Dates to Remember

When it comes to deadlines under self-assessment, it is applicable to two aspects: registration and filing/submission. Here are the deadlines you must keep an eye on:

- 5 October – It’s the deadline to register for Self-Assessment for newly self-employed or to file a tax return for the first time.

- 31 October – This date is the self-assessment deadline for submitting paper return tax to the HMRC.

- 31 January – Submission of the online tax return needs to be done. Plus, it is also the deadline to pay the self-assessment tax.

- 31 July – This is the second payment deadline for any outstanding balance.

It must be noted that the tax year in the UK runs from 6 April to 5 April the following year. These deadlines apply to most individuals and businesses.

Who Needs to Register for Self-Assessment?

Self-Assessment tax return is a system developed by the HMRC to collect Income Tax. Salaried people’s taxes get deducted automatically, which cannot be done for businesses or people with other income sources. Hence, they are expected to report it in a self-assessment tax return.

It means that self-assessment is applicable only if your clients fall into the following criteria:

- Self-employed or sole traders who earned more than £1,000 before claiming tax relief.

- Partners in a business partnership

- Income from property, investments, or savings is not taxed at source.

Your clients will also be required to do a self-assessment if:

- They are getting money from renting out a property

- Earning foreign income

- Tips and commission

Therefore, you must constantly review your clients’ records to confirm all your eligible clients are registered on time to avoid penalties.

Consequences of Missing the Self-Assessment Deadline

If you register your clients late (after 5 October) for self-assessment and do not pay the tax by 31 January, then your clients will get a ‘failure to notify’ penalty. This penalty is based on the amount still left to pay and will be received within 12 months after HMRC receives your Self-Assessment tax return.

Now, if there is a delay in tax return filing, the penalties will be:

- £100 penalty initially

- After 3 months, additional daily penalties of £10 per day, up to a maximum of £900

- After 6 months, a further penalty of 5% of the tax due or £300

- After 12 months, another 5% or £300 charge, whichever is greater

And if the payment deadline is missed, then:

Penalties of 5% are applicable on the tax unpaid at

- 30 days

- 6 months

- 12 months

Plus, an interest will be charged on the amount owed by your clients. Hence, ensure your clients make the payments as soon as possible and save them from unnecessary hassle.

How to Register for Self-Assessment Online

To make a self-assessment for your client, you will need to register for self-assessment with the HMRC before or by 5 October. Hence, this is what you need to do.

- Create a government getaway account on the HMRC website

2. Provide your clients’ personal details, such as:

- Name (and any previous name)

- National Insurance Contribution number

- Date of birth

- Home address

- Telephone number and email address

- Reason you need to register

- Business name

- Business address (if different from your home address)

- Date you started self-employment

- Type of work

3. The Unique Taxpayer Reference (UTR) number will arrive within 1 to 2 weeks with an activation code.

4. Sign in to the account to submit your client’s tax returns electronically.

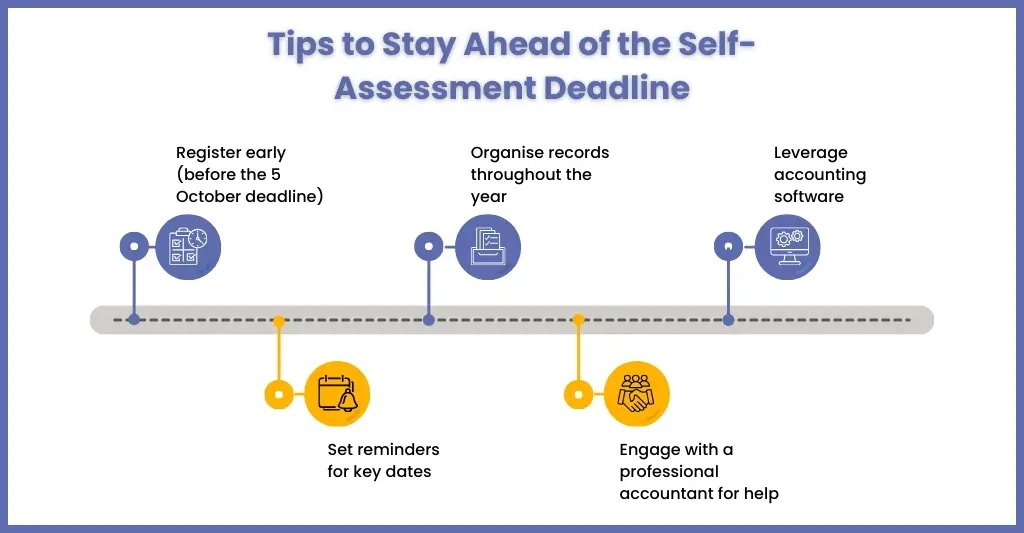

Tips to Stay Ahead of the Self-Assessment Deadline

It’s better to avoid the last-minute rush in registering your clients for self-assessment, as there is potential for costly mistakes. Therefore, it would be preferable to take proactive steps throughout the year to streamline the self-assessment process.

Here are some tips to stay ahead of the curve in self-assessment:

Register Early

Always encourage your clients to register for self-assessment or assist them in registration as soon as they start their business. With early registration, the HMRC will have all the details in advance, thus giving your clients the time to prepare for tax returns.

Why it matters: Early registration will save your clients from penalties even if they are not ready to submit their returns.

Organise Records Throughout the Year

Keeping financial records up to date throughout the year is one of the most effective ways to avoid last-minute stress when filing a self-assessment tax return. Encourage your clients to maintain accurate and organised records of all their profit and loss accounts, cash flow statements, receipts, and invoices.

Why it matters: A well-maintained record system ensures that clients don’t waste time hunting for documents at the last minute. It also reduces the likelihood of errors or missing deductions, which could increase their tax liability.

Leverage Technology

Select the best accounting software to track your clients’ incomes and expenses efficiently. Also, encourage your clients to use this software that integrates with their bank account, tracks business expenses, and calculates taxes automatically.

Why it matters: Utilising accounting software reduces human errors and simplifies the entire process. It will also ensure that the time and effort spent on filing is saved. Through accounting software, your clients will get access to accurate financial statements at any time, thus maintaining accountability. You can also utilise year-end accounts outsourcing services, which provide access to accounting software, thereby saving money on purchasing, installation, and training.

Set Reminders for Key Deadlines

There are multiple deadlines associated with self-assessments. The process begins with the registration deadline of 5 October, followed by filing the tax return by 31 January. Keeping track of these deadlines is essential; hence, keep a reminder system to ensure no deadlines are missed.

Why it matters: When reminders are sets for deadlines you will be in a position to alert your clients in advance about it thus saving them from HMRC penalties or other legal hassles.

Engage a Professional Accountant

The best way to handle the self-assessment process of your clients is to use the expertise of an accountant. A professional and experienced accountant is well aware of the UK tax laws, thus ensuring full compliance and minimising the risks of costly mistakes.

Why it matters: If in-house accounting expertise is unavailable, consider outsourcing to a provider with accountants who can assist and offer strategic advice. This way, you can reduce your clients’ liabilities and ensure everything is in order.

How We Can Help Your Clients Meet the Deadline

We have seen situations where accounting practices get overwhelmed with multiple self-assessments. It is a situation that you would want to avoid after all, your clients are looking towards you for guidance. In such an overwhelming situation, you must partner with Corient, which is well-experienced in dealing with self-assessment deadlines.

Our services include:

- Proactive registration for new Self-Assessment clients.

- Timely submission of tax returns before HMRC deadlines.

- Accurate record-keeping and preparation of supporting documents.

- Strategic tax planning to minimise liabilities.

- Regular reminders and communication to ensure no deadlines are missed.

When your clients know that professional accountants of Corient are handling their assessments, then they will have the peace of mind that all the compliance related to self-assessment will be taken care of.

Related Tax Deadlines You Should Know

Well, we have covered everything related to self-assessment. Let’s take a look at other important UK tax deadlines. These deadlines are not related to self-assessment, but keeping an eye on them is essential to keep your clients compliant and avoid penalties or interest charges. Here’s a detailed look at some of the most important deadlines:

- PAYE submissions for employees: Submitted by employers monthly

- VAT returns: Quarterly for VAT-registered businesses

- Corporation Tax payments: 9 months after the end of the accounting period.

- Payment on account: Due on 31 January and 31 July each year.

Given the complexity associated with UK tax deadlines, accounting practices need to maintain a comprehensive tax calendar to track all their clients’ obligations efficiently.

Frequently Asked Questions (FAQ)

Yes, late registration is possible, but penalties apply. HMRC may impose fines and interest for delayed registration.

Once registered, clients are responsible for submitting their tax return and paying any owed tax by 31 January following the end of the tax year.

Yes, accountants can register clients on HMRC’s portal, receive the UTR, and assist in setting up online accounts to ensure timely filing.

Suppose you meet the criteria for self-assessment and owe tax. In that case, the 5 October registration deadline is a legal obligation, and you may be charged a failure-to-notify penalty if you register late.

It is essential to register as self-employed if your income exceeds £1,000 per tax year (the trading allowance). The process is straightforward and can be completed entirely online. Make sure to register by 5 October.

You will find the official guidance for HMRC’s self-assessment registration on GOV.UK. Here are the most relevant places to look:

a. The main guide “Registering for Self-Assessment” page

b. The “Sign in or set up an account HMRC online services” page, which includes registration for Self-Assessment as part of setting up your personal/business tax account.

Conclusion

The deadline to register for self-assessment is crucial for your UK-based business clients. By missing the deadline to register, you will be making them liable for penalties, interest, and other legal hassles. Therefore, it’s your responsibility to ensure that your clients are compliant with it. Ensure that the tips, like record-keeping, early registrations, and setting reminders, are followed to keep your clients compliant, so that they are focused on their business.

Agreed, that even with all the tips and awareness, handling multiple self-assessments single-handedly is not viable. You will need professional and experienced support, which can only come through by partnering with a well-renowned service provider like Corient. Since 2011, Corient has been providing valuable assistance to countless accounting practices in the UK in handling bulk self-assessments through year-end accounts outsourcing services with success.

If your clients need support with Self-Assessment, registration, or filing, our team is here to guide them every step of the way. For assistance, please use our contact form to get the help you deserve.