Capital Allowance services claims are now much easier

Every business should have the opportunity to gain advantage of capital allowance claims. We assist accountants in handling a greater volume of capital allowance claims, enabling accounting firms to help several businesses identify their full entitlements

Our tasks include gathering information, assessing fixed assets, and submitting claim reports. We have established a dedicated Business Tax Support team comprised of experts ready to assist your accounting firm with the workload of capital allowance work.

Our Business Tax Support team will simplify and streamline the complex process of Capital Allowance services, freeing you to focus on tax advisory and other advisory services aimed at enhancing your business without straining your firm's resources, time, or finances.

We utilise secure cloud-based technology to make our working papers and supporting documentation accessible for your review. We are also open to utilising your firm's document management systems to record our work if that is your preference.

Our tasks include gathering information, assessing fixed assets, and submitting claim reports. We have established a dedicated Business Tax Support team comprised of experts ready to assist your accounting firm with the workload of capital allowance work.

Our Business Tax Support team will simplify and streamline the complex process of Capital Allowance services, freeing you to focus on tax advisory and other advisory services aimed at enhancing your business without straining your firm's resources, time, or finances.

We utilise secure cloud-based technology to make our working papers and supporting documentation accessible for your review. We are also open to utilising your firm's document management systems to record our work if that is your preference.

GDPR & Data Protection

Compliance with GDPR and ISO27001 is a cornerstone of Corient, ensuring your client data's endless security and offering you peace of mind.

Our teams have extensive experience and certification in all major cloud-based accounting software, which we access from our secure servers. Alternatively, if you prefer, we can establish secure remote login arrangements to access your firm’s server. You can fully rely on our team of knowledgeable and experienced professionals to provide you with bookkeeping services as per your requirements.

Our teams have extensive experience and certification in all major cloud-based accounting software, which we access from our secure servers. Alternatively, if you prefer, we can establish secure remote login arrangements to access your firm’s server. You can fully rely on our team of knowledgeable and experienced professionals to provide you with bookkeeping services as per your requirements.

Business Tax Support

Scope of the work

You may rely on our highly skilled business tax support to deliver the following services based on your requirements

Our processes include

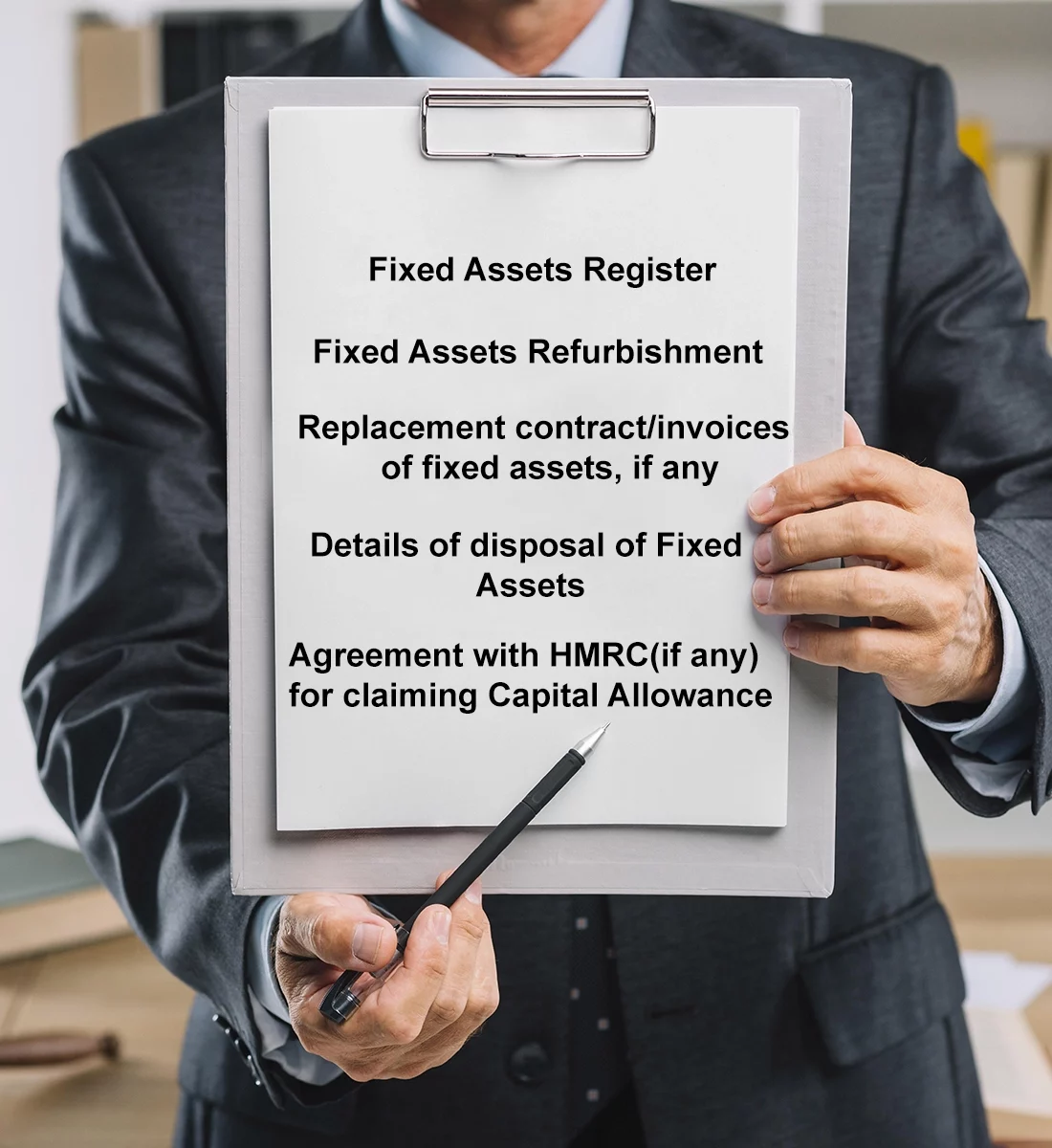

You are required to provide

Reports generated

Our processes include

You are required to provide

Reports generated

Schedule a Call With Us Today

If you want to take your Accountancy firm to the next level and increase the quality and efficacy of your year-end accounts preparation services while lowering expenses, contact our professional team today.