Bookkeeping vs Accounting: What’s the Real Difference?

If your clients keep asking you, “Bookkeeping vs Accounting: What’s the Real Difference?” you’re not alone. It’s one of the most common questions we hear from accountants across the UK. And while the distinction might be crystal clear to us as professionals, it’s genuinely confusing for most business owners.

To address this confusion, we have created this blog. Here, we will explain the distinction in detail and explain how outsourcing accounting work will make your practice profitable.

If bookkeeping work is straining your resources, then this article is for you.

Key Takeaways

- Bookkeeping is the process of recording what happens with your client’s money every day.

- Accounting is about making sense of those records and using them to make smart business decisions

- Your bookkeeper keeps the records straight; your accountant tells you what they mean and helps with tax planning

- Most businesses genuinely need both, though one person or firm can sometimes handle both roles

- Outsourcing can cut your costs by up to 60% compared to hiring someone full-time

- Bookkeepers typically have AAT qualifications; accountants usually hold ACCA, CIMA, or ICAEW credentials

What Actually Is Bookkeeping?

Think of your bookkeeper as someone who’s keeping a detailed diary of every penny that comes in and goes out of your business. That’s really what it boils down to.

What Your Bookkeeper Does All Day

Bookkeeping is straightforward work, but it must be done accurately and consistently. There are over 290,000 qualified bookkeepers working across the UK right now, according to the Association of Accounting Technicians (AAT), and they’re all doing basically the same thing: keeping businesses organised.

Here’s what they’re actually doing:

- Recording sales invoices and purchase invoices

- Posting receipts and payments

- Bank reconciliation

- Payroll processing

- VAT return preparation (the number-crunching part, not the planning)

- Managing accounts payable and receivable

- Maintaining the nominal ledger

The Software They Use

Most bookkeepers have transitioned from manual to digital and automation using the latest accounting software like Xero, QuickBooks, Sage, or FreeAgent. These software linked to your clients accounts and collects data from multiple sources.

These tools are very important because they are MTD-compliant, and MTD will be implemented on Income Tax in 2026. Thus making it important for preparing a proper bookkeeping.

Money-Saving Tip

Outsourcing both services can save you 40-60% compared to hiring full-time staff—plus you get expert-level work!

What Actually Is Accounting?

If bookkeepers are the people documenting what happens, accountants are the ones who look at all that documentation and tell you what it actually means for your practice.

What Your Accountant Does

Under accounting, the records generated in bookkeeping will be used for preparing financial statements and insights, which are:

- Preparing statutory accounts for Companies House

- Analysing financial statements to identify trends and issues

- Corporation Tax and Self-Assessment planning and compliance

- Management accounts with commentary and recommendations

- Cash flow forecasting and scenario planning

- Strategic business advice on structure, growth, and efficiency

- Audit services were required

- Advisory work on transactions, funding, and exits

The Qualifications That Matter

UK accountants typically have one of these qualifications, which take years to earn:

- ACCA (Association of Chartered Certified Accountants): Over 240,000 members worldwide, recognised pretty much everywhere

- ICAEW (Institute of Chartered Accountants in England and Wales): The traditional gold standard, with over 208,000 members

- CIMA (Chartered Institute of Management Accountants): Focuses more on business strategy and management

These aren’t quick online courses. We’re talking years of study plus practical experience, followed by ongoing professional development to stay current.

What are the main differences between bookkeeping and accounting?

| What’s Different | Bookkeeping | Accounting |

| The Big Picture | Focused on recording what happens | Focused on understanding what it means |

| When It Happens | Daily or weekly—ongoing work | Monthly, quarterly, or yearly reviews |

| What You Get | Clean records, sorted receipts, balanced books | Financial reports, tax returns, business advice |

| Skills Needed | Detail-oriented, organised, software-savvy | Analytical, tax-knowledgeable, strategic thinker |

| Business Decisions | Gives you accurate data to work with | Helps you make smart decisions with that data |

| How Often You Need It | Constantly—it never stops | Periodically—when you need guidance |

| Best Used For | Keeping your finances organised | Understanding and growing your business |

Why Your Business Needs Both (Yes, Really)

You cannot choose between bookkeeping and accounting. Both are important and are the foundations of your client’s business.

One Can’t Exist Without the Other

Accounting literally cannot happen without bookkeeping. You can’t analyse data that hasn’t been recorded. You can’t file accurate tax returns from messy, incomplete records.

And here’s what most people don’t realise: if your bookkeeping is a mess, your accountant will charge you accountant rates to clean it up before they can even start doing actual accounting work. That’s expensive.

They Solve Different Problems

Bookkeeping solves chaos. Without it, you don’t know who’s paid you, who you owe money to, or whether you’re actually profitable.

Accounting solves confusion. Even with perfect bookkeeping, you might not understand whether your business model works, how to save on taxes, or whether you’re on track financially.

A Real Example

Imagine an accounting practice in the UK with two partners and a handful of staff. The firm looks after around 200 clients, mostly limited companies, contractors and a few busy sole traders.

For years, the team tried to do everything themselves: bookkeeping, VAT returns, payroll, management accounts and year‑end compliance. As the client list grew, so did the late nights. Every quarter felt tight, and the run‑up to year-end was a constant scramble.

Every quarter, the partners step in to do the higher‑value work:

- Reviewing VAT returns

- Spotting trends in margins and cash flow

- Planning for Corporation Tax

- Giving advice on drawings, dividends and pensions

The outsourced team keeps the engine running; the practice provides the steering. They need both: outsourcing for efficiency and capacity, and in‑house expertise for strategy and client relationships.

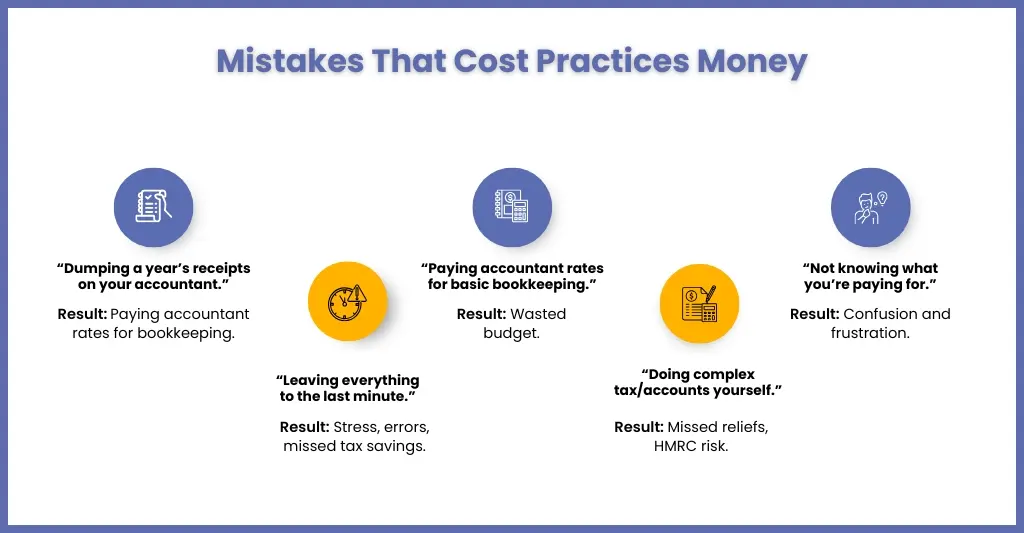

Mistakes That Cost Practices Money

Understanding the difference helps you avoid these expensive errors:

Mistake 1: Dumping a Shoebox on Your Accountant

Lots of people bring a year’s worth of receipts to their accountant in January and expect them to sort it. But you’ll pay accountant rates for what’s basically bookkeeping work.

Better approach: Keep your bookkeeping current throughout the year. Your accountant can then focus on actual accounting, saving you money.

Mistake 2: Leaving Everything Until the Last Minute

Scrambling to organise transactions right before your Self Assessment deadline (January 31st) or company year-end creates stress and errors. You also miss opportunities to save on tax.

Better approach: Treat bookkeeping as ongoing. Weekly or monthly updates keep everything manageable and give your accountant time to spot tax-saving opportunities.

Mistake 3: Paying Accountant Rates for Bookkeeping

Some businesses recruit accountants to do their bookkeeping which is a wasteful expenditure.

Better approach: Let the expert bookkeeper do the bookkeeping and accountants must do taxation work and strategy.

Mistake 4: Going Completely DIY on Complex Stuff

Some self-employed people try to handle everything themselves, including tax planning and accounts. It might save money in the short term, but it often costs more in missed tax relief or HMRC issues.

Better approach: At a minimum, hire an accountant annually for tax planning. What they save you usually exceeds their fee multiple times over.

Mistake 5: Not Knowing What You’re Paying For

Some business owners don’t understand whether they’re buying bookkeeping, accounting, or both. This leads to confusion and frustration.

Better approach: Ask specific questions. Know exactly what’s included in any service package.

How Technology Is Changing Everything

The line between bookkeeping and accounting keeps shifting as technology evolves.

Automation Is Taking Over Routine Stuff

Modern software increasingly handles traditional bookkeeping tasks automatically. Bank feeds import transactions, AI categorises them, and OCR technology reads receipts straight into your accounts.

Sage research shows that automation can cut bookkeeping time by up to 80% for routine tasks such as transaction categorisation.

But this doesn’t eliminate bookkeepers; it changes their role. Instead of manual data entry, they focus on reviewing automated entries, handling exceptions, and ensuring compliance.

Cloud Software Changed the Game

Cloud platforms like Xero, QuickBooks Online, and Sage Business Cloud transformed how bookkeepers and accountants work together. Both access the same real-time data simultaneously.

For practices, this means your external team has instant access to your data while you can check your finances anytime you want.

Real-Time Tax Is Coming

Making Tax Digital is just the start. HMRC‘s vision is for real-time digital tax accounts, where businesses interact continuously through software rather than submitting quarterly or annually.

This makes accurate, up-to-date bookkeeping even more critical. The old approach of sorting everything at year-end won’t work in a real-time world.

But Humans Still Matter

Despite all the tech, both bookkeeping and accounting need human judgment. Software can categorise transactions, but it takes a person to spot fraud patterns, interpret financial trends, or give tailored business advice.

The best approach combines technology’s efficiency with human expertise, letting software handle routine tasks while professionals focus on analysis and advice.

Making the Right Choice for Your Business

So how do you decide what you actually need?

Ask Yourself These Questions:

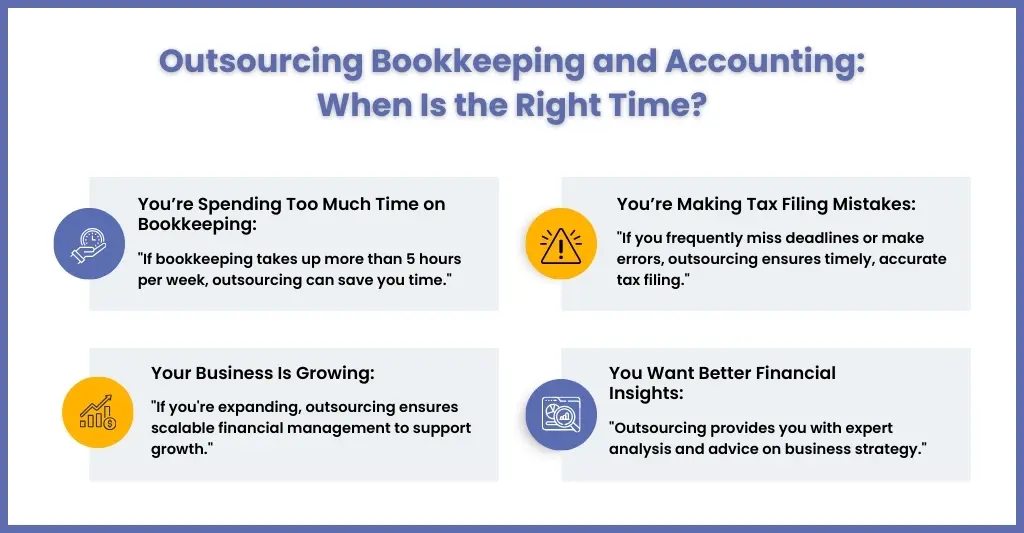

How many transactions do you process monthly? Fewer than 50? You might manage yourself. More than 100? Professional help makes sense.

How comfortable are you with financial stuff? If it intimidates you, outsourcing removes that stress entirely.

What’s your time worth? If bookkeeping takes 5 hours weekly and your time is worth £50/hour, that’s £13,000 annually, way more than professional services cost.

How complex is your business? Multiple income streams, VAT, employees, and international sales all increase complexity. More complexity usually means you need professional help sooner.

What are your growth plans? Planning to expand? You need accurate financial data and strategic advice. Get the infrastructure in place before you need it.

Frequently Asked Questions

Yes, qualified accountants can definitely handle both. But here’s the thing: you’d be paying accountant rates (£50-£150+/hour) for basic bookkeeping work, which isn’t cost-effective. Better setup? The bookkeeper handles daily transactions, the accountant reviews periodically and handles tax planning. Many firms offer combined packages at reasonable rates.

Bookkeepers are required to have the following qualifications, which include AAT (Association of Accounting Technicians), ICB (Institute of Certified Bookkeepers), or IAB qualifications. Professional accountants are required to acquire certifications from ACCA and ICAEW. These qualifications or certifications ensure they are well-versed in UK tax laws and UK accounting standards.

Outsourcing firms use advanced accounting software that uses encryption to secure financial data and comply with UK GDPR and ISO 27001. Platforms like Xero offer controlled access, hence question a provider for such services before signing up.

If you are spending considerable time in bookkeeping and accounting and making errors that trigger HMRC investigation, then it’s time to hire professionals through an outsourcing service provider.

Final Thoughts

Bookkeeping and accounting depend on each other to create a clear financial picture. Bookkeeping organises the data, and accounting uses that data to create statements that comply with HMRC regulations.

The real question is how to get them done: by yourself, by employees, or by outsourced specialists. Both are important, so the question arises: how to get it done, in-house or through outsourcing.

In recent years, accounting practices in the UK have been turning towards outsourcing due to access to expertise at a fraction of the cost and the ability to scale up as per accounting demands.

The choice of handling yourself or partnering with a specialist outsourcing provider like Corient is yours to make. But make sure it is covered properly, after all, your client’s business depends on it.

If you are finding it challenging to handle it in-house, then choose to outsource to Corient by using the contact form.

Your future self will thank you for making financial clarity a priority today.