Benefits of Outsourcing Payroll: Why UK Businesses Are Making the Shift

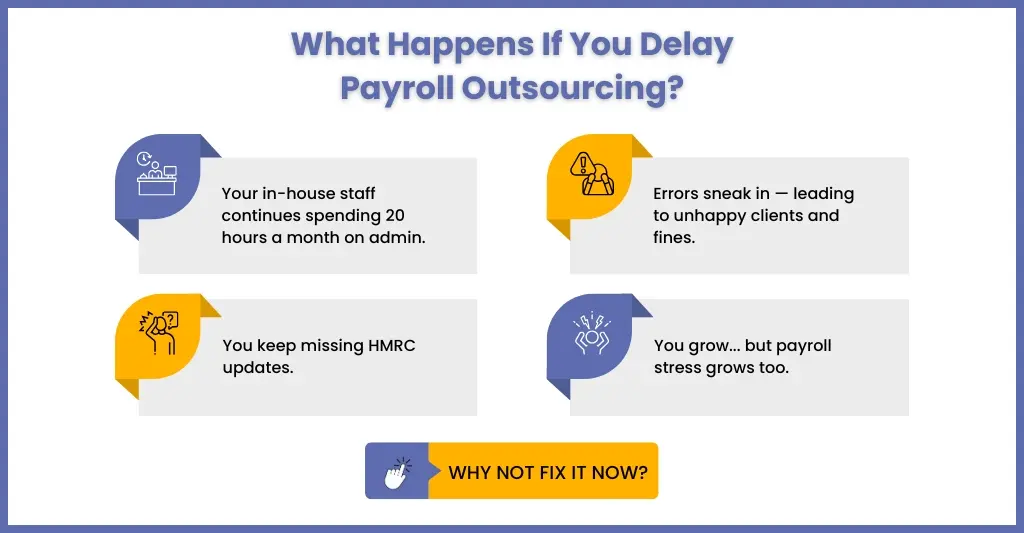

Payroll management is a highly demanding job in terms of time and resources. For this very reason, your UK business clients have offloaded this important responsibility onto your shoulders. However, practices have discovered that they are in a position to offer far more benefits to their clients by outsourcing payroll rather than getting it done in-house.

The benefits of outsourcing payroll for your clients include minimising errors, saving time, maintaining full compliance, and reducing costs, among others. Seeing these benefits, even your clients will back you up. This blog explores the benefits of outsourcing payroll, why UK businesses will prefer outsourcing payroll, and how it can help them thrive in today’s competitive market.

Let’s explore.

Why UK Businesses Choose Payroll Outsourcing

UK businesses are increasingly preferring practices that involve payroll outsourcing, and there are some strong reasons for this preference. Currently, the UK accounting environment presents numerous challenges, including complex tax laws, evolving employment regulations, and the time-consuming nature of managing payroll in-house.

Naturally, such challenges will slow down their payroll work, which your clients will not like. Therefore, your clients will prefer that you outsource their payroll work to speed up the entire process. Through payroll outsourcing services, your clients will get access to payroll experts who will reduce the risk of costly errors, save valuable time, and ensure full compliance with the latest HMRC payroll regulations.

Along with these complexities, you will also need to consider that as your client’s payroll volume grows, handling it in-house, even with an expanded staff, would be difficult. Plus, with the rise of automation and AI in payroll, your clients will expect these advanced solutions.

Top 7 Benefits of Outsourcing Payroll

Accounting practices across the UK are increasingly preferring to outsource payroll work. However, acceptance among practices in the past for outsourcing payroll was low due to data security issues and client objections to sharing their sensitive data. However, there is now widespread acceptance of outsourcing among clients, primarily due to the benefits it offers.

Let’s go through the top 7 benefits.

Time Saving

Payroll work is highly complex and time-consuming, involving managing employee data, tax calculations, deductions, and compliance checks. By outsourcing payroll to a service provider, you can free up your valuable time to focus on strategic objectives, speeding up the payroll process, and benefiting your clients.

Cost Savings

One of the most significant benefits of outsourcing payroll is the cost savings it offers. Outsourcing payroll reduces the need to expand your in-house team, payroll software, and training costs. This will result in a reduction in operating costs and paying only for the services availed from the service provider. The lower payroll outsourcing cost can then be passed on to your clients.

Reduction in Payroll Errors

Professional payroll service providers have started automating the entire payroll process, especially the labour-intensive aspects. By automating these aspects, payroll outsourcing providers have successfully reduced human errors in payroll, which typically occur during manual calculations and data entry.

Explore how a service provider helped in correcting payroll errors in this case study.

Protection of Sensitive Employee Data

Outsourcing payroll involves sharing your client’s sensitive employee data, including salaries, employee bank details, and National Insurance numbers. To avoid data leaks, reputable providers have started securing the data through robust data protection to prevent data breaches and full GDPR and Data Protection Act 2018 compliance.

Maintaining Compliance

Reputed payroll service providers always stay on top of HMRC regulations and their updates so that you and your clients do not fall into legal hassles. Also, a payroll provider will always take the lead in filing all the paperwork of your clients on your behalf.

Full Transparency

Professional service providers maintain transparency for employees by allowing them access to their pay information, log hours, and so on. Such initiatives increase employee confidence and dedication to work harder.

Employee Satisfaction

When payroll processing is done accurately, it will increase employee satisfaction. What better way to get it done than through outsourcing? A professional payroll service provider will ensure that your clients’ payroll work is done with full compliance and accuracy, which will create trust and satisfaction among the employees.

What Is the ROI of Outsourcing Payroll for a 50–200 Employee Company?

For accounting firms managing mid-sized clients, payroll quickly becomes resource-heavy as headcount grows. Outsourcing payroll delivers clear ROI by reducing internal delivery costs, freeing up team capacity, and lowering compliance risk.

For a 50–200 employee company, outsourcing typically replaces in-house software, training, and payroll staff time with a predictable monthly cost. This often results in 20–30% cost efficiency, especially when rework, error correction, and compliance updates are considered.

From an accounting firm’s perspective, the biggest return comes from time reclaimed. Payroll outsourcing can free several hours per payroll cycle, time that can be redirected towards advisory services, client management, and higher-margin work.

Outsourcing also reduces exposure to payroll errors and HMRC penalties by shifting responsibility to specialists who manage compliance, RTI submissions, and regulatory changes at scale.

How Outsourcing Payroll Supports Business Growth

How can outsourcing payroll have a positive impact on my business growth? It’s a valid question that your clients will ask. You can answer them in two parts.

Outsourcing payroll will free up your resources, which were consumed in handling multiple payroll tasks, thus reducing your operational costs. The resources freed up can be used for value-adding services like customer service and product development, which will help improve your client’s operational efficiency.

Additionally, through payroll outsourcing service providers, you will gain access to valuable payroll data. This data will help your clients identify business trends, make informed decisions, and improve workforce management. With accurate and timely payroll data, businesses can better plan for the future and make informed decisions that support long-term growth.

Choosing the Right Payroll Outsourcing Provider

The UK is home to countless payroll outsourcing providers offering services to practices based in the UK. However, it is essential to know what you are looking for in a payroll outsourcing provider. This will help in a smooth transition, minimise disruptions for employees, and preserve peace of mind.

Did you know?

Source: CIPP, 2024 Survey

61% of payroll errors are caused by manual entry and spreadsheet-based systems.

Therefore, while searching for a potential partner, consider the following factors:

Fix Your Requirements

Always decide on the payroll frequency and employee classifications, and find out providers that can handle these requirements. By choosing a provider that can handle your requirements, you will be saving your clients from future hassle.

Experience and Expertise

Select a payroll outsourcing service provider that has a strong record of managing payroll for clients of all sizes based in the UK.

Check the Reviews

Before selecting a payroll outsourcing partner, review their clients ‘ reviews and connect with them. They can provide outside decisions freely and without influence, thus helping you in making better decisions.

Handling Compliance

Search for a payroll service provider that is well-versed and fully compliant with UK tax laws, employment regulations, and GDPR.

Customer Support

The provider should offer excellent customer service, providing quick responses to queries and issues that may arise.

People Also Ask

The cost of payroll outsourcing depends on multiple factors, such as the size of the business, the complexity of the payroll, and the services provided. Outsourcing payroll costs between £2 and £25 per employee per month on average.

Payroll outsourcing providers use AI for automating tasks like calculating tax deductions, processing paychecks, and ensuring compliance with regulations. AI tools can highlight errors and discrepancies quickly, thus reducing the risk of mistakes. It will also help in increasing payroll accuracy by learning from previous data.

Some of the best payroll outsourcing companies in the UK are:

a. Corient: Preferred by accounting practices for its tech-savvy, experienced, reliable, and compliant payroll outsourcing services.

b. ADP: Known for its global payroll solutions and compliance expertise.

c. PayStream: Offers tailored payroll services for SMEs and contractors.

d. Sage Payroll: A reliable option for UK businesses looking for scalable payroll solutions.

e. FMP Global: A trusted provider with a focus on compliance and data security.

Outsourcing payroll will save you both time and money. Not having to spend long hours on administrative work affords you the ability to focus on growth initiatives, and improved accuracy can prevent costly penalties.

Payroll outsourcing can help save time, minimise errors, and improve the accuracy of paychecks, all while helping your clients comply with tax regulations.

A professional outsourcing provider will use time tracking tools, project management software, and access to talent at lower costs. By outsourcing non-core activities, you can focus on core accounting tasks and improve your profitability.

Conclusion

Considering the complexities in the UK payroll, it is clear that outsourcing payroll has a bright and long-term future. By choosing the right payroll outsourcing provider, you can help your clients in streamlining their payroll processes and ensure accuracy and timely payments for their employees. At the same time, you get time to focus on strategic initiatives for your clients. If you are looking to add more value for your clients in payroll, consider the outsourcing option.

Speaking about outsourcing options, there are many, but only a few will meet your requirements, and we believe that Corient will be the right choice for you. Since 2011, we have gathered experts and created accounting services that will add value to your services and streamline the payroll process for your clients. Our payroll outsourcing experts are experienced in PAYE RTI, Auto-enrolment, and utilise specialised software such as Xero, Payroll Manager, SAGE Payroll, IRIS, and other systems. We will also handle communications with HMRC on your behalf.

If you are saddled with too many payroll responsibilities then outsourcing payroll should be your next strategic move. So, what are you waiting for? Connect with us and get more access to our experts.