Which Outsourcing Companies Offer VAT and Tax Return Preparation for UK Accountants?

Currently, UK accounting market has multiple professional outsourcing companies such as Corient and QX Global Group which offers services in VAT and Tax return preparations for UK accountants. Ask any accounting practice and you will get the answer that VAT return and tax compliance is the two most important but time-consuming services that they provide to their clients.

To overcome this situation, practices have started relying on outsourcing VAT and tax return preparations. Outsourcing is not only about saving time, but also about improving accuracy, ensuring full compliance with HMRC regulations, and providing more advisory and customer service work.

To make the right choice when selecting an outsourcing partner, consider the following essential factors.

In this blog, we’ll walk through:

- Why outsourcing VAT and tax return preparation is becoming the norm

- Key factors UK accountants should consider

- A list of reputable outsourcing companies specialising in these services

- UK market insights on outsourcing adoption

Let’s get started.

Why UK Accountants Are Outsourcing VAT and Tax Return Preparation

Outsourcing is now becoming a lifeline for numerous accounting practices in the UK when it comes to navigating complex HMRC and tax regulations. These days, accounting firms are finding it easier to outsource their clients’ VAT and tax return preparations, and we have data to support this.

According to the UK Accounting Industry Report 2024 by IBISWorld, nearly 27% of accounting firms in the UK are now outsourcing compliance tasks such as VAT returns and corporate tax filings. These figures are expected to rise further in the future.

The main reason for this trend is:

Resource Management

Currently, UK firms are facing difficulty in sourcing the right talent, especially tax and VAT specialists. This demand for talent is being effectively met through outsourcing, thereby reducing the need for constant hiring of in-house teams.

Cost Efficiency

One more significant reason for outsourcing’s is its cost efficiency compared to hiring a VAT specialist in-house. The cost efficiency of outsourcing becomes more apparent during seasonal or peak-period workloads, such as year-end filings.

Focus on High-Value Services

Accounting practices have found it beneficial to outsource repetitive compliance tasks. It has saved time for multiple practices, thus allowing accountants to focus on value-adding advisory and consulting services, which clients favour.

Did You Know?

Over 5.5 million businesses in the UK are VAT-registered, creating constant demand for VAT return services

What UK Accountants Should Look for in an Outsourcing Partner

It would be inaccurate to say that every outsourcing firm is capable of meeting VAT return deadline and tax preparation. That’s why you will be required to understand your requirements and evaluate certain key factors during the selection process. These factors are:

UK Tax Law Expertise

Your outsourcing partner must have trained professionals who are familiar with HMRC regulations, UK tax systems, and accounting standards. Such familiarisation will help you in maintaining compliance with the latest updates for your clients.

Compliance & Data Security

Data security is not a luxury; it’s a necessity, especially when it comes to your clients’ sensitive data, such as personal information, workers’ salary details, and so on. Therefore, it is essential to verify that the provider is compliant with the GDPR, ISO 27001, and other relevant data security certifications.

Technology & Software Integration

These days, accounting tasks are completed more efficiently and effectively using the best accounting software such as Xero, QuickBooks, and Sage. Hence, select a partner who has experience in operating these accounting tools.

Transparent Communication

Emphasis on selecting an outsourcing partner that communicates with you through regular updates about the status of your accounting work. Such frequent communication is beneficial during major escalation points where a quick decision is required.

Turnaround Times

Choose a provider that offers guaranteed service-level agreements (SLAs), especially during peak seasons.

Reputable Outsourcing Companies Offering VAT and Tax Return Preparation for UK Accountants

Over 60% of UK accounting firms now utilise some form of outsourcing for compliance services, including VAT and tax returns. Sensing this business opportunity, multiple outsourcing accounting firms have emerged in the UK to provide relevant accounting outsourcing services, including tax return preparation and VAT outsourcing services.

Here are some credible names of UK outsourcing firms on which you can trust for VAT and tax return outsourcing:

Corient Business Solutions

Established in 2011, Corient has become the first choice for accounting firms based in the UK due to its efforts in staying well-versed with the latest UK accounting standards and requirements, such as MTD.

The strength of Corient is its dedicated, certified, and talented accounting staff, as well as its adherence to GDPR-compliant data handling practices. Over 200+ accountants have placed their trust on Corient’s VAT outsourcing, corporation tax outsourcing, personal tax return preparation, year-end accounts services, and more.

QX Global Group

QX Global has placed considerable focus on meeting the unique and evolving demands of UK accounting practices. Established in 2003, QX Global has been trusted by top accounting firms and offers services such as Tax returns, VAT filing, CIS returns, bookkeeping, and payroll outsourcing, among others.

Initor Global

Since 2006, Initor Global has been offering accounting outsourcing services to accountants and practices in the UK. It has earned its reputation as one of the top providers by offering relevant accounting services and a prompt turnaround time for practices and accountants. It has achieved compliance with its services under UK GAAP and FRS 102.

Outbooks UK

Offers transparent pricing models and tailored packages for small to mid-sized practices. Its VAT returns, year-end accounts, and corporation tax self-assessment services are compliant with the latest accounting standards and have proven effective for numerous accounting firms in the UK.

How to Get Started with VAT and Tax Return Outsourcing

According to the UK Office for National Statistics (ONS), as of Q1 2025, there are over 5.5 million VAT-registered businesses in the UK, a number expected to rise further. Naturally, these businesses require VAT services from your accounting firm. However, high work volumes, complex HMRC and VAT regulations, and changing accounting standards have placed pressure on accounting practices.

These factors have the potential to reduce practice productivity and increase the likelihood of errors in calculations and compliance, which is detrimental to the practices and their clients. To avoid this, outsourcing is becoming a preferred choice.

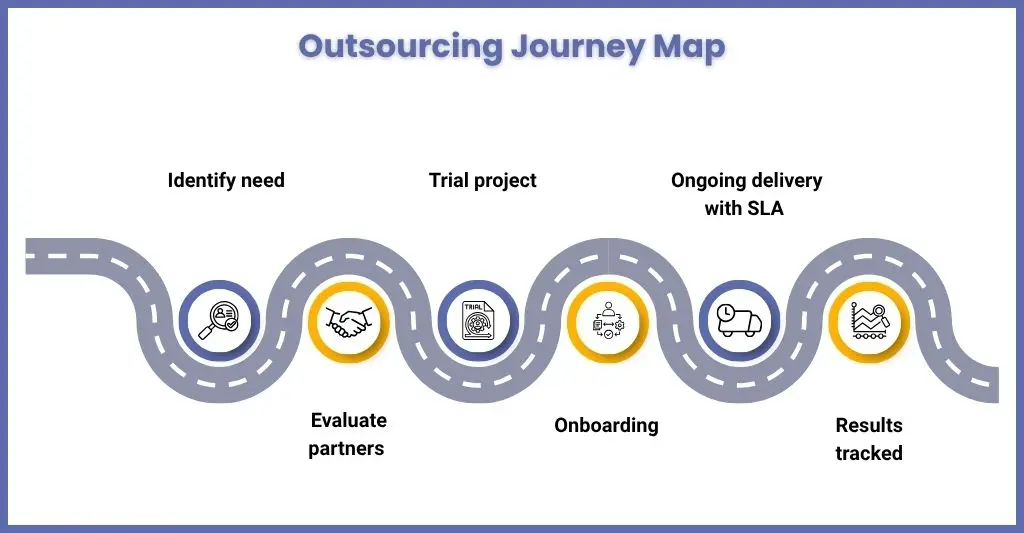

Here is how we will get started with VAT and tax return outsourcing:

Identify Your Firm’s Needs

It is essential to understand your needs before you begin searching for an outsourcing partner. Hence, determine whether your requirement is for year-round support or just seasonal assistance. When requirements are fixed you will be better positioned to see which outsourcing provider can fulfil these requirements.

Research Providers

Once you have selected several outsourcing providers, ensure that you conduct a thorough review of their performance by reviewing their case studies, websites, and client reviews. Additionally, check for reviews on platforms such as Google Reviews and LinkedIn for an independent assessment.

Request a Trial or Pilot Project

Ask the outsourcing provider for a trial to see if they can fulfil your unique accounting requirements. Usually, professional outsourcing firms offer free or discounted trials initially.

Their Compliance History

Check their performance in following GDPR and HMRC-compliant processes, which will save you and your client from future hassles.

Integrate with Your Practice Management System

Currently, various accounting tools, such as Zero and TaxCalc, have streamlined the entire accounting process. Apart from assessing their proficiency in operating it, you must also verify whether the outsourcing provider can successfully integrate these tools into your workflow.

Conclusion

Outsourcing VAT and tax return preparation is no longer just an option for UK accountants; it has become a wise business decision. It allows accounting firms to scale efficiently, focus on strategic growth, and reduce compliance risks.

For practices considering outsourcing, carefully consider your accounting requirements and future demands of your clients and select your outsourcing partner accordingly. When it comes to accounting practices, seeking growth and future readiness, Corient will be ideal. Established in 2011, Corient has quickly created a strong base among accounting practices based in the UK. Its accounting services, including bookkeeping, payroll, VAT, and tax outsourcing, have made life easier for many. For more information, please share your details and question using our contact form, and our executive will be in touch with you shortly.