Deadline for P60 – Key Dates, Tips, and Compliance Guide

Time waits for no one, and the same can be said about the P60 deadline. That’s why the end of the tax year makes many of your accounting firm clients anxious. These days, accounting firms directly manage P60s for their clients, who expect accurate and timely submissions and a clear understanding of the deadline. Meeting the deadline for P60 is crucial for maintaining trust, avoiding penalties, and upholding HMRC compliance standards.

Neither you nor your clients would like to miss the May 31st deadline because missing it would mean exposing your clients to unnecessary hassles. That’s why it’s important to be one step ahead and prepared with clear plans and the latest compliance insights. In this guide, we will explain key dates related to P60 that every accountant must know, practical tips to streamline your P60 processing, and essential compliance checkpoints to safeguard your clients and your accounting reputation.

What is a P60 Used for– A Quick Overview

The P60 form informs an employee about earnings and deductions made for Income Tax and National Insurance over the course of the entire year (April 6th to April 5th).

In the past, employers issued this document, but they are now handing it over to accounting practices. Your clients will expect no negligence regarding accuracy in P60 because this document serves as formal proof of income and tax paid.

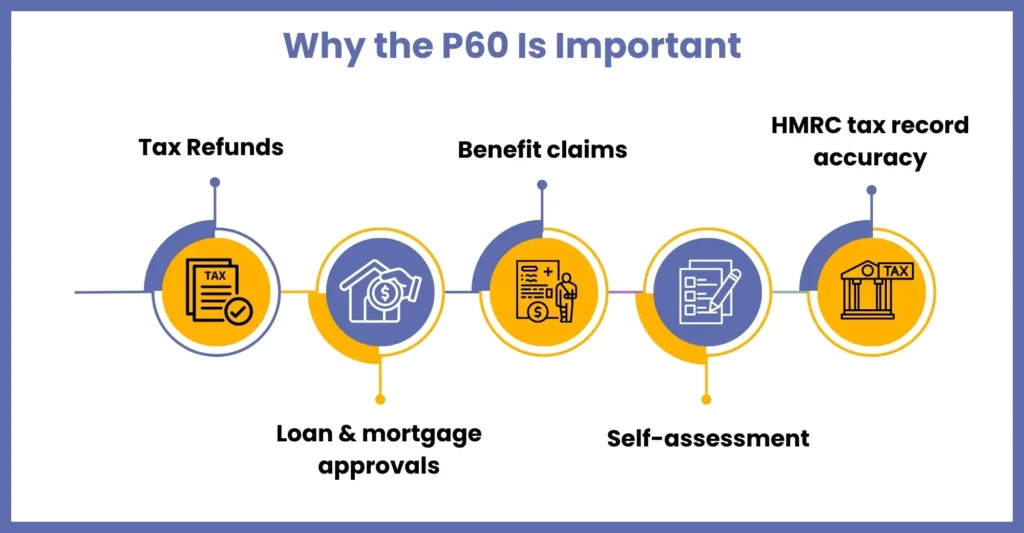

Accuracy in P60s is required, and that’s what will be expected from your clients because this piece of document is used for several important purposes, such as:

- Tax Refund Claims: Employees use P60 to review the tax deducted from them. If they find out that they have overpaid, they can use this document to claim it back from HMRC.

- Loan and Mortgage Applications: Banks and financial institutions will always consider the P60 document evidence of a stable income source and ask for it during loan and mortgage applications.

- Benefit Applications: If your clients’ employees want to take advantage of certain government benefits, such as tax credits, they will need income verification, which can be done through a P60.

- Cross-Referencing Tax Records: The P60 document can be used for cross-checking with HMRC to maintain tax records accuracy.

- Filing Self-Assessment Returns: The P60 provides key figures for accurate reporting for employees with additional income streams.

Hence, it is important for you to ensure that P60s are generated on time and accurately so that your client stays compliant and its employees’ financial affairs and queries are taken care of, thus preventing the risk of fines for both.

Deadline for P60 – Everything You Must Know

At first glance, generating P60s looks like a piece of cake, but that is not the case, especially when its high-volume, deadline, and accuracy are taken into consideration. For this reason, your clients have placed faith in your accounting practice to handle the P60 job. By generating P60s, you are helping them stay compliant and becoming a trusted advisor. Your accurate P60s will help your clients avoid costly penalties, thus maintaining their reputation.

However, we have noticed that in the horde of maintaining accuracy, meeting the P60 deadline takes a backseat. Always remember these two dates: April 5th and May 31st. April 5th is the tax year end date, and May 31st is the date by which the P60 must be issued to the employees.

Meeting these deadlines is important. Without that there will be consequences such as:

- HMRC Penalties: Missing the P60 deadline will result in penalties for your clients, calculated based on the number of employees facing delays.

- Employee Frustration: Your client’s employees will eagerly wait for accurate and timely generated P60s, which will be used for filing Self-Assessment tax returns, claiming tax refunds, applying for mortgages, and more. Not meeting the deadlines will frustrate employees, leading to your client losing trust in you.

- Client Trust: Lastly, the timely distribution of P60 will reflect a positive image of your accounting practice among your clients, thus raising your reliability and service standards. Such a positive image will allow you to attract new clients.

P60 Tips to Remember

Yes, it’s important for you to concentrate on the accuracy and meeting of deadlines while issuing P60s on behalf of your clients to its employees. However, we have encountered multiple practices that face unique situations while working on P60s, and we have helped them through it. Here are some tips that will help you out.

- If an employee demands corrections in their P60, you can send a new one marked as a replacement or a letter detailing the changes.

- We have encountered situations where practices have to deal with employees doing more than one job. In such situations, they will get a P60 from each job. You don’t have to worry about collating income tax information from multiple employments.

- You must come across employees requesting to send P60s multiple times throughout the year. Such frequent requests come up because employees need P60 for mortgage applications. In such situations, payroll software comes in handy; you can buy one or access its service through payroll outsourcing services.

Why Employers Must Prioritise P60 Deadlines

Generating and dispatching P60s is not ordinary paperwork; it’s an employer’s legal obligation. The financial consequences on employees make this document even more important; hence, it cannot be pushed down. The deadline of May 31st for issuing P60S has to be met, or else the consequences will be costly.

Here’s why employers must take the P60 deadline seriously:

Legal Compliance with HMRC

As of April 5th, every employer is legally obliged to provide P60S to every employee on payroll. Missing the deadline will result in automatic penalties, which HMRC will enforce.

Avoiding Reputational Damage

Any delays or inaccuracies in P60s will result in employee dissatisfaction and complaints, leading to loss of trust and reputational damage. By providing accurate and timely P60s, an employer will project itself as professional and committed to compliance.

Supporting Employee Financial Needs

Employees need P60s for various financial purposes like:

- Claim tax refunds

- Complete Self Assessments

- Apply for mortgages, loans, or benefits

A delay could affect their financial plans and obligations, and that frustration often returns to HR or payroll departments.

Streamlining Payroll Operations

By giving preference to meeting P60 deadlines, year-end payroll processing goes smoothly, and employers can prevent last-minute chaos.

Minimising Risk of HMRC Audits

The risk of HMRC audits or investigations on employers increases with frequent delays or inconsistencies with P60s. Hence, due diligence must be done to maintain accuracy and timeliness.

With the risks involved with P60s, employers have started playing it safe by entrusting the responsibility of P60 generation and issuance to accounting firms. However, things get complicated for accounting firms when their clients increase their employee numbers. This requires enhancing capacity to accommodate high volumes of P60s, thus complicating deadline and accuracy requirements. In such situations, accounting firms will find researching case studies and choosing payroll outsourcing services quite convenient.

How Payroll Outsourcing Services Can Help You Meet the P60 Deadline

Getting P60s done quickly when other payroll responsibilities pile up is tough and can become overwhelming, even with a dedicated payroll team. Of course, you can encourage your team to handle P60s, but that would mean pushing things which could compromise accuracy and compliance, which your clients would not like. The reliable solution left is using payroll outsourcing services.

Here’s how outsourcing can help you meet the P60 deadline with confidence:

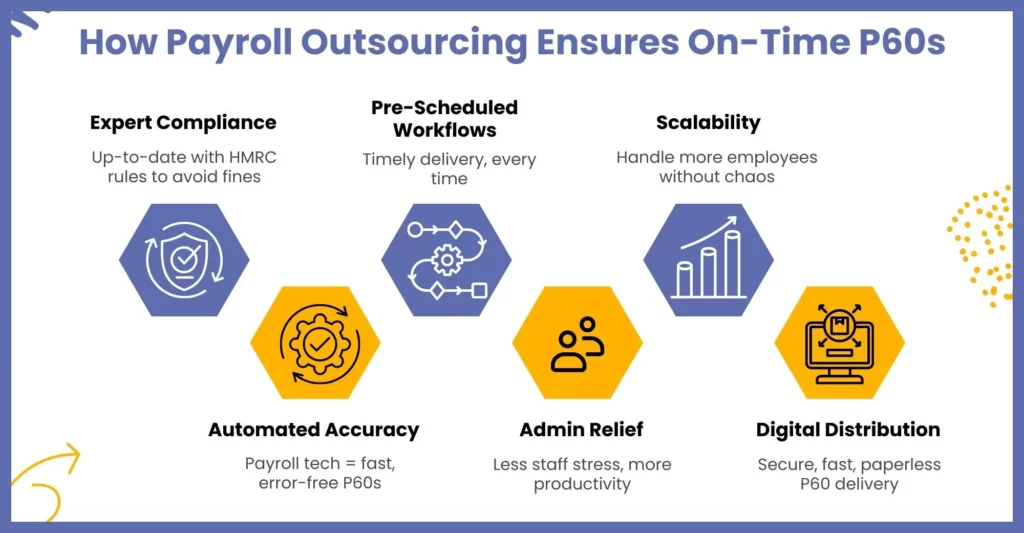

Expert Handling of Compliance Requirements

A professional payroll service provider will always keep track of the latest developments in HMRC regulations, including deadlines and P60 formatting requirements. A compliant P60 document will reduce the risk of errors and penalties.

Automated and Accurate Processing

Professional payroll service providers have started relying on payroll software and automation tools to quicken the entire payroll process without compromising on quality and compliance. These tools help generate accurate P60s without any manual intervention, thus reducing the chances of human error and rework.

Deadline-Driven Workflows

Professional payroll service providers proactively plan their tasks to complete them well before the deadline. This is also applicable to their P60 preparation. They achieve that by following structured year-end calendars and compliance checklists.

Reduced Administrative Burden

By outsourcing payroll, you are freeing your team from time-consuming tasks like generating P60s and responding to employee-related queries. With the time available, they can now focus on strategic work and customer service.

Scalability During Peak Periods

Outsourced services provide additional support when there are too many P60s to manage and not enough staff, ensuring work continues smoothly and deadlines are met.

Secure Distribution for P60s

Payroll providers prefer to distribute P60s to employees via digital format, which is secure, reduces paperwork and printing costs, and eliminates distribution delays.

Frequently Asked Questions (FAQ)

April 5th is the tax year end date, and May 31st is the deadline by which the P60 must be issued to the employees; otherwise, the employer will face penalties.

Employees who are unable to get their P60 form from their employers can find all the information related to P60 on the HMRC website. You can also access the information using the HMRC app.

P60 provides accurate figures on income and tax deductions for the entire year, making it important for tax filing. This document is also used for other purposes.

Tax Refund Claims

Loan and Mortgage Applications

Benefit Applications

Cross-Referencing Tax Records

Filing Self-Assessment Returns

P60 is a significant document, and it’s vital to keep it safe. Generally, it should be kept for a minimum of 3 years.

If you change jobs during the tax year, you will not receive a P60 at the end of the tax year from your current employer. Instead, you will receive a P45 form showing how much tax you’ve paid on your salary so far in the tax year (April 6th to April 5th). This document needs to be submitted to the next employer.

Conclusion

Generating and distributing P60s to employees is an important responsibility that accounting firms handle quite effectively. However, in recent years, accounting firms have found themselves unable to meet the P60 deadline due to multiple factors. We have made an earnest effort to elevate this situation by making you aware of outsourcing P60 work. Outsourcing is the present and will stay for the near future.

Outsourcing P60s allows you to meet deadlines, meet compliance requirements, and resolve employee disputes without much investment. It offers many options, but if you’re seeking long-term capacity enhancements for P60 generation and delivery, make Corient your first choice. We have built our reputation among accounting firms as a tech-savvy and dependable payroll service provider, and our payroll services have made life easy for our accounting firm clients. If you are interested in our services or need further information, contact us using our website contact form, and our executive will connect with you shortly.

Good luck with your future endeavors, and looking to connect with you soon.