Why Statement of Account is Crucial for Your Clients

- What is a Statement of Account?

- Different Types of Accounting Statements

- Statement of Account Template

- Common Challenges of Statement of Accounts and How to Overcome Them

- Is the Invoice and Statement of Account the Same?

- Why is Statement of Account Important?

- What Goes into the Statement of Accounts?

- Frequently Asked Questions

- Conclusion

You don’t need me to say how important a statement of account or account statement is for your clients. Your clients use it to inform their opposite party about all the transactions that have taken place during a specific time period, usually a month. The statement of account also reveals any outstanding amounts and can be sent to the opposite party as a reminder to pay dues.

These days, multiple professional accounting practices in the UK handle this important accounting task on behalf of their clients. Also, multiple accounting software have been designed to help them in this task. Using accounting software, it has become much easier to keep track of financial transactions and to send statements of accounts in a professional format and a speedy manner. But before that, let’s understand the importance and workings of the statement of accounts a little deeper.

Let’s get going!

What is a Statement of Account?

A statement of account is a summary produced by you using accounting software on behalf of your client. This statement is then sent to the opposite party, providing it with all the information regarding outstanding transactions within a specified period.

The statement of account can feature all the transactions made during the specified period, but it is popularly used to show only outstanding transactions to remind the opposite party about the dues. If the balance at the end of the statement is not zero, it will automatically remind the user about any outstanding payments.

Different Types of Accounting Statements

There are three different types of account statements that, when coming together, will give you an accurate picture of the overall health of your client’s business. These account statement types are as follows:

Balance Sheet: It shows the balance between assets, liabilities and equity of your client’s business. In short, balance sheet helps you determine its financial health.

Profit and Loss Statement: The profit and loss statement shows the difference between income and expenditure, known as net income.

Cash Flow Statement: This statement shows how much cash enters and leaves your client’s business during a set period.

Statement of Account Template

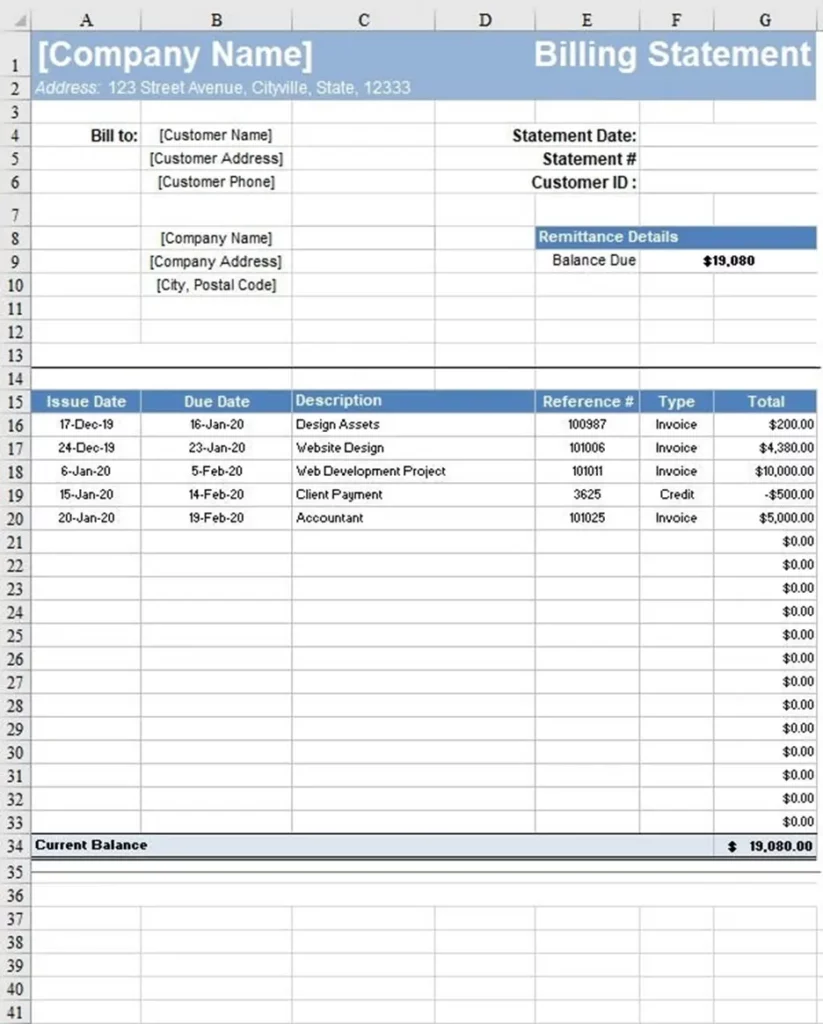

There is no set format for a statement of accounts; it depends on the business and the type of information your clients want to include. You will find all kinds of statement of account templates available in accounting software like FreshBooks; here is one statement of account example:

Common Challenges of Statement of Accounts and How to Overcome Them

The statement of accounts is a crucial financial document that shows the transactions that have taken place between your client and its suppliers. However, making the statement of accounts, including reconciliation, is full of challenges. We have listed down some common challenges and solutions to overcome them:

Inaccuracy During Data Entry

While manual data entry is time-consuming, it can also lead to human errors, such as incorrect balances, missed payments, or misrepresentations of transactions. To overcome this challenge, accounting software like Xero and QuickBooks must be invested in to automate data entry and reduce errors.

Missing Transactions

Missing out on transactions, even due to a mistake, can cost your clients dearly and disrepute your accounting practice. To address this challenge, you must regularly reconcile bank statements with accounting records. Also, you must leverage accounting software tools to get real-time updates and maintain clear communications with your clients to ensure all transactions are accounted for.

Absence of Standardisation

Lack of following a set template for statement of accounts will only lead to confusion for your clients and HMRC and difficulty in tracking the transactions. However, following a standard set of templates for making a statement of account through accounting software will solve this problem completely.

Delays in Statement Generation

Disruption in statement generation can disrupt your client’s cash flow, customer relations, and payment cycle. However, this problem can be solved by focusing on automating statement generation through accounting software. Also, focus on streamlining the workflow, this reduces the number approvals and speed up the statement generation process.

Below Average Communication with Your Clients

Even after sharing the account statement with your client, their misunderstanding is possible. Such misunderstanding will lead to delays in payments and disputes. But if you ensure that the statement of accounts is easy to read by highlighting important points, providing support via email, chat or phone, and offering proactive support by sending reminders for payments and dispute resolution, things will be fine.

Data Security Concerns

Sharing highly sensitive account statements via insecure communication channels increases the chances of data leaks and misuse. Hence, proper investment must be made in encrypted communication channels with your clients. Also, make your portal secure by restricting access to sensitive data and using multi-factor authentication for added security.

Problem in Handling Large Statements

Making and distributing large statements of accounts to multiple clients is a time-consuming task. However, if you incorporate accounting software into your work, you can speed up the process. Still, if this takes too much time, you can try outsourcing accounting services from accounting service providers. But before you make your mind for outsourcing take a closer look at their case studies to know their achievements in the accounting industry.

Is the Invoice and Statement of Account the Same?

No, it’s not. The statement of account acts as a report that contains the history of financial transactions done during a specified period between two businesses. On the other hand, an invoice is a bill for a single transaction. An account statement contains all the financial transactions, such as invoice amount, payment received, and refunds. With all the transactions listed, you can easily identify missed payments, thus acting as a payment reminder.

To further elaborate, the invoice performs the following functions:

- Describes the items purchased and the cost per unit.

- Adds taxes.

- Shows the total amount owing.

- Shows invoice payment terms and payment details.

On the other hand, a statement of account contains:

- Lists all previous invoice amounts, with invoice numbers and dates, as individual line items.

- Lists all the transactions that took place in a defined period.

- Payments or credits are laid out as individual line items.

- Displays any outstanding balances.

- Cost buckets.

Why is Statement of Account Important?

A statement of account is an important tool for your clients to remind those who still need to pay. It also allows your clients to track expenditures, check for double payments, and monitor missed payments, which can help them save a lot of money on late fees. The resulting client payments increase a vendor’s cash flow and allow the business owner to spend the money on the resources they need to keep the business going.

What Goes into the Statement of Accounts?

Statements of accounts can be prepared using various templates, but a typical statement of accounts will show the vendor and client business information, the date of issue, the statement number, the client’s account ID, the balance from the previous period (from the last statement of account issued), and all transactions.

In the statement of account, one line will be dedicated to each transaction, whether it is an invoice, payment, or credit. An optional payment slip can also be included. Business information provided includes the vendor’s business name and client name, the vendor and customer’s physical address, phone number, and email.

Frequently Asked Questions

No, it’s not a legal requirement. What is required is that the statement be accurate and up-to-date about the transaction history.

A statement of account is not a receipt. A statement of account provides a comprehensive overview of all transactions between your client and its customers over a specific period, including payments and outstanding balances.

It is generally safe to submit your statement for credit and other financial purposes. However, make sure to check the credibility of the financial institution before submitting the statement of accounts.

The major elements of the financial statements are assets, liabilities, fund balance/net assets, revenues, expenditures, and expenses.

It is safe to share your statement of accounts when the recipient is a trustworthy one. For example, financial institutions, government agencies, and people you know and trust. Also, examine the purpose of the request.

Conclusion

A statement of accounts is important for your clients and their customers because it reflects all transactions and payments between them during a specific period. When your clients use a statement of account to resolve the dues, it will showcase their professionalism and transparency in their business practice. Hence, your client would appreciate it if you provided the best statement of accounts using the latest accounting software. This blog aims to help you understand the statement of accounts in detail, thus allowing you to better your services to your clients.

We understand that making a statement of accounts is time-consuming but necessary work. Hence, you can outsource this task to a professional accounting outsourcing service provider to save time and get the job done. Now, hundreds of service providers offer a wide range of accounting services, but Corient UK is grabbing a lot of attention these days.