Is digital VAT reporting under MTD giving you’re the benefits you are looking for? Since 2022, manual VAT reporting and filing have been discontinued, and MTD for VAT has been fully implemented. This implementation has fully digitised the VAT return, filing, and reporting process, bringing multiple benefits to businesses and accounting practices involved in VAT.

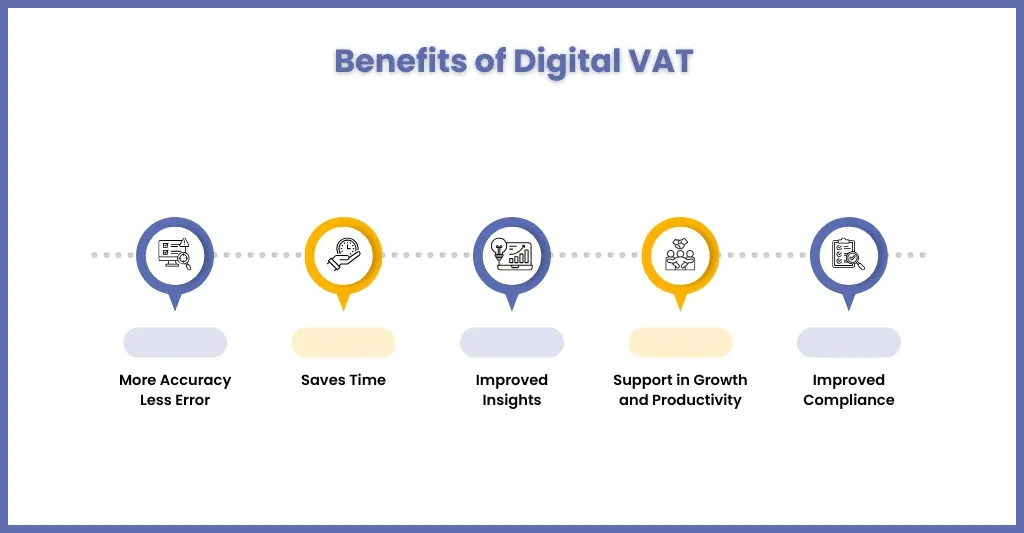

Let’s understand some of those significant benefits in detail.

More Accuracy Less Error

Under MTD for VAT, you must keep all VAT-related records in digital format. Also, submissions will be made only through MTD-compliant software. All this will reduce manual intervention and forgery, thus increasing the accuracy of VAT calculations and reducing human error. Less errors leads to less corrective work, less late submissions or penalties, and a stronger compliance position.

Saves Time

The use of MTD-complaint software will streamline the entire VAT process meaning less paperwork, fewer manual interventions, and smoother VAT return submissions. Even saving a few hours on VAT work for each client will help you to refocus on high-value advisory work.

Improved Insights

With digital records and MTD-compliant software tracking VAT return filing and submissions, you are in a position to show your clients a clear, transparent view of their VAT and, indirectly, their financial health. These insights will help them avoid surprises and make informed business and financial decisions, such as budgeting and cash flow forecasting.

Support in Growth and Productivity

Apart from the goal of digitising VAT, MTD’s digital record-keeping has, in turn, promoted secure systems and integrated processes. These measures have sped up decision-making and increased productivity.

Improved Compliance

Since MTD has become compulsory for all VAT-registered businesses, all VAT submissions must be made through MTD-compliant software. This has reduced the risk of VAT miscalculation and missed VAT return deadlines, and has made your clients more compliant.

People Also Ask

How will Making Tax Digital affect accountants?

MTD has changed how accountants used to keep records, submit them to HMRC, and their engagement with clients with regard to their finances.

What counts as digital records for MTD?

All records that are digitally created, stored, and sent to HMRC through an MTD-compliant software are considered digital records.

What are the benefits of Making Tax Digital?

Common benefits of MTD are:

1. Digital records with less manual intervention

2. Accurate submissions

3. Real-time numbers that help you plan your tax position

4. A simpler tax return at the end of the tax year

5. All tax records in one place

6. Enables better business decisions with digital tools

7. Easier collaboration with HMRC

8. Long-term confidence as the UK tax system goes digital

What does Making Tax Digital for VAT mean?

Since its application in 2022, MTD for VAT means all records and details must be stored in a digital format. That includes name, address, contact details of the client’s business, VAT registration number and details of any VAT accounting scheme.

Summary

In short, digital VAT reporting under MTD helps clients by making VAT compliance more accurate, faster, more transparent and better integrated into their broader business systems.

For further assistances, you can explore that option of VAT outsourcing services through Corient’s professional services. We will take care of the challenges faced in MTD VAT and streamline the entire process for you. If you have any specific request or issues to elaborate feel free to connect through our contact form.

Feel free to approach us!