Modern Payroll Solutions for UK Accountants in 2025

- Introduction

- What Is a Payroll Solution and Why Is It Important for UK Accountants?

- How Modern Payroll Solutions Benefit UK Accountants

- Key Features of Modern Payroll Solutions for UK Accountants

- Why UK Accountants Should Switch to Modern Payroll Solutions

- Challenges UK Accountants Face Without a Modern Payroll Solution

- How to Choose the Right Payroll Solutions for Your Firm

- The Future of Payroll Solutions for UK Accountants

- People Also Ask

- Conclusion

Introduction

Have you ever imagined that a payroll task that usually takes a week is now completed with just a few clicks? That’s the reality of today’s UK payroll. Rapidly evolving technologies, such as automation through AI, have created modern payroll solutions that bring peace of mind to both accountants and their clients. Hence, it is important for your UK accountants to fully embrace modern payroll solutions and stay ahead of the curve.

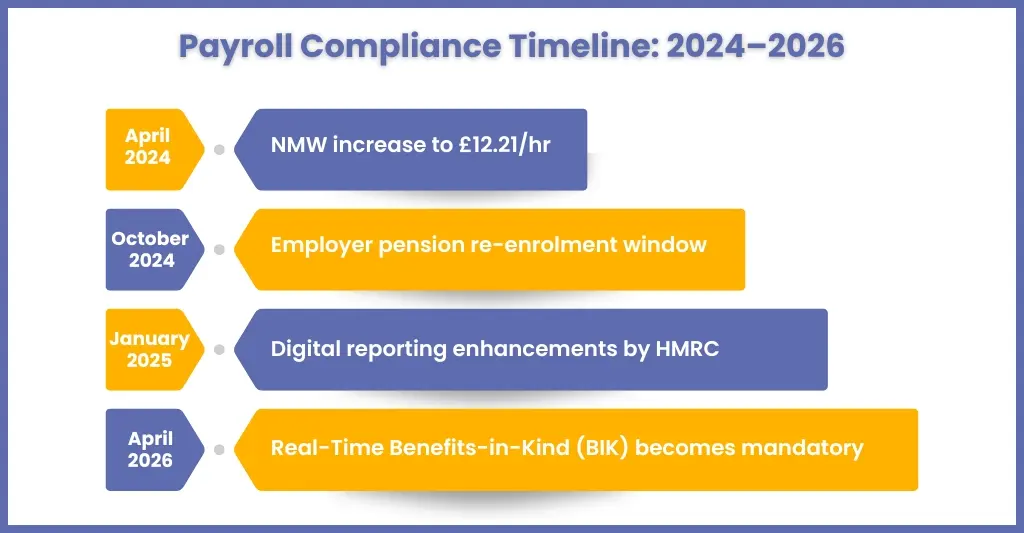

Adopting modern payroll solutions is not a luxury but a necessity. With HMRC tightening Real-Time Information (RTI) rules and real-time benefits submission coming into effect in April 2026, your practice will struggle to survive without a practical and modern set of payroll solutions.

In this blog, we will gain a deeper understanding of modern payroll solutions and their importance. Additionally, we will gain a better understanding of its benefits and challenges for not implementing it, as well as the future of it in the UK.

Let’s get on with it.

What Is a Payroll Solution and Why Is It Important for UK Accountants?

It would be unimaginable for any accounting practice to survive in today’s UK accounting environment without adopting modern payroll solutions. These solutions ensure accuracy, streamline compliance with ever-changing HMRC regulations (like real-time benefits reporting by April 2026), and significantly reduce manual workload. These solutions also boost payroll services through automation, secure cloud access, and real-time updates, while addressing skill shortages and maintaining full regulatory compliance.

How Modern Payroll Solutions Benefit UK Accountants

With the UK accounting landscape becoming increasingly fast-paced, adopting modern payroll solutions is crucial. It will keep your practice compliant, efficient, and client-focused. Here’s how they deliver value:

Ensures Full-Compliance with HMRC

Modern payroll solutions reflect the latest HMRC rules, including:

- Real-Time Information (RTI) submissions

- Auto-enrolment pension contributions

- Upcoming mandatory benefits-in-kind reporting from April 2026

Using updated payroll solutions will keep your practice one step ahead of changing regulations, thus saving you from penalties.

Save Time and Reduce Manual Workload

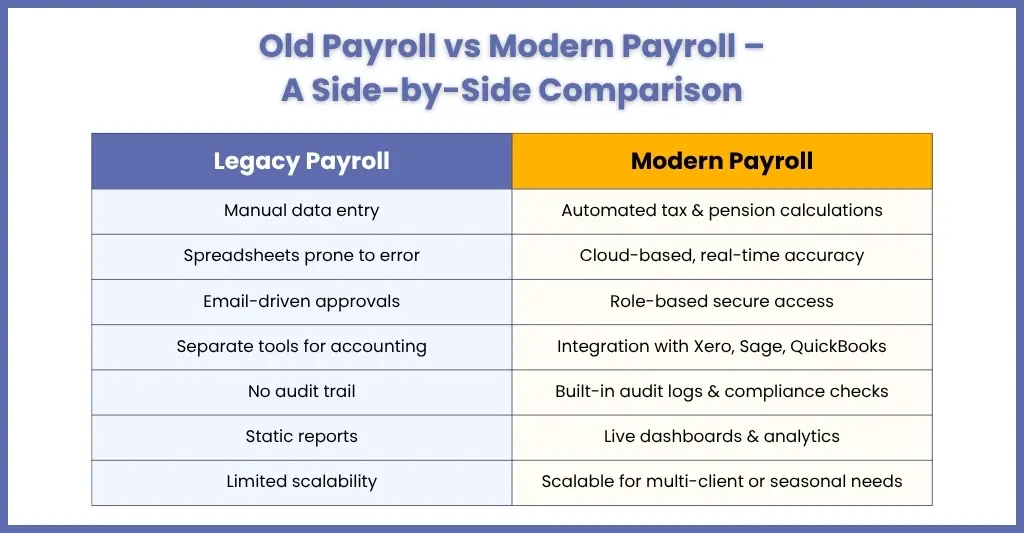

Old payroll solutions were quite labour-intensive and time-consuming. On the other hand, modern payroll solutions are successful in automating:

- Payslip generation

- Tax and NI calculations

- Holiday pay tracking

- Pension uploads

Such automation saves a considerable amount of time, thus allowing you to focus on advisory services or strategic planning.

Improve Accuracy and Reduce Risk

Previous payroll processes are prone to human errors, which can create dissatisfaction among clients and result in fines. But with in-built validation, audit trails, and compliance checks, modern software reduces human error, ensuring peace of mind for both your team and your clients.

Scalable Client Management

Modern payroll solutions are comfortable in scaling their effort, especially when your practice requires it in situations like:

- Onboarding new clients quickly

- Handling complex payroll cycles (weekly, fortnightly, monthly)

- Serving clients with fluctuating headcounts (like seasonal businesses)

Such flexibility will help your practice grow and cater to a diverse range of businesses.

Support Remote Work and Collaboration

Modern payroll solutions offered through payroll outsourcing services will enable you to work from anywhere. Your team will have real-time access to timesheets, view reports, and access payslips through secure portals, eliminating the need for back-and-forth emails.

Boost Client Satisfaction

Using the best payroll software often includes branded client dashboards, custom reports, and real-time notifications. These features allow you to offer a premium service that positions your firm as proactive, tech-savvy, and client-centric.

Integrate with Accounting Platforms

Seamless integration with tools like Xero, Sage, QuickBooks, and FreeAgent means smoother bookkeeping, real-time reconciliation, and better reporting accuracy. This also reduces duplication and speeds up financial reporting.

Key Features of Modern Payroll Solutions for UK Accountants

These days, your accounting practice has a difficult dual task of fulfilling HMRC regulations and meeting clients’ expectations through updates to payroll services. However, by adopting modern payroll solutions, your practice will be well-positioned to meet these dual requirements. Here are some key features:

HMRC-Approved Real-Time Information (RTI) Submissions

Modern payroll software is fully compatible with HMRC’s RTI system, automatically submitting:

- Full Payment Submissions (FPS)

- Employer Payment Summaries (EPS)

- New starter/leaver details

This ensures your clients remain compliant with HMRC and avoid late filing penalties.

Automated Tax, NI, and Pension Calculations

Professional accounting practices and payroll outsourcing service providers use the latest payroll software that automatically calculates:

- Income tax and National Insurance Contributions

- Employer/employee pension contributions (with auto-enrolment triggers)

- Statutory pay (SSP, SMP, etc.)

This reduces manual work and improves accuracy, particularly helpful for complex payroll cases.

Integrated Benefits-in-Kind (BIK) Processing

With HMRC mandating real-time benefits reporting from April 2026, modern payroll solutions now allow:

- In-payroll processing of company cars, medical cover, and other BIK

- Automated Class 1A NIC calculation

- Real-time adjustments to tax codes

This means modern payroll solutions are crucial for staying compliant with future regulations.

Cloud-Based Access and Data Security

Cloud payroll software features modern payroll solutions, such as:

- Secure access from any device

- Encrypted storage and GDPR-compliant workflows

- Multi-user logins and role-based permissions

Thus allowing firms to operate flexibly and securely in a hybrid work model.

Accounting Software Integration

Modern payroll tools integrate directly with:

- Xero, Sage, QuickBooks, FreeAgent, and others

Which means payroll data flows directly into ledgers and journals, reducing duplication and reconciling faster at month-end.

Why UK Accountants Should Switch to Modern Payroll Solutions

The move to Modern Payroll Solutions isn’t just about convenience, it’s a strategic shift that brings powerful advantages for UK accountants and their clients.

Comply Seamlessly with Changing HMRC Rules

Payroll legislation is evolving fast in the UK. From Real-Time Information (RTI) to auto-enrolment pensions and the upcoming mandatory real-time benefits-in-kind reporting by April 2026, staying compliant manually is not possible. Only by using modern payroll software can you update automatically:

- HMRC tax thresholds

- National Minimum Wage (NMW) changes

- Statutory pay rates

- Pension auto-enrolment staging

Such automation ensures that deadlines are never missed and penalties are never incurred, even during busy periods.

Save Time and Reduce Admin Pressure

Using Modern Payroll Solutions practices can cut payroll processing time by automating:

- Payslip creation and distribution

- Tax and pension calculations

- Filing and payment reminders

The time saved for every client can be utilised for advisory purposes.

Deliver a Better Client Experience

Clients expect numerous additional facilities from your payroll services, such as employee portals, branded dashboards, and real-time updates, which you can offer them by using the best payroll software. Through it, you can deliver to your clients:

- Instant access to payslips and P60S

- Clear breakdowns of payroll costs

- Fewer repetitive queries to your team

Reduction in Overheads

Whether you’re handling 10 or 100 clients, modern payroll solutions are scalable and handle multiple things for you, like:

- Additional clients without hiring additional staff

- Handling complex payroll needs (multiple pay cycles, bonuses, deductions)

- Maintaining consistent turnaround times

It’s the ideal way for firms to expand service offerings while keeping operations lean.

Ensures Data Security and GDPR Compliance

There are growing concerns over cyber threats and data breaches, which traditional payroll solutions struggle to address. New payroll solutions offered by the latest payroll software will offer:

- Bank-grade encryption (AES 256-bit)

- GDPR-compliant workflows

- Role-based access controls

This provides peace of mind for both you and your clients without requiring expensive in-house IT infrastructure.

Enable Seamless Outsourcing and Collaboration

You can avail yourself of modern payroll solutions through a professional outsourcing partner. Partnering with a provider like Corient lets you:

- Offload routine processing

- Focus on advisory and higher-value work

- Maintain client ownership and control

You will keep your brand front and centre, while your outsourcing partner will manage the backend using modern tools and ensure compliance. Take a look at the case studies of a provider before selecting it, it will give you an idea about their experience, capabilities, and achievements.

Challenges UK Accountants Face Without a Modern Payroll Solution

Adhering to outdated payroll procedures will keep your practice behind the times and increase the risk of inefficiencies, compliance issues, and client dissatisfaction. Some other challenges you accountants will face are:

- Increased risk of HMRC penalties

- Time-consuming manual calculations

- Lack of scalability

- Higher error rates

- Difficulty managing real-time benefits reporting

- Lack of compliance with GDPR

- Reduced competitiveness with your competitors

How to Choose the Right Payroll Solutions for Your Firm

If you are not interested in investing in the latest payroll solutions, consider outsourcing, which is a cost-effective option. While searching for the right outsourcing provider, you will have to look for the following:

- Check whether their payroll process can handle real-time benefits, auto‑enrolment, and changing NMW rates.

- Look for integrations with your accounting software, such as Xero, Sage, QuickBooks, and others.

- Verify data security standards, such as GDPR compliance, ISO 27001-certified infrastructure, end-to-end encryption, and role-based access controls.

- Confirm whether the level of support and scalability can work with fluctuating headcount and payroll complexity?

The Future of Payroll Solutions for UK Accountants

As digital transformation accelerates across UK accountancy, Payroll Solutions are poised to become even more intelligent, integrated, and indispensable. Expect features like AI‑led payroll anomaly detection, further automation of benefits‑in‑kind, and richer analytics on workforce costs. Over 30% of practices will adopt AI tools for payroll within the next two years, and the impact of AI will also be significant on payroll outsourcing , which will remain a key route to access these innovations.

People Also Ask

They automate real-time tax, NI, pension, and benefits-in-kind reporting, meeting new HMRC mandates and reducing human error.

Yes. Reputable providers use encrypted data protocols, follow GDPR, and often hold ISO/IT security certifications.

By automating calculations, filing, and administrative tasks, we cut errors and reduce the time taken, while outsourcing costs per employee remain predictable and scalable.

Yes. Modern solutions are built to support bureau-style processing enabling accounting firms to manage payroll for multiple clients across different industries efficiently.

We integrate with leading platforms like Xero, BrightPay, Sage, and Paycircle, delivering seamless processing and custom workflows that grow with your practice.

Conclusion

For forward-thinking UK accounting firms, adopting modern Payroll Solutions is no longer optional; it’s a strategic necessity. When combined with outsourcing, it delivers accuracy, compliance, efficiency, and client satisfaction. Invest in the future: streamline payroll, reduce risk, and free your team to provide value.

You may wonder if investing in the latest payroll solutions is the right move, given their expense. However, with the advent of outsourcing, this problem is also solved. By approaching professional and experienced accounting outsourcing service providers like Corient, you can get access to the latest payroll solutions at a fraction of the cost.

Since 2011, Corient has been providing the latest accounting outsourcing solutions to numerous UK practices, including cutting-edge payroll solutions through payroll outsourcing. Our solutions have helped reduce compliance errors, saved clients from costly penalties, and provided professional support to simplify HMRC compliance. Interested in trying out our payroll outsourcing services? Connect with us via the contact form and get a detailed explanation from our experts.