How Much Does It Cost to Outsource Accounts Payable in 2025?

- Understanding Accounts Payable Outsourcing

- Accounts Payable Outsourcing Pricing Models

- Comparing Costs: In-House vs. Outsourced Accounts Payable

- Why UK Accounting Practices Are Shifting to Outsourced Accounts Payable in 2025

- How to Choose the Right Accounts Payable Outsourcing Partner

- Frequently Asked Questions (FAQ)

- Conclusion

All accounting practices in the UK are feeling squeezed when it comes to accounts payable, and we are not surprised by it. We say that because, according to research by the Hackett Group and Gartner, the average cost of processing an invoice in the UK ranges from £4 to £25. Some specific complex or error-prone processes costing up to £50 per invoice (prices are subject to change). The worrying part is that these prices will only continue to rise, which is not good news for practices.

With rising operational expenses and growing compliance demands, many UK accounting practices are assessing whether outsourcing is a cost-effective solution. In this blog, we’ll break down the pricing models, make accurate cost comparisons, and explain why practices are rapidly moving to outsourced Accounts Payable models.

Understanding Accounts Payable Outsourcing

Accounts payable outsourcing involves transferring invoice processing, vendor payments, and related tasks to a third-party provider. This service enables firms to focus on their core activities while enhancing accuracy and efficiency.

Tasks typically included in outsourced AP services:

- Invoice receipt and data entry

- PO (Purchase Order) matching and approvals

- Payment processing

- Supplier communications

- Reconciliation and reporting

Outsourced accounts payable helps reduce manual errors, ensure timely payments, and streamline audit trails, all of which are critical for HMRC compliance and financial transparency.

Accounts Payable Outsourcing Pricing Models

We understand that your practice must manage multiple clients and high volumes of invoices, which can lead to complications such as rising costs and resource allocation issues. These complications can be overcome through accounts payable outsourcing by reducing costs, streamlining operations, and freeing up resources. To maximise the benefits of accounts payable outsourcing, you will need to understand the pricing models and select the one that fits your workflow and budget.

Here are the three most common AP outsourcing pricing models used by UK providers:

Per-Invoice Pricing

Approximately charged between £1.50 to £5 per invoice, the Per-Invoice Pricing model is ideal for accounting practices that handle a fixed number of monthly invoices. This model charges a flat fee for every invoice processed, providing full transparency and making it easy to track against client billing. Practices can pass costs directly to clients as a line item or bundle them into service packages, making it easy to maintain profitability while delivering efficiency.

Full-Time Equivalent Pricing

More prominent practices that handle large volumes of complex invoices will find the Full-Time Equivalent pricing model to be beneficial. Under this model, a specialist or a team will be assigned to review your accounts exclusively. This ensures consistency, scalability, and control. Thus, making it ideal for practices that require tailored solutions, frequent client communications, and specific accounting systems.

Tiered/Volume-Based Pricing

It is ideal for growing accounting practices with seasonal invoice peaks. It is also ideal for those handling clients from the hospitality sector, which has fluctuating transactions. This model gives predictability during peak periods making it useful for practices onboarding new clients or expanding into new sectors.

Comparing Costs: In-House vs. Outsourced Accounts Payable

Key Cost Factor Outsourcing In-House

| Cost Factors | Outsourcing | In-house |

| Cost of Staffing | Instead of recruiting an individual and paying salary and benefits, you will be paying only for the services you avail, in this case, for accounts payable services. | You will be required to hire, train, and provide salaries and benefits, which can be considerably high. |

| Technology and Infrastructure | You will not be required to purchase expensive technologies and Infrastructure; the service provider will invest in it and include the cost in the package, which will be significantly less. | Significant investments will be required in software, hardware, and maintenance. These costs are expected to increase in the future. |

| Efficiency and Error Rate | Errors will be minimised due to the heavy use of specialised expertise and advanced technologies, thereby saving you and your client from penalties. | The potential for errors increases due to the use of less specialised staff or outdated systems, leading to penalties. |

| Scalability and Flexibility | Offering instant scalability and flexibility, especially when demand picks up, which is much easier than hiring new people. | Scaling up means hiring more staff and investing in new technology, which will be a burden during lean periods. |

| Compliance | Professional outsourcing firms maintain robust compliance measures, thereby reducing the risk of non-compliance. | You will need to constantly monitor accounting standards and regulations and update your systems, which is a costly endeavour. |

| Opportunity Costs | Releases your resources from performing non-core activities like accounts payable to strategic ones, thus adding value to your services. | Managing accounts payable in-house will tie down your resources, which could have been spent on core accounting activities. |

Why UK Accounting Practices Are Shifting to Outsourced Accounts Payable in 2025

Many accounting functions conducted by accounting practices are changing fast, and among them is the accounts payable function. These days, practices are finding it convenient to outsource accounts payable functions. From cost savings and efficiency to improved compliance and scalability, this shift isn’t just a passing phase it’s becoming the new norm.

Let’s understand what’s driving this shift towards outsourcing.

Rising Operational Costs

Rising salaries and compliance costs increasingly pressure UK accounting practices as they strive to maintain high standards. In such situations, you will find outsourced accounting payable services a viable option, offering skilled professionals at a fraction of the cost.

Automation + Outsourcing = Unmatched Efficiency

Professional outsourcing providers offer their accounting payable services, utilising automation tools in conjunction with human expertise, to process high volumes of invoices quickly and accurately. This way, outsourcing and automation will get faster turnaround times, fewer human errors, and reduced duplication of payment.

A Scalable Solution for Growing Demands

In 2025, clients expect accountants to manage payments, track invoices, and handle reconciliation, not just crunch numbers. Naturally, for your practice with limited capacity, handling all these tasks at once is not feasible. Partnering with an outsourced provider lets you scale and manage service spikes without hiring additional staff.

Built-In Compliance and Reduced Risk

UK VAT regulations, MTD mandates, and GDPR requirements are constantly evolving, making compliance increasingly challenging. However, professional outsourcing providers stay up to date with all the latest developments in the accounting industry and implement systems to ensure there is no risk of non-compliance. Through outsourcing accounts payable, you will not only save time but also protect your reputation.

Focus on Core Services

Accounts payable is an important responsibility, but it is also repetitive and time-consuming work. By outsourcing, you can refocus on core accounting functions or value-added services, such as advisory services, client acquisition, and strategic planning. In a highly competitive business environment, it helps you stay one step ahead of your competitors.

Flexible Pricing Models Make It Accessible

The outdated perception that outsourcing is expensive has long since been dispelled. In 2025, UK accounting practices can choose from flexible pricing models such as:

- Per-invoice pricing – Ideal for predictable workloads

- FTE-based pricing – Great for high-volume or complex workflows

- Tiered pricing – Suited for firms with fluctuating invoice volumes

These models enable practices of any size to access outsourcing without incurring excessive financial commitments.

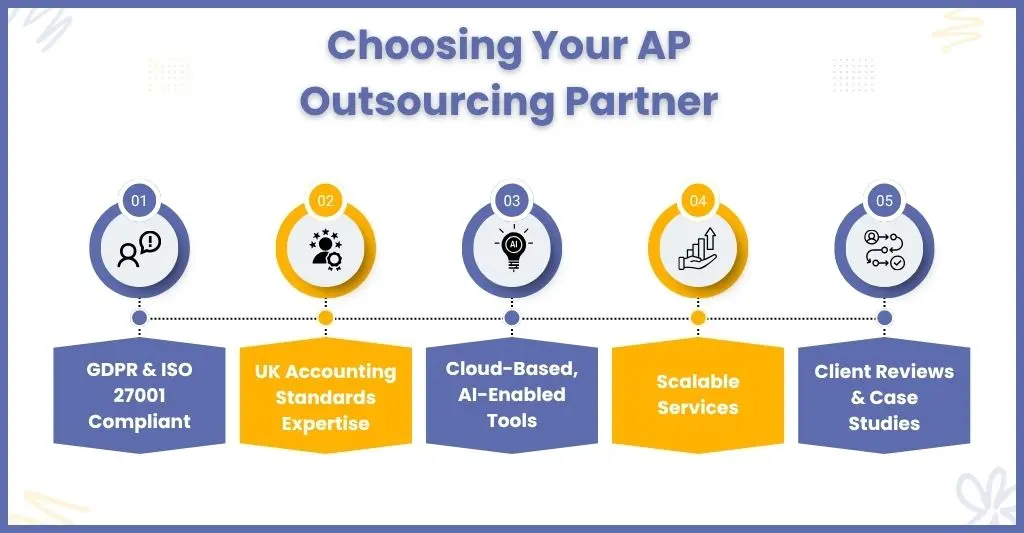

How to Choose the Right Accounts Payable Outsourcing Partner

Now that you understand the benefits of outsourcing accounts payable, it is even more important to select a suitable outsourcing partner. Hence, searching for one, you must consider the following:

Compliance & Security

Ensure that you verify the GDPR compliance, ISO 27001 certification, and signed Data Processing Agreements (DPAs) for every outsourcing service provider.

Industry and Accounting Standards Experience

Search for outsourcing partners that are experienced in keeping track of UK tax laws and HMRC regulations updates.

Technology Stack

Professional accounting practices utilise the latest and best accounting software and AI tools to automate the entire accounting process, thereby reducing the time and resources spent on manual work.

Client Reviews

Before selecting a service provider, review their past achievements in the accounting field by examining their case studies and client testimonials, and verify the information.

Frequently Asked Questions (FAQ)

Accounts payable outsourcing providers often set pricing per invoice not by the hour.

To ensure data security when outsourcing accounts payable, start by choosing a reputable provider with robust compliance standards such as ISO 27001 or GDPR alignment. Also, ensure they are followed by conducting frequent reviews.

Yes, accounts payable can be outsourced. These days accounting practices often send repetitive AP tasks like invoice processing, payment approvals, and vendor management to professional service providers to reduce compliance costs without sacrificing quality and adherence to accounting standards.

Yes, accounts payable can be automated either by you investing in automation tools in-house or you can achieve it through outsourcing. Automation has helped practices in minimising human intervention, eliminated human errors, and made accounts payable efficient and fast.

Conclusion

So, what is the cost of outsourcing accounts payable in 2025? It is certain that it is far less than managing it in-house. From reducing manual errors to improving supplier relationships, outsourcing accounts payable can be a game-changer for UK accounting practices. With the right partner, you not only save money but also boost efficiency and compliance.

Speaking about the right partner, we would like to bring to your attention an upcoming star among accounting outsourcing service providers. Your competitors have noticed it; we are talking about Corient. We have made our name by offering tech-savvy accounting services to numerous practices in the UK, bringing a meaningful difference to their accounting processes, including accounts payable. Please write down your requirements or queries on our website’s contact form, and our executive will connect with you to assist you.

All the best and looking forward to see your soon.