Complete Insights into Accounting Practices to Accelerate Your Accounting Firm’s Growth

Expect your clients to pose some interesting and difficult questions related to accounting towards you, and you should be ready with the answers. Please explain accounting practices to me and how they work. We are sure you must have faced this question and must have been in a situation where you could not explain it fluently due to multiple reasons, even after having experience with it.

You can expect your clients’ questions to become more complex and frequent, so it’s better to be prepared with your answers. We understand that research will help you find the right answers, but it takes time. Therefore, we have created a detailed guide on accounting practice, types, and importance to relieve you. This guide will help you answer your clients’ questions and create a good impression on them. Let’s get started.

Understanding Accounting Practice

Accounting practice is the process of documenting the financial transactions made by your clients on a day-to-day basis. The importance of accounting practice can be gauged from the fact that without it, it would be impossible to generate annual financial statements. Banks and financial institutions demand these financial statements for loan purposes and by investors and stakeholders to understand the performance of a business.

Under accounting practice comes multiple types of accounting methods that your client can choose from, and accounting principles, such as GAAP, must be followed. The General Accepted Accounting Principles (GAAP) UK are a set of accounting standards and principles established by the Financial Accounting Standards Board (FASB).

Every business uses different accounting methods to prepare financial statements. However, there are only two main methods of accounting: cash accounting and accrual accounting.

Cash Accounting

Under this accounting method, revenue and expenses are recorded as they are done. For example, when payment of sales is done, it is recorded has revenue, while expenses are recorded when bills are paid. The cash accounting method is preferred by SMEs.

Accrual Accounting

Under accrual accounting, you match revenues and expenses, providing an accurate picture of your client’s financial position. This accounting method records transactions you have incurred but not yet paid. Similarly, you record expenses even when you have not made the payments.

Types of Accounting Practices

As an accounting firm, you are catering to multiple clients, and each of your clients has its preferred accounting practices. These accounting practices include:

Financial Accounting

The main goal of financial accounting is to monitor, record, and report financial transactions as per guidelines such as Generally Accepted Accounting Principles (GAAP). Through financial accounting, you can go through past performance via financial statements and be in a position to maintain transparency and faith in the process.

Governmental Accounting

Government accounting applies to all levels of government and is used to track income and expenditures, such as funds for road improvement. This capital comes through a separate fund, and through government accounting, you can accurately report fund performance and public spending.

Public Accounting

Public accounting is ideal for a wide range of entities, including service industries, factories, retailers, non-profits, governments, and individuals. Under it comes various services such as auditing, tax preparation, financial statement preparation, and so on. Apart from accounting firms like yours, public accounting is also offered by outsourced accounting service providers using the latest accounting software.

Cost Accounting

Cost accounting is quite special. It is used to investigate actual business costs. While it is preferred by manufacturing clients, it is also beneficial for service providers. Under this accounting type, fixed and variable costs, such as material and production expenses, are examined. It also helps produce crucial information for management, such as break-even points. Cost accounting focuses on the future by aiding your client’s decision-making process rather than reporting past performance.

Forensic Accounting

The combination of accounting, auditing, and investigative strategies is called forensic accounting, and it is used for investigating the financial moves of any entity. This accounting method is frequently used by banks, police, and businesses to analyse financial transactions and prepare final reports

It is through forensic accounting that fraud cases are investigated using data analytics. Accountants who do forensic accounting are tasked with reconstructing financial information and can be summoned by courts to explain their investigation findings.

Management Accounting

Management accounting is used for producing high-quality data which will be used by decision-makers. This accounting type helps decision-makers make their business more forward-looking and enhance efficiency by creating sound policies.

While the reports created under financial accounting are shared with outsiders like banks, the management accounting reports are only for the internal eyes. Currently, there are 3 types of management accounting: strategic, performance and risk management.

Management accounts must be considered very important because they produce specific and detailed reports. Hence, it is important to understand what makes management accounts different from others. However, we know that performing management accounts requires specialisation and experience. To execute this delicate accounting task, you can use management accounting services offered by accounting outsourcing service providers.

Tax Accounting

Tax accounting will ensure that your clients comply with the regulations set by the HMRC. Through tax accounting, your accountant can help your clients accurately calculate and lower their tax liabilities, prepare and file tax returns, and develop a plan to reduce their taxes. To perform tax accounting flawlessly, your accountants need to be thorough and updated with the evolving UK tax laws and regulations. Tax accounting is important for individuals, businesses, and governments to report accurately, plan and comply with law.

Auditing

Under auditing, it is checked whether the activities are being done according to the set standards. There are multiple types of audits, such as compliance, investigative, financial, and tax audits. For example, an investigative audit is done to uncover frauds and criminal activities, and a financial audit scrutinises the financial statements for accuracy.

Importance of Accounting Practices

The importance of accounting practices can be gauged from the clarity they offer to ensure compliance and help your clients make informed decisions. Sound accounting practices can make the difference between triumph and fiasco. That’s not all, there is a list of points that make accounting practices more important, such as:

Financial Transparency

Accounting practice ensures that all financial transactions your clients make are recorded and reported accurately. Such transparency will increase the trust placed by stakeholders like investors and customers in your clients and in you.

Better Decision-Making

With accurate financial data in hand, your client will be in a position to make impactful decisions. The decision could be related to launching a new product or cutting costs. When data is in your hand, you can help your clients in making informed decisions.

Regulatory Compliance

UK tax regulations are set and enforced by HMRC and it is strictly enforced. It is only through proper accounting practices that your accounting firm can help your clients stay compliant and avoid penalties and legal issues.

Efficient Resource Management

By following sound accounting practices, you will ensure that your clients can track all their incomes, expenses, and profitability. This will help you manage resources effectively.

Fraud Prevention

By conducting regular audits, you will be able to detect and prevent fraud before it affects your client’s reputation and finances. This will also help boost your accounting firm’s reputation.

Building Investor Confidence

By following good accounting practices, you will help your clients by generating accurate financial statements. Investors and lenders depend on these reports for assessing your client’s financial health. By providing accurate financial statements, you are boosting investor confidence and the reputation of your clients and yourself.

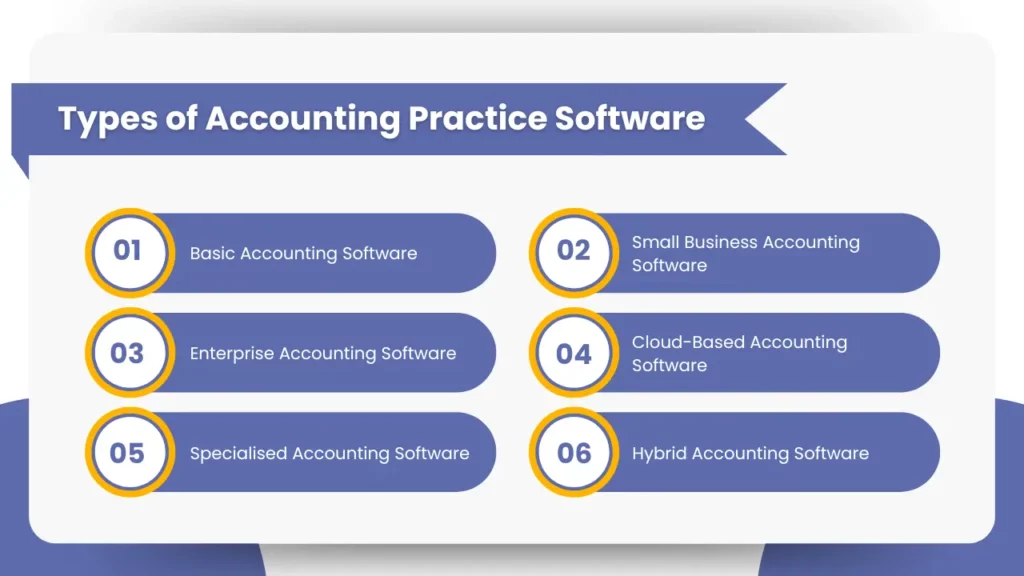

Types of Accounting Practice Software

We can all agree that managing finances for your clients is important, but it’s not simple due to the complexities involved. However, accounting practice software has made life easy for accounting firms like yours. Accounting practice software has simplified financial tasks, allowing your clients to focus only on their growth.

Whether your client is a small business owner or a large multinational, accounting software can be tailored to meet their needs. Let’s examine the different types of accounting software.

Basic Accounting Software

The basic accounting software is ideal for your small business clients to handle their basic but essential accounting tasks like recording transactions, generating invoices, and tracking expenses. It is user-friendly, low-cost, and can fulfil your client’s basic accounting requirements.

Small Business Accounting Software

Small business accounting software is one step up from the basic one and is ideal for small businesses that are rapidly expanding. It has certain advanced features, such as payroll management and inventory tracking, that will cater to your client’s growing business.

Enterprise Accounting Software

Ideal for large corporations with complex financial needs, enterprise accounting software can be used to manage your client’s high-volume transactions. Plus, this software is advanced enough to integrate with your client’s system, therefore it is high demand.

Cloud-Based Accounting Software

These days cloud-based accounting software is in high demand among accounting firms because it allows your clients to access their financial data from anywhere and anytime. This software type is ideal for those who work remotely and has promoted ease of use and flexibility.

Specialised Accounting Software

Certain niche industries like construction or ecommerce have special accounting requirements which can be fulfilled by specialised accounting software. Such software possesses unique features that fulfil unique requirements. If you are into offering services to construction industries then you will have to get one of these tools.

Hybrid Accounting Software

Hybrid accounting software combines the best features of desktop and cloud-based software. It offers the reliability of desktop software and the accessibility of cloud-based solutions.

How to Grow Your Accounting Firm?

Running an accounting firm in the UK is challenging but rewarding only if you know how to grow it. Let us explore some practical steps to help your practice expand without compromising service quality.

Select your Niche

The accounting field is a vast world and pleasing everyone is impossible, but giving your clients the best of services is important. That’s why we would advise you to focus on a niche and become an expert in it, that way, you will be able to attract your target audience.

Identify the type of clients with whom you are working and expand your knowledge with regard to their accounting requirements. Once you gain the expertise, you can promote yourself on social media and attract new clients.

Invest in Technology

Stay focused on selecting the right tools to streamline your accounting process, such as cloud-based accounting software. Nowadays, accounting software like Xero and QuickBooks is popular among your competitors. These tools, along with automation and data analytics, will reduce errors, save time, and present you with a proactive and tech-savvy accounting practice.

We understand that operating these tools requires a level of training and specialisation which your accounting team may not possess. Therefore, to overcome this shortcoming, you can try accounting outsourcing services offered by service providers. Through them, you can avail the benefits of these tools without having to buy them thus saving your cost.

Build a Strong Online Presence

It’s the digital age, and what better way to create a fine impression about yourself than having a user-friendly website. Ensure that the website can communicate your goals, visions, expertise, and contact information.

Platforms like Facebook and LinkedIn should be your preferred choice for showcasing your expertise. These platforms will also update you about industry happenings and provide you with contacts for potential clients.

Network and Build Relationships

Attending local and national events related to accounting allows you to connect with potential clients. In these events, you will get to meet consultants, lawyers, and financial advisors. Strike an alliance with them because they will refer your name to the potential client and vice versa. You can also join groups such as ICAEW (Institute of Chartered Accountants in England and Wales), which enhances your practice credibility and opens new networking opportunities.

Offer Value-Added Services

Your clients expect more than just basic accounting work; they want greater value for their money. Therefore, you must offer additional services, such as cash flow forecasting, financial planning, business advisory, and risk management.

You can help your clients in expanding their financial understanding by holding webinars and workshops. This way you will be trusted by your clients and put you in a better position to attract new clients.

Improve Client Retention

Only those clients will stay with you who feel they are getting the best of services plus they will be your publicity agents by recommending your services to others. But for that, you will need to provide them with excellent services by responding to their queries promptly, giving them clear advice, and putting in effort to solve their accounting queries. Care for their experience with you by asking for client feedback; this shows your willingness to listen and implement diverse views.

Create a Referral Programme

Take the help of your existing clients by encouraging them to refer to your name to get discounts and more services. You can also encourage your clients to share their good experiences through testimonials and case studies. These case studies and testimonials give you credibility.

Training Your Accounting Team

Accounting standards and UK regulations keep updating, and your accounting team must be in sync with them. There is no better way to keep your staff updated than training at regular intervals. These trainings will motivate your staff to give better results and give them new skills which will positively impact the services and growth.

Measure and Adapt

It is important to keep track of your performance; for that, you will have to constantly monitor indicators like revenue numbers, retention rates, and client acquisition. You also need to adapt to new technologies and regulations that can change the way accounting is done. For that, you have to be more open to adapting your services, tools, and processes to meet expectations.

Frequently Asked Questions (FAQ)

It is through outsourced accounting services your accounting firm will get access to expert support without incurring any in-house staff cost. It will give you flexibility, full-compliance with latest regulations, and allow you to focus on important activities.

You will need the help of an expert accountant how will keep an eye on the latest UK tax laws and accounting standards. The accountant must be registered with relevant regulatory bodies like the Association of Chartered Certified Accountants (ACCA) or the Institute of Chartered Accountants in England and Wales (ICAEW).

Reports generated through management accounts provide an insight into your client’s business performance such as profit and loss, cash flow, and balance sheets. These reports will help you clients in making informed decisions.

Staying updated with the latest accounting trends and regulations is possible by attending webinars, and subscribing to a reputed industry publication. Periodic training and certification programs will also do the trick. You can also choose to outsource and the service provider will keep a tab on the latest trends and regulations on your behalf.

Conclusion

Accounting practices, including accounting methods and types, shape how accountants perform their work, so gaining a deeper understanding of them is essential. For this reason, we have created this elaborate guide to help you understand various aspects of accounting practices and their impact on your accounting firm and your clients. After reading this guide, you will be able to answer all the doubts posed by your clients.

Certain aspects mentioned in the guide are challenging to implement yourself, such as investing in technology. In such cases, you can enlist the help of accounting outsourcing service providers with more experience, such as Corient. We are an experienced and professional service provider that multiple accounting firms rely on.

We have access to the latest accounting software and tools, which have streamlined processes and made our clients more efficient. Our accounting services, which range from bookkeeping, year-end, and payroll to audit, corporation, and VAT services, are widely known. Feel free to clarify your doubts through our website contact form. Our executive will connect with you as soon as possible.

Looking forward to an excellent association.