How Do I Choose The Right Outsourced Accounting Firm For My Company?

Is your practice under pressure to cut operating costs and compliance costs, thereby degrading output quality? It’s a problem many of your counterpart’s face, and the solution is accounting outsourcing. Around 45% of UK accounting firms have chosen to outsource some of their accounting function or thinking of doing so in 2025, according to a recent industry report.

However, before that, you will have to go through a selection process that will help you in finding the outsourcing provider that has the required expertise, technology, and services that will meet the practice and the client’s accounting requirements.

Let’s start the hunt for the best!

What Are Your Needs?

Finding an ideal outsourcing partner can be a tough nut to crack if you are not settled on what you need from an outsourcing provider.

To avoid such a situation, you will need to do the following.

- Identify Functions That Need Outsourcing: List down accounting functions like bookkeeping, payroll, or VAT compliance that need third-party assistance.

- Need for Industry Expertise: Focus on what kind of expertise you want from an accounting outsourcing service provider. A service provider’s accounting and regulatory experience will keep you compliant with UK regulatory requirements.

- Scalability: Ask your clients what their goals are. Accordingly, you will know the scale you will need and find an outsourcing provider that can scale up services.

What to Consider Before Partnering with an Accounting Outsourcing Service Provider?

Trends and studies suggest that in the coming years about half of accounting practices (50%) will resort to outsourcing some of their accounting tasks. However, to get the best out of outsourcing you will need select an outsourcing partner that meets your requirements. That can be achieved if you follow the below points.

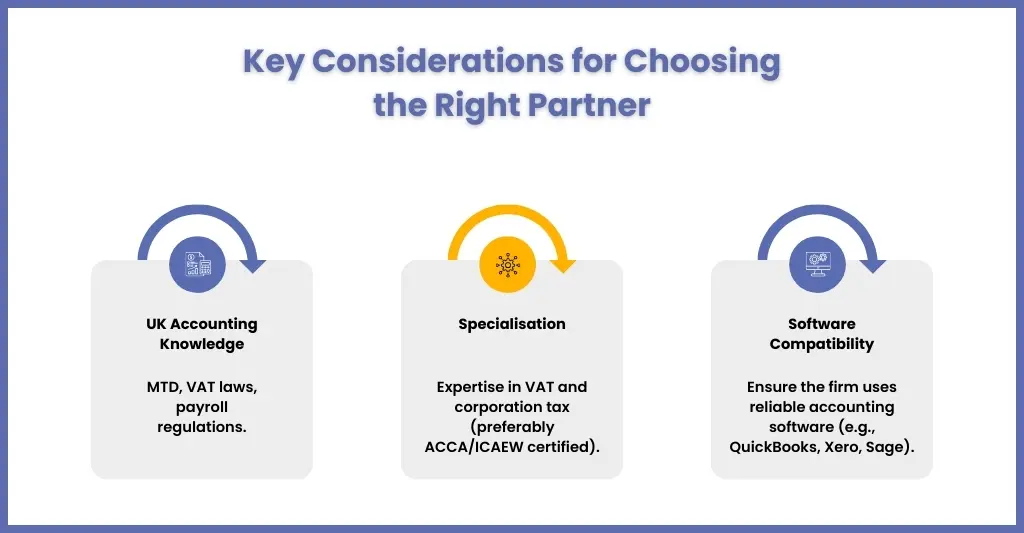

Knowledge of UK Accounting Standards and Regulations

Get on the side of a provider that has expert understanding on the latest UK accounting standards and HMRC regulations like MTD, VAT laws, and payroll regulations.

Specialisation

Find out the kind of accounting services offered by each outsourcing service provider and what they specialise in. Ideally, ACCA and ICAEW certified accountants should be your first choice due to their expertise in VAT and corporation tax, and they work as your extended team.

Software Used

Identify which accounting software does the service provider uses and give preference to reputed ones like Xero, QuickBooks, or Sage. Based on that you can easily make your selection.

Communication

Find out what communication, either email or video conference, is used by a service provider and see for a dedicated point of contact. Also, understand their response time to queries and their willingness to collaborate with your team.

Scalability

Understand a service providers capacity to scale up and down their accounting services before selecting it as your partner.

Track Record

Case studies, reviews, and testimonials will give you detailed insight of their track record and reliability.

Data Security

GDPR-compliant status and security certifications like ISO 27001 must be verified. Also, understand their policies on data encryption, access control, and data retention.

Cost Structure and Transparency

What pricing models are on the offer? Per hour, flat fee or something else. Demand transparency from the service provider and then make the selection.

Cultural Fit and Values

Take a look at their working culture and work ethos before you select a service provider. By selecting a partner with ideal work culture, you will be ensuring efficiency and good work relationship.

Strategic Support and Advisory Services

Beyond usual accounting tasks, see whether the accounting outsourcing service offered by the provider offers you strategic advice that will help you push your clients towards making informed business decisions.

Key Questions to Ask an Accounting Outsourcing Service Provider

Now you know what an outsourcing provider needs to have to offer the best outsourcing services. That makes you ready to ask service providers questions. This set of questions is not standard and will help you understand their expertise and whether they can meet your requirements.

We have categorised these questions as follows:

Related to Expertise & Experience

- What is your experience with businesses in our specific industry?

- Who will be working on my client’s accounts, and what is their expertise and certifications?

Compliance & Security

- How to keep my practice and clients compliant with the latest UK accounting standards, tax laws, and MTD regulations?

- What data security measures are being taken for safeguarding sensitive information?

Process & Technology

- Which accounting software do you use, and will it integrate with our existing systems?

- What is your average turnaround time for monthly reports and ad-hoc requests?

Service Model

- Can you demonstrate how you helped accounting firms of our size?

- If any errors or discrepancies are highlighted, what will be the rectification process?

Pricing & Contract

- Can you explain in detail all the fees and costs?

- What are the contract terms, and how flexible are they if our needs change?

We are sure that by asking these questions during interviews with service providers, you will get detailed responses about their track record, software they use, expertise and experience, compliance, and pricing.

People Also Ask

Get useful information on their experience in the industry, their track record, customers catered to, and look into whether the clients are satisfied with the work.

Some of the mistakes to avoid while outsourcing are:

1. Lack of decision on what to outsource

2. Overlooking cultural differences

3. Ignoring contract details

4. Poor project management

5. Impractical cost expectations

6. Not evaluating your results

7. Overlooking relationship building

Never think of outsourcing your core business. That’s your advantage, which must never be delegated because you have the expertise, and outsourcing will create unwanted dependence.

Untrue, a professional service provider will provide regular reports and full visibility, thus allowing you to retain control over decision-making.

Conclusion

Having clarity when choosing your outsourcing partner is important; it will help you choose the right one. This blog aims to clarify what you need to consider when selecting an outsourcing service provider and to ask specific key questions.

As UK accounting regulations keep getting stricter, outsourcing will keep gaining relevance by keeping you compliant, reducing operational pressure, and giving your accounting team the bandwidth to focus on high-value advisory services. The right outsourcing partner will work like an extension of your arm.

Through this blog, you will find that Corient is the most suitable outsourcing partner. Corient has the experience, certified accounting talent, and tools to handle complex accounting tasks, including bookkeeping, payroll, corporate tax filing, year-end, and more.

If you have any special requirements, please request our contact form, and we will connect with you.