Corporation Tax Return – A Complete Guide for UK Accounting Firms

- Understanding Corporation Tax Return

- Steps to File Corporation Tax Return

- How to Calculate Corporate Income Tax

- UK Corporate Tax Rate – How It Affects Your Clients’ Business

- Choosing the Right CT600 Software for Corporation Tax Filing

- Common Mistakes to Avoid When Filing Corporation Tax Return

- Frequently Asked Questions (FAQ)

- Conclusion

We say with full responsibility that handling corporation tax compliance and running a business at the same time is not a joke. Agreed, many businesses successfully handle corporation tax returns themselves, but it comes at a cost in treasure and time. In recent years, businesses around the UK have faced a 15% rise in tax administration costs between 2019-20 and 2023-24 due to increasing complexity in the tax system. Errors in calculating corporation tax returns have also increased due to complexity.

These facts paint a grim picture; however, businesses and accounting firms can improve the situation by understanding corporation tax complexities, especially corporation tax returns.The good news is that many businesses have realised this and are taking steps to manage it either on their own or through an accounting firm. Surprisingly, accounting firms are also finding it difficult to handle corporation tax returns due to high volumes and complexity. Therefore, to simplify things, we have developed a simple guide on corporation tax returns that will benefit businesses and accounting firms.

Understanding Corporation Tax Return

Corporation tax is a part and parcel of a business person’s professional life, and having an understanding of it will help in making your client’s business sustainable in the long run. But before that, let’s understand corporation tax returns. In layperson’s terms, the corporation tax return is a set of financial information that a business or an accounting firm on behalf of their client will have to provide to the HMRC every year. The financial information includes profit and loss, loans, and other relevant information used in calculating the corporation tax your business clients owe.

A corporation tax return includes the following:

- A CT600 form

- The company’s accounts

- The company’s tax computations

- Any supplementary documentation

If your business client gets a Notice to Deliver a Company Tax Return, it’s your responsibility to handle the corporation tax return. The deadline for completing a Corporation Tax Return is 12 months after the end of the accounting period that it covers.

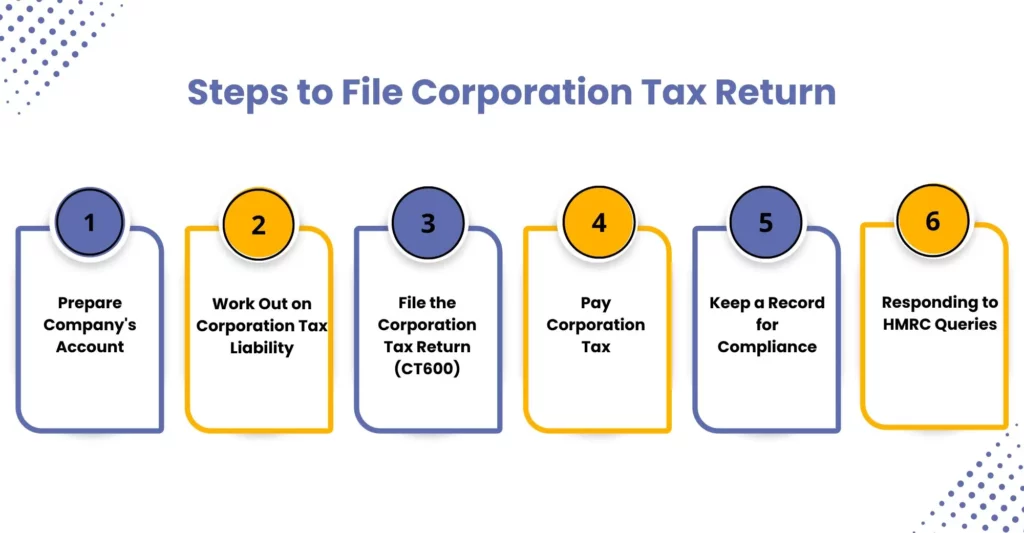

Steps to File Corporation Tax Return

Filing a corporation tax return requires you to follow several key steps. The below-mentioned steps will ensure a smooth preparation and filing of the corporation tax return, thus preventing unwanted disruption to the business.

Prepare Company’s Account

Before starting with your client’s corporation tax return, ensure its records are in the proper place. Special emphasis should be placed on statutory accounts, which will cover your client’s entire financial year.

Work Out on Corporation Tax Liability

Start calculating the taxable profits and apply any relevant deductions, allowances, and reliefs (e.g., capital allowances, R&D tax relief). Keep track of the current corporation tax rates and calculate accordingly.

File the Corporation Tax Return (CT600)

Once all the calculations are done, it’s time to file the return by logging in to HMRC’s online site. You can also use approved accounting software for filing corporation tax returns. Once logged in, provide details like your client’s profits, losses, tax adjustments, and capital allowances.

Pay Corporation Tax

After the calculations, if you find that your client owes corporation tax, it must be paid. The payment of corporation tax must be made within 9 months and 1 day after the end of your accounting period. Even if your client does not owe any corporation tax, it must be informed to HMRC.

Keep a Record for Compliance

Always properly record all accounting records, invoices, and tax computations. This will come in handy when HMRC asks for them during an audit.

Responding to HMRC Queries

It is one of the major reasons why businesses these days are handing over corporation tax responsibility to accounting firms. HMRC may conduct surprise checks and ask for further details. You, as an accounting firm handling corporation tax responsibilities for your client, will be ready with all the supporting documents to satisfy any regulatory authorities.

How to Calculate Corporate Income Tax

Calculations are crucial for the success of your client’s business. To help you do this, we have prepared some points that will smoothen the calculation process.

Identify Your Client’s Profits

It’s well-known that corporation tax is calculated on a business’s taxable profits. These profits include trading profits, investment income, and capital gains from selling assets. Hence, identify these profits in the first place.

Apply the Corporation Tax Rate

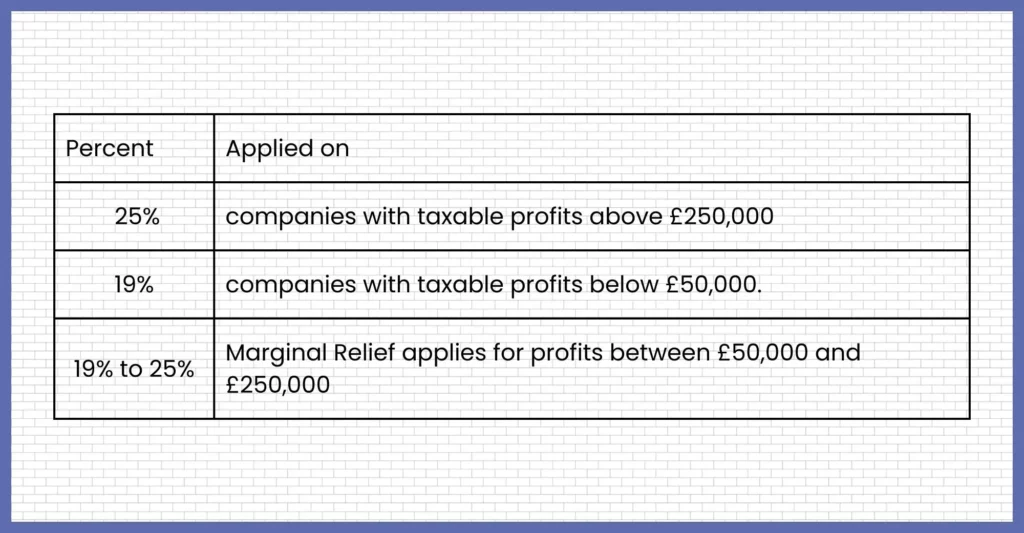

Currently, there are three corporation tax rates in the UK, which are:

Select the applicable tax rate for your client based on the profits earned.

Adjust for Tax Deductions and Reliefs

Businesses rely on accounting firms for corporation tax work because these firms excel at reducing tax by identifying tax reliefs. Your clients will expect the same from you. Therefore, you must be able to identify the following.

- Capital allowances for, e.g., Annual Investment Allowance for business assets

- Loss relief

- Patent Box relief for profits derived from patented inventions taxed at 10%

Submit the Corporation Tax Return (CT600)

Once you complete the calculations and identify tax reliefs, file the corporation tax return (CT600) within 12 months of the accounting period’s end. After filing, your clients must pay the tax within 9 months and 1 day after the accounting period ends.

With your vital support, you can help your clients get relief that will help them minimise their tax liabilities while keeping them compliant with the latest HMRC regulations. If you require any assistance in tax calculations, then feel free to get expert help through corporation tax outsourcing services offered by service providers.

UK Corporate Tax Rate – How It Affects Your Clients’ Business

You need to understand the impact of corporation tax rates on your client’s business based on which you will be advising your clients. Any changes in tax rates impact your client’s investment decisions, profitability, and tax planning strategies negatively or positively.

To prevent your clients from panicking about changes in corporation tax rates, we advise you to understand the following important points.

Understanding Corporate Tax Rates

Corporation tax is applied to businesses’ profits; however, tax rates differ based on these profits. Currently, there are three corporation tax rates applicable which are 25, 19 to 25%.

Impact of Corporation Tax on Different Business Sizes

Corporation tax also impacts the future of your client’s business in the following way:

If your client’s business profits are below £50,000, they will enjoy a lower tax rate of 19%, leaving more profits in their hands for reinvestment. Those businesses with profits between £50,000 and £ 250,000 will have to pay taxes higher than 19% but less than 25%, leaving less funds for reinvestment. In such situations, the importance of deductions and reliefs rises.

25% is the primary corporation tax rate applicable if your client earns profits of more than £250,000. Such a tax rate will undoubtedly impact your client’s cash flow and investment decisions; hence, more focus will be placed on efficient tax strategies.

Other Considerations for Your Clients

You must devise new ways to reduce your client’s tax liabilities by focusing on claiming reliefs and reducing expenses. Also, note that a higher corporation tax will leave less funds for your clients for investment, hiring, and restructuring.

Choosing the Right CT600 Software for Corporation Tax Filing

As an accounting firm, you must understand the importance of choosing the right CT600 software. Its importance has increased further due to HMRC’s MTD initiative and the increasing complexity of tax regulations. Using CT600 software, you can reduce errors and make timely client submissions.

To choose the best CT600 software, you will have to look for specific features in it, which are:

- HMRC-recognised and MTD compliant software

- A software that covers all aspects such as trading profit calculations, capital allowances, R&D tax relief claims, and marginal relief computations.

- Integrates well with multiple accounting software

- Automates calculations and error checks

- Enables easy online filing with HMRC

- Data security by being GDPR compliant

Some of the best CT600 software in the market of corporation tax filing are:

TaxCalc

Ideal for mid-sized accounting firms, TaxCalc features an in-built error checker to avoid compliance issues. It is also recognised for its direct CT600 e-filing feature.

BTCSoftware

It supports multiple client’s bulk submissions and integrates well with Xero, Sage, and other accounting software.

IRIS Business Tax

Perfect for large accounting firms, the IRIS business tax software can handle complex calculations and bulk transactions from multiple clients through automation.

To choose the best CT600 software from the above, you have considered the following things:

- The size of your client’s business and the number of clients you are handling.

- Does it integrate well with multiple accounting software?

- Check whether it is light on your pockets.

- Ensure the software is recognised for CT600 filing and future MTD updates.

Common Mistakes to Avoid When Filing Corporation Tax Return

As your experience will say, errors while filing corporation tax returns are bound to happen and remaining compliant with HMRC is important. Many accounting firms have made common mistakes that have led to penalties and delays for your clients. Those common mistakes are as follows:

Missing the Filing Deadline

The CT600 form must be submitted within 12 months of the accounting period’s end, however, many times delays lead to automatic penalties. Reminders will help you keep track of the deadline, and CT600 software will help you streamline the submission.

Wrong Calculations of Taxable Profits

Errors can occur in calculating allowable expenses, capital allowances, and reliefs, leading to overpayment or underpayment of tax. Only double-checking expenses, depreciation, and R&D tax relief and using accounting software for the correct application will do the trick.

Not Claiming tax Reliefs

It’s hard to believe, but many times, multiple accounting firms have been missing out on tax reliefs that clients are entitled to, such as R&D Tax Credits, Annual Investment Allowances (AIA), and Loss Relief. Only a thorough review and expert handling can prevent this error. Many accounting firms have relied on corporation tax outsourcing services for expert help in tax reliefs. Go through the case studies of accounting outsourcing service providers to know their experience before selection.

Incorrect Financial Data

Missing or entering incorrect financial data like revenue, costs, and profits will lead to miscalculations in tax profits and potential inquiries. Hence, inspecting the financial statements’ data thoroughly is important.

Using the Wrong Corporation Tax Rate

You must select the right corporation tax rate based on the profit; otherwise, your clients may overpay or underpay taxes, causing financial losses, penalties, and reputational damage to your accounting firm.

Not Maintaining Proper Records

Records must be maintained for 6 years as per HMRC directives. Failure to do so will lead to penalties and difficulty claiming tax reliefs for your clients during the audit period. Hence, store all invoices, receipts, and financial statements, ideally in digital format. Therefore, to make it more efficient, you can use cloud accounting software for better record-keeping and retrieval.

Submitting Incomplete CT600 Form

Leaving out important information like R&D tax relief and capital allowances must be avoided. To ensure it does not happen, you will be required to double-check the form for its completion. Make it foolproof using CT600 software, which will flag off any missing information.

Frequently Asked Questions (FAQ)

An accounting firm must retain on behalf of their clients all financial records that contribute to tax calculations, including Company Income Records, Sales Invoices and Receipts, Bank Statements, and Investment Income Records, to name a few.

The corporation tax will remain constant for 2025, at 25% for companies with profits over £250,000 and 19% for companies with profits of £50,000 or less.

Businesses can handle their corporation tax returns, but they risk making errors. Without expertise, they may face avoidable problems that experts could prevent.

MTD requires businesses to store all corporation tax return records digitally, reducing the risk of errors or misplacement.

The deadline for a corporation tax return is 12 months after the end of the accounting period it covers.

Yes, Corient uses TaxCalc and Sage for year-end accounts preparation and corporation tax

Almost all companies cannot submit their Corporation Tax Return (CT600) directly through HMRC’s online portal and must use commercial tax software instead.

Conclusion

Our experience while working with accounting firms has made us realise how corporation tax return responsibility might be taking a considerable amount of your time and resources. In addition to the misery, complexity, and volume of corporate tax return work given by your clients, it will be impossible to handle it alone. Therefore, to make life easier for you, we have developed a guide on corporation tax returns, how to handle the calculations, filing and mistakes to avoid, as explained in plain and simple language. We hope it makes a difference.

Speaking about making life easier, if you are interested in further streamlining your corporation tax return services, then why not get outside expertise in the form of corporation tax services? In the UK, you will be spoilt for choices; however, many accounting firms are placing their faith in the upcoming and aspirational Corient.

Since 2011, we have worked on establishing ourselves as a trusted accounting outsourcing service provider for accounting firms. Our tech-savvy bookkeeping, corporation tax, payroll, and other accounting services have had a considerable positive impact on multiple accounting firms. If you are interested in gaining benefits from us, then do contact us through our website contact form. Our executive will get in touch with you.

Best of luck and looking forward to meeting you soon.