Is your accounting team bogged down with multiple complex accounting tasks like VAT filing, payroll responsibilities and so on for your clients? If the answer is yes, then it’s time to outsource your accounting work and relieve their pressure. Getting accounting work done in-house for UK-based practices is getting difficult with every passing year.

The reasons are many, including tight deadlines, complex HMRC compliance rules, and growing client demands, to name a few. All these reasons have made in-house accounting work complex and slow. These reasons have made outsourcing cost-effective and an innovative strategy that allows accounting practices to focus on strategic tasks while ensuring accuracy and compliance.

In this blog, we will understand why practices are placing their faith in outsourcing accounting work and the sure signs that will tell you it’s time to outsource.

Let’s get started:

Why Accountants Are Turning to Outsourced Accounting Services

Today’s UK accounting is very complex and competitive, and accounting practices are under increasing pressure to deliver more to their clients while keeping the costs under control. To achieve it, practices have turned toward outsourced accounting services, which have helped in incorporating modern and flexible ways to manage workloads. Here’s why so many practices are making the shift:

Scalability Without the Risk

Busy periods such as year-end or tax season can bog down even the best accounting practices. Instead of going down the path of hiring extra staff who are not required all year-round, outsourcing will allow you to scale up quickly. This way, you can save your funds and maintain a lean and mean accounting practice.

Expertise on Demand

Getting the right talent for an accounting practice in the UK is a tall ask. But through outsourcing practices, you will gain access to a vast pool of experienced professionals. Whether it’s handling complex tax compliance or managing VAT filings, you can depend on their skills, which cost you a fraction compared to hiring and training internally.

Greater Efficiency

Have you noticed that most of your time is consumed in handling repetitive manual tasks such as reconciliations, payroll runs, and data entry? You are not alone. Thankfully, outsourcing provides a way out by freeing up your accountant’s time so that they can focus on high-value advisory work, building client relationships, and other strategic tasks.

Cost-Effectiveness

Hiring, training, onboarding, and retaining experienced staff is an expensive affair. The costs include salaries, training expenses, pensions, and other overheads. Outsourcing will save you from these fixed costs compared to the price of the services you use.

5 Signs It’s Time to Outsource Your Accounting Work

When will you realise that it’s time to outsource your accounting work? When you see these 5 signs, it means the time has come. These signs are:

You’re Spending More Time on Numbers Than on Strategic Advisory Work

Running an accounting practice means numbers will surround you, and in the old days, it was normal. However, with complex accounting regulations in place and clients demanding high-quality services, getting bogged down with numbers is not an option.

Therefore, if you are facing:

- High time consumption in balance sheet reconciliation

- If invoices are getting piled up

- Too much time is going into fixing errors

Then it’s time to outsource. It’s not the time that you will save, but your mind space will be freed for handling client relations, strategic decisions, and advisory work. Choose accounting outsourcing services of an outsourcing provider and free your staff from day-to-day accounting work.

Struggling to Keep Up with Compliance

Is your calendar resembling a mind field of filing dates for VAT returns, and tax submission reminders? You are not alone. UK tax laws, VAT return deadline, and new initiatives like Making Tax Digital have made life difficult for accounting practices and accountants, placing requirements for specialised knowledge.

Any mistakes in following the law or missing deadlines will invite penalties. The issue is that these laws and deadlines keep on changing, creating a lot of uncertainty, increasing penalty risk, and slowing down the process. Through outsourced providers, you can ensure your accounting work remains fully compliant.

If Your Client Has Outgrown Your Capacity

If your client’s business is expanding at a rapid pace, this can lead to problems, especially when you do not increase your capacity with it. Essential tasks like handling payroll, suppliers, and client payments slow down. By outsourcing, you will prevent a slowdown and ensure that you have enough capacity to meet the accounting demands of your clients.

Occurrence of Multiple Tax Mistakes

Tax mistakes can happen, and it’s very stressful. Whether it’s misreporting VAT, mistakes in payment of Corporation Tax, or missing out on claimable expenses, the risks are real (and expensive).

Some of the common mistakes that occur are:

- Late or incorrect filing of CT600 forms

- Missing out on allowable expenses that could reduce your clients’ tax bill

These mistakes happen from your client’s side, and if you miss out, then it will cost your reputation dearly. However, through outsourcing, you can reduce these mistakes. A professional outsourcing provider like Corient will keep your clients’ records clean and compliant.

You Want to Focus on Clients, Not Paperwork

Spending too much time on routine accounting work takes attention away from client relationships and advisory services. Outsourcing helps you focus on growth, while routine tasks are handled in the background.

Why Choose Corient for Your Accounting Work?

With its experience in solving pressing accounting issues for practices based in the UK, Corient has the tools to meet the tight deadlines of the HMRC and stay compliant with it constantly. Based on our experience, we have designed our outsourcing accounting services that are not only reliable but also designed to help your practice grow.

Here’s why practices across the UK trust Corient with their accounting work:

Industry Expertise

Our accounting team consists of ICAEW members and directors with backgrounds in Big Four firms. It means we will bring to you high standards, technical knowledge, and attention that a top accounting firm delivers, but in a cost-effective way. Our services are designed to be flexible to cater for practices of all sizes.

Access to Latest Technology and Tools

We have made considerable investments in technology, such as invoice automation and specialist platforms. Plus, we also work with the best accounting software like Xero, QuickBooks, Sage, and TaxCalc, ensuring that your accounting work is completed with the highest accuracy and efficiency. By combining technology with human expertise, we reduce errors and speed up turnaround times.

Open to Accounting Practices and Accountants of All Sizes

Whether you are an accountant or the owner of an accounting practice, we are open to all and we will adapt to meet your accounting needs. You can pay for the services you use during peak seasons, or you can opt for long-term outsourcing. The costs will be transparent.

Proven Track Record

With years of experience in supporting UK-based practices, we have built a reputation for trust, competence, compliance, timely results, and accuracy. From bookkeeping to payroll runs and management accounts, you can count on us to handle your accounting work with the same attention as your in-house team.

People Also Ask

1. What are the benefits of outsourcing accounting for UK businesses?

Outsourcing reduces costs, improves compliance, ensures access to specialist expertise, and frees up time for businesses to focus on growth.

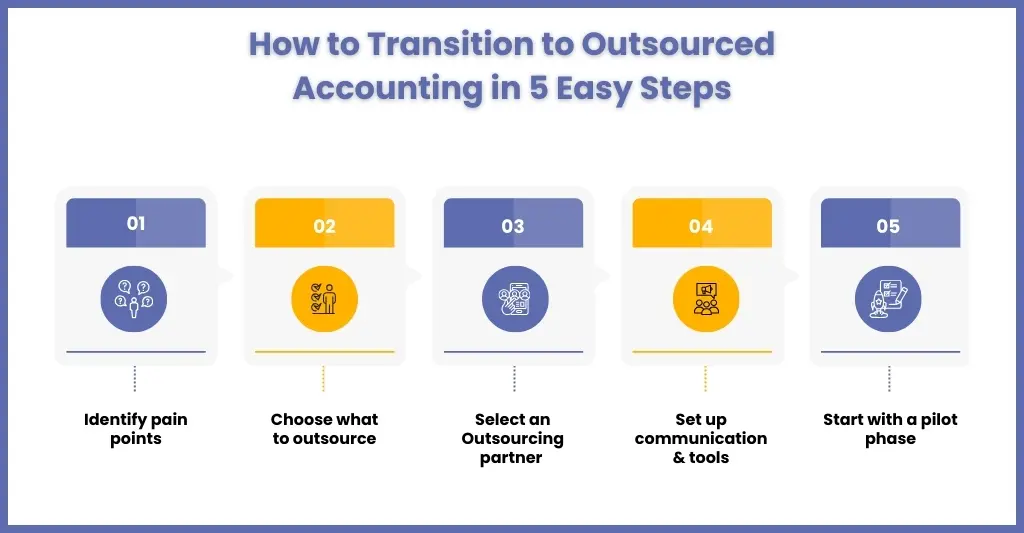

2. How do I transition from in-house to outsourced accounting smoothly?

Start by identifying the tasks you want to outsource, choosing a trusted provider, and ensuring clear communication about timelines, deliverables, and data security. A phased transition often works best.

3. What is outsource accounting?

Outsourced accounting occurs when a practice hires an external, third-party company to handle accounting functions. These functions can include managing payroll, accounts payable, accounts receivable, monthly bank reconciliations, tax prep support, legal compliance and financial reporting, among others.

4. Is it cheaper to outsource accounting?

Under outsourced accounting, practices are required to pay only for the work needed rather than hiring a full-time in-house employee. This typically means the annual cost of the outsourced accountant will be significantly less than the salary of an equally experienced in-house accountant

Ready to Outsource Your Accounting Work?

In conclusion, we would like to ask a million-dollar question, are you facing any of the signs mentioned above? If yes, then choose your outsourcing partner quickly and enhance the productivity and accuracy of your accounting process. In the UK, you will be spoilt for choice when it comes to outsourcing service providers, but Corient has a special place among accounting practices.

Established in 2011, Corient has made its name by offering MTD-compliant and tech-savvy accounting services for practices across the UK. Our services have helped reduce costs by 50% and increase productivity and capacity. That’s why accounting practices say that we are a reliable, efficient, and cost-effective outsourced accounting service. Want a free trial of our services? Please fill out your details on our contact form and get started.