VAT Return & Payment: How to File and Pay VAT Online in the UK

- Introduction

- What is a VAT Return, and Why Is It Important for UK Businesses?

- Step-by-Step Guide to File Your VAT Return Online

- How to Make a VAT Payment Online Through HMRC

- Common Mistakes to Avoid When Filing and Paying VAT

- Benefits of Filing VAT Returns Online and Automating Your Process

- Why Partnering with VAT Experts Ensures Accuracy and Peace of Mind

- Frequently Asked Questions (FAQ)

- Conclusion

Introduction

Filing VAT return and making payments on time is a legal requirement for all VAT-registered businesses in the UK. To do that your clients are required to file and pay VAT online in the UK, log in to their HMRC account, submit their VAT return using compatible software, and pay via HMRC-approved methods. Naturally, your clients will take a premium interest in filing returns and making VAT payments to avoid penalties and stay compliant. But nowadays it is increasingly being handled by accounting practices.

Ideally, this should have been a happy ending, but that’s not the case. In recent times, we have been increasingly approached by accounting practices for guidance in the filing and payment of VAT. This means only one thing: Even accounting practices in the UK are finding it difficult to cope with the ever-changing VAT regulations and compliance requirements. But do not worry—we are here to help you.

In this blog, we’ll guide you through the VAT return & payment process step-by-step, highlight common pitfalls, and show how automation and expert support can simplify your VAT compliance.

What is a VAT Return, and Why Is It Important for UK Businesses?

A VAT return is a form submitted to HMRC that briefs your client’s sales and purchases and the VAT they owe or can reclaim. Most UK businesses must file their VAT return every quarter unless they are under an annual or monthly scheme.

It must be understood that filing VAT returns and making payments is not just a box-ticking exercise for your clients. Through accurate VAT reporting, you can ensure for your clients:

- Regulatory compliance with HMRC rules

- Avoidance of penalties and interest

- Healthy cash flow management

Step-by-Step Guide to File Your VAT Return Online

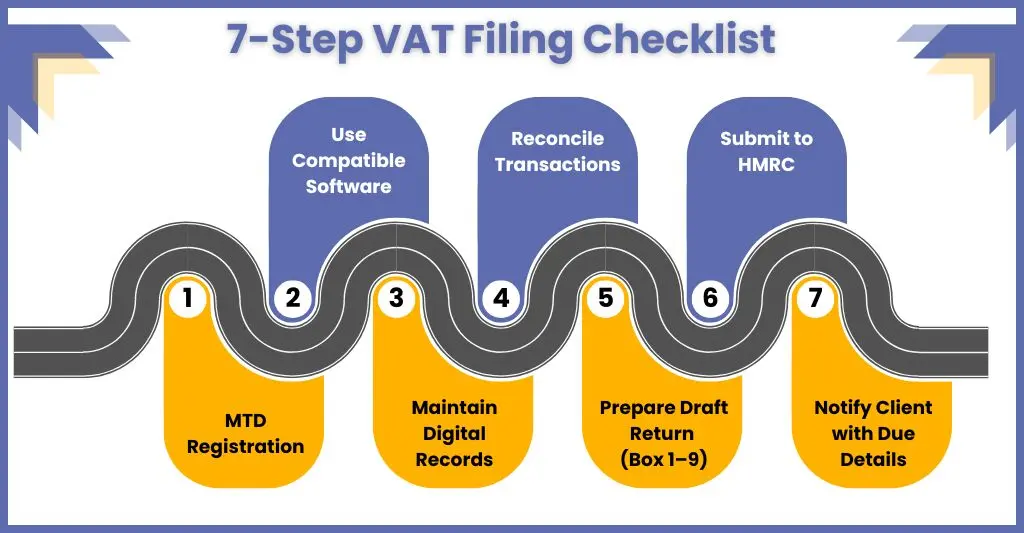

As an accounting practice, handling VAT returns and payments on behalf of your clients requires technical accuracy and full compliance with Making Tax Digital (MTD) regulations. Whether your client is a small retailer or a growing eCommerce brand, following an efficient process ensures timely submissions and exact VAT liabilities.

Here’s a detailed guide to help you manage and file VAT returns online efficiently:

1. Ensure Your Client is MTD-Compliant

Before anything else, check that your client is registered for Making Tax Digital for VAT, which is compulsory for all VAT-registered businesses in the UK (regardless of turnover) since April 2022.

- Sign them up through the HMRC MTD VAT portal.

- Use their Government Gateway ID to link their profile with MTD services.

2. Use MTD-Compatible Accounting Software

Select and set up an MTD-compliant accounting software that goes well with your practice workflow. Some of the popular options in accounting software are:

- Xero

- QuickBooks

- Sage

- FreeAgent

- IRIS

These tools are essential to manage your clients VAT and they help in managing the following:

- Enabling automated calculations of VAT owed or reclaimable

- Giving a direct link with HMRC for real-time submissions

You are responsible for ensuring that your accounting staff is trained in using these tools correctly and that all software updates are applied.

3. Maintain Digital Records and Reconcile Transactions

The Make Tax Digital initiative has been completely implemented on VAT, and among the multiple compliances under this initiative is maintaining digital records as mandated by the HMRC.

Here are some of the records you will have to maintain digitally:

- Sales and purchase invoices

- VAT rates applied

- VAT account summary

- Dates of supply and payment

As an accounting practice, ensure each of your client’s data is:

- Digitally linked (no manual copying and pasting between systems)

- Reconciled with bank feeds and physical receipts

- Categorised correctly for standard-rated, zero-rated, or exempt VAT treatment

To avoid discrepancies in these records, it is recommended that a mid-period VAT health check be performed to resolve inconsistencies before submission deadlines.

4. Prepare the VAT Return

Once the VAT period ends (usually every quarter), use your accounting software to generate a draft return.

Review the 9-box format return, which contains the following:

- Output VAT (Box 1)

- Input VAT (Box 4)

- Net VAT payable or reclaimable (Box 5)

- Total sales and purchases (Boxes 6 to 9)

- Verify the accuracy of all figures

- Run internal checks, especially for:

- Non-standard VAT rates

- EC sales/purchases

- Capital asset acquisitions

- Reverse charge mechanisms (common in construction or B2B digital services)

5. Submit the VAT Return to HMRC

Once reviewed and finalised, submit the VAT return to HMRC. To do that, use the MTD software, select the client and relevant VAT period, and submit the return directly to HMRC through the software. Once that is done, you will get a receipt and acknowledgement, which must be retained for audit.

6. Communicate VAT Liabilities and Payment Instructions to the Client

Once you have filed a VAT return, you must inform your client of the VAT amount and its due date, which is usually 1 month and 7 days after the VAT period ends. Hence, provide the following information to your clients:

- The amount payable

- Due date

- Payment reference (usually the VAT registration number)

- Recommended payment methods

7. Keep a Digital Audit Trail

For every VAT return filed, maintain a clear audit trail including:

- Source documents (invoices, receipts)

- VAT return report and breakdown

- Submission confirmation from HMRC

Keeping these records will protect your practice and your Client during VAT inspections or if amendments are required.

How to Make a VAT Payment Online Through HMRC

Once the VAT return has been filed, your clients must pay the VAT due before the deadline to avoid penalties. Some of the payment methods identified by the HMRC are as follows:

- BACS payment system

- CHAPS system for settling wholesale high-value payments

- Direct debit or credit card

- Payments through online telephone banking

- Through accounting software that allows direct payment links

Common Mistakes to Avoid When Filing and Paying VAT

Nowadays, it is common for businesses in the UK to hand over the responsibility of managing VAT return & payment to an accounting practice because of an assurance of accuracy and timely execution. But you will agree that mistakes still happens, resulting in penalties, client dissatisfaction, and HMRC scrutiny.

Hence, let us focus on the common VAT filing and payment mistakes, along with practical advice on preventing them.

Missing Filing and Payment Deadlines

Failure to submit payments or meet VAT returns deadline (usually 1 calendar month and 7 days after the end of the VAT period) can lead to:

- Surcharges and penalties

- Accrued interest on unpaid VAT

- Reputational damage with clients

Solution:

Work on implementing automated reminders using your practice management software. Also, keep a master VAT calendar that flags deadlines per Client and VAT scheme (quarterly, monthly, or annual).

Incorrect VAT Calculations

Miscalculations in VAT are a common occurrence that occurs due to misconfigured accounting software or manual calculations; this can result in:

- Overstated VAT liabilities

- Under-claimed input VAT

- Misclassification of exempt or zero-rated goods

Solution:

To avoid miscalculations, you are required to correctly set the VAT codes in your MTD-compatible software. Also, prioritise regularly reconciling input/output VAT against sales and purchase ledgers and conducting internal peer reviews before submission.

Using Incomplete or Non-Digital Records

As per the MTD regulations, all VAT data must be recorded in digital format. Relying on spreadsheets, manual inputs, or partial records increases the chances of errors and breaches of compliance, thus triggering potential audits.

Solution:

Make a point to use MTD-approved software with live bank feeds. Also, educate your clients on the importance of timely submission of their records in digital format. We recommend investing in secure data storage infrastructure for the safe transfer of client data.

Applying the Wrong VAT Scheme

Applying the wrong VAT scheme is a mistake that keeps coming up, and failing to correct it when your client’s turnover changes lead to underpayments or overpayments.

Solution:

To avoid such a mistake, you must conduct quarterly reviews of your client’s turnover and business activities to assess VAT scheme suitability. You can also seek help from a VAT specialist, who you can access through VAT outsourcing services offered by service providers.

Failure to Handle International Transactions Correctly

Recently, we have encountered accounting practices that commit mistakes when handling EU and non-EU transactions. These mistakes include:

- Not applying reverse charge correctly

- Misreporting import VAT

- Confusion between dispatches and exports

Solution:

Keep yourself updated with UK-EU VAT rules, and ensure your team is trained on cross-border VAT treatment. Use accounting software that flags anomalies in foreign VAT handling.

Neglecting to Inform Clients About VAT Liabilities

Sometimes, practices submit the return but delay communicating the amount owed, leading to missed payment deadlines.

Solution:

Create a system to auto-generate VAT summaries and payment instructions post-submission. Notify clients the same day the return is filed and offer payment support if required.

Not Keeping an Audit Trail

Always expect HMRC to come up and request your client’s supporting documents for any VAT return you made for them. If there are insufficient documents, your client will face penalties.

Solution:

Hence, you are required to store a digital trail for every submission, which includes:

- Invoices and receipts

- Reconciliation reports

- Submission confirmation

- Communication logs with clients

By avoiding these mistakes, your practice can maintain full HMRC compliance, build long-term trust with clients, and reduce the risk of financial penalties for your clients.

Benefits of Filing VAT Returns Online and Automating Your Process

For UK-based accounting practices, handling VAT return & payment processes manually is no longer just obsolete—it’s risky, unproductive, and likely to cause an error. With Making Tax Digital (MTD) now being fully enforced on all VAT-registered businesses, online filing and automation aren’t a choice but a compliance.

But compliance is only the beginning. Filing VAT returns online and automating the process unlocks many strategic benefits for your practice and clients.

However, we have noticed that MTD compliance is a blessing in disguise. Filing VAT returns online and automating the process opens a host of strategic benefits for your practice and your clients.

Improved Accuracy and Fewer Errors

We all know how many mistakes, such as miskeyed invoices, incorrect VAT rates, or duplicated entries, are made while doing manual data entry. However, with the use of MTD-compliant accounting software, these mistakes have become a thing of the past. Using this software, you can:

- Automatically pull VAT data from digital records

- Calculate VAT liabilities without manual intervention

- Flag anomalies or inconsistencies in real-time

According to HMRC, it has worked; digital submissions have reduced VAT filing errors by up to 12% among UK businesses.

Time-Saving for You and Your Clients

VAT filing done in the old way was time-consuming, especially when dealing with paper invoices, spreadsheet reconciliation, or chasing clients for missing information. By automating your entire VAT filing process, you can achieve the following:

- Generate returns in minutes, not hours

- Eliminate repetitive admin tasks

- Batch-file VAT returns for multiple clients from a central dashboard

This efficiency frees your team to focus on higher-value advisory work, from tax planning to cash flow strategy.

Guaranteed HMRC Compliance

Using MTD-approved software ensures your submissions align with HMRC requirements. You’ll never worry about:

Following HMRC compliance requirements is important, but also complex, and chances are that you can miss out on some. But by using MTD-compliant software, you can ensure submissions are done as per the HMRC mandate. Incorporate this tool either by buying it or accessing it through accounting outsourcing services.

Real-Time Visibility and Better Decision-Making

By automating VAT solutions, you can add value to your clients by giving them instant access in real time. These real-time insights give you the following:

- Accurate cash flow forecasts

- Timely reminders of payment due dates

- Early identification of VAT liabilities and reclaim opportunities

Such real-time insights enhance client confidence and position your practice as a proactive financial partner.

Scalability for Growing Client Portfolios

Scaling up VAT services manually is impossible, but you can scale without much effort with automation or online filing of VAT returns. Whether you are handling VAT for 5 clients or 500, automation will help you achieve it without expanding your team.

Through automation, you can:

- Onboard new clients quickly

- Handle complex VAT scenarios (e.g., partial exemptions, imports/exports)

- Centralise submissions and client reporting

Stronger Audit Trails and Reduced Risk

One of the biggest benefits of digital systems is their transparency. Under accounting software, every action is timestamped and traceable from invoice uploads to final submission.

Having a digital trail of all your tasks will be helpful in the event of an HMRC inquiry. Then, you can present a clear audit trail of all transactions, supporting documents, proof of submission, and payment records. This level of documentation reduces the risk of penalties and builds long-term compliance resilience.

Enhanced Client Satisfaction and Retention

Your clients expect speed, transparency, and reliability from your practice. By automating VAT filings, you deliver:

- Timely submissions

- Fewer mistakes

- On-demand reporting

This positions your practice as a trusted strategic partner—one that clients are more likely to stay with and recommend.

Why Partnering with VAT Experts Ensures Accuracy and Peace of Mind

In today’s regulatory landscape, VAT rules are progressively becoming complex, and HMRC is tightening its enforcement, accuracy and timeliness in VAT return & payment. While accounting software can automate the basics, it can’t replace deep VAT knowledge and real-world experience.

That’s where VAT experts come in, and if you want an experienced one, you will find them easily with an accounting outsourcing service provider. For practices managing a growing portfolio of clients, partnering with dedicated VAT professionals adds a layer of assurance, efficiency, and strategic value for your clients.

Navigate Complex VAT Scenarios with Confidence

The UK VAT landscape can be anything but simple, and handling these complexities requires more than expertise in data entry. It also requires interpretation, judgment, and up-to-date technical knowledge, which only VAT experts possess.

A VAT experts help your team confidently manage:

- Retail and hospitality-specific VAT rules

- Construction Industry Scheme (CIS) reverse charges

- International eCommerce VAT obligations

- Charity and not-for-profit exemptions

Minimise Risk and Avoid Costly Penalties

Never negate the possibility of mistakes in VAT returns, which can occur due to misclassification, misreporting, or late submission. Such mistakes will lead to default surcharges, interest charges, and full-scale VAT audits.

Partnering with VAT specialists can eliminate these risks. Their proactive checks, reconciliation reviews, and deep understanding of HMRC expectations ensure your clients remain compliant and audit-ready.

Improve Efficiency Without Sacrificing Accuracy

Time is money, and who knows that better than an accounting practice that is handling multiple VAT clients at the same time? You will likely get bogged down in resolving VAT anomalies or researching sector-specific rules, which VAT specialists can easily do. This lets your in-house team focus on client relationships and strategic advisory work without compromising on high-quality VAT compliance.

Stay Ahead of Changing VAT Regulations

HMRC updates and digital platform VAT obligations change constantly. By partnering with experts, your firm stays informed and prepared without constantly monitoring legislation updates in-house.

Enhance Your Value Proposition to Clients

By engaging the experts, you are upgrading your practice from transactional to robust, value-added. Such value-added services will build confidence among your clients, thus enabling long-term retention and helping you stand apart from the rest.

Frequently Asked Questions (FAQ)

Most businesses file VAT returns quarterly, though some opt for monthly or annual schemes depending on cash flow and turnover.

HMRC may issue late filing penalties and impose a default surcharge on any VAT owed, starting from 2% of the unpaid tax.

Refunds are usually made within 30 days of HMRC receiving your VAT Return. If you have not heard anything after 30 days, contact HMRC. If HMRC has your client’s bank details, the repayment will go directly to the bank account.

HMRC will carefully review your VAT returns to ensure they are accurate and filed in a timely manner. This means you must correctly calculate the VAT repayments due and make them by the deadlines specified by HMRC.

Claiming a tax rebate (also called a tax refund) in the UK is straightforward once you know which method applies to your situation.

a. Check if You’re Clients Eligible

b. Gather the Required Documents

c. Claim Through the Correct HMRC Method

d. HMRC Reviews Your Claim

e. Receive the Refund

There are several common reasons why HMRC tax refunds get delayed.

a. Processing Backlogs & Busy Periods

b. Additional Security or Verification Checks

c. Errors or Incomplete Information in Your Return or Bank Details

d. Manual Claims

e. Outstanding Tax Liabilities

Conclusion

Filing and paying your VAT return & payment online seems overwhelming, but that’s not the case. With the right tools, knowledge, and expert support, you can stay compliant, avoid penalties, and focus on growing your practice. Whether you are integrating online filing of VAT returns or embracing automation, both are important in qualifying into a modern UK accounting practice.

Where will you find such expertise, especially when you are saddled with multiple VAT responsibilities? Here, we are introducing accounting outsourcing services like Corient, which are valuable when offering VAT specialists through their VAT outsourcing services.

Corient has made its name by providing tech-savvy and compliant VAT services that have made a difference for multiple practices in the UK market. Apart from that, it also offers bookkeeping, payroll, and year-end services, to name a few. To learn more about our services or to clarify your doubts, write down your questions on our website contact form, and our executive will connect with you soon.

Best of luck in your future VAT endeavours and looking forward to hear from you soon.