Making Tax Digital for VAT: Common Mistakes and How to Avoid Them

Are you unsure if your clients fully comply with Making Tax Digital for VAT? This question arises among many accounting practices. Many practices in the UK are still adjusting to the ongoing changes brought by HMRC’s MTD initiative. Even accounting practices that believe they’re compliant often make costly but common mistakes like using the wrong accounting software, transferring data manually, or missing deadlines.

In this article, we’ll explain MTD for VAT, why it matters, the most common errors practices make, and how to avoid them. We’ll also recommend the best MTD-compatible software and show how Corient helps practices simplify compliance easily and confidently.

What is Making Tax Digital for VAT?

Making Tax Digital for VAT is a UK government initiative introduced by HMRC to digitise tax administration. It aims to make the tax system more effective, efficient, and easier for businesses to get right.

As of April 2022, all VAT-registered businesses—regardless of turnover—must:

- Maintain digital VAT records.

- Use MTD-compatible software to submit VAT returns.

- Keep all data connected through digital links (no copy-paste allowed).

According to HMRC, over 1.8 million UK businesses have joined the MTD program, with more than 11.5 million VAT submissions completed through MTD-compatible software by the end of 2024.

Is Making Tax Digital Just for VAT?

Making Tax Digital is not limited to VAT. While it started with VAT compliance, MTD is part of HMRC’s broader strategy to digitise the UK tax system over the coming years fully.

The next major step is Making Tax Digital for Income Tax Self-Assessment (ITSA), scheduled to launch in April 2026. This phase will apply to self-employed individuals and landlords with a gross annual income of over £50,000. From April 2027, the threshold will be reduced to include those earning over £30,000. Affected taxpayers must keep digital records and submit quarterly income and expense updates to HMRC using MTD-compatible software, followed by a final end-of-year declaration.

In addition, Making Tax Digital for Corporation Tax is currently under consultation, with implementation expected sometime after 2026. Although no fixed timeline has been announced, accounting industry anticipates similar requirements to those for VAT and ITSA—namely, digital record-keeping, payment of corporation tax, and tax submissions via HMRC-recognised software.

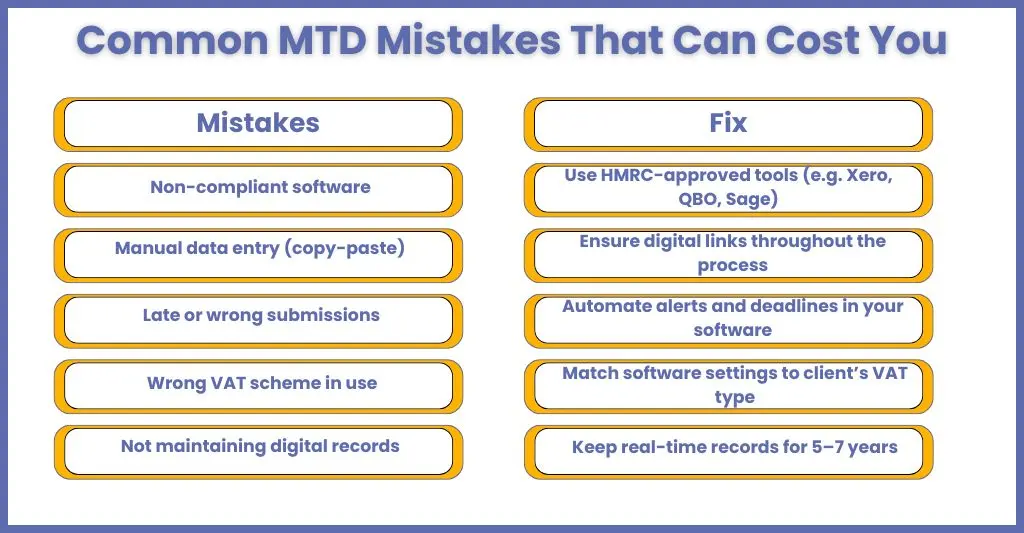

Common Mistakes Accounting Practices Make with MTD for VAT

While working with accounting practices, we have noticed that time and again, practices are falling into trouble during the MTD for VAT for their clients. Most of these troubles are avoidable, and by listing them, you can save time and resources of your clients.

These are the most common issues:

Using Non-Compliant Software

Using outdated accounting tools, especially those not recommended by HMRC, must be completely avoided. These systems lack the required features to send data directly to HMRC, thus adding to your work.

Solutions: Select cloud-based software that is recognised by HMRC and allows full digital record-keeping and submissions.

Manual Data Entry

With the introduction of MTD for VAT, manual data entry has become a thing of the past. Still, some accounting practices conduct manual data entry, breaking the digital link. Such breaks in the link cause data loss, manipulation, misreporting, and non-compliance.

Solutions: Hence, ensure that each step in your VAT reporting—from invoice input to submission—is digitally connected without any manual intervention through implementation of MTD.

Late or Incorrect Submissions

Another common mistake practices make is miscalculating VAT and missing submission windows. The chances of such mistakes increase when there is a manual element, which can trigger automatic penalties from HMRC.

Solutions: By automating VAT calculations, filing schedules, and submission alerts using your accounting software, you can reduce the chances of human error or missing deadlines.

Incorrect Use of VAT Schemes

Incorrect application of VAT codes or applying the wrong scheme, such as flat rate or margin scheme, by practices in their software is a common mistake that leads to incorrect submissions.

Solutions: To avoid this mistake, you have to verify with your clients about their VAT schemes and adjust the settings in the software to ensure they align with the correct reporting requirements.

Failure to Maintain Real-Time Digital Records

The MTD initiative has made it mandatory for practices and clients to update and keep their records digitally. If you do not maintain digital records, HMRC can focus on you during audits.

Solutions: Maintain digital records for a few years, ideally for 5 to 7 years. If you are finding it difficult to get access to tools for maintaining digital records in real-time then get assistance from an accounting outsourcing service provider.

Best Software for Making Tax Digital for VAT

To help you implement MTD, we have listed some reliable tools that have earned the trust of other accounting practices. Let’s have a look at them:

- Xero: It offers real-time tracking, smart VAT rules, and seamless MTD compliance.

- QuickBooks Online: Highly user-friendly interface and excellent support for digital record-keeping and direct VAT submissions.

- Sage Accounting: Trusted by accounting firms that need robust reporting and compliance tracking.

- FreeAgent: Ideal for accounting practices that serve contractors, freelancers, and small businesses.

- BTCSoftware and TaxCalc: These tools are ideal for practices that are still dependent on Excel but seeking MTD compliance.

Benefits of Complying with MTD for VAT

Apart from being a regulatory requirement, MTD for VAT is a perfect opportunity to boost your efficiency, accuracy, and client service. By complying with MTD requirements, you are not just saving your clients from penalties but also future-proofing your practice.

Here are some key benefits for MTD for VAT and how it can transform your accounting operations.

Streamlining VAT Submission Process

MTD has simplified the entire VAT process by introducing digital record-keeping and filing through HMRC-compatible software. Such automation will eliminate the need for manual calculations and reduce repetitive tasks associated with VAT returns.

Real-Time Financial Visibility

Maintaining digital records and using the latest accounting tools allows your clients access to financial data in real-time. Such real-time information will allow you to advise and provide more proactive support.

Increased Accuracy and Compliance

With the introduction of MTD-compliant accounting software, all data entries are validated, ensuring that the data goes directly from the digital records to VAT returns. This process ensures lower chances of mistakes, omissions, and miscalculations, which in turn reduces the risk of penalties.

More Efficient Client Management

Digital records and automated workflows make it easier for practices to manage multiple clients without adding overhead costs. Standardised processes allow practices to serve more clients using the same resources.

Stronger Client Relationships

By adopting MTD, you are turning your practice from a once-a-year compliance provider into an all-year business advisor. You can communicate with your clients at regular intervals through regular digital submissions and offer continuous support. Such value-added services will lead to higher client retention and long-term engagement.

Reduced Risk of Late Submissions

An MTD-compliant accounting software will give you automated reminders and filing alerts so you do not miss out on HMRC deadlines. This reduces the pressure on your teams from last-minute filings and expensive oversights.

Future Readiness for Other MTD Mandates

MTD for VAT is just the beginning. By 2026, MTD for Income Tax Self-Assessment (ITSA) will be a reality, and plans are being made for corporation tax, too. Hence, it will invest in the tools required for the smooth implementation of MTD. This will make transitions smoother and maintain your competitive edge in digital compliance.

If implementing new processes or advanced MTD-compliant software is adding to your expenses then you can explore the option of VAT outsourcing services and get access to MTD-compliant accounting services and tools without compromising your budget and compliance.

Enhanced Practice Reputation

Clients trust accounting practices that stay ahead of regulations and adopt modern technologies. Offering MTD-compliant services positions your practice as reliable, forward-thinking, and digitally capable.

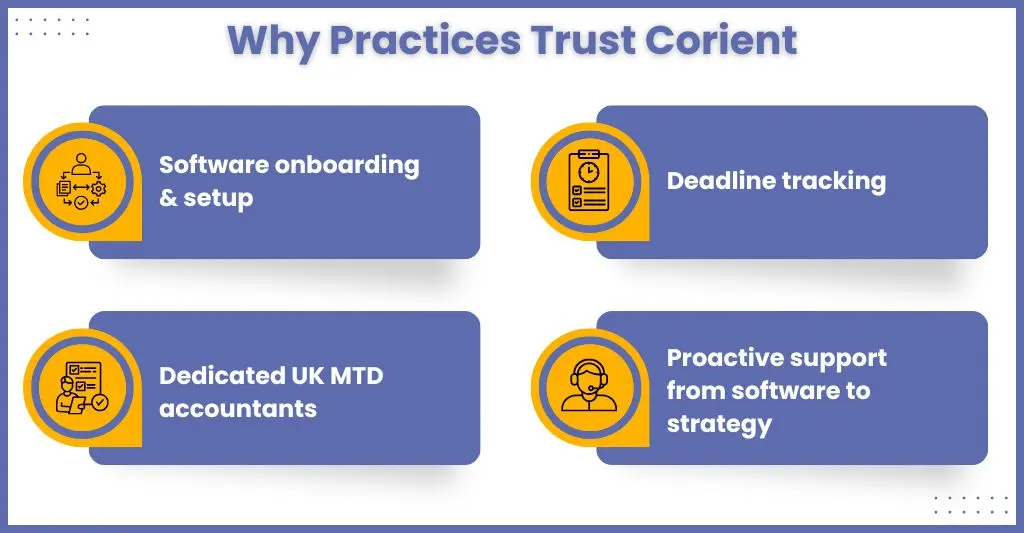

Why Partner with Corient for MTD Compliance?

Corient has made its name not by being an accounting outsourcing service provider that offers accounting services, but by being one step ahead in adopting new tech and compliances, including MTD. At Corient, we don’t just help your clients stay compliant—we help your practice become more efficient, scalable, and future-ready.

Here’s how we will help:

- Software Onboarding & Setup: We have earned the trust of accounting practices by professionally handling migration, setup, and training on cloud systems like Xero and QuickBooks

- Dedicated MTD Teams: MTD is becoming applicable to Income Tax and possibly corporation tax. To cater this demand, we have started investing in UK-focused accountants experienced in handling MTD compliance. These trained professionals will help you with every client submission accurately and promptly.

- Meeting Deadlines: We track all client VAT cycles and manage submissions to prevent any missed deadlines.

- Proactive Support: From software to strategy, we guide your practice on every step of the MTD journey.

Frequently Asked Questions (FAQ)

Since April 2022, all VAT-registered businesses must comply with Making Tax Digital for VAT. ITSA will apply from April 2026 for income above £50,000.

Visit HMRC’s MTD registration portal, log in using your Government Gateway ID, and follow the prompts. First, make sure your software is MTD-compliant.

HMRC uses a points-based penalty system. A single missed deadline may result in a warning, but repeated offences lead to fines starting from £200 per submission.

Making Tax Digital doesn’t change the kinds of tax records your client’s business must keep. It only influences how you manage and submit your tax information. For VAT, you will be keeping a digital record of information such as: name, address and contact details for your client’s business.

Yes, Corient does provide support for Making Tax Digital (MTD) for VAT and more broadly offers MTD‑related services.

Yes, you can use third-party software for Making Tax Digital for VAT (MTD VAT) submissions, in fact, you must.

MTD has fundamentally changed how VAT filing has changed for small businesses. Here’s how:

a. Digital record-keeping has become mandatory

b. VAT returns must be submitted through MTD-compatible software

c. Reduced errors and better accuracy

d. Continuous compliance compulsory through software

e. Penalties for missing submissions, failing to keep digital records, or not using MTD software

Conclusion

Making Tax Digital for VAT is not just a regulatory requirement, it’s an opportunity for accounting practices to modernise, save time, and enhance accuracy for your clients. By avoiding common pitfalls and adopting the right technology, your firm can remain fully compliant and client-focused. Whether navigating MTD alone or seeking a trusted partner, Corient is here to help you every step of the way.

Corient has established itself as a trusted accounting outsourcing partner among multiple accounting practices in the UK. We have achieved that by proactively offering MTD-compliant VAT services along with bookkeeping, payroll, corporation tax, and more. If you have any queries, you can send them to us using our website contact form. Our executive will get in touch as soon as possible.

Looking forward to a long-term partnership.