Why UK Accounting Firms Are Choosing Outsourced Bookkeeping in 2026

UK Accounting firms are finding it attractive to choose bookkeeping services thanks to the benefits they offer such as cost effectiveness, meeting latest HMRC compliance, addressing staff shortages, and handling scalability issues. Even before 2026, UK firms have been actively rethinking their traditional bookkeeping models due to rising demand for agility, cost efficiency, and compliance. All these factors have made outsourcing solutions attractive.

In this blog, we will focus on why accounting firms are reconsidering their traditional bookkeeping methods, why they are choosing outsourcing solutions, and the benefits associated with it. Let’s dive in deeper.

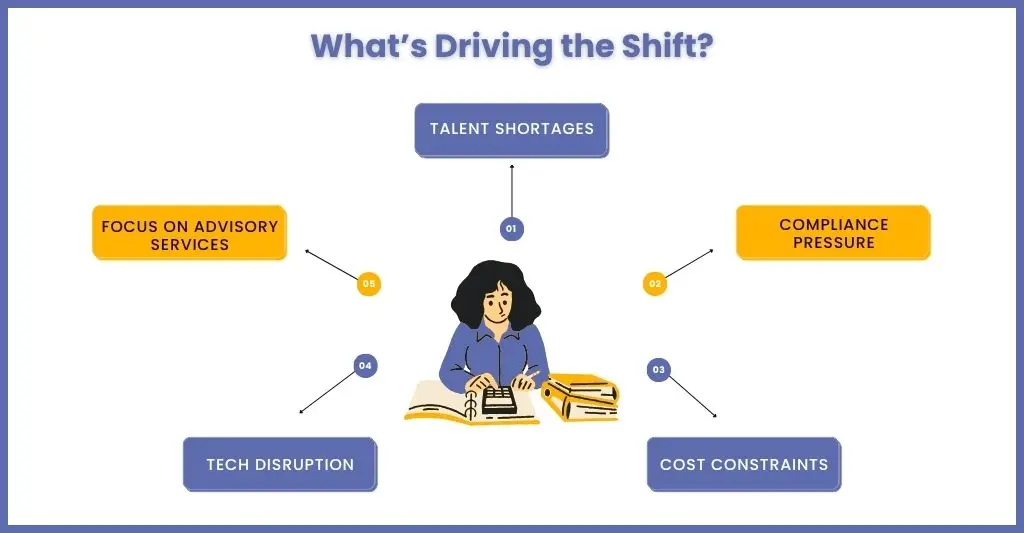

Why UK Accounting Firms Are Rethinking Their Bookkeeping Strategies

For several years, multiple factors have been gradually prompting accounting firms to reassess the way bookkeeping is conducted. These factors combine with industry pressures and evolving client expectations.

Let’s understand these factors in detail:

Talent Shortages

An ICAEW survey found that 67% of UK firms struggle to recruit qualified staff and 60% face retention challenges. The challenge of finding and retaining skilled bookkeepers is making it harder for practices to maintain or improve their service quality.

Increasing Compliance Demands

The Make Tax Digital on VAT has already been implemented and will soon be extended to Income Tax and Corporation Tax. Additionally, expect more stringent HMRC regulations that must be complied with, making the compliance task more time-consuming, resource-intensive, and demanding in terms of expertise.

Cost Pressures

The rising bookkeeping costs are making it difficult for accounting practices to stay competitive in the UK accounting market. To remain competitive, accounting firms are experimenting with multiple bookkeeping strategies, including adopting outsourcing.

Technology Advancements

Latest cloud-based AI tools and AI-driven processes have achieved the seemingly impossible by streamlining accounting processes and introducing accuracy in complex accounting work. These benefits are now motivating firms to adopt AI tools and other modern methods to stay relevant in the future.

Focus on Advisory Services

These days, clients are demanding more value for their money, making it essential to offer them higher-value services, such as financial planning and business advisory services. By outsourcing only bookkeeping services, you can free up internal resources and divert them towards advisory roles.

Why More UK Accounting Firms Are Choosing Outsourced Bookkeeping

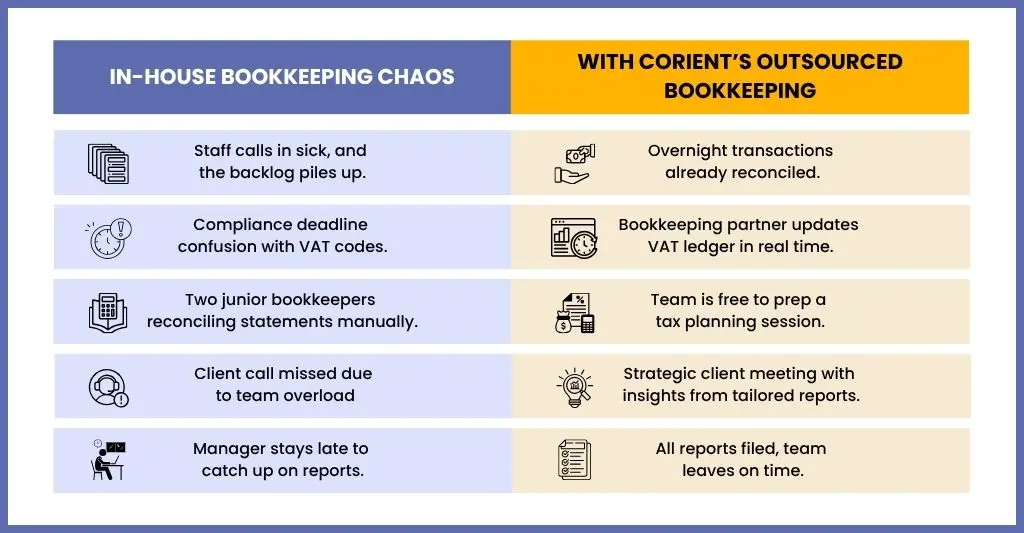

Traditionally, bookkeeping was the most time-consuming and labour-intensive aspect of accounting for any accounting practice. However, things are changing in 2026, as competition and regulatory demands have prompted accounting practices to seek alternatives to in-house bookkeeping. Among the other options, bookkeeping outsourcing stands out for not just saving time and influencing the future of accounting, but also in strategic decision-making and long-term profitability.

Here’s a closer look at the driving factors behind this shift:

Access to Trained Experts

Professional outsourcing providers have a pool of highly skilled bookkeeping professionals, already trained in leading software platforms such as Xero, QuickBooks, Sage, FreeAgent, and others. These professionals:

- Are aware of the latest UK accounting standards, including FRS and MTD compliance

- Receive training at regular intervals to stay updated with regulatory changes

- Can start work with minimal onboarding, saving weeks of recruitment and training time.

This way, practices get access to highly trained and qualified talent. A 2025 CABA survey revealed that 47% of UK practices struggled to fill bookkeeping roles in the last 12 months.

Cost-Efficiency

Hiring bookkeepers in-house incurs significant costs, including salaries, pensions, training, software licenses, and office space. That’s not the case with outsourced bookkeeping that operates on a fixed price. Outsourcing helps firms in:

- Saving costs up to 40% as per the 2024 ACCA report

- Paying only for the hours or services used makes it ideal for practices with fluctuating workloads.

- Reducing or avoiding expenses related to recruitment and staff turnover

These savings, done through less outsource bookkeeping services cost can be invested in technology upgrades, client acquisition, or advisory development.

Scalability Without the Growing Pains

Seasonal spikes in accounting work are expected, especially during January self-assessments or April year-end closings. Outsourcing will give your practice that flexibility to scale up during peak months and scale down during lean periods.

Benefits include:

- Access to a larger team without hiring anyone new

- Faster turnaround times, even during high-volume months

- No need to worry about sick leaves, holidays, or overtime

The flexibility is beneficial for practices in avoiding the risk of overhiring or missing deadlines.

Refocus Internal Resources on Advisory Services

These days, clients are not just satisfied with getting their bookkeeping done or following compliance; they want more in the form of insightful advice, forecasts, and proactive planning. But if you are bogged down with multiple transactional tasks, then there is little time for advisory tasks.

Through outsourcing, you can free up your internal resources and can:

- Offer strategic services like budgeting, tax planning, and cash flow forecasting

- Develop deeper client relations and increase their engagement time with you

- Helps you transition from compliance-driven to consultancy-driven

Firms that have made this shift report a 25–30% increase in advisory revenue, according to a 2025 UK Accounting Trends Report.

Key Benefits of Outsourcing Bookkeeping for UK Practices

Outsourcing will give your long-term benefits that are operational, financial, and strategic. These benefits will directly impact the performance and scalability of your accounting practice.

Let’s understand these benefits:

Improved Turnaround Time

Outsourcing bookkeeping teams are highly efficient and have dedicated accountants and optimised workflows, which help in delivering bookkeeping updates on the same day or the next day.

They help in achieving:

- Daily banking transactions overnight

- Purchase and sales ledger updates processed within 24 hours

- Fast month-end closings with fewer backlogs

The speed at which financial reports are received will help your practice in staying on top of filing and compliance deadlines.

Round-the-Clock Operations

If your practice chooses an outsourcing provider, you will likely benefit from the time zone difference, primarily if the provider is based in India, where overnight processing is possible.

- It creates a seamless 24-hour work cycle without extending your team’s working hours

- Urgent or last-minute requests can be prioritised for overnight completion

This results in increased productivity without burnout.

Compliance Confidence

UK regulations related to accounting, such as HMRC regulations and UK GAAP, are constantly evolving, and not following them leads to late payment penalties. But you don’t have to worry about it when your outsourcing partner is by your side, who invests in training their teams on regulations and stays updated on them.

The outsourcing partner will take care of:

- Making Tax Digital (MTD) requirements

- CIS (Construction Industry Scheme) submissions

- VAT codes and quarterly return deadlines

- Anti-money laundering (AML) and GDPR standards

This will reduce the instances of costly mistakes, giving you peace of mind knowing that professionals are handling your work by UK accounting standards and regulations.

Data Security

For a top accountancy firm data security will always be a priority, and a professional outsourcing provider will provide full-proof data protection such as:

- ISO 27001 certification for information security management

- Restricted access and two-factor authentication on internal systems

- GDPR-compliant workflows for UK client data

These measures ensure sensitive financial information is kept confidential, traceable, and protected from unauthorised access.

Customised Reporting

Rather than receiving not so easy to read spreadsheets, UK accounting firms working with the right outsourcing partner get:

- Tailored dashboards built on Power BI or Excel

- Weekly email summaries of client finances

- Management accounts and KPIs aligned to the client’s business goals

- Custom formats for VAT returns, cash flow projections, or aged debtors

This makes it easier for accountants to present clear, value-driven reports to clients without spending hours manually preparing them.

Reduced Burnout

There are many repetitive accounting tasks, such as data entry, receipt matching, and invoice logging, which not only consume time but also mentally drain your accounting teams. Through outsourcing, top accountancy firms have reduced the pressure. Here’s how it does it:

- Junior staff are freed up to focus on learning advisory, tax, or client management

- Senior team members can use their expertise where it truly matters, in strategic decisions

- Workloads become more balanced, leading to better morale and lower staff turnover

In a sector struggling with talent shortages, keeping your team happy and retained is a competitive advantage.

How Corient Supports UK Accounting Firms with Scalable Bookkeeping

At Corient, we don’t just offer bookkeeping outsourcing services; we provide scalable solutions tailored for the UK’s top accountancy firms. Our approach is designed to help practices of all sizes reduce overhead, increase efficiency, and expand their service offering without the challenges of recruiting or training in-house staff.

Here’s how we will help you in streamlining your bookkeeping:

Dedicated Teams

A dedicated team of accountants is assigned to every accounting firm, including yours, who are specially trained in:

- UK accounting standards such as FRS 102, UK GAAP, and MTD

- Popular bookkeeping platforms include Xero, QuickBooks, Sage, and FreeAgent

- Client-specific processes to ensure seamless integration with your existing workflow

Our team will work as an extension of your in-house team, delivering quality and reliability at every step.

Compatible with the Latest Software and AI Tools

Our accounting processes and systems are entirely compatible with the latest versions of best accounting software. We have developed our systems that are well-integrated with:

- Xero, QuickBooks Online, Sage Business Cloud

- Receipt capture and expense tools like Dext and Hubdoc

- Workflow and communication platforms like Karbon, Senta, and Microsoft Teams

This ensures you never have to alter your internal systems or retrain your staff. We plug into your ecosystem, not the other way around.

Secure, GDPR-Compliant Workflows

Corient does not compromise on data protection. We say that because we use:

- Bank-grade encryption (AES 256-bit) for all data transfers

- ISO 27001-certified infrastructure to ensure maximum data security

- Strict GDPR protocols, including role-based access controls

- Regular internal audits and compliance training for all staff

The above measures will ensure your clients’ sensitive financial data is handled with the same level of security as major UK financial institutions.

Risk-Free Trial

Want to understand how we work? Then get a first-hand experience through a free 10-hour trial, with no strings attached. In this trial, you will:

- See how we blend with your existing team

- Assess our turnaround times

- Review our accuracy and communication

The trial period will enable you to assess our performance, allowing you to make informed, long-term decisions. You can also check our case study to understand how we eliminated backlogs and enabled real-time financial reporting.

When Should You Consider Outsourcing Your Bookkeeping?

There are specific issues you must look for while operating your accounting practice, such as:

- Losing time on low-margin bookkeeping tasks

- The team is overworked or struggling to meet deadlines

- Aspiring to offer advisory services, but can’t free up time

- Need better accuracy and faster reporting

- Urgency to reduce overheads without compromising quality

If you are facing any of these issues, then it’s time to choose a capable outsourcing partner and enhance your practice’s capabilities.

People Also Ask

Yes. Leading providers like Corient follow the GDPR, utilise ISO-certified systems, and ensure that all data is encrypted both in transit and at rest. You maintain complete control over client relationships and review every report before it’s finalised.

Absolutely. Many UK accounting firms outsource during peak seasons like year-end or VAT quarters to manage workload spikes. Corient offers flexible onboarding and offboarding to match your business cycles.

If you’re facing issues like team overload, tight deadlines, lack of advisory focus, or high overheads, it’s time to consider outsourcing. You can also try Corient’s 10-hour free trial to evaluate the fit.

Not at all. You retain full oversight. Providers like Corient operate as an extension of your team, ensuring transparent communication and data access at all times.

Absolutely. Many UK firms outsource temporarily during year-end, tax seasons, or when internal staff are unavailable. Corient’s flexible onboarding makes short-term or seasonal support easy.

Conclusion

As 2026 unfolds, UK accounting firms that embrace outsourcing are gaining a real competitive advantage. With the right partner, bookkeeping becomes faster, more accurate, and less of a bottleneck, allowing your team to focus on higher-value services and client relationships. Speaking about choosing the right partner, we are confident that the Corient name has sparked some interest within you.

Established in 2011, Corient has established its name by staying one step ahead in offering tech-savvy accounting outsourcing services, including bookkeeping. Through our bookkeeping services, we have achieved a zero-transaction backlog, providing clients with real-time information and ensuring the timely closure of Management Accounts for our clients. To learn more about our achievements in detail, please get in touch with us using our contact form, and we will provide access to our brightest minds.