Top 5 Accounting Tasks UK Firms Should Outsource in 2025

Accounting firms based in the UK have multiple responsibilities ranging from compliance, meeting deadlines, and handling client expectations. You are expected to handle these responsibilities apart from handling your core tasks like bookkeeping, payroll, year-end, and VAT returns, among others. In short, the pressure on you is huge.

The practical way to reduce the workload without compromising on quality is to outsource key accounting tasks. Therefore, in this blog, we’ll explore what accounting outsourcing is, the benefits it offers, the top 5 tasks that UK firms should consider outsourcing in 2025, and why now is the perfect time to make the move.

What is Accounting Outsourcing?

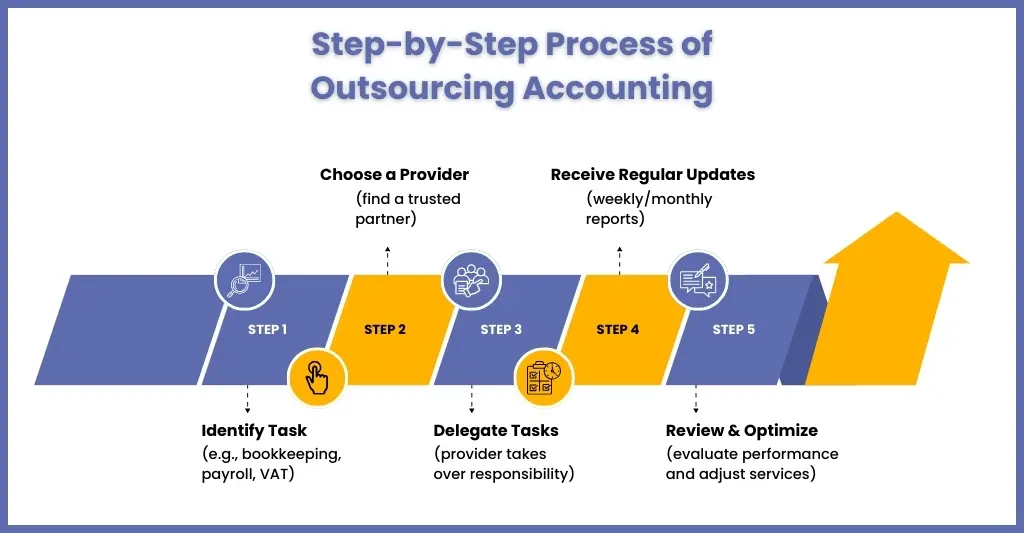

Outsourcing is the process of delegating accounting task responsibilities to an external outsourcing service provider. The accounting task can be bookkeeping, payroll, tax preparation, or management reporting.

It is a mistake to think that outsourcing is only for reducing the workload of an accounting practice. Accounting outsourcing is also about gaining access to accounting expertise, modern cloud based accounting software, and industry expertise without the need for hiring additional in-house staff.

These days, accounting outsourcing teams have become an integral part of many accounting practices, helping them improve efficiency, accuracy, and client satisfaction. Hence, if you are spending stressful nights handling accounting work for your clients, then it’s a sign to outsource accounting work.

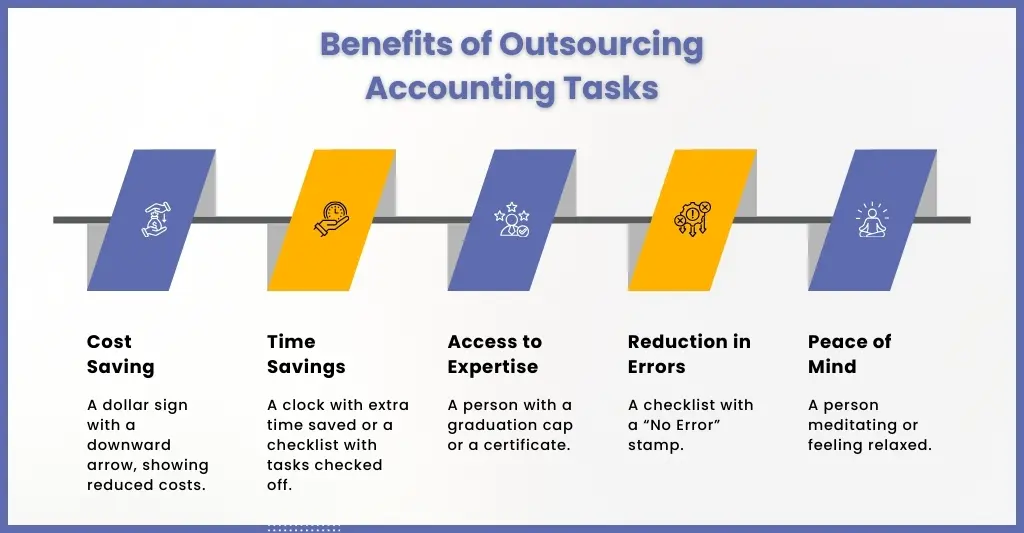

Benefits of Outsourcing Accounting

The benefits of outsourcing accounting tasks are immense, but we will focus on key ones. These benefits are:

Cost Saving

Partnering with a professional service provider gives you access to experienced accounting staff, reducing your need for full-time staff and training costs.

Saves Time

Certainly, by outsourcing key accounting non-core and routine tasks, you will save time that can be used to focus on high-value advisory services.

Access to Expertise

Indeed, by approaching a professional accounting outsourcing service provider, you will get access to qualified professionals familiar with UK tax laws, MTD requirements, and the latest accounting standards. These professional will in real-time handle accounting problems.

Reduction in Errors

Most professional outsourcing service providers offer automated accounting services along with expert oversight, thus reducing the chances of human errors.

Peace of Mind

With multiple recurring accounting tasks taken care of by a professional service provider who will also ensure timely submissions, you will be at peace with its quality and accountability. Hence, you can concentrate on other core accounting activities.

Top 5 Accounting Tasks UK Firms Should Outsource

Here are the top five everyday accounting tasks that you must outsource.

Bookkeeping

Bookkeeping is an integral part of accounting and the most outsourced one. The bookkeeping tasks are highly resource-intensive and time-consuming, making them ideal for outsourcing. Outsourcing bookkeeping ensures transactions are recorded correctly, reconciling bank accounts are completed on time, and financial data is always up-to-date. Hence, the majority of accounting firms are choosing to outsource bookkeeping.

Payroll

Payroll is not just about paying employees; it also involves performing payroll work with precision and strict compliance with HMRC regulations. By outsourcing payroll, you will get access to payroll experts who will maintain compliance with the latest regulations. On the other hand, these experts will ensure all deductions, tax submissions, and reports are handled professionally.

VAT Return

VAT outsourcing allows firms to access VAT specialists who ensure compliance, identify savings, and manage submissions efficiently, helping your clients avoid late filing penalties.

Year-End Accounts

One of the significant sources of trouble in year-end accounts is the failure to submit, which leads to penalties. We understand that this task can be particularly stressful, especially when handling other accounting responsibilities, as well as your clients. Therefore, by outsourcing year-end, you will be unburdened from this stressful task of preparing financial statements like balance sheet and cash flow statements, thus ensure timely submissions for your clients.

Management Accounts

Your clients depend on management accounts for decision making and you can help them better using management accounts outsourcing services. Through it you can save you time and provide your clients with accurate and detailed financial data insights such as business expenses, income, cash flow, thus helping them make informed decisions.

Why Outsource Accounting Tasks in 2025?

The UK accounting landscape in 2025 is already competitive and technology-driven, and there is no sign of going back. Also, accounting firms have to deal with multiple additional regulatory requirements including Making Tax Digital (MTD), alongside meeting client’s expectations like their weekly accounting or monthly accounting tasks of their account.

Therefore, in such tough working conditions, outsourcing will be your valuable backup by providing the experience, tech-support, and staff resources. It will help you survive and thrive and ensure quality accounting services for your clients.

Outsourcing will allow you to:

- Leverage advanced cloud based accounting software without heavy investment.

- Stay compliant with HMRC and MTD regulations.

- Focus on strategic growth areas, such as consultancy and advisory.

- Handle peak periods without hiring temporary staff.

By outsourcing key tasks, UK firms can not only survive but thrive in 2025 and beyond.

Frequently Asked Questions (FAQ)

The cost of outsourcing accounting work will depend on the work complexity, volume of work, and the expertise required to handle that work. There are multiple professional providers offering flexible pricing, such as monthly packages or per-task billing for accounting firms in the UK.

Some of the immediate benefits of outsourcing accounting tasks are a reduction in human errors and streamlining of the accounting process. In the case of long-term benefits, you will notice an increase in your client advisory capacity.

A professional outsourcing provider like Corient is well-versed with MTD for VAT and is capable of handling your future requirements in MTD for Income Tax. Modern service providers are capable of digital submissions, VAT reporting, and HMRC communications.

If your accounting team is constantly playing catch-up, struggling to meet deadlines, or producing late and inaccurate financial reports, it means that your current setup is not working and it’s time to outsource the accounting responsibility.

Outsourcing bookkeeping is an attractive idea for your clients because of the benefits it brings. These benefits include cost efficiency, access to expertise, increased focus on core activities, scalability, and risk reduction.

Checking the tech stack of outsourced accounting partner is important because it impacts accuracy, turnaround times, stability, data security, and how it will affect your practice. To check this, focus on the following areas:

a. Compatibility with your accounting software

b. Use of automation and OCR tools

c. Workflow & collaboration tools

d. Data security & compliance infrastructure

e. Reporting & insights tools

f. E-commerce & industry-specific integration capability

g. Internal quality assurance technology

h. Communication & file-sharing tools

i. Scalability & customisation

Conclusion

Gone are the days when outsourcing accounting tasks was considered a luxury; it is now a necessity for UK firms who want to survive and thrive in 2025. By delegating specific repetitive or complex accounting responsibilities to a professional outsourcing accounting service provider, you will save time, minimise human error, and ensure your staff focuses on high-value advisory services to your clients.

Whether it’s bookkeeping or payroll, outsourcing providers have got you covered. If you’re looking for comprehensive coverage, Corient has got you covered. Established in 2011, we have created accounting outsourcing services that are designed to help practices stay competitive, compliant, and profitable in a fast-changing UK financial landscape. Whether it’s bookkeeping, payroll, or management accounts outsourcing services, we have got you covered.

Do you need our services to reduce your workload and quicken the process? Contact us with your requirements, and we will provide a free trial. Looking forward to hearing from you soon.