How Can Accounting Practices Identify, Prevent and Resolve Payroll Errors

Making mistakes is a part of life but even a simple mistake committed while performing payroll is unacceptable. Since we are aware of the realities of the accounting world in the UK, we know how difficult managing payroll is. As a matter of fact, almost 94% of businesses in the UK have admitted to committing payroll errors every month. For this reason, they have placed their trust in professional accounting practices like yours for reducing errors but that’s not enough.

Payroll regulations in the UK have progressively become tough and tightly enforced by HMRC. We are aware of the reality that a sizable number of accounting practices are increasingly finding it difficult to handle the payroll responsibilities for their clients. Payroll error occurring again are the last thing your clients would expect from you which would lead to significant pay delays for your client’s employees.

Lack of pay or delays in salary payments will certainly demoralise their employees which will further lead to multiple compounded issues. Such mistakes will also damage your reputation in the accounting world and also attract legal cases. Therefore, it is important to preempt such mistakes by identifying them and avoiding them. If some mistake does happen, then resolving them without much damage to the practice’s reputation and financial damage – should be the first priority.

Common Payroll Mistakes Accounting Practices Should Avoid

It is important to note that the payroll field is full of payroll error minefields and to avoid them it’s important to first identify them and then avoid them. However, there are so many payroll error occurring that focusing becomes difficult hence we have narrowed it down to some common payroll errors your clients make while doing payroll.

Miscalculations in Payments

It will be disheartening for your client’s employees to receive an incorrect paycheck. Not only it will demoralise them, affecting their payroll operation but also damage your client’s reputation. Equally frustrating will be for you to investigate and rectify the human error which will consume a considerable amount of time and resources. Hence, it will be important for you to avoid any mistakes.

Some of the common miscalculations are overpaying or underpaying employees, missing out on paychecks for new employees, wrong deductions for benefits, and incorrect payments for those employees who are on leave.

Wrong Employee Information

There is always a possibility that your clients may make an error in their employee information. Therefore, it is your responsibility to verify the vital information provided by your clients before using it. Incorrect information such as address or National Insurance Number will lead to wrong calculations and delays in payroll disbursement.

Delays in Payments

Delays in payments can happen due to multiple reasons from lack of information to lack of records. If there are any documents or information required from the clients for payment purposes then it must be communicated quickly. Any payment delay will lead to legal issues and trust breakdown between you and the client and lower the morale of the employees.

Inaccuracy in Records

Inaccurate records are a recurring problem which can be controlled by verifying the employee records received from your clients. These records are essential for compliance and any failure will lead to penalties from the HMRC.

Incorrect Tax Codes

Any inaccuracy in tax codes can cause you over or underpayment of taxes and it is important to make sure that accurate tax codes are added.

Not Tracking Working Hours and Free Time

Inaccurately recorded working time will lead to payment errors and will require corrections that will span multiple tax years. Rectifying this human error will consume multiple hours which will be stressful for you. Hence, it is important to make sure that accurate overtime and breaks are recorded for accurate payments.

Not Upgrading Payroll Systems

Failing to update payroll systems with new technologies and regulations leads to non-compliance and errors.

Failure to Provide Payslips

You are required to give payslips to your client’s employees to maintain transparency. Any neglect to provide this crucial document will lead to trust breakdown and confusion among your client’s employees. The non-providing of payslips will also escalate into a legal issue.

Employee Misclassification

It is a common payroll mistake made where individual workers are not categorised correctly under the law. Previously workers under contract for service or not under contract were termed as freelancers, or contractors instead of employees. But since the introduction of IR35, it has been stopped. Any misclassification will lead to wrong calculations, benefits, and taxes.

How to Fix Payroll Mistakes Effectively

Panicking when you find out a payroll mistake will only worsen the situation and the only way to salvage it is by rectifying and making sure that the affected employee will get its fair amount.

- You will not be able to rectify the common payroll mistake without identifying it. Hence, it is important for you to check the payslips and payroll records of the affected employee and detect the error. The error could be anything from incorrect tax code, wrong employee information, incorrect working hours, and deductions.

- If the mistake has been detected then it must be rectified without any delays. For example, if an incorrect tax code has been identified then it must be taken up with the HMRC and incorrect salary details must be rectified in the next pay cycle.

- Once the error is rectified you will have to inform the employee about it. You must provide the employee with the updated payslip so that you can explain the changes and the employee can review it to their satisfaction.

- Keep a record of the mistakes committed and note down the actions taken to rectify them. These records will allow you to prevent similar mistakes in the future.

It is understandable that rectifying these mistakes or keeping an eye on them is a resource-intensive and complicated process. Hence, if you are unable to resolve it then you must seek help from a professional service provider offering payroll outsourcing services. Through payroll outsourcing you can streamline your payroll process and select from the best payroll service providers you can compare their case studies and note down their achievements.

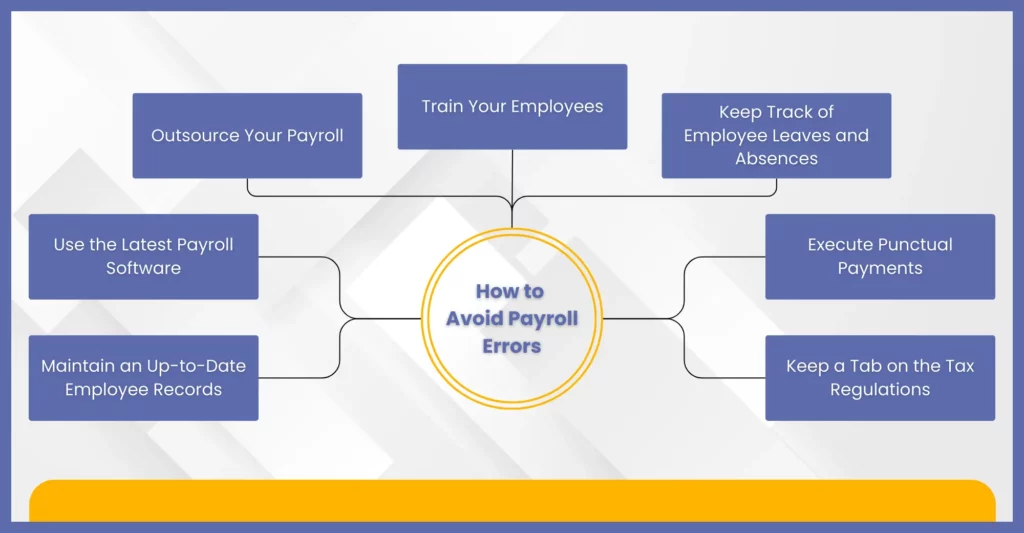

How to Avoid Payroll Errors

Youmust have heard doctors saying “prevention is better than cure”. Well, guess what, this phrase fits accurately when it comes to payroll errors. Rather than committing and then rectifying the error which will consume a vast amount of time and resources it is better to prevent it. By taking such preventive measures you will be in a position to offer error-free payroll services to your clients, thus gaining and maintaining their trust. You can also market your achievements and try to gain new clients.

Here are some ways you can avoid errors in payroll:

Use the Latest Payroll Software

We would recommend you to identify the best and most advanced payroll software and use it for your payroll process. Payroll software will help you streamline the process, promote automation, and reduce manual errors. With the help of payroll software, you will be in a position to calculate huge volumes of salaries, benefits, taxes, overtime, and other deductions accurately.

Maintain an Up-to-Date Employee Records

It is an important responsibility to check your client’s employee records are up-to-date and reviewed at regular intervals. If any employee’s salary, benefits, address or any other information changes then that change must be reflected in your payroll system. These records are required to be up-to-date for payroll reporting purposes, which will ensure further accuracy and compliance.

Keep a Tab on the Tax Regulations

Tax legislations in the UK keep changing at least expect that to happen once a year. Hence, it is important to keep a tab on the latest rules and payroll regulations. For further assistance, you can take the help of a tax consultant or you can use the latest payroll software which will help you stay compliant.

Execute Punctual Payments

Avoid penalties by making the salary payments on time which was time-consuming if done manually. However, these days you have payroll software to do the heavy lifting. You just have to fix the payment dates and payments will be executed automatically.

Keep Track of Employee Leaves and Absences

To maintain accuracy in payroll calculations you will have to keep track of your client employee’s leaves and absences. To do that you can use an automated system where employees can apply for leaves. Also, conduct regular audits of time-off requests and attendance records to identify discrepancies.

Train Your Employees

Provide regular training to your payroll staff, especially in new updates in payroll regulations and on how to use the latest payroll software. Such training will benefit both your payroll team and your client’s employee in smoothening the process of managing leaves, and payslips.

Outsource Your Payroll

UK-based accounting practices like yours are these days facing a lot of difficulties to singlehandedly manage payroll for their clients. There are many reasons for this situation and the result of this is a lot of time and payroll staff required for managing payroll. Also, you will require more expertise to handle complex payroll regulations. Fulfilling such requirements will put your budget overboard, therefore payroll outsourcing services is the only viable option. Through payroll outsourcing services, you will be able to proactively avoid all payroll errors beforehand, thus ensuring your client’s employees are paid accurately and on time.

Frequently Asked Questions (FAQ)

It is HMRC that comes up with payroll regulations and regulates the companies when it comes to enforcing payroll regulations.

Once an error is identified in the wages it must rectified immediately and not on the pay day.

To prevent errors in payroll from interrupting your payroll process you will have to invest in certain things.

a. Use payroll software integrated with HMRC.

b. Perform monthly payroll audits to catch discrepancies.

c. Train payroll staff on UK payroll regulations and best practices.

d. Outsource payroll to professionals for accuracy and compliance.

Yes, outsourcing payroll is the preferred choice by multiple accounting practices in the UK because it has helped them reducing errors, ensuring compliance, this has saved them considerable amount of time and money. Professional outsourcing payroll services will handle tax calculations, NI contributions, pensions, and HMRC filings accurately on your behalf.

Conclusion

Payroll errors are the biggest headache for any accounting practice and they will not disappear magically without doing something. Only by acknowledging and proactively countering these errors can you offer error-free and value-added payroll services to your clients.The motive of this blog is to identify those common errors in payroll and suggest measures to fix and avoid those errors, this way you will be saving a considerable amount of time and resources that would go into rectifying these errors.

Agreed that some of these measures are too much to do singlehandedly, hence we would suggest that you explore the option of payroll outsourcing services which are in abundance in the UK. Corient can be the ideal payroll outsourcing service provider for you due to its experience in handling complicated payroll tasks for accounting practices since 2011. Its tech-savvy payroll services have brought in quality transformation for multiple practices and that’s the reason why it is very much trusted by them. You can write your doubts and questions related to services on our website contact form and our executive will get in touch with you.

Wishing you the best of luck and looking towards a fruitful partnership.