Payroll Compliance in the UK: How to Stay Compliant and Avoid Costly Mistakes

- Introduction

- What is Payroll Compliance?

- Key Payroll Compliance Requirements for UK Businesses

- Common Payroll Compliance Mistakes and How to Avoid Them

- Payroll Compliance Checklist for Accountants (2025 Edition)

- Verify PAYE and National Insurance Contributions

- Check All Tax Codes Are Up to Date

- Ensure FPS and EPS Submissions Are Sent on Time

- Confirm Auto-Enrolment Pension Duties

- Review Compliance with Minimum Wage Legislation

- Calculate Statutory Pay Correctly

- Keep Payroll Records for at Least Three Years

- Conduct Regular Internal Payroll Audits

- Advise Clients on HMRC Payroll Updates (2025)

- Document All Payroll Policies and Procedures

- What are best practices for outsourcing payroll while remaining HMRC compliant?

- 1. Make Sure You’re Partnering With a Payroll Provider That Knows Their Stuff

- 2. Keep the Communication Channels Open & Stay In Touch

- 3. Get Your RTI Submissions Sorted

- 4. Double-Check Employee Classification & Tax Codes

- 5. Confirm Your Partner’s Got Auto Enrolment Covered

- 6. Make Sure You’ve Got Accurate & Secure Records

- 7. Stay Ahead of Regulatory Changes

- How Accountants Can Help Clients Stay Payroll Compliant

- When to Consider Payroll Outsourcing for Compliance

- FAQs on Payroll Compliance

- Final Thoughts – Why Payroll Compliance Matters More Than Ever

Introduction

Have you recently been approached by clients who are finding it difficult to keep up with the latest UK payroll regulations? You’re not alone and it’s something we anticipated. Payroll is one of the most essential functions of any business. It ensures employees are paid accurately and on time, which isn’t just good practice, it’s a legal requirement. Yet, despite its importance, many businesses are still struggling to get it right.

UK payroll regulations are constantly evolving, and accounting teams are under pressure to monitor updates, interpret new rules, and stay compliant. In reality, managing payroll has become a full-time job in itself.

For accounting practices, the stakes are even higher. Your clients depend on you to keep their payroll running smoothly and fully compliant, especially as HMRC continues to tighten its reporting requirements.

Therefore, we’ve put together a practical guide. It breaks down what payroll compliance really means, highlights common pitfalls to avoid, and explains how your practice can support clients more effectively in 2025. Let’s begin.

What is Payroll Compliance?

While payroll involves calculating and disbursing wages and salaries to employees, payroll compliance in the UK extends beyond that. It requires employers to follow GDPR rules, store sensitive employee data securely, verify payroll numbers, and calculate the correct income tax and National Insurance (NI) deductions.

Key Payroll Compliance Requirements for UK Businesses

Employers in the UK are required to follow multiple payroll compliance requirements. Some of those essential requirements are:

PAYE and Tax Deductions

Employers are required to deduct income tax and national insurance contributions from employees’ wages and report this through HMRC’s Real Time Information (RTI) system.

National Minimum & Living Wage

All employees in the UK are entitled to a National Minimum Wage, depending on their employment status. Hence, HMRC keeps a regular watch on this compliance and names and shames those who do not follow, along with heavy fines.

Auto-Enrolment Pensions

It is the responsibility of an employer to auto-enrol its staff into a workplace pension scheme and make regular contributions. Failure to do so will result in fines from The Pensions Regulator, making it a crucial responsibility for payroll compliance.

Holiday & Statutory Pay

Your business clients must calculate and pay statutory entitlements such as holiday pay, sick pay, and maternity/paternity leave. If they miscalculate these entitlements, employees will feel dissatisfied, and it will count as a compliance issue.

Timely Reporting

It is the responsibility of each employer to submit Full Payment Submissions to HMRC, which contain an employee’s pay, tax, and NI. Additionally, Employer Payment Summaries must be submitted on or before payday to report adjustments.

Record Keeping

Storing 3 years of accurate payroll records is compulsory for employers. These records include details of pay, tax deductions, pension contributions, and statutory payments. Good record keeping not only ensures compliance with HMRC but also helps during audits and internal reviews.

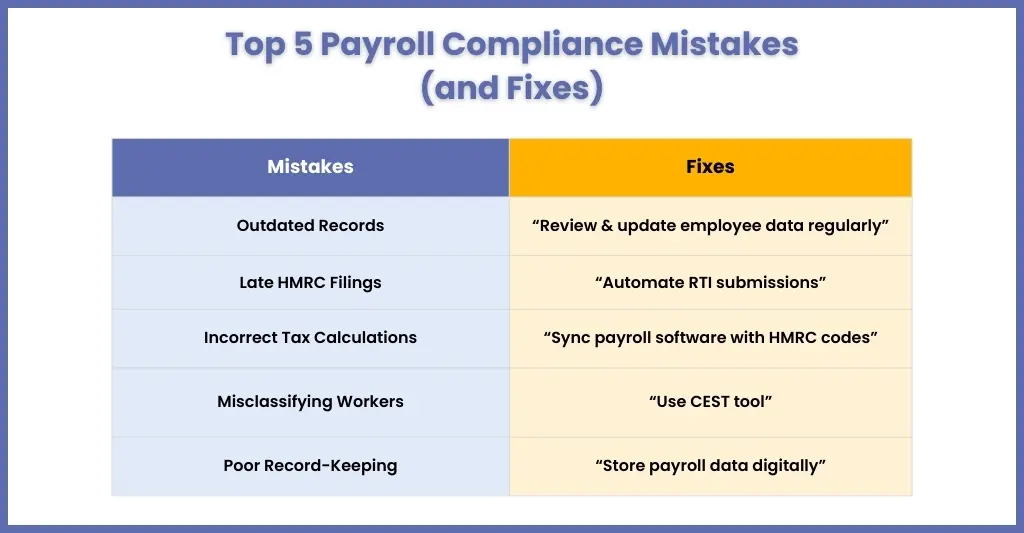

Common Payroll Compliance Mistakes and How to Avoid Them

Beware of errors in payroll, which can happen easily and will cost you and your clients’ reputation and your pocket dearly. Some of these mistakes are complex and likely to occur due to the intricacies of payroll processing and compliance. Let’s examine these common mistakes.

Outdated Records

Outdated employee records are a compliance error that can result in a significant penalty. The penalty will depend on the number of employees affected and the duration of the inaccurate records. There is also the possibility that this error will lead to further mistakes.

How to avoid it:

- Conduct regular reviews of employee records and update employee details, such as removing those who have resigned.

Late HMRC Filings

You must ensure that your clients submit payroll information to HMRC without delay on or before payday through the Real Time Information (RTI) system. Missing these deadlines can result in automatic fines, interest charges, and, in some cases, a loss of credibility with HMRC.

How to avoid:

- You can set reminders for your clients

- Make use of the best payroll software that automatically submits RTI on time.

Incorrect Tax Calculations

Using the wrong tax code is a common payroll mistake that can result in employees underpaying or overpaying income tax. This typically occurs when tax codes are not updated when employee designations change, an employee changes jobs, or has multiple incomes, resulting in confusion and potential HMRC scrutiny.

How to avoid it:

- Always check new starter information against HMRC’s guidelines.

- Regularly update employee details when circumstances change.

- Use payroll systems that automatically sync with HMRC tax code updates.

Misclassifying Workers

Misclassification of workers occurs at a regular interval and is a compliance issue where someone is incorrectly treated as an employee. Such wrong misclassification leads to failure in deducting PAYE and National Insurance, therefore leaving your client exposed to significant tax liabilities.

How to avoid it:

- Review employment contracts carefully.

- Follow HMRC’s “Check Employment Status for Tax” (CEST) tool.

- Seek expert advice through payroll outsourcing services when unsure of a worker’s status.

Poor Record-Keeping

It is compulsory to store payroll records for three years as directed by HMRC. Missing of records or incomplete records will lead to issues during audits by HMRC.

How to avoid it:

- Store all payroll records digitally in a secure, centralised system.

- Keep evidence of tax deductions, pensions, and statutory payments.

- Conduct periodic internal checks to ensure that records are up to date.

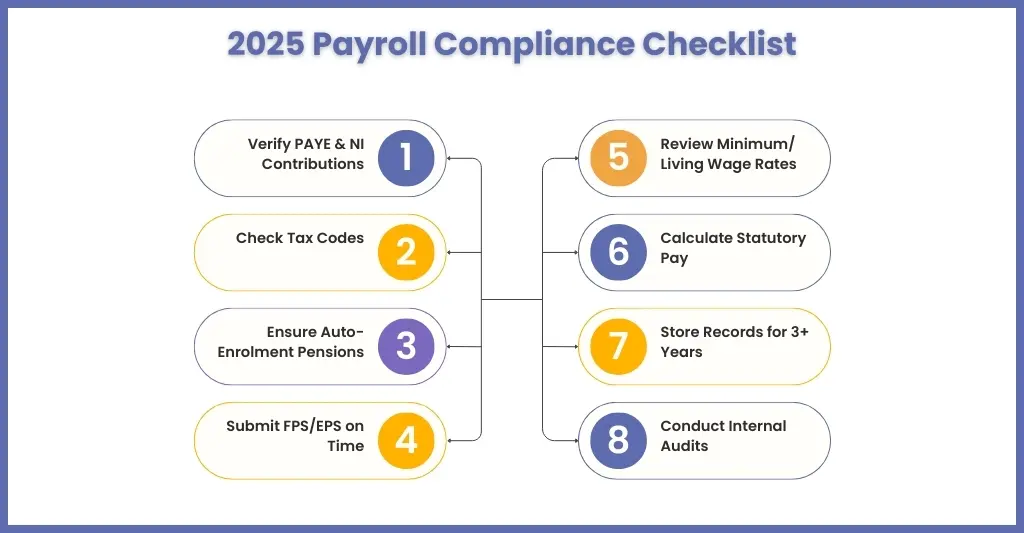

Payroll Compliance Checklist for Accountants (2025 Edition)

To quicken and streamline the payroll compliance process for your clients, you need a compliance checklist. It reduces the risk of errors and gives your clients confidence that their payroll is handled in accordance with HMRC guidelines. Here’s the checklist to follow:

Verify PAYE and National Insurance Contributions

Errors in National Insurance contributions trigger penalties and frustrate employees, especially when they receive unexpected tax bills.

Check All Tax Codes Are Up to Date

Verify all tax codes for your clients’ employees, as these may change if they switch jobs, receive benefits, or have multiple income sources. Incorrect codes will cause over- or underpayments

Ensure FPS and EPS Submissions Are Sent on Time

The Full Payment Submission must be sent to HMRC every payday, and the Employer Payment Summary must be sent when adjustments are needed. Late or missing filings attract fines.

Confirm Auto-Enrolment Pension Duties

Enroll all your clients’ employees in workplace pension schemes and ensure you deduct and pay the required contributions correctly.

Review Compliance with Minimum Wage Legislation

Wages must be aligned with the National Minimum and Living Wage rates. Wages below it will lead to fines for your clients and reputational damage.

Calculate Statutory Pay Correctly

Your clients’ employees are entitled to statutory sick pay (SSP), maternity/paternity/adoption pay, and holiday pay. Miscalculations can cause disputes and compliance risks.

Keep Payroll Records for at Least Three Years

Accordingly, HMRC guidelines state that your clients must retain all payroll records for a minimum of three years. Missing or inaccurate records will cause problems during audits.

Conduct Regular Internal Payroll Audits

It is your responsibility to conduct surprise internal audits to identify compliance gaps before HMRC becomes aware of them. Through the surprise audits, you must check RTI submissions, pension contributions, and employee entitlements.

Advise Clients on HMRC Payroll Updates (2025)

Inform your clients that tax codes, National Insurance thresholds, and minimum wage rates are regularly updated. Your clients will heavily rely on you for this.

Document All Payroll Policies and Procedures

Establish a consistent payroll procedure to protect your accountants and clients in the event of disputes or HMRC reviews.

What are best practices for outsourcing payroll while remaining HMRC compliant?

Outsourcing your payroll can save you a load of time and money, and help with accuracy too – but only if you do it right and stay on top of HMRC regulations. For UK accounting firms, that’s a no-brainer. Staying in line with HMRC rules is a must if you want to avoid getting hit with penalties and keep your employees trust intact. So here are some tips on how to get this right when you go down the outsourcing route:

1. Make Sure You’re Partnering With a Payroll Provider That Knows Their Stuff

Start by finding a payroll outsourcing company that has a good understanding of UK legislation and can handle RTI (Real Time Information) submissions and HMRC reporting. Ask them for proof they’re compliant and for examples of their UK-based clients – you want to know they’re the real deal.

2. Keep the Communication Channels Open & Stay In Touch

Even though you’re outsourcing, you’re still the one who’s responsible for PAYE obligations. So make sure your provider gives you real-time access to your payroll data and keeps you in the loop with any updates, changes or last-minute alterations – you need to be able to keep an eye on things.

3. Get Your RTI Submissions Sorted

Your provider needs to get your Full Payment Submissions (FPS) and Employer Payment Summaries (EPS) filed on time and correctly – delayed or dodgy RTI submissions are going to trigger automatic penalties from HMRC.

4. Double-Check Employee Classification & Tax Codes

Getting employee classification wrong or using the wrong tax codes can cause all sorts of compliance issues. Check with your provider that they’re keeping an eye on these details and updating them when HMRC notify them of any changes or status updates.

5. Confirm Your Partner’s Got Auto Enrolment Covered

Your payroll partner needs to be able to handle all the auto-enrolment tasks, like setting up pension schemes, keeping employees informed, and working out the contribution calculations. That way you know you’re meeting all the requirements from The Pensions Regulator.

6. Make Sure You’ve Got Accurate & Secure Records

HMRC require you to keep payroll records for at least three years – so make sure your outsourcing partner is storing your payslips, P60s, tax submissions and audit logs in a secure & GDPR-compliant way.

7. Stay Ahead of Regulatory Changes

HMRC regulations are always changing – especially with updates to minimum wage, NI thresholds or PAYE guidance. Your payroll partner should be on top of all these changes and keep you in the loop – they need to be proactive in making sure you stay compliant.

How Accountants Can Help Clients Stay Payroll Compliant

In 2024, about 524 employers were named by the government for failing to pay the minimum wage as per the National Minimum Wage (NMW) law, leaving over 172,000 workers out of pocket. However, such a serious lapse in payroll would not have happened if these employers had experienced accountants by their side.

Accountants play a vital role in helping businesses remain compliant. They can:

- Monitor HMRC deadlines and ensure timely submissions.

- Conduct ongoing payroll audits to identify and correct errors promptly.

- Train businesses on correct record-keeping and reporting.

- Use cloud-based payroll software to automate calculations and filings.

- Keep clients informed about legislative changes that affect payroll.

By looking after their compliance, your accountants can protect your clients from costly mistakes and help them focus on their core activities. However, we have noticed that even experienced practices and accountants require assistance due to the increased complexity of UK payroll regulations. That’s why payroll outsourcing services of outsourcing service providers are in high demand.

When to Consider Payroll Outsourcing for Compliance

Without adequate resources and talent in place, no practice can manage payroll in-house for its clients. It will be too risky for your clients and time-consuming. To give the best service to your client, you will need the support of payroll outsourcing services.

Here are some situations where outsourcing will make sense:

Limited Payroll Expertise

Due to the constant changes in payroll regulations by HMRC, your accounting team may find itself unprepared to handle them. Without specialist knowledge, compliance mistakes can occur. Additionally, if the volume of payroll tasks increases, your team will become spread too thin.

By gaining access to payroll experts through outsourcing, you benefit from their expertise in understanding HMRC rules, resulting in accurate calculations, deductions, and filings.

Frequent Compliance Errors and Penalties

If your accounting team repeatedly misses deadlines or makes incorrect PAYE deductions, it’s a clear sign to outsource payroll. However, an experienced provider like Corient uses advanced payroll software to handle tasks accurately, reduce compliance risks, and avoid costly penalties.

A Growing or Complex Workforce

As your client expands, so will the payroll complexity, and the more complicated the payroll becomes, the higher the risk. An outsourcing payroll provider will offer you the scalability and experience to handle multiple pay types and categories with ease.

The Need to Focus on Core Business Activities

If you are burdened with handling tax codes and filing deadlines, then it’s time to outsource. By using the services of a payroll specialist, you can free up your time and concentrate on high-value services like advisory and client relationships.

There are immense benefits of payroll outsourcing for your practice, so do explore it.

FAQs on Payroll Compliance

Payroll compliance refers to an organisation’s adherence to all legal requirements for compensating employees, including wage laws, tax regulations, and employment standards.

Late submissions, incorrect filings, or failure to meet pension duties will invite penalties which will be charged by HMRC.

The frequency of payroll compliance audits can be done based on your requirements preferably on a quarterly basis. Annual audit is highly recommended

Professional payroll outsourcing service providers have dedicated payroll specialist who use the latest payroll software and are updated on the regulations, thus reducing the compliance risks.

Final Thoughts – Why Payroll Compliance Matters More Than Ever

Payroll compliance cannot be ignored anymore; it’s a legal duty for every UK business. With HMRC tightening controls and penalties for mistakes rising, UK businesses are making a strategic choice, handing over the payroll compliance tasks to professional accounting practices like yours. It is now your duty to ensure your clients’ payroll systems are accurate, timely, and fully compliant.

However, there are times when you will need highly specialised assistance in compliance. That’s when you must approach a professional payroll outsourcing service provider like Corient. We combine specialist knowledge with innovative technology to deliver payroll services that are accurate, fully compliant, and tailored to the needs of your clients. From meeting HMRC deadlines to handling auto-enrolment pensions, our team ensures peace of mind, freeing your accounting team to focus on what matters most.