Maximising ROI with Outsourcing for UK Accountants: Key Strategies for Success

- Introduction

- Understanding the Need for Outsourcing

- Key Benefits of Outsourcing for UK Accountants

- Strategies to Maximise ROI Through Outsourcing

- Top Outsourced Services for Accountants in the UK

- Common Mistakes to Avoid When Outsourcing

- Case Studies

- Future Trends in Outsourcing for Accountants

- Frequently Asked Questions (FAQ)

- Conclusion

Introduction

It’s hard to imagine how outsourcing has become an important tool for enhancing the UK’s efficiency and capacity of accountants and accounting firms to offer their clients the best of services. Through outsourcing, accounting firms have been able to work with complex UK accounting standards and regulations. No wonder, it has become a backbone for many accounting firms. That’s not all; outsourcing has done more to gain the trust of countless UK accountants.

With multiple accounting firms jostling for business in the accounting market, your accountants are required to up their offering by becoming more efficient and, in turn, becoming more profitable. Outsourcing can help you by taking over some of the non-core accounting tasks so that you can focus on core services and reduce production costs. Hence, your accountants need to adopt outsourcing so that you get the maximum return on investment (ROI). This blog will explore the need for outsourcing, its benefits, and how UK accountants can maximise ROI through effective outsourcing practices.

Understanding the Need for Outsourcing

Outsourcing is no longer a choice; the situations created by regulatory changes, technological advancements, and clients’ hunger for better accounting services have made it a necessity. Without it, many accountants have struggled with high operational costs, a lack of experts, and the inability to offer high-quality accounting services.

Multiple accountants and accounting firms feel the need for outsourcing because it allows your accountants to delegate non-core and time-consuming accounting responsibilities to experts employed by your outsourcing partner. Outsourcing saves considerable time for your accountants, which can be refocused towards client engagement and strategic advisory roles.

Key Benefits of Outsourcing for UK Accountants

There are many benefits associated with outsourcing for your accountants and accounting firms. However, we will focus on the important ones, which include:

Reduction in Overhead Costs

One of the main benefits of outsourcing is that you will save the cost you might have to pay in recruiting, training, and maintaining an in-house staff. This cost includes salaries, benefits, taxes, and expenses related to office infrastructure. Hence, outsourcing will save you money, which can be reinvested in other aspects of your practice.

Get Access to Expertise

When you approach a professional accounting outsourcing firm for accounting outsourcing services, your accountants will automatically get access to expert accountants. These accountants have accumulated years of accounting experience. They can use their experience in handling complex taxes, managing client assets, and making crucial decisions directly impacting your clients.

Get Scalability

When your client experiences an expansion in their business, they will require more accounting services to handle their high volume of transactions. Handling a sudden increase in accounting demand from your client would be impossible if you only had a limited accounting staff. However, when you have the backup of an outsourcing team, you can quickly scale up your services without compromising on quality.

Improved Efficiency

Handing over complex accounting tasks to an experienced outsourcing team will not only promote accuracy in the task but also enable your accounting team to stay more focused and efficient in their jobs.

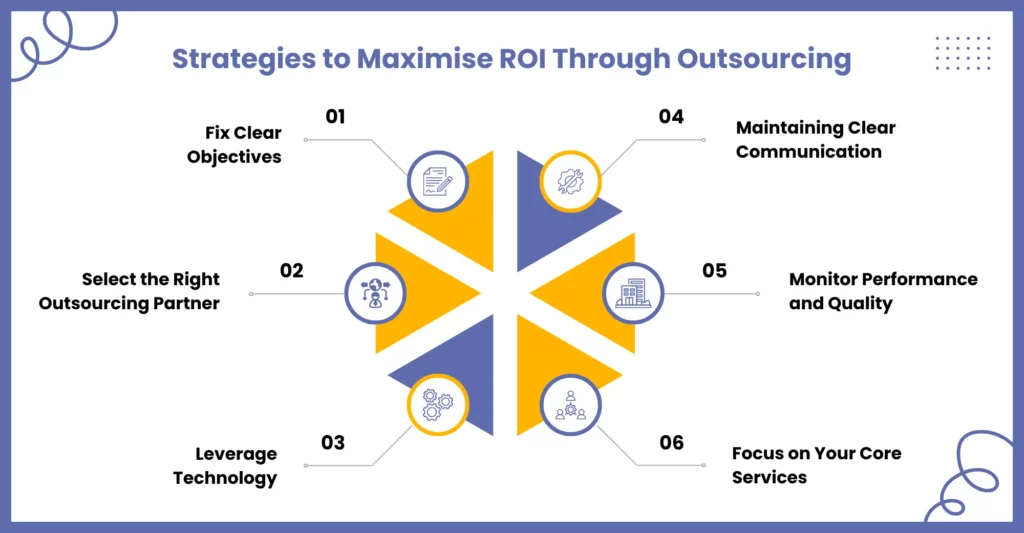

Strategies to Maximise ROI Through Outsourcing

With so many benefits in outsourcing, the question that arises is why some of your competitors have not had a great experience with accounts outsourcing. Outsourcing is not to blame for their bad experience but their lack of homework before and after choosing their outsourcing partner. Therefore, it is essential to understand that outsourcing is not a magical wand that will solve all your issues by just handing over accounting tasks to a partner; that’s just a first step.

To ensure maximum return out of outsourcing, you will have to follow the following points:

Fix Clear Objectives

Get your objectives set before you even start searching for an outsourcing partner. Armed with the goals you want to achieve, such as cost reduction, increasing efficiency, getting access to expertise, and so on, you will be in a better position to choose the right outsourcing service provider.

For instance, if your emphasis is on reducing your operating costs, you would focus on getting an outsourcing firm reliable enough to handle your routine accounting tasks like data entry and bookkeeping. On the other hand, if you need specialised services to handle complex accounting responsibilities, you must focus on an outsourcing firm that offers experienced accountants.

Select the Right Outsourcing Partner

Your success will depend on choosing the right outsourcing partner. Hence, to achieve that you will have to take your time and do thorough research and evaluation of every potential outsourcing partner. Properly evaluate industry experience, reputation, client testimonials, and the services offered.

After the evaluation, select a partner who aligns with your objectives. A transparent and trustworthy outsourcing partner will act as your support team and contribute to your overall success.

Leverage Technology

Another primary reason accounting practices and accountants prefer outsourcing is the access to high-end technology at a fraction of the cost. Without it, you will have no other option but to invest your funds in getting the technology and training your staff. A professional outsourcing service provider will always use the latest accounting software and automation tools to provide accurate, fast, and efficient accounting services.

Maintaining Clear Communication

The foundation stone of a successful relationship between you and your outsourcing partner is the line of communication. A transparent line of communication ensures that everyone is on the same page, thus creating reliability and accountability.

You can discuss with your outsourcing partner and find a convenient mode of communication, i.e., phone, conference call, online video meeting, etc. Through the chosen communication mode, you can conduct regular meetings to get your vital concerns addressed. You also educate your outsourcing partner about your accounting requirements; this will help them perform better.

Monitor Performance and Quality

Conduct a performance review of your outsourcing partner on a regular basis to keep yourself updated and ensure your standards are being met. To do this, you must fix KPIs based on which your outsourcing partner will be assessed.

Focus on Your Core Services

Outsourcing will also make your practice more profitable by taking over all your routine accounting tasks. This will allow you to afford to spend time providing high-value services to your clients, such as financial advisory, tax planning, and business consultancy. Such services will not only add value to your clients but also help you grow your practice exponentially.

Top Outsourced Services for Accountants in the UK

As we speak, multiple accounting outsourcing firms in the UK are offering their priced accounting services to countless practices and accountants in need. However, it is worth mentioning a few accounting services that are in demand.

Bookkeeping Services

Under it, an outsourced bookkeeping team will ensure accurate financial records without needing in-house staff.

Payroll Processing Services

When a professional outsourcing service provider handles payroll on your behalf, expect accurate salaries, tax deductions and full compliance with PAYE regulations.

Corporation Tax and VAT Services

Corporation and VAT services are quite sought after thanks to the relief they have provided in handling complex tax compliance responsibilities.

Year end Accounting Services

Multiple accounting practices have saved their precious time by opting for year-end services, which include preparing working papers and in-depth analysis of income and expenses.

Common Mistakes to Avoid When Outsourcing

Due to the benefits, it offers, outsourcing has become the talk of the town. However, in the excitement of gaining those benefits, accounting practices and accountants make some mistakes. These mistakes will contribute to a lack of benefits; hence, you must be mindful of not committing these common mistakes.

Misunderstanding an Outsourcing Provider

An accounting outsourcing service provider does not just handle your accounting tasks; it works like your backup team. It brings in new experience and expertise that enlighten you and help you achieve your goals. One of the biggest mistakes that gets repeated is treating your outsourcing partner like a cost-cutting tool. Such an attitude will lead to lack of trust, ineffective collaboration, and partnership failure.

Therefore, to avoid it, you will have to invest time in guiding your outsourcing partner. Plus, it is important to understand their valuable contributions in terms of expertise and skills. Hence, it is important to maintain open communication with your service partner to understand each other’s expectations and objectives and discuss the way forward.

Choosing an Outsourcing Provider Based on Cost

It would be a big mistake to choose an outsourcing provider based on cost alone. A service provider may offer you the price you want, but how can you guarantee that the service quality will remain the same? There is also a possibility that the service provider is not capable of giving you quality service in the first place.

To avoid this trap, you must focus on quality and cost equally. Also, check the experience and skill level of the service provider’s staff, making sure they can handle complex accounting tasks.

Not Setting Clear Expectations for Your Outsourcing Provider

Not communicating your expectations to your outsourcing partner will only lead to confusion, inefficiency, and low output quality. The end result would be that your accounting tasks would not be completed, leading to failure to meet the objectives and hindering the operations of your accounting practice. However, by establishing effective communication, this mistake can be avoided.

Ignoring Data Security

Any neglect on your part to check the data security measures of the service provider will cost you dearly in the future. Also, after selecting your outsourcing partner conduct regular checks. This is to ensure that your partner is complying with the UK GDPR and data protection act 2018.

These are some of the biggest mistakes committed by UK accountants and practices while outsourcing. We are sure that by going through these points in detail you will be in a position to choose the best accounting outsourcing partner that will meet your accounting requirements.

Case Studies

How Corient Helped an Accounting Firm Resolve Talent Shortage

A medium-sized accounting firm in the UK was facing a severe talent shortage. This affected its ability to provide high-quality services to clients. Corient stepped in with a tailored solution, allowing the firm to enhance its service offerings and focus on high-level advisory work. Read more to understand this case in detail.

Transforming Real-Time Bookkeeping for Our Client

Our client is a financial services provider who faced significant challenges in managing real-time bookkeeping for their clients who had high-volume transactions. With delays in clients submitting information, the client struggled to keep up with bookkeeping, VAT filing, and production of management accounts. The firm sought Corient’s expertise to streamline its bookkeeping process and improve its financial reporting efficiency. Read more to understand this case in detail.

Future Trends in Outsourcing for Accountants

The outsourcing landscape for UK accountants is evolving, with several key trends shaping its future:

Increased Role of AI and Automation

Artificial Intelligence and automation are increasingly impacting the way accounting outsourcing will work in the future. AI will be increasingly used to automate recurring accounting tasks, leading to efficiency and accuracy. AI will be used to identify trends and patterns in data sets to predict the future, and automation will reduce the risk of human errors. Thus, allowing accountants to focus on other important matters. Both AI and Automation will continue to shape the future of outsourcing.

Rise of Accounting Outsourcing Services in India

According to KPMG, Indian accounting outsourcing companies handle over 50% of the global accounting outsourcing market. These companies will continue to grow for the next five years. This rise is due to the cost-effectiveness of services, the large talent pool of accountants, and technological prowess, which are attracting global accounting firms.

Increasing Importance of Advisory Services

The accounting profession is witnessing a radical shift from traditional bookkeeping to a more consultative role. According to an estimate, accountants are increasingly preferring advisory and consultative services due to their client requirements. Accounting outsourcing services are adjusting to this change by offering various advisory services. This includes financial planning, risk management, and business consulting. Hence, this development is changing accountants from managing tedious compliance tasks to becoming strategic partners.

Increasing Role of Big Data

Big Data is revolutionising the accounting industry by enabling more informed decision-making. This trend empowers accountants to move beyond traditional record-keeping and compliance roles to become strategic business advisors. By leveraging big data accountants can be in a position to offer more nuanced and sophisticated financial analysis. Through it, you can give a competitive edge to their clients.

Frequently Asked Questions (FAQ)

The accounting industry in the UK is evolving quickly due to changing regulations, rising client expectations, and the need for digital transformation. Outsourcing helps firms stay competitive by reducing operational costs, filling talent gaps, and freeing up time for high-value client services like advisory and planning. It’s no longer just a cost-saving option—it’s a strategic move.

Start by clearly defining your goals—do you want to cut costs, increase efficiency, or access specialised skills? Then, evaluate potential partners based on their industry experience, client testimonials, technology stack, and communication style. Remember, it’s not just about finding the cheapest provider—it’s about finding the right fit for your practice.

Some of the top bookkeeping outsourcing firms in the UK are known for their ability to deliver accurate, efficient, and compliant financial records while scaling with your accounting needs. Leading firms in this space include Corient, which stands out by offering dedicated teams, robust internal controls, proficiency in AI tools, and ISO-certified data security.

Absolutely! By offloading routine tasks, your team can dedicate more time to services that clients value most—and are willing to pay more for. Plus, you save on hiring and training costs, reduce error rates, and avoid compliance risks. It’s a win-win that boosts both efficiency and your bottom line.

To estimate the ROI of outsourcing payroll for a company with 50 to 200 employees, you will have to look at both hard cost savings and benefits like time saved, compliance risk reduction, scalability, etc.

There are multiple factors to be considered while choosing the right outsourcing accounting firm. These factors are:

a. Checking their experience

b. Assessing their technical stack

c. Evaluating their data security measures

d. Checking the quality of their staff

e. Transparency in their pricing

f. Report quality

g. Communication style

h. Analysing their case studies

Conclusion

Outsourcing has gained importance among accountants and accounting firms. The reason for this success is enhanced efficiency, reduced costs, and helped accountants focus on their core accounting activities. Hence, it is important to choose the right partner and get the maximum ROI out of it by implementing the strategies. Who knows, by following it, you might find the right outsourcing partner like Corient.

Established in 2011, we have made our name by offering high-quality accounting services to accountants and accounting firms based in the UK. Whether you need payroll, bookkeeping, year-end, corporation, VAT, or audit services, we have you covered. Our tech-savvy and trend-setting services have worked wonders for our clients, and we are confident that we can perform the same magic for you. Share your problems or questions related to our services on our website contact form, and our executive will get in touch with you.

Wishing you the best of luck and looking forward to a great partnership.