Management Accounts (UK): What They Are, What’s Included, and How Often You Need Them

- What Is Management Accounting and Why It Matters for Your Clients?

- Learn the Benefits of Account Management for Better Decision-Making

- How Often Should You Prepare Management Accounts?

- What’s Included in Management Accounts?

- Difference Between Management Accounts and Statutory Accounts

- How to Prepare Accurate Management Accounts

- Outsourcing Management Accounts – When and Why

- Best Practices for Management Accounting

- Common Mistakes to Avoid

- People Also Ask

- Conclusion

Wanting to give insights to your clients? Turn towards the management accounts, which periodically generate internal reports and convert raw bookkeeping data into valuable insights. These insights are presented as commentary, KPIs, and forecasts to guide your clients’ planning.

Unlike statutory accounts, management accounts are optional, but a tight cash-flow environment has made them more relevant. According to the UK Government’s late-payments study, £26bn in late payments is owed at any given time, and 28% of businesses are affected each year. Through management accounts, the risk of delayed payments can be identified early, and plans can be put in place.

In this blog, we explore what management accounts are, their benefits, key components, how to prepare them accurately, and how outsourcing can help UK practices save time and resources.

Let’s jump into it.

What Is Management Accounting and Why It Matters for Your Clients?

Every accounting practice in the UK will have a fair idea of what management accounting is and its purpose. For beginners, management accounts are a practice of preparing financial reports for internal analysis and decision-making. The reports, prepared on a monthly or quarterly basis, include a profit and loss account and a balance sheet.

Your clients will demand management account services from you because they provide a clear financial picture, helping them avoid costly mistakes and make informed decisions. It is more like personalised services that help your clients be informed about their financial position and make decisions accordingly.

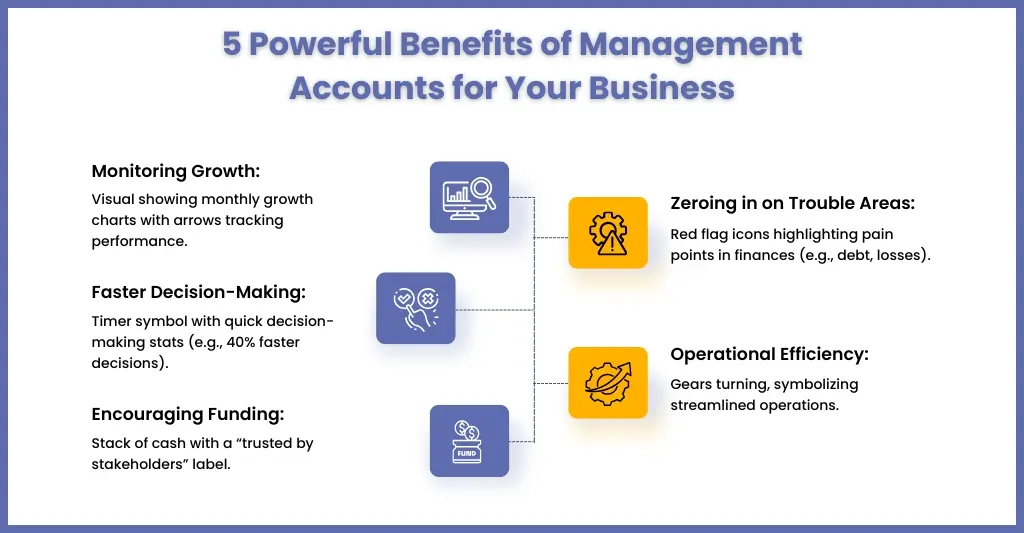

Learn the Benefits of Account Management for Better Decision-Making

Yes, management accounts are not a compulsion like statutory accounts, but it offers so many benefits that it’s hard to ignore. The wealth of data generated by these reports will enable your clients to do a thorough analysis and take corrective measures. That’s why you must convince your clients to get management accounts done regularly.

Let’s now go through each benefit one by one.

Monitoring the Growth

Under management, accounts reports are generated on a monthly, quarterly, and yearly basis. Your clients can compare these reports every month and take corrective actions when required.

Faster Decision-Making

It provides the latest financial data, including cash flow and income patterns, to your clients, enabling them to predict the future and make quick financial decisions.

Encourages Funding

Financial reports generated through management accounts will be helpful for your clients’ stakeholders to get a peek into the performance. These reports will foster trust and accountability among your clients’ stakeholders, attract new ones, and enable your clients to capitalise on ample funding opportunities.

Highlighting Trouble Areas

Instead of making your clients wait for statutory accounts to understand their financial performance, management accounts can focus on specific areas of concern, zero in on loss-making regions, and highlight the profitable ones.

Operational Efficiency

Through management accounts, you can identify inefficiencies in your clients’ finances and suggest cost-saving measures that they can implement.

How Often Should You Prepare Management Accounts?

While statutory accounts are conducted once a year, management accounts do not have that compulsion. However, it is ideal for UK-based accounting practices to do so monthly for their clients.

What’s Included in Management Accounts?

The management accounts are made up of the following key components:

- The Profit and Loss Accounts: It shows the revenue, costs, and profits for the period covered by the account.

- Balance Sheet: This financial document shows the exact and detailed status of assets, liabilities, and equity for a specific period.

- Cash Flow Statement: This statement will show the actual cash flow over the period covered and also forecast the cash flow for the future period.

- Key Performance Indicators: These are the set of measures used to assess performance, such as profitability, conversion rates, feedback, and return on investment.

- Budget Comparison: It compares the actual performance with the budget and highlights discrepancies.

- Analysis: Management accounts also offer detailed analysis, sometimes focusing on specific areas, and provide comments on financial performance, highlighting trends and issues.

Difference Between Management Accounts and Statutory Accounts

The goal of management accounts and statutory accounts is the same, to create accountability in front of stakeholders. However, there are fundamental differences between the two. Let’s find out:

| Feature | Management Accounts | Statutory Accounts |

| Purpose | Internal decision-making | Legal compliance and filing with HMRC |

| Frequency | Monthly or quarterly | Annually |

| Level of Detail | Flexible and detailed | Standardised and regulated |

| Audience | Management and stakeholders | HMRC, shareholders, auditors |

| Focus | Financial performance and insights | Compliance and reporting |

Managements accounts is utilised for internal use which can be shared with your clients’ stakeholders for transparency purposes. On the other hand, statutory accounts are primarily for meeting legal obligations.

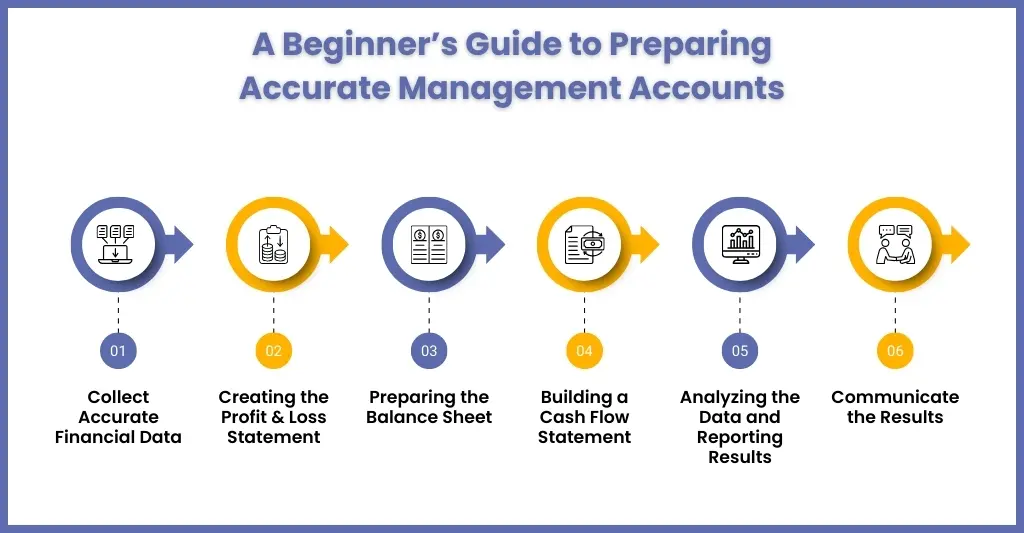

How to Prepare Accurate Management Accounts

To prepare it flawlessly, you will need to follow some important steps. These steps are as follows:

Gathering Accurate Financial Data

Collect all the required information such as revenue figures, expenses and cash flow data. This data is available in the accounting software you use, as well as in bank statements, invoices, and receipts. Verify the collected data against external sources, such as comparing the bank balance in your client’s account with the statements or ensuring the HMRC balances match your client’s HMRC account.

Start Creating the Profit and Loss Account

Begin by calculating your clients’ revenues and expenses to start working on the profit and loss statement. Split the costs and income into the relevant periods, which includes calculating accruals/prepayments and Work in Progress. This ensures that your clients can view the information for the applicable period, thereby providing accurate profit margins.

Prepare Balance Sheet

A balance sheet will show your clients their financial position and value of their business at a specific point in time by showing assets, liabilities, and equity. Through the balance sheet, your clients will understand their financial obligations and ownership.

Prepare Cash Flow Statement

How much cash has come in and gone out? It will be shown accurately by a cash flow statement. It will help your clients identify the cash flow issues and potential opportunities.

Analyse Your Financial Data

Once all the financial statements are ready, you can analyse the economic performance of your clients, identify problem areas, and suggest improvements. Identify the trends in the statements and compare them with previous ones. Also, give importance to non-financial data to get a well-rounded view

Communicate the Results

Once the results are ready, you must share them with your clients, who will in turn share them with their shareholders, managers, or investors. Also, keep your suggestions ready for improving their financial performance based on the data available in the reports.

Outsourcing Management Accounts – When and Why

Clients are demanding it; you are convinced that offering management accounting services is necessary for accuracy and transparency. Still, the majority of practices are unable to provide it by themselves. The reason is simple: every practice is too overloaded with multiple accounting tasks and regulatory compliance.

To address this situation, you will need to approach an accounting outsourcing service provider offering management accounting outsourcing services. Outsourcing will be beneficial to you when:

- You lack the expertise to prepare thorough reports

- Your accounting team is burdened with daily operations

- You want access to professional insights without hiring full-time or part-time staff

- You need to offer your clients timely and consistent reporting for strategic decisions

Professional outsourcing service providers ensures your clients receive accurate, compliant management accounts on schedule. Just like Corient which has helped a growing accounting firm reduce 3,000+ outstanding queries and delivered timely management accounts, thus enabling it to focus on other value-added accounting tasks.

Best Practices for Management Accounting

We all know that management accounting offers numerous benefits for your clients, but many practices are not able to take full advantage of it. To do that, you will need to adopt some best practices for management accounting. These practices are:

Prepare Reports Regularly, Ideally Monthly

To ensure that your clients get the latest updates on their business performance, you must consistently prepare management accounts, ideally every month. Such frequent monthly management updates will help in identifying emerging issues and resolving them proactively. Through it you can help your clients stay aligned to their budgets and ensure that cash flow, profits, and expenses are constantly monitored.

Use Cloud Accounting Software for Real-Time Data

Using the latest cloud accounting software for conducting accounts is now becoming a common practice, which also includes management accounts. Software like Xero, QuickBooks Online, or Sage offers real-time access to financial data and reduces manual errors in management accounts reports.

Monitor KPIs

Your clients must meet specific Key Performance Indicators (KPIs) to gain key insights into their financial health. Some common examples are gross profit margin, operating ratio, debtor days, and revenue growth. By regularly monitoring these KPIs, you can guide your clients into achieving their strategic goals by providing them with data for informed decision-making.

Compare Actual Performance Against Budgets and Forecasts

Management accounts are not just about generating numbers, but also about understanding the variances. By comparing actual performance with the decided figures or the forecasts, you can identify discrepancies for your clients and help them understand why they occurred. Based on that, they will change strategies.

Keep Reports Concise, Clear, and Actionable

Your clients will expect clarity in the reports you present so that they can understand the insights at a glance. Avoid unnecessary details and focus on numbers to communicate risks, trends, and opportunities clearly. The report you create should serve as the foundation for actionable decisions.

Common Mistakes to Avoid

Even experienced accounting practices can fall into pitfalls that reduce their usefulness. Avoiding these mistakes ensures that your financial reports are accurate, insightful, and truly actionable.

Infrequent Reporting

Avoid the mistake of relying on quarterly or annual management accounts to identify emerging issues. Such delays will prevent timely intervention, leading to cash flow problems and missed growth opportunities. Always go for monthly reporting for continuous monitoring.

Mixing Personal and Business Finances

Your clients often make the mistake of combining personal and business transactions, which distorts numbers and leads to inaccurate performance analysis and audit complications. Hence, care must be taken to avoid that.

Overcomplicating Reports

Showing important details is necessary, but showing unnecessary data can overwhelm your clients and hide key insights. Hence, create management account reports that are concise, clear, and focused on actionable insights.

Ignoring Key Performance Indicators (KPIs)

Management accounts are of no use if you fail to add KPIs to them. By not adding KPIs like gross margin, operating expenses, or debtor days, you are making it difficult to assess the performance accurately. Therefore, select the right KPIs for real insights.

Ignoring Communication and Commentary

Numbers alone rarely tell the whole story. Management accounts should include clear commentary highlighting trends, risks, and opportunities. Omitting this narrative can leave management uncertain about implications and unable to make informed decisions.

People Also Ask

No, they are not legally required. However, they are highly recommended for internal decision-making and financial planning.

Monthly management accounts are ideal for active monitoring, but quarterly accounts can suffice for smaller or less complex businesses.

Yes, many UK businesses outsource it to qualified accounting firms for accuracy, compliance, and timely reporting.

While statutory accounts break down the financial actions taken by the company during the year, management accounts are prepared for internal decision-making.

A financial statement contains data for a defined period of time. Meanwhile, managerial accounting looks at past performance but also creates business forecasts.

Through management accounts services offered by outsourced providers, you will get a clear view of how your client’s business is performing, help them plan, and highlight opportunities for growth or efficiency.

Corient’s accountants are certified and trained to handle Xero and QuickBooks. Its internal systems are built to work with modern cloud‑accounting tools like Xero, QuickBooks Online, which supports seamless data flow and timely collaboration. Through these software, Corient is able to manage bank reconciliations, ledger maintenance, VAT accounting, A/R & A/P, cash‑flow tracking, management‑account reports.

Conclusion

Management accounts are essential for UK businesses seeking timely financial insights and better decision-making. By providing a clear view of revenues, expenses, and key metrics, these accounts empower management to act strategically and proactively.

Whether prepared in-house or outsourced to expert accounting firms, management accounts help businesses plan effectively, identify opportunities, and mitigate risks. By adopting regular reporting, accurate analysis, and professional guidance, businesses can turn financial data into actionable insights that drive growth and long-term success.

Management accounts are essential for your clients who need timely financial insights for better decision-making. By providing clear insights into revenues, expenses, and KPIs, management accounts enable your clients to act strategically and proactively. Whether you do it in-house or choose to outsource to an expert accounting outsourcing firm, management accounts will help in accurate analysis and professional guidance.

Speaking about outsourcing, we are sure you have heard about Corient from your competitors. Established in 2011, we are a well-established service provider when it comes to offering tech-savvy and UK accounting standard-compliant accounting services, including management accounts. Practices that availed our management services have managed to achieve cost savings ranging up to 50% on overall in-house operational expenses.

Do you need to review your management accounts? Contact us and share your requirements with us. Looking forward to seeing you soon.