Making Tax Digital for Accountants: Your 2025 Compliance Guide

- Introduction

- What Is Making Tax Digital

- What Does Making Tax Digital Mean for Accountants in 2025?

- Best Accounting Software for Making Tax Digital

- Benefits of MTD for Accountancy Practices

- Enhanced Efficiency and Automation

- Stronger Client Relationships Through Real-Time Support

- Scalable Growth with Digital-First Clients

- Better Practice Management and Workflow Control

- Improved Accuracy and Compliance Confidence

- Competitive Advantage and Modern Client Appeal

- New Service Offerings and Revenue Streams

- Being Ready for Future Regulations

- Better Work-Life Balance for Your Team

- How Corient Helps Accounting Firms Navigate MTD Compliance

- Steps to Get MTD-Ready in 2025

- Frequently Asked Questions (FAQ)

- Conclusion

Introduction

Accountants must prepare for the 2026 MTD expansion to Income Tax by adopting MTD-compliant software, offering quarterly reporting, and digitising workflows. To do that you will need to: upgrade systems, train staff, educate clients, and embrace automation. This ensures compliance and boosts efficiency, client engagement, and growth.

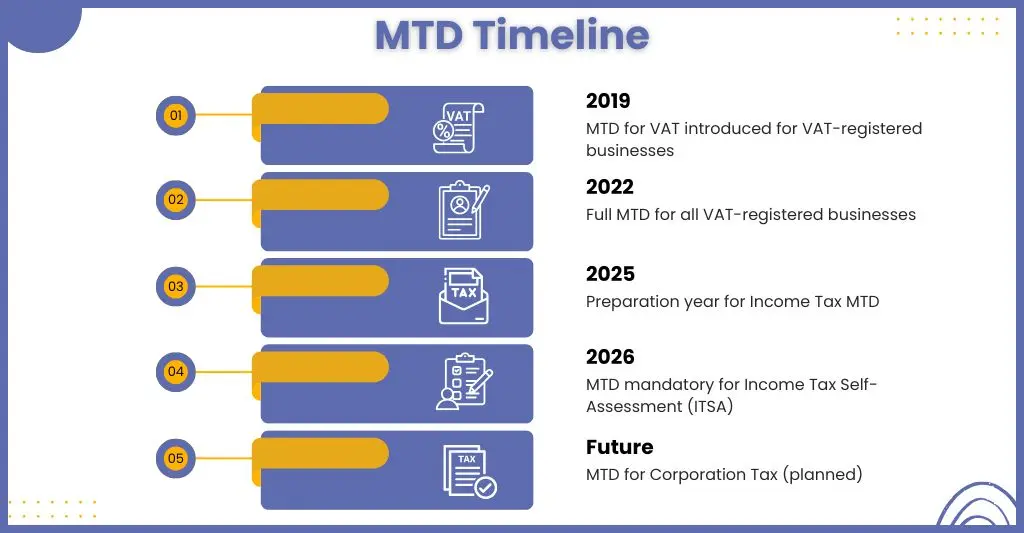

In 2019 accounting practices in the UK started implementing Making Tax Digital (MTD) for VAT-registered businesses as directed by the HMRC. It was a phased introduction by the regulatory body to make life easier for both accounting practices and enterprises in the UK. By 2022, MTD had been fully implemented for all VAT-registered businesses in the UK.

Make Tax Digital has significantly changed how tax compliance in the UK will work. It has also brought an end to paper-based compliance and given rise to real-time digital reporting, but now new deadlines are approaching. Come 2026, when the MTD mandate will be expanded from VAT to Income Tax and possibly Corporation Tax in the future, you will be faced with one critical question: Are you ready to lead your clients through this transformation or risk being left behind?

This guide will help your accounting practice to stay ahead, remain compliant, and turn MTD from an obligation into an opportunity. Let’s explore how your practice can adapt, scale, and thrive in a digital-first tax environment.For an even deeper dive, check out our Making Tax Digital guide for 2025 to understand the roadmap and actions required this year.

What Is Making Tax Digital

Making Tax Digital (MTD) is an HMRC initiative aimed at digitising the UK tax system, requiring businesses and individuals to maintain digital records and submit tax returns using compatible software.

Through this initiative, paper-based compliance will be a thing of the past, and taxpayers will be required to maintain digital records and use MTD-compatible software to make tax submissions electronically.

HMRC has laid down a time-bound plan for implementing MTD on all taxes, including VAT, income tax, and corporation tax. All VAT-registered businesses must follow MTD. By April 2026, it will apply to Income Tax in phases.MTD for Corporation Tax is still being planned. HMRC is working with businesses and software developers on the rollout.

What Does Making Tax Digital Mean for Accountants in 2025?

The Making Tax Digital initiative has been reshaping the UK tax landscape since 2019, and 2025 will be a crucial year with significant implications for accounting practices. Instead of treating MTD as a regulatory requirement, use it to modernise workflows, strengthen client relationships, and take on an advisory role.

Here’s what MTD means for you in 2025.

Digital-First Compliance Becomes the Norm

Instead of manual systems, you and your clients will be required to use MTD-compliant software to maintain records and submit returns. Hence, to be digitally friendly, you must focus on accounting software like Xero, QuickBooks, Sage, or FreeAgent based on your client’s needs.

Quarterly Reporting = Ongoing Engagement

With MTD applying to income tax from April 2026, you must submit income and expenses quarterly, not annually. Your work will shift from year-end tasks to real-time advisory services like cash flow forecasting and tax planning.

More Automation, Less Admin

One reason for HMRC’s MTD push is to reduce paperwork and increase automation through MTD-compatible software. These tools will be used for data capture, bank feeds, and reconciliations. With the reduction in manual work, your accountants will be able to focus on providing more strategic guidance to your clients. So, start training your accountants on these software and use the time saved to provide advisory services.

Increased Need for Client Education

Many of your self-employed clients are still unaware of the upcoming MTD-compliance obligations. You are responsible for informing, educating, and clarifying their doubts on MTD systems and successfully onboard them. To achieve that, you can conduct webinars, regular email campaigns, or offer MTD-readiness audits through an accounting outsourcing service provider.

Practice Management Must Evolve

Be prepared for more frequent submissions in corporation tax and income tax. For that, you have to select the best MTD-compliant software and integrate it with your system. If your system is unable to integrate the growing number of digital clients or the new software, then it must be upgraded. Start by investing in integrated practice management software for workflow automation, client tracking, and deadline management.

Best Accounting Software for Making Tax Digital

MTD will become a core part of the UK accounting system, so prepare early by choosing the right accounting software. This will be a critical decision that will impact compliance, efficiency, and client satisfaction.

By choosing the right best accounting software that is MTD-compliant, you can streamline the submissions, reduce errors, and provide your clients with real-time advisory services. Whether you’re supporting VAT returns, preparing for MTD for Income Tax Self-Assessment (ITSA), or anticipating MTD for Corporation Tax, select and be ready with your MTD-compliant software because it matters.

Here’s a look at the top accounting software for MTD in 2025.

- Xero

- QuickBooks Online

- Sage Accounting

- FreeAgent

- TaxCalc

Benefits of MTD for Accountancy Practices

MTD was introduced by HMRC as a compliance requirement, but its benefits have turned it into a transformative force that is making accounting practice more efficient and proactive. Along with compliance, MTD has been successful in unlocking new efficiencies, better service models, and deeper client relationships for accounting practices.

Let’s examine how your accounting practice can benefit from embracing MTD in 2025 and beyond.

Enhanced Efficiency and Automation

MTD-compatible software has automated many manual accounting tasks like bank reconciliations, expense categorisation, and VAT returns. This automation has helped reduce time spent on admin work, increase productivity, and minimise human errors.

Stronger Client Relationships Through Real-Time Support

The MTD for ITSA will bring quarterly reporting instead of annual returns, meaning you will have more interactions with your clients using these reports. This is an unintentional benefit created by MTD, thus giving you an opportunity to offer proactive support, tax planning, and value-adding advisory services to clients instead of reactive year-end rushes.

Scalable Growth with Digital-First Clients

An MTD-compliant software will allow you to scale up faster by onboarding your clients quickly, giving you and your clients access to data remotely, and allowing you to collaborate with your clients in real time. With this software, you can serve more clients without expanding your accounting team, thus reducing your expenses.

Better Practice Management and Workflow Control

Integrated platforms such as Xero and QuickBooks manage deadlines, tasks, communication, and tax filings simultaneously. With MTD becoming compulsory in the future, these tools will be very beneficial in digitising your workflow, thus reducing any last-minute surprises.

Improved Accuracy and Compliance Confidence

Due to MTD, digital record-keeping and automated submissions are becoming the new norm, and they have helped significantly reduce errors associated with manual entries. Software validations and audit trails help ensure that what’s submitted to HMRC is complete, accurate, and compliant. MTD will help minimise HMRC penalties for your clients, which will help you build a stronger reputation.

Competitive Advantage and Modern Client Appeal

Businesses are increasingly preferring to hand over their accounting work to tech-savvy, proactive, and paperless practices. With early implementation of MTD, your practice will develop into a modern, innovative, and proactive one, adding value to your clients.

New Service Offerings and Revenue Streams

MTD is turning out to be more than just a compliance; it has started creating new demands for onboarding training, digital migration, real-time tax planning, and cash flow insights. These tasks are an opportunity for your practice to earn revenues. You can start offering these services through premium, tiered service packages.

Being Ready for Future Regulations

HMRC will not stop at digitising just VAT and Income Tax Self-Assessment (ITSA). There are plans to implement MTD for corporation tax and by being prepared you will be in a position to adapt more easily.

Better Work-Life Balance for Your Team

Fewer paper files, streamlined communications, and predictable workflows mean fewer late nights. MTD helps create a more balanced, sustainable working environment for accountants.

How Corient Helps Accounting Firms Navigate MTD Compliance

MTD is not just a regulatory shift; it has changed the way accounting firms manage and report client data to HMRC. However, many practices are also finding it difficult to adjust to mandatory digital compliance due to multiple operational, technological, and compliance-related hurdles. That’s where Corient steps in—not just as a service provider offering accounting outsourcing services but as a strategic partner.

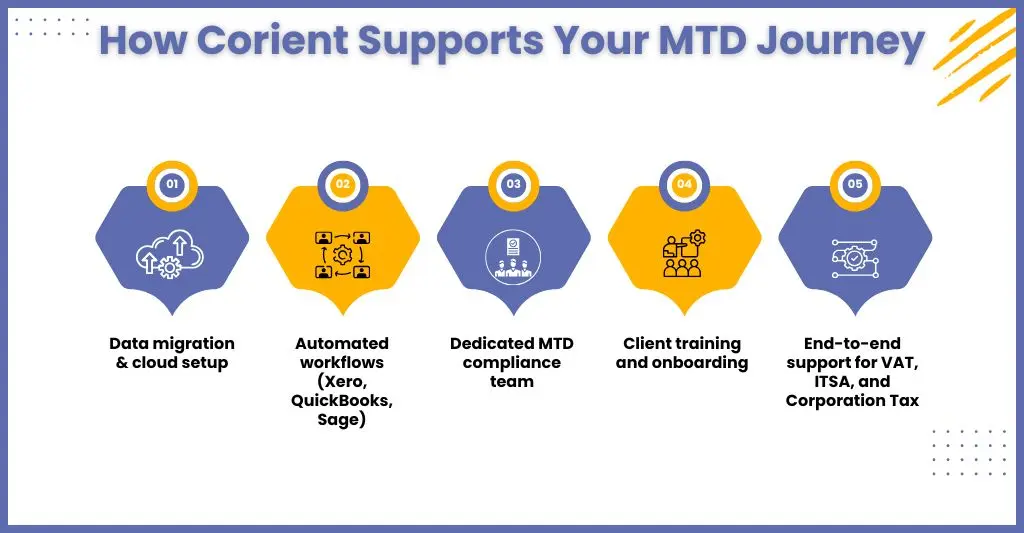

We can help you become MTD compliant in the following ways:

Digital Record-Keeping & Automation

We will help you migrate your client’s data into fully digitised platforms. Our accounting team can integrate cloud accounting solutions like Xero, QuickBooks, and Sage with automated workflows to minimise human error and streamline tax submissions.

Dedicated Compliance Teams

We are already one step ahead when it comes to MTD compliance by training and creating dedicated MTD specialists. These specialists provide HMRC updates, manage client onboarding, and align every submission with the latest MTD mandates.

Client Training & Support

Corient will help you train and increase digital literacy and awareness about MTD among your clients. This will reduce the compliance burden on your internal teams and ensure clients understand the value of digitisation.

Steps to Get MTD-Ready in 2025

The MTD initiative will accelerate in 2025, expanding from VAT to ITSA and later Corporation Tax. Staying MTD compliant helps reduce risks and adds value to the services you offer clients.

Here are some steps to become MTD-ready:

- Identify which clients fall under MTD for VAT, ITSA, or Corporation Tax

- Migrate to MTD-compliant software such as Xero, QuickBooks, Sage, or FreeAgent

- Upskill staff on MTD regulations, software, and client communications

- Educating and onboarding your clients

- Digitising your internal processes

- Setting up monitoring and review systems

- Collaborating with an experienced outsourcing partner

Frequently Asked Questions (FAQ)

Accountants help choose and set up MTD-compatible software for accurate digital record-keeping and system integration. They ensure compliance with HMRC’s digital links rule and train clients on using digital tools effectively. Accountants also educate clients about new reporting timelines, including quarterly ITSA submissions. Many accountants take on the responsibility of handling VAT submissions directly, reducing the risk of missed deadlines or errors.

Yes, Excel can be used for Making Tax Digital (MTD), but only when used with HMRC-approved bridging software.

Making Tax Digital (MTD) will help reduce the tax gap. To do this, businesses will be required to keep digital records, use compatible software, and submit updates every quarter to bring the tax system closer to real-time.

MTD requires every VAT registered business to record and submit VAT returns electronically using ‘functional compatible software’. By April 2026 MTD will be applicable on ITSA and in future on corporation tax.

The purpose of MTD is to promote better and more timely record-keeping to reduce errors and mistakes.

Setting up MTD for VAT is simply but you will need to follow steps in correct order to avoid errors. Here’s what you must follow:

a. Check if your client must follow MTD rules

b. Choose MTD-compatible accounting software

c. Create or verify your HMRC Government Gateway account for your client

d. Sign up your client for MTD with HMRC

e. Connect the software to HMRC

f. Maintain digital records

g. Submit VAT calculations from the software only

Conclusion

What was once deemed impossible, the full implementation of MTD is slowly becoming reality, and you must be prepared for it. Such a shift might look complex, but it also offers opportunities to make your practice future-ready and deliver value-added services to your clients. By understanding the key requirements, adopting the right software, educating your team and clients, and staying proactive, you’ll not only stay compliant—you’ll stay ahead.

There is also another ally that can help you become MTD-compliant much quicker and that is through accounting outsourcing services. Corient is among those service providers that have been one step ahead when it comes to making its accounting services MTD-compliant and has helped multiple accounting firms in this endeavour. Whether it is VAT, income tax, or corporation tax, we will cover MTD compliance. If you have any queries or questions, communicate with us using our website contact form, and our executive will contact you.

Looking forward to an excellent partnership.