How to Register for Self-Assessment with HMRC: A Complete Guide for UK Taxpayers

- Why is Self-Assessment Registration Worrying You?

- Who Needs to Register for Self-Assessment? A Quick Guide

- Step-by-Step Process: How to Register for Self-Assessment with HMRC

- How to Register for Self-Assessment Online in The UK

- Late Registration for Self-Assessment: What Happens When Clients Miss the Deadline?

- HMRC Deadlines Related to Self-Assessment Every UK Accountant Should Know in 2025

- Why UK Accountants Trust Us with Self-Assessment Registration Support

- Help Your Clients Register for Self-Assessment the Right Way With Expert Support

- Frequently Asked Questions(FAQ)

- Conclusion

Why is Self-Assessment Registration Worrying You?

Are you concerned about managing your clients’ Self-Assessment registrations efficiently? You are not alone; this is a common challenge across accounting practices. Self-Assessment registration is the official process of informing HMRC that an individual is required to file a tax return, usually because their income is not fully taxed at source. This applies to self-employed individuals, landlords, company directors, partners in a partnership, and anyone earning additional untaxed income. It is an essential step because HMRC uses this information to issue a Unique Taxpayer Reference (UTR), without which a tax return cannot be filed.

The registration process itself involves submitting the correct and complete form, CWF1 for the self-employed or SA1 for individuals with other types of untaxed income and setting up a Government Gateway account. All of this must be completed before 5th October following the end of the tax year to avoid delays and ensure a UTR is issued in time.

While each registration is manageable on its own, handling high volumes can quickly become complex. To put things into perspective, more than 11.5 million UK taxpayers filed their Self-Assessment tax return by midnight on 31st January for the 2023–24 tax year. This number is expected to rise to over 12 million by 2025, increasing the demand on your accounting team.

Hence, you need to streamline the process of helping your clients register for Self-Assessment with HMRC to avoid penalties, confusion, and delays.

In this blog, we are going to do just that, so let’s get started.

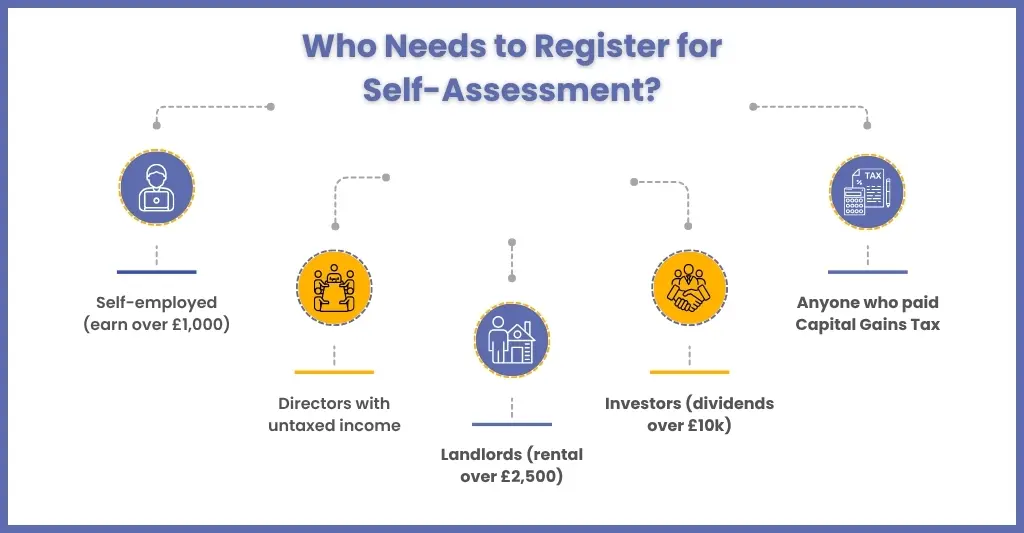

Who Needs to Register for Self-Assessment? A Quick Guide

As an accounting practice, it is your responsibility to determine which of your clients’ need to register for a self-assessment tax return. As per the regulations set by HMRC, many are required to do a self-assessment and complete personal tax returns for HMRC, including:

- Self-employed sole traders who earn more than £1,000 in a year

- Limited company directors who receive untaxed income

- Receive rental income over £2,500 after expenses

- Individuals who had to pay capital gains tax when they sold or ‘disposed of’ something that increased in value

Step-by-Step Process: How to Register for Self-Assessment with HMRC

There is a process to follow for registering for a self-assessment tax return with HMRC. Let’s go through the process step by step.

Step 1: Choose the Correct Form

Self-employed clients must fill out the CWF1 form. The SA1 form is for clients who are not self-employed but need to file (e.g., landlords). For clients in a partnership, they must complete the SA401.

Step 2: Set Up a Government Gateway Account

Register via the HMRC website and enter your client’s details such as :

- Name

- National Insurance number

- Date of birth

- Home address

- Telephone number and email address

- The reason you need to register

- Business name

- Business address

Once registered, you will receive a Unique Taxpayer Reference (UTR) by post in 10–15 working days.

Step 3: Log In

After receiving the UTR number, your client can log in to the Government Gateway and file their self-assessment. This process ensures your clients are correctly linked and ready to file digitally via MTD-compatible software.

How to Register for Self-Assessment Online in The UK

When registering your clients for Self-Assessment online with HM Revenue & Customs (HMRC), the digital route provides a streamlined, efficient way to meet the 5 October deadline and receive the Unique Taxpayer Reference (UTR) required for filing. Below is the step-by-step process your practice should follow to register for self-assessment correctly and promptly.

Step 1: Create or Access a Government Gateway Account

To begin with, log into or create the client’s Government Gateway user ID. If your client doesn’t yet have access, you’ll need to set up their sign-in credentials through HMRC’s online portal.

Step 2: Choose the Correct Registration Form

Depending on the client’s circumstances:

- Self-employed clients (sole traders or partners) should complete form CWF1.

- Clients who are not self-employed but need to file (for example, landlords, investors) should use form SA1.

- Selecting the wrong form can lead to delays in UTR issuance.

Step 3: Submit Registration Details

Complete the online registration with accurate client information: full name, National Insurance number, date of birth, address, email address, and reason for registration (e.g., self-employment from a specific date, rental income).

Once submitted, the client usually receives their UTR by post within approximately 10 to 15 working days.

Step 4: Activate the Self-Assessment Service

When the UTR and activation code arrive, help your client activate the Self-Assessment service in their Government Gateway account. Without this step, they cannot file online. Some delays may apply if the activation code is not received in time.

Step 5: Confirm Registration Before the Deadline

Ensure the registration is completed by 5 October following the end of the tax year in which the client became chargeable — failing to do so may trigger a “failure to notify” penalty. Once the UTR is active and linked, your client is set to file a tax return by the following 31 January deadline.

By guiding each client through these steps and ensuring that key dates are met, your practice can reduce risk, avoid penalties, and build a more efficient workflow for high volumes of registrations.

Late Registration for Self-Assessment: What Happens When Clients Miss the Deadline?

Your clients must register for Self-Assessment by 5th October following the end of the relevant tax year (e.g., for 2024–25, the deadline is 5th October 2025). Missing this deadline could result in:

- an initial £100 penalty

- After 3 months, added daily penalties of £10 per day, up to a maximum of £900

- After 6 months, a further penalty of 5% of the tax due or £300

- After 12 months, another 5% or £300 charge

As an accounting practice handling your clients’ accounts, you must keep track of your clients timelines and send proactive reminders to avoid these penalties.

HMRC Deadlines Related to Self-Assessment Every UK Accountant Should Know in 2025

Your clients need to know that there are multiple deadlines associated with the Self-Assessment Tax Return.

Here is list of deadlines for registration for self-assessment and the submission and payment tax::

| Task | Deadline |

| Registration for Self-Assessment | 5th October 2025 |

| Submission of paper tax return | 31st October 2025 |

| Submission of online tax return | 31st January 2026 |

| Paying tax owed (first payment) | 31st January 2026 |

| Pay second payment on account | 31st July 2026 |

Why UK Accountants Trust Us with Self-Assessment Registration Support

At Corient, we understand that time and accuracy are crucial during the Self-Assessment period, and clients rely on your support in maintaining these standards. However, with vast volumes of self-assessment tax returns, giving such support to each client is impossible. That’s why practices approach us for accounting outsourcing services, including managing time-consuming self-assessment registrations and other tasks.

Here’s how we will provide you vital support:

1. Managing Form Submissions

Our accountants are experienced enough to handle all types of clients and their forms, including:

- CWF1 for self-employed clients and sole traders

- SA1 for landlords, investors, and individuals with untaxed income

- SA401 for partnership members

By handling these forms end-to-end, we eliminate errors, avoid rejections, and save your team valuable hours.

2. UTR Tracking and Status Updates

Getting a Unique Taxpayer Reference (UTR) from HMRC can be a bottleneck. To overcome these delays, we will implement continuous monitoring and proactively address any delays. If any issues arise, we will notify you so that there are no unwarranted surprises.

3. Assistance in Government Gateway Onboarding

We will also assist your clients in:

- Creating secure Government Gateway accounts

- Linking their UTR for Self-Assessment

- Adding the relevant services and ensuring full HMRC access

Such assistance is essential for MTD compliance and seamless online filing, and we ensure it’s done right the first time.

4. Thorough Verification and Support

Additionally, our experts are well-versed in HMRC’s identity verification protocols, ensuring your clients submit the correct documents in advance for a smooth verification process. This helps avoid unnecessary back-and-forth and prevents client confusion.

5. Other Advantages

By outsourcing self-assessment registration to Corient, we will help you in:

- Freeing up your accountants to focus on advisory, forecasting, and planning

- Reducing internal workload

- Improve client onboarding speed and satisfaction

Our experts will ensure timely and accurate registration, enabling your practice to perform better.

Help Your Clients Register for Self-Assessment the Right Way With Expert Support

Handling clients’ registrations for self-assessment tax return is a time and resource-consuming exercise, especially during peak tax periods. For this reason, accounting practices are choosing outsourcing partners like Corient, which are experts in clients’ registrations.

By collaborating with us, your clients will enjoy the following benefits.

Dedicated Team

Furthermore, a dedicated team will be assigned to you, comprising experts in Self-Assessment onboarding who understand HMRC forms and registration rules in detail. They will work closely with your team to ensure seamless coordination and prevent any issues.

Get Free Trial

You can be extra sure about us by taking a free trial and experiencing our:

- Real-time response handling

- The speed of our form processing

Our risk-free trial will provide you with complete transparency into our working style and how our support will integrate with your workflows. Additionally, you will gain insight into how much time and money you will save for yourself and your clients.

Full Compliance with HMRC, GDPR, and ISO 27001

Security and regulatory compliance are non-negotiable. That’s why Corient’s infrastructure and workflows ensure:

- End-to-end encryption (AES 256-bit) of all data

- GDPR-compliant processes for UK data handling

- ISO 27001-certified systems to protect client confidentiality and traceability

Your clients’ sensitive financial data is protected to the highest global standards.

Frequently Asked Questions(FAQ)

It typically takes 10 to 15 working days for HMRC to send the UTR number by post. Clients should wait for this before attempting to file their Self-Assessment return.

In fact, many accounting firms now outsource this task to specialised partners like Corient, who manage form submissions, UTR tracking, and Gateway setup—freeing your team to focus on advisory work.

The deadline for paying the self-assessment tax is 31st January and the second payment is on 31st July.

In case if your client has forgotten its HMRC login details (Government Gateway ID, password, or both), it can be easily recovered through GOV.UK:

1. Recover Your Government Gateway User ID

Go to the HMRC sign-in page and select “Forgot user ID”. It will ask for the email address linked to your HMRC account. HMRC will then send your client’s ID to that email.

2. Click “Forgot password” on the login page.

Your client need one of the following to reset it:

a. Government Gateway user ID

b. The email linked to your account

c. Access to two-factor authentication (text message, app, or landline code)

3. If You Lose Access to the Email or Phone Number

Choose “I cannot access these” during recovery.

HMRC will ask for identity verification, which may include:

a. National Insurance number

b. Recent payslip or P60

c. Passport details

4. If You Still Can’t Log In

Your client might need to create a new Government Gateway ID, but still can link it to your existing UTR during setup.

Conclusion

Helping clients register for Self-Assessment tax return is more than just ticking a box; it’s about safeguarding them from penalties and ensuring your practice runs smoothly during tax season. Moreover, with HMRC increasing digital compliance and tightening deadlines, your clients will rely on your practice for even more support.However, we have noticed that practices are faltering simply because of the high volume of assessments being placed on them. Such an excess load of self-assessments can be handled by partnering with an outsourcing firm.

When it comes to outsourcing self-assessments, you will find Corient’s name among the top listers. As a result, we have achieved this position by investing in our talent and processes, ensuring you receive up-to-date Self-Assessment services. With our experts on your side, you won’t have to worry daily about client registrations, filings, or deadlines. Are you considering getting a free trial? Great, but first, connect with us through our contact form and gain access to our experts.