AI in Accounting The Future of Finance for UK Firms

- What Is the Role of AI in Accounting Today?

- Benefits of AI in Accounting for Modern Firms

- Challenges of AI in Accounting Firms

- Can AI Replace Accountants? A Realistic Outlook

- AI in Accounting Use Cases: Real-World Applications

- Why AI Won’t Replace Accountants But Will Empower Them

- The Future of AI in Accounting: What’s Next?

- Why Partner with an AI-Enabled Accounting Outsourcing Service Provider?

- Frequently Asked Questions (FAQ)

- Conclusion

AI (artificial intelligence) in accounting is a reality, and it is fundamentally changing the way accounting is done in the UK. Rather than being a challenge to the existence of accountants, it has made them more accurate and efficient and given them strategic competence. So, it’s correct to say that AI will not replace accountants.

Instead of resisting AI system, which aligns with HMRC’s push for digital transformation, it would be ideal to understand its workings and learn how to utilise it effectively. By understanding it, you will unlock opportunities for your accounting firm to become more precise and data-driven. In this blog, we will focus on what AI in accounting means today, addressing concerns related to job losses and the future of AI in the accounting field.

Let’s explore.

What Is the Role of AI in Accounting Today?

Artificial intelligence in accounting refers to the use of artificial technologies, such as machine learning algorithms and natural language processing, to automate and enhance accounting processes. Accounting tasks, such as financial reporting, audit and compliance, fraud detection, and data analysis, can be automated using AI.

The embracing artificial intelligence in accounting has led to improvements in accuracy and efficiency. Additionally, it has helped accounting firms reduce hiring costs and provide valuable insights, which have proven vital in informed decision-making. That’s why many professional accountants and experienced practices are using AI technology to make their work easier and help their clients better.

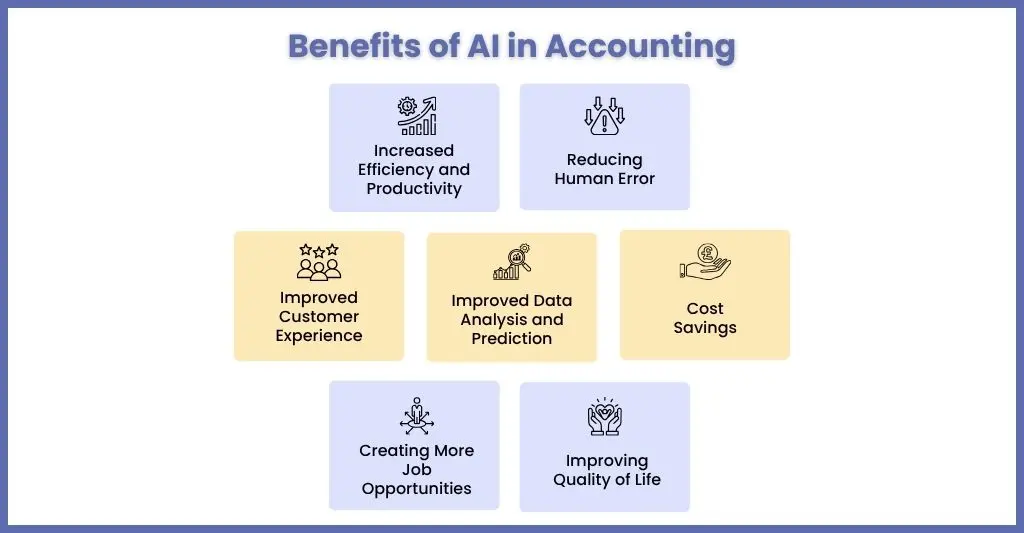

Benefits of AI in Accounting for Modern Firms

Now, let’s examine some of the benefits of artificial intelligence in accounting for modern UK accounting firms. It has improved the work life of countless accountants and businesses.

Increased Efficiency and Productivity

AI technology has made it easier to handle repetitive accounting tasks, thus freeing up your time for more critical accounting responsibilities. This way, AI will help you become more productive and efficient, as you can now focus on your core responsibilities.

Reducing Human Error

Through AI technology, you can automate multiple accounting tasks, thus improving accuracy and efficiency. It also reduces the occurrence of human error, especially in routine and repetitive tasks and processes, which results in more reliable financial data and reporting. For example, automating routine tasks like data entry reduces the likelihood of manual mistakes. This makes financial planning and audits smoother and more dependable.

Improved Customer Experience

The use of AI tools like ChatGPT can help your team members draft emails more efficiently, saving them time. This highly popular tool has helped many practices in answering tricky queries asked by clients, thus improving customer support services.

Improved Data Analysis and Prediction

Faster data analysis is now a reality due to AI algorithms, making it an effective tool for identifying trends. AI has enabling accountants and practices manage financial data efficiently by analysing transactions, cash flow, budget, and accounting data to identify trends, errors, and areas of improvement.

Cost Savings

Embracing AI automation saves considerable time and money for accounting firms by automating routine accounting tasks. Due to accounting automation, accountants will be free to focus on strategic decision-making, thus enabling increased productivity while reducing expenses.

Creating More Job Opportunities

Rather than eliminating jobs, AI technology has been creating new job opportunities through AI tools and cloud-based systems. As the importance of artificial intelligence in accounting grows, it has taken over most of the repetitive tasks, creating new opportunities in monitoring AI accounting operations and maintaining AI tools.

Improving Quality of Life

It seems like a dream, but AI tools have indeed improved the quality of life for accountants. Time-consuming accounting tasks such as data management, expense management, accounts payable, and expense reports are now easily performed using AI tools. This brought quality and improved job satisfaction for accountants.

Challenges of AI in Accounting Firms

However, there are a few thorns when it comes to implementing artificial intelligence in accounting. Let’s understand these challenges thoroughly.

- Requirement for Human Oversight: While AI tools can do the accounting task for you, there is still a requirement for human oversight to catch errors and validate results. Yes, even AI can make mistakes, although rare, and it cannot engage in critical thinking, which the human brain can do.

- Skills Gap and Learning Curve: Advanced AI tools, such as ChatGPT and other chatbots, have advanced features that require training and knowledge to operate flawlessly.

- Cost of Implementation: Although many AI tools are available for free, you will not have access to all their advanced features, which require a purchase, similar to the paid version of ChatGPT.

- System Integration Issues: Older accounting systems will struggle to integrate AI tools, often encountering connection failures and synchronisation errors.

- Data Quality: The AI outputs will be correct only if you provide the right inputs and financial data. Otherwise, AI has a tendency to fill in the gaps, which isn’t ideal with sensitive data.

Can AI Replace Accountants? A Realistic Outlook

Are you feeling threatened by the increasing influence of generative AI? Realistically speaking, AI is having an impact on the work of accountants. The proportion of accounting tasks handled by accountants is expected to decrease from 47% to 33% by 2030, according to the Future of Jobs report. But to say that accountants will go extinct is too far-fetched.

Here’s why:

Complex Decision-Making

AI cannot make complex decision-making, which is required for handling complex business transactions, navigating regulatory frameworks, and understanding industry nuances. No matter how advanced AI becomes, it cannot replace the human brain in terms of ethics, human intelligence, judgement, and creativity, which are necessary for complex decision-making.

Client Relationships

Building and maintaining client trust and relationships are now integral to an accountant’s job profile. Interpersonal skills, communication, and the ability to understand a client’s unique financial goals and challenges are things that AI can’t replicate.

Oversight and Interpretation

AI will handle all the data entries and analysis, but it cannot interpret those results nor provide context or advice on making strategic decisions. Only a human accountant can provide that guidance.

AI in Accounting Use Cases: Real-World Applications

Artificial Intelligence in accounting was first introduced to take over repetitive tasks. Now, it is increasingly used for identifying patterns in financial data and providing insights for better decision-making.

Some of the specific uses of AI in accounting are:

- Invoice Processing and Reconciliation

- Fraud Detection

- Predictive Financial Analysis

- Budgeting and Forecasting

- Tax Compliance and Preparation

- Bookkeeping and Data Entry

- Audit Support

Why AI Won’t Replace Accountants But Will Empower Them

Yes, it’s accurate; AI won’t replace accountants no the accounting firms; instead, it’ll increase their value. While AI can automate routine tasks like data entry, invoice matching, and reconciliation, it lacks the human judgment, ethical reasoning, and strategic insight that accountants bring to the table.

Here’s how AI empowers accountants:

- Speeds up compliance work by automating VAT filings, payroll, and reporting tasks.

- Reduces human error in calculations and bookkeeping, thus saving from HMRC penalties

- It frees up time, allowing accountants to focus on advisory services, forecasting, and client relationships.

- AI-powered tools help accountants to focus on understanding data more quickly, enabling better decision-making.

AI tools are like assistants who will carry out the heavy workload, allowing you to have time to spare for making strategic decisions for your clients.

The Future of AI in Accounting: What’s Next?

Artificial Intelligence is the present and the future of accounting, slowly pushing the field towards automation and beyond. In the near future, AI is expected to act as a real-time advisor rather than staying in the background.

Here’s what’s next:

- Predictive Analytics: AI will forecast cash flow, tax liabilities, and risk areas before they happen.

- Smart Decision Support: AI will help accountants to focus on providing data-backed advice to clients in real time.

- Voice-Activated Accounting: Imagine managing your books or asking for a report through voice commands.

- Deeper Integration: AI will connect seamlessly across platforms from payroll to CRM for a single view of business health.

- Stronger Fraud Detection: AI will scan transactions instantly for red flags and anomalies.

It is incorrect to conclude that AI system will replace accountants or accounting practice, but one thing is certain: it will transform the role of accountants from number crunchers to forward-thinking business advisors.

Why Partner with an AI-Enabled Accounting Outsourcing Service Provider?

It seems like a piece of cake, but using AI in accounting throws up a set of unique challenges for your accounting practice. These challenges include integration with new systems, the requirement of skill sets to operate advanced AI tools, data quality, and the need for human oversight. Handling these challenges requires different kinds of experience and skills that neither come cheap nor in the possession of practices.

Therefore, practices must partner with service providers offering AI-enabled accounting outsourcing services. A professional service provider will always be one step ahead by training its staff on the latest AI tools and how to get complete and accurate outcomes from them. The impact of AI on outsourcing providers has led to enhancement in their services including quality and speed. AI-enabled outsourced accounting for UK businesses has helped firms stay compliant and cost-effective.

An AI-trained expert accountant will offer accounting services that are enhanced by the use of AI tools, which directly benefit the performance of your practice and gains for your clients. Therefore, select the right service provider and reap the full benefits of AI-enabled accounting services.

Frequently Asked Questions (FAQ)

No, AI reduced the proportion of work that was previously done by accountants alone. It also helped in improving their service quality and decision-making process.

You can start with identifying repetitive accounting tasks, such as data entry, bank reconciliation, or invoice processing, that can be automated. Then:

Choose AI-powered tools that integrate well with your accounting software

Use the selected AI tool in pilot way before expanding

Train your team on how to use the AI tool

If you are not satisfied with the performance of your team then partner with tech-enabled outsourcing firm

Ensure compliance with UK data protection laws (e.g., GDPR) when using AI tools

Some of the major benefits of AI in accounting are as follows:

Automated data entry and processing

Reducing human error

Cost savings

Real-time financial insights

Errors detection

Faster reconciliation

AI tools can scrutinise vast data sets, find patterns, make forecasts, extract and synthesize structured and unstructured data, and can automate tasks, such as data entry, transaction reconciliation and financial reporting.

Some of the major challenges of implementing AI in accounting are:

Skill gap

Data security and privacy

Integration with older systems

High initial cost of investment

Constant human oversight

Accountants can use cloud tools like Xero, QuickBooks to automate bill capturing, matching receipts, and syncing bank feeds. Additionally, outsourcing routine tasks, such as bank reconciliations, month-end processing, and bookkeeping clean-up gives practices a dedicated team that works in the background.

Conclusion

AI is no longer a futuristic concept. It is a tool that is actively changing the accounting landscape every day. If demand for savvy or AI-enabled services rises among your clients, you will need to embrace AI, which will not only boost your efficiency but also add value to your services. With AI doing the recurring accounting tasks, you will be spared time for more advisory, analytical, and forward-thinking.

A lack of skills to operate AI tools may come your way. Still, with a professional service provider as your partner, you can turn this challenge into an opportunity, and Corient falls under that category. Corient has consistently been one step ahead of its competitors in adopting new technology and tools and has teams of accountants with extensive experience in operating AI tools. Want to know more about our AI-enabled accounting services? Connect with our experts and enjoy the benefits of our services.