Business Tax Rates UK: A Complete Guide

You must have noticed your clients panicking when it comes to handling corporation tax or filing a self-assessment tax return, and rightly so. Keeping track of business taxes, especially rates and filing, is an important aspect of any business and also a stressful one. Why? Because this task of monitoring and filing business taxes is both time-consuming and costly if mistakes occur.

To overcome this challenge, your business clients have placed their faith in your accounting firm, but the issue still persists. These days, many accounting firms are facing problems in keeping track of the everchanging business tax rates and their regulations. That’s why we have created this guide on business tax rates UK, which will be beneficial for businesses and accounting firms. Also, we will focus on what, when and how your clients will need to pay their taxes. Let’s understand it in detail.

What Is the Business Tax Rate in the UK?

A business tax rates UK is the rate of tax applicable to a business subject to the profits earned. Take, for example, the corporation tax. It is one of the major business taxes applied to businesses operating in the UK. When it comes to its current tax rates, it is 25% for companies with profits over £250,000. Businesses with profits under £50,000 will pay the 19% rate, and those with profits between £50,000 and £250,000 will pay between 19% and 25%.

However, we would like to note that these corporation tax rates or other tax rates are subject to change, and it is important to check for updates before starting your calculations.

Which Business Taxes Do You Need to Pay?

In the UK, there are multiple business taxes, and your clients are required to pay these taxes depending on multiple factors such as:

- How is their business is structured?

- How much profit do they make?

- How do they pay themselves as an owner? (whether that’s through business drawings, a salary, or dividends)

The good news is that your clients are liable to all business taxes. However, it is better to be prepared by knowing each of the business tax rates UK. Knowing these taxes in detail will help you in assisting your clients if they become applicable on them in the future.

Some of the main business taxes to know about are:

- Corporation tax

- Income tax

- National insurance

- VAT

- Dividends tax

- Capital gains tax

Corporation Tax

If your client runs a limited company, then it’s liable for corporation tax. This tax is also applicable to foreign companies whose branches are in the UK. Corporation tax is paid on the annual profits your client’s business made during the financial year, including profits made by investments and the sale of assets.

The corporation tax rate is determined by the profits earned. It is 25% for companies with profits over £250,000, 19% for businesses with profits under £50,000, and between 19% and 25% for those with profits between £50,000 and £250,000.

Corporation tax does not get deducted automatically; therefore, to pay it, your clients will have to follow some steps:

- Register Your Clients for Corporation Tax: Your clients must register their businesses with Companies House and create a User ID and password alongside the UTR number.

- Keep Your Client Accounting Records Updated: If you are handling the accounting for your client, it is your responsibility to keep proper accounting records. These records will be used to calculate corporation tax and prepare corporation tax returns.

- Payment of Corporation Tax: Corporation tax payment must be done within nine months and one day of the end of your accounting period. If your clients’ profits are more than £1.5 million, it can be paid in installments. Even if there is nothing to pay, you will have to report it on behalf of your client before this deadline.

- Filing of Corporation Tax Return: The deadline for filing the company tax return is slightly later than paying corporation tax. The deadline is 12 months following the end of the accounting period to submit your client’s return.

Income Tax

Your client will have to pay income tax only if it is a sole trader, freelancer, or self-employed business owner. The income tax must be paid via a self-assessment tax return, which must be submitted by 31 January. Otherwise, your client will be liable for a penalty.In addition, clients making advance payments should be made aware of the payment on account system in the UK, which ensures that their income tax is paid in two installments rather than as a lump sum.

If your clients are business owners, they will have directors and employees, which is why they will need to register their company with PAYE (Pay As You Earn). This will allow HMRC to collect income tax and National Insurance through monthly deductions from every employee’s and directors’ pay cheques.

National Insurance

Like income tax, Nation Insurance is applicable to clients if they are sole traders, freelancers, self-employed or an employer. Suppose your client is a sole trader, freelancer, or self-employed required to pay both Class 2 and Class 4 National Insurance Contributions (NICs). From 6th April 2024 to 5th April 2025, an employer has to make contributions alongside its employees, which is 13.8% for salaries ranging from £758 to £4,189 a month. However, from 6th April 2025, the National Insurance Class 1B rate for 2025 to 2026 will be 15%.

VAT

VAT is among the most well-known taxes, added to goods and services. This tax is applicable if your client’s business is VAT-registered. Your clients are required to register, submit VAT return before deadline and pay VAT it if their taxable turnover is greater than £90,000.

Dividend Tax

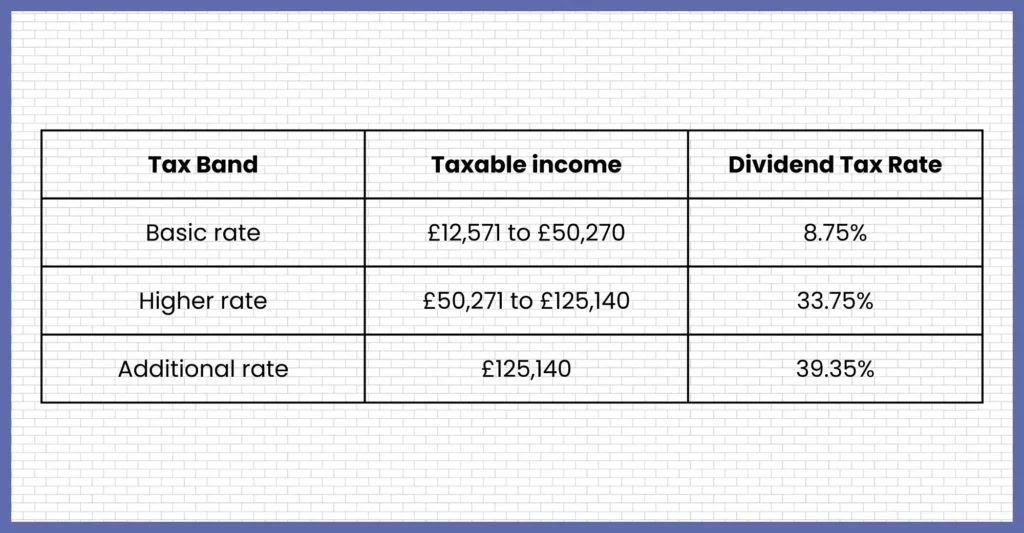

If your clients are paying themselves dividends, then they will be subjected to tax if the dividend allowance is greater than the dividend allowance of £500 from 6th April 2024 to 5th April 2025. How much tax to pay? That will depend on the income tax band, which is

Capital Gain Tax

Capital gains tax is paid on the profit your clients make when they sell an asset, such as shares in a business or a property that isn’t their home. This tax is applicable on the following:

- Land and buildings

- Fixtures and fittings

- Plant and machinery

- Registered trademarks

- Business’s reputation

What Do Tax Deductions Mean?

Your clients may definitely demand that you reduce their tax burden, and the only way to do that is by skillfully identifying certain costs and expenses. These expenses can be used to deduct your client’s turnover to reduce its taxable profits. Now, the tax-deductible expenses differ for limited companies and sole traders.

The self-employed expenses that can be included are:

- Office costs, such as business rent and stationery

- Staff costs, including salary and benefits

- Travel costs, for business purposes

- Specific work clothing, such as uniforms and protective gear

- Advertising and marketing costs

- Legal and financial costs on accountants, solicitors and surveyors

- Banking charges, such as overdraft and credit card fees

- Certain training courses

Common Mistakes Businesses Make with Taxes

Calculating and paying taxes is not an attractive aspect for any business and is, frankly, time-consuming. Such a situation increases the prospect of slip-ups, which can cost your client penalties, cash flow issues, or even legal trouble. Therefore, making your clients aware of their tax-paying responsibilities is important to keep their business compliant and running smoothly.

Now, most businesses rely on accounting practices to take care of their accounts and tax calculations, so while these mistakes can be avoided, we have still prepared a list of common mistakes they make so that they can reduce your workload and quicken the process.

Let’s explore these common mistakes:

Missing Tax Deadlines

Many of your clients must be taking the tax deadline lightly, leading to late filing and late payments. These delays lead to HMRC penalties, interest on unpaid taxes, and unnecessary stress during year-end.

Only by setting automatic reminders for important tax deadlines for corporation tax, VAT, PAYE, etc., can help your clients. If your accountants are handling their taxes then using cloud-based tax software will be necessary to keep everything on track. Getting tax software will require investments, training and experience which through corporation tax outsourcing services can be completely avoided.

Not Keeping Accurate Records

Incorrect or incomplete records invite troubles such as incorrect tax filings and missed deductions. Such mistakes will lead to your client paying more than they owe or, even worse, facing an HMRC inquiry. To avoid this, you can educate your clients to maintain and update their income, expenses, invoices, receipts, and payroll records. Also, you can make things easier by using tools like Xero or QuickBooks.

Mixing of Business and Personal Expenses

Your clients might commonly use the same bank account for personal and business expenses, making it difficult to identify legitimate business costs. This also creates confusion during tax preparation, and to avoid it, you will have to counsel your client to open a separate account for business.

Overlooking Allowable Deductions

Many clients do not understand what expenses to claim and usually try to play safe by underclaiming. Due to this, many of your clients will lose chances to save taxes. You can help businesses by making them aware of the allowable business expenses or by offering them services through tax outsourcing support services to make their lives easier.

Incorrect VAT Handling

Errors in VAT calculations, failure to register, and missing VAT deadlines are regular mistakes businesses commit. Such VAT errors can result in financial penalties or loss of VAT reclaims for businesses. Hence, your clients must ensure they are registered once they cross the VAT threshold. You can also help your clients with their VAT process by using VAT outsourcing services. Such services will give your clients access to VAT-compatible software to file returns accurately.

Conclusion

Business tax rates UK for corporation, VAT, National Insurance and so on are an integral part of any business operations. Rather than running away from it, you must advise your clients to invest in updating and keeping a tab on these business rates. Also, your accounting practice can assist them in handling these taxes; in this process, you are making them more compliant. If you require any assistance, then accounting outsourcing service providers like Corient will always be at your service.

We have been in this business since 2011 and offer accounting outsourcing services to practices across the UK. Our specialisation is providing corporation tax, VAT, and various other accounting services, which have positively impacted many practices. Please write down your queries on our website contact form, and our executive will contact you as soon as possible.

We wish you the best of luck and looking forward for your reply.