Accounts Payable Workflow Automation – The Complete UK Guide

Let’s be honest, how many times do you face these questions while operating your practice?

- “Has this invoice been approved?”

- “Who signed this off?”

- “Why is this supplier chasing us again?”

- “Is this already paid?”

Do these questions keep coming up frequently? Then your accounts payable process must be in manual format, if not completely broken.

According to multiple industry surveys, most practices are spending 40 to 60% of their time on transactional tasks instead of high-value advisory work. At the same time, in 2026, HMRC will be breathing down your neck when it comes to digital compliance under Make Tax Digital (MTD), increasing the pressure for clean audit trails and structured record-keeping.

These factors make accounts payable workflow automation a necessity.

What Is Accounts Payable Workflow Automation?

Accounts payable workflow automation is a solution through which your accounting practice will get invoices, manage approvals and process payments automatically, either through a single platform or multiple digital tools. All this will be achieved without any manual intervention.

For your practice, such automation is relevant due to:

- HMRC’s MTD framework

- VAT reporting requirements

- Digital record-keeping obligations

- Increased scrutiny during compliance checks

Automation creates structure, and structure reduces risk.

Accounts Payable Automation vs Manual Payables – A Side‑by‑Side Comparison

| Manual AP Process | Accounts Payable Workflow Automation |

| Email-based approvals | Pre-defined digital approval routes |

| Manual data entry | Automated invoice capture |

| High risk of duplicate payments | Built-in duplicate detection |

| Poor visibility of liabilities | Real-time dashboard tracking |

| Delayed month-end close | Faster reconciliation cycles |

| Limited audit trail | Full digital audit logs |

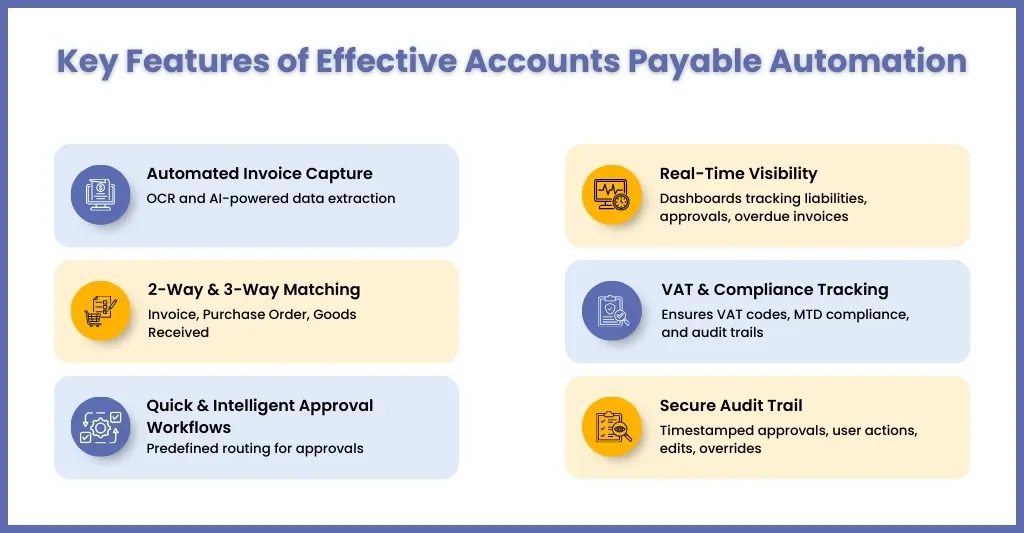

Key Features of Effective Accounts Payable Workflow Automation

All accounts payable workflow automations are not the same, but if it has all the right features, things will move smoothly.

Automated Invoice Capture

Manual data entry is an open invitation for errors. An effective system uses OCR (Optical Character Recognition) and AI-powered extraction to:

- Capture invoice data from email, portal, or EDI

- Auto-populate supplier details, VAT amounts, invoice numbers

- Flag incomplete or inconsistent data

For UK practices managing multiple clients, this is critical. As a result, even a single mistyped VAT amount can distort quarterly returns under HMRC’s MTD framework.

2-Way and 3-Way Matching

Frauds and duplicate payment often fall in between the cracks when the controls are weak. To cover these gaps, you will need the following matching processes.

2-way matching compares:

- Invoice vs Purchase Order

3-way matching compares:

- Invoice vs Purchase Order vs Goods Received Note (GRN)

This ensures:

- The invoice amount matches the agreed pricing

- Goods were actually received

- Services were authorised

Quick And Intelligent Workflows Approvals

Under the manual system, approvals come through email and meetings.

Under automation, predefined routing rules are designed based on:

- Invoice value thresholds

- Department ownership

- Supplier category

- Cost centre

For example:

- Under £1,000 → Department Manager approval

- Over £5,000 → Partner sign-off required

It helps remove ambiguity and speeds up the decision-making process.

Real-Time Visibility – Know Your Liabilities at Any Moment

Cash flow will throw you some nasty surprises if you lack visibility.

A strong system provides dashboards showing:

- Outstanding liabilities

- Pending approvals

- Overdue invoices

- Upcoming payment runs

- Supplier concentration exposure

Improvement in visibility will help you in:

- Advisory conversations

- Cash forecasting

- Working capital planning

Instead of reacting to suppliers, you anticipate them.

VAT & Compliance Tracking – Built for UK Regulatory Standards

Even a small mistake in VAT return filing can be expensive for you and your clients.

To avoid that, you will need automation that will ensure:

- Correct VAT codes are applied

- Digital records are maintained for MTD compliance

- Audit trails meet HMRC expectations

- Supporting documentation is stored securely

With HMRC in no compromising mood when it comes to digital compliance under MTD (which is expanding to income tax in 2026), you have no other option but to maintain clean invoice data.

Automation will help you in achieving that through:

- Accurate VAT submissions

- Faster reconciliations

- Reduced compliance risk

For you, this is like a value-added feature.

Secure Audit Trail – Every Action Logged, Every Decision Recorded

Expect certain questions during an HMRC investigation:

- Who approved the invoice?

- When was it approved?

- What changes were made?

- Why was it paid?

You need to have answers to these questions, and for that, you will need a proper accounts payable workflow automation system that logs:

- Approval timestamps

- User actions

- Edits and overrides

- Payment confirmation

This creates an undeniable compliance record and ensures internal controls align with good governance practices.

Accounts Payable Workflow Automation Example

Let’s make this practical.

Imagine a mid-sized UK accounting practice handling accounts payable for multiple clients.

Before automation:

- Invoices arrive via email.

- Admin manually enters details into Xero.

- Approval emails go back and forth.

- Supplier calls asking for payment status.

- Duplicate invoice slips through.

- VAT reconciliation at quarter-end reveals discrepancies.

Now, with Accounts Payable Workflow Automation:

- Invoices are auto-captured.

- Data is validated instantly.

- System flags duplicates.

- Approval is routed automatically.

- VAT codes are applied correctly.

- Payment is scheduled based on cash flow priorities.

- Full audit log is stored digitally.

The result?

- Faster processing

- Fewer errors

- Better cash control

- Happier suppliers

That’s not theory. That’s operational sanity.

How Automation Improves Cash Flow and Supplier Relationships

The goal of automating accounts payable workflow is to improve the cash flow of your clients and supplier relationships. This is achieved from the benefits it offers, such as:

Timely Payments

One of the major benefits of implementing accounts payable workflow automation software is the assurance that all payments will be sent or collected on time. By automating the payment schedule, you will be in a position to eliminate late payments completely.

Fraud Reduction

Fraud reduction will be the primary objective of automating the workflow process. This is achieved through the software, which will weed out suspicious or habitual offenders or highlight them for your attention. Plus, it will keep an oversight into taxes and their regulations.

Removing Manual Data Entry

Entering accounts payable data manually is a time-consuming process, and it’s an invitation for human errors. However, through automation of data entry through the right software, you will be saving time on data entry and corrections, which can be used for other high-value tasks.

Centralisation to Reduce Paperwork

Keeping centralised accounts is one of the best ways of avoiding multiple issues, and automating accounts payable workflow helps you in achieving that. By centralising and automating the accounts payable process, you are automatically reducing tonnes of paperwork and the increase your ability to handle all financial transactions and approvals through one software.

Added Security

Automation through software will add an additional layer of security in the invoice approval workflow. This makes it easier to identify and reject fraudulent invoices.

Improved Audit Trails

You will be in a position to check financial records at ease due to the automation of the AP workflow. Through an automated system, audit teams will get access to all the information without the delays associated with a paper-based audit.

Common Implementation Challenges and How to Overcome Them

We will never say that implementing accounts payable automation is a path full of roses. However, it would be wrong to say that these challenges are associated with automation, but rather crop up due to rushed implementation, misunderstandings, and resistance.

The good news is that these challenges can be managed easily. Let’s understand these challenges deeply and the solutions to overcome them.

Resistance to Change

Whether it’s your internal accounting team or your clients, get something new that they don’t know of, and you will face resistance, and the same applies to the automation of accounts payable workflow. Both your team and clients are familiar with the manual process, and automation might bring a sense of insecurity and confusion.

Automation may sound like:

- Extra work

- Loss of familiarity

- A threat to job roles

No wonder resistance will take place

The solution to this is:

Starting a pilot project with a section of your clients. This will give time for others to familiarise themselves with automation.

Poor Data Standardisation

Automation will work flawlessly and show correct outputs only when the data is consistent. When we talk about inconsistent data, we are talking about:

- Duplicate supplier records

- Incorrect VAT numbers

- Missing payment terms

- Inconsistent naming conventions

If not addressed, automation will struggle with:

- Matching invoices

- Generating accurate reports

- Ensuring VAT compliance

The only way to overcome it is through clean and consolidated supplier master data before rollout.

Fear of Losing Control

It’s a fear that keeps coming up among your clients. They mostly think that automation is equal to:

- Reduced oversight

- Delegated responsibility

In reality, well-designed automation increases control. Manual processes rely on memory and email threads.

How to overcome it:

Choose an automation software that offers:

- Structured approval hierarchies

- Real-time dashboards

- Role-based access controls

- Full audit trails

With these in place, your clients can see:

- Outstanding liabilities

- Pending approvals

- Payment timing

- Supplier exposure

That’s not less control, that’s clearer control.

Integration Concerns

Whenever you think about integrating a new software into your system, the first thing that comes to your mind is its compatibility with your existing system.

Most practices use:

- Xero

- Sage

- QuickBooks

- IRIS

- BrightPay

- Other cloud accounting tools

If integration is weak, automation creates duplication rather than efficiency.

Solution:

The ideal solution is to work with specialists who understand UK accounting practice workflows and have the expertise of accounting software ecosystems.

This is where outsourcing partners like Corient add value without adding much cost. It is among the top accounts payable outsourcing companies and through their bookkeeping outsourcing services, combined with automation expertise, they offer a structured process management.

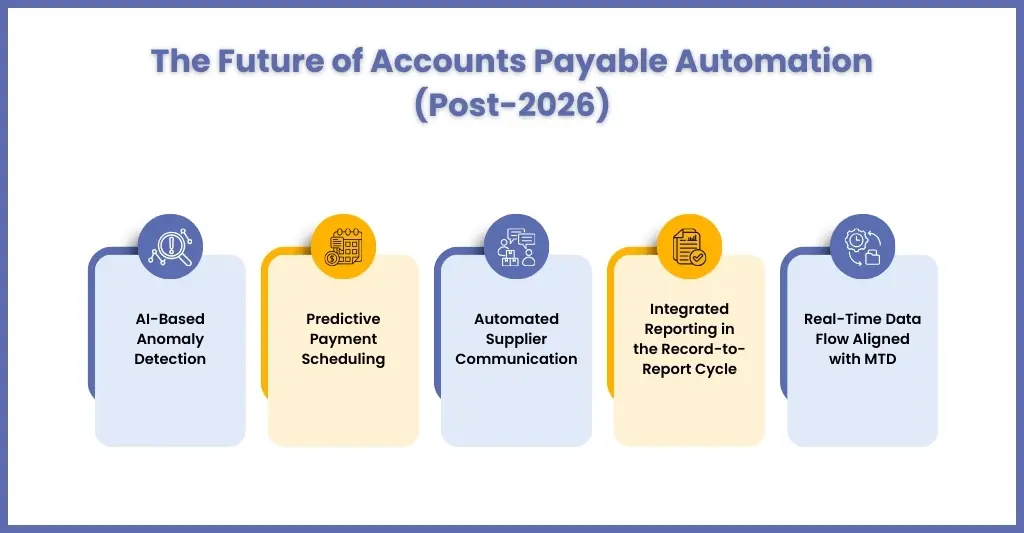

Future of Accounts Payable Workflow Automation

In 2026 and beyond, accounts payable workflow automation is moving ahead towards new frontiers like:

- AI-based anomaly detection

- Predictive payment scheduling

- Automated supplier communication

- Integrated reporting into the record-to-report cycle

- MTD-aligned real-time data flow

With HMRC enforcing digital compliance and structured reporting, as a result, the manual accounts payable process is becoming outdated, making automation essential.

People Also Ask

Yes, it is if implemented correctly. Automation supports the digital record keeping requirement under MTD and improves VAT audit trails.

Accounts payable workflow automation helps in eliminating human errors by automating data entry, enforcing matching rules, and flagging duplicates or discrepancies

Accounts payable workflow automation is a solution through which your accounting practice will get invoices, manage approvals and process payments automatically, either through a single platform or multiple digital tools.

An accounts payable workflow is the structured process a business uses to manage and pay its invoices from vendors and suppliers.

Conclusion

The question is not “can you afford to automate?” but “how long can you afford not to automate?” Accounts payable automation may not look attractive, but it has long-term significance going beyond 2026. Accounts payable workflow automation will transform your financial operations, saving time and reducing costs while improving accuracy and compliance.

By addressing common challenges, you can successfully implement accounts payable automation and reap its long-term benefits. Accounts payable workflow automation allows your practice to:

- Reduce errors

- Protect compliance

- Improve cash flow control

- Free up senior staff time

- Scale without hiring reactively

If tackling the challenges associated with accounts payable automation is consuming much of your time and resources, then approaching a professional outsourcing provider makes sense. Here’s where Corient comes in: we help UK accounting practices implement structured, automation-backed accounts payable processes delivered through secure, scalable outsourcing models aligned with UK compliance standards.

Time is running out! Connect with us and see the difference.