Is your accounting team getting entangled with the job of doing accounts double entry bookkeeping? Well, you are not alone. Double-entry bookkeeping is an accounting system in which every transaction must be recorded in two accounts: one in debit and one in credit. It is easy to understand, but practices are finding it challenging to implement, especially without expert assistance.

That’s why we have pulled our socks and prepared this document to guide you in understanding what double-entry bookkeeping is, the rules that govern it, how it works, its importance, and how you can avoid mistakes with the help of experts. Using this guide, you can make your clients and your accounting teams’ lives easy. Let’s get started.

What Is Accounts Double Entry Bookkeeping in Accounting?

The Accounts Double entry bookkeeping is an accounting method in which each transaction is recorded in two accounts: one debit account and one credit account. The total debits and credits must balance (equal each other).

The double-entry bookkeeping method has brought in a level of standardisation in the accounting process. It has helped improve the accuracy of financial statements through enhanced error detection.

Core Principles and Rules of Double-Entry Bookkeeping

When it comes to rules of account double entry bookkeeping, you must be worried about only three major components.

- All the business transactions must be compulsorily recorded in two accounts in the books.

- For every transaction, the total debits recorded must equal the total credits recorded.

- Total assets must always equal total liabilities plus equity (net worth or capital) of a business. Both sides of this equation must be the same (they must balance).

How Does Accounts Double Entry Bookkeeping Work?

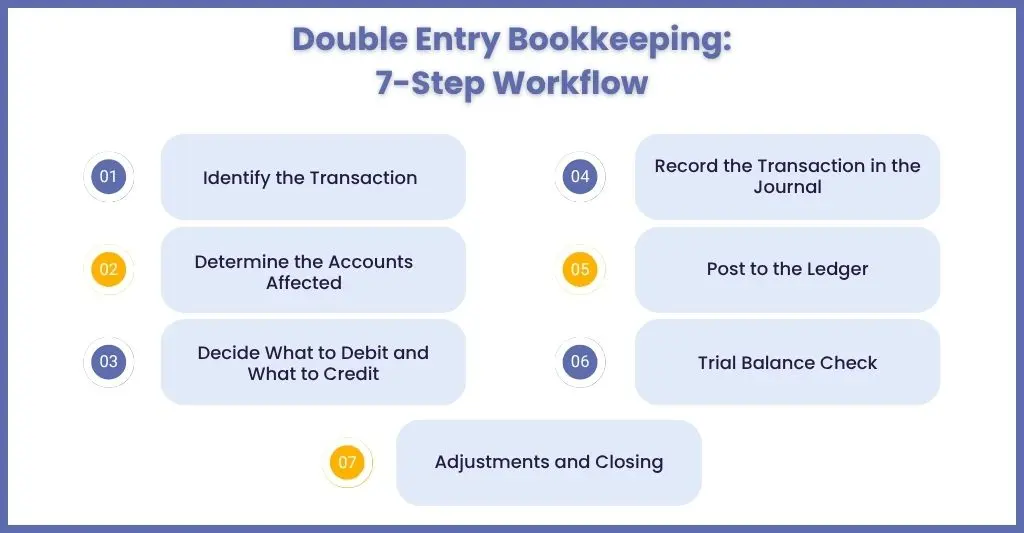

As we know by now, under an accounts double entry bookkeeping system, every transaction trigger two accounts: one debit and one credit. The total debits must always equal credits, keeping your books balanced. However, having a clear understanding of the process will help you and your clients be better prepared. Let’s understand the steps mentioned below:

Identify the Transaction

It all begins with a transaction, make sure to know what the transaction is. For example: A client pays you £1,000 for services.

Determine the Accounts Affected

Once the transaction has occurred, you must quickly classify it under a proper account type. The account types are as follows:

- Assets: For cash, receivables

- Liabilities: For loans, payables

- Equity: For owner’s capital, retained earnings

- Income: Sales, interest

- Expenses: Rent, salaries

Correct classification is essential; otherwise, it impacts the accuracy of the financial statements.

Decide What to Debit and What to Credit

Use this basic rule of thumb:

| Account Type | Increase | Decrease |

| Assets | Debit | Credit |

| Equity | Credit | Debit |

| Income | Credit | Debit |

| Expenses | Debit | Credit |

Record the Transaction in the Journal

Either you do it manually (which we would not advise due to the risk of errors and high time consumption) or through the best accounting software, which will automate the entire process of recording debit and credit entries. You obtain this software, but installing and training your staff on it will require a budget that you would like to avoid. In such situations, the accounting outsourcing services of service providers can be convenient.

Post to the Ledger

Next, move the journal entries into the general ledger, where you compile every financial transaction that occurs during the business process into an accounting record. Through this, you can keep track of balances for each account, and without it, general ledger reconciliation can never take place.

Trial Balance Check

The trial balance plays a crucial role in the accounting process, particularly in preparing financial statements by verifying entries and identifying errors. The trial balance report must be prepared using accounting software and must show that total debits equal total credits; any imbalance indicates a mistake.

Adjustments and Closing

Make year-end adjustments (e.g., depreciation, accruals) and close temporary accounts, such as income and expenses, into retained earnings.

Example of Double Entry Bookkeeping

A client buys new equipment for her business for £1,000. She credits her equipment expense account for £1,000 and debits her cash account for £1,000. This is because her equipment expense assets are now worth £1000 more, and she has £1000 less in cash.

Why Is Accounts Double Entry Bookkeeping Important for Your Clients?

You must have noticed that if your client is running a small business, it is comfortable using just a single bookkeeping system. However, as the business grows, accounts double entry bookkeeping becomes a necessity and essential for your clients. Here’s why it is so:

Presenting a Complete Financial Picture

The double-entry bookkeeping method is the ideal way to monitor the financial health of any business. It ensures that every transaction taking place is recorded, thus reducing the chances of fraud. This method is compulsory for clients with more than one employee or account, and through it, multiple crucial reports, such as balance sheets and profit and loss statements, are generated.

Better Financial Decisions

Financial statements prepared under the double-entry bookkeeping method will provide you and your clients with an understanding of their profitability and the financial strength of various aspects of their business. In short, you can see the money coming in and where it is getting spent.

Using double-entry bookkeeping, you can help your clients make better financial decisions by providing them with accurate and timely information. Such valuable information will contribute to informed decision-making.

Brings Down Bookkeeping Errors

When a double-entry bookkeeping system generates a balance sheet, the liabilities and equity must be equal. If the amounts don’t match, something is wrong. This method helps identify errors quickly, allowing you to correct them promptly. It is a more transparent way of keeping the books in order and maintaining accountability.

Preferred by Investors

Because the double-entry system is more comprehensive and transparent, anyone considering investing in your client will have complete confidence in the process. Double-entry bookkeeping generates reports that enable investors, banks, and potential buyers to obtain an accurate and comprehensive view of a business’s financial health.

Common Mistakes and How to Avoid Them

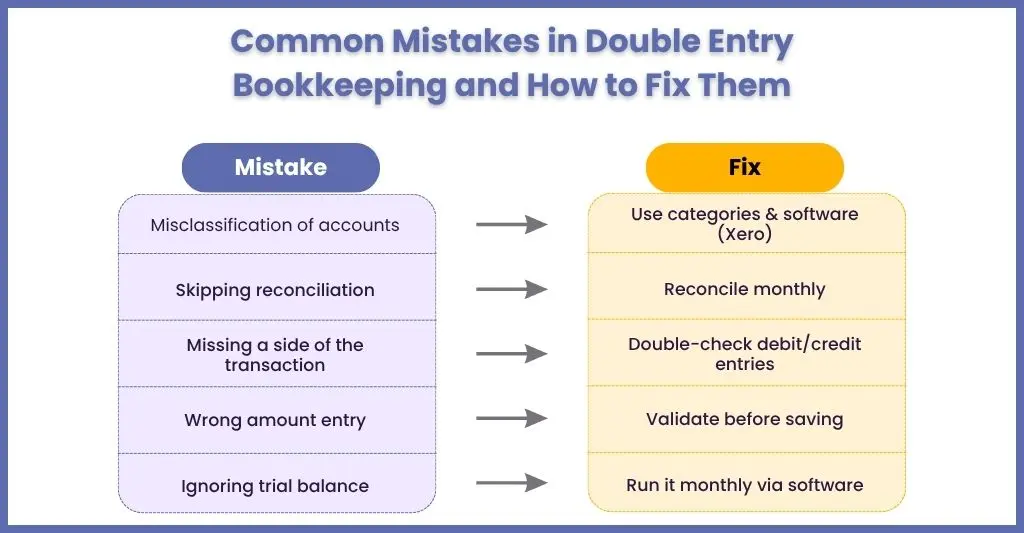

Mistakes can occur during the double-entry bookkeeping process, and it is essential to avoid them at all costs. Since we assist numerous accounting practices with this process, we encounter multiple mistakes committed during the double-entry accounting. However, we’ve identified a few common ones you must avoid. Let’s go through them.

Misclassification of Accounts

Placing a transaction in the wrong category occurs frequently but can have serious consequences. Misclassification of transactions, such as categorising loans as income, can significantly compromise the financial statements, leading to a loss of trust and reputation.

How to Fix It:

- To fix it, focus on creating clear expense and income categories.

- Additionally, we utilise accounting software like Xero, which automatically classifies each transaction.

Non-Reconciling the Account

You will verify your recorded transactions against the bank account to identify any discrepancies during the bank reconciliation process. If you skip this vital step, then an error will escalate rapidly.

How to Fix It:

- Fix the reconciliation process for your clients at least once a month

- Use accounting software to quicken the process

- Make sure to check the balance sheet with the bank account statement

Forgetting to Record Transactions on Both Sides

Under double-entry bookkeeping, you must record each transaction in two accounts, one debit and one credit, and if you miss one, you will create an imbalance in the books. However, you can prevent this.

How to Fix It:

- Double-check that every transaction has a debit and a credit

- Review the records to check for any missing entries

- Check the balance sheet by seeing whether the total of the assets agrees with the total of the liabilities

Adding the Wrong Amount

Even a typo error while recording transaction amounts (like £1,500 instead of £150) will discredit the entire financial statement prepared by your practice.

How to Fix It:

- Double-check your figures before saving them

- Use tools to reduce manual entries and errors

Ignoring the Trial Balance

A trial balance helps you verify that everything balances. Ignoring this step can let mistakes slip through the cracks, making it harder to spot issues later.

How to fix:

- Run a trial balance report monthly.

- If something doesn’t balance, investigate straight away.

- Use Xero’s trial balancing feature for quick checks.

Get Help with Accounts Double Entry Bookkeeping by Hiring a Professional

With an accounting team in place, you can handle accounts double entry bookkeeping by yourself. Still, there is a better way to get it done by seeking professional help through bookkeeping outsourcing services offered by service providers. One of the significant benefits of bookkeeping outsourcing is that you will get access to expert bookkeepers who will handle the double-entry bookkeeping task for you, thus reducing the chances of non-compliance.

Most professional service providers utilise the latest accounting software to expedite the entire process and eliminate manual entries, thereby reducing errors and enhancing quality. Lastly, by utilising bookkeeping outsourcing services, you can reduce the time spent on the double-entry bookkeeping task and save money on the additional staff required to work on it. You can instead divert these resources toward more value-adding activities, such as customer service and service upgrade investments.

The craze for outsourcing is catching on, and you wouldn’t want to be left out.

Frequently Asked Questions (FAQ)

1. What are the three basic rules of double-entry bookkeeping?

The three main rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in and credit what goes out.

2. How to understand double-entry bookkeeping?

The accounting equation administers double-entry bookkeeping. If revenue equals expenses, the following (basic) equation must be valid: assets = liabilities + equity. For the accounts to remain in balance, a change in one account must be matched with a change in another account.

3. What are the requirements for double-entry accounting?

This type of accounting follows two rules: businesses must record every transaction in two or more accounts, and the total amount debited must equal the total amount credited.

4. How Does Double Entry Bookkeeping Affect Budgeting?

Double-entry bookkeeping systematically records all historical financial information, which businesses then use for budget forecasting. By conducting a thorough analysis of financial data, you will be better equipped to make informed predictions for your clients and guide them toward realistic goals.

5. How does double entry differ from single entry bookkeeping?

Under single-entry there is one entry per transaction on the other hand double-entry bookkeeping performs two entries per transaction, a debit and credit.

Is double entry required for financial audits?

Double-entry bookkeeping is necessary to keep accuracy, thus reducing the chances of getting fined during HMRC audits.

What Should You Do?

The double-entry bookkeeping system is the foundation for accurate financial statements. While the system brings structure, accountability, and insight into your client’s financial health, the real pain lies in implementation, consistency, and accuracy, and that’s where the majority of the practices lack.

If your accounting practice struggles with misclassifications, reconciliation delays, or resource strain, then you need to rethink how you manage this essential task. By leveraging outsourced bookkeeping services, you gain access to qualified professionals and leading accounting technology. You also save time and reduce costs, allowing you to redirect resources toward growing your practice and serving your clients more effectively.

At Corient, we’ve helped hundreds of UK accountants handle double-entry bookkeeping with ease, speed, and accuracy. We have achieved this through our talented and experienced team of accountants, who utilise the latest accounting software to get the job done. Whether you’re scaling, modernising, or simply want to reduce the burden on your in-house team, our experts are here to help you. Need help implementing double-entry bookkeeping for your clients? Book a free consultation with Corient’s experts today.