10 Best Internal Audit Outsourcing Companies in the UK (2025 Edition)

Your clients rely on the internal audits conducted by your practice to maintain financial accuracy, ensure regulatory compliance, and promote operational efficiency. However, many accounting practices have faced challenges in recent years when conducting in-house audits due to resource constraints, cost pressures, or limited expertise. In this context, enter outsourcing internal audit, which will provide you with access to specialised skills, advanced technology, and strategic insights.

To access a professional internal audit outsourcing service, you will need to find and select from the best internal audit outsourcing companies. However, outsourcing audit is no longer an option, rather it’s a necessity. According to a 2024 survey by ICAEW, 62% of accounting firms in the UK plan to increase their reliance on outsourced audit services over the next three years, citing cost efficiency and access to expertise as key motivations.

Therefore, let’s understand why internal audit outsourcing matters, its benefits, and how to choose the best.

Why Internal Audit Outsourcing Matters for Practices

Internal audit outsourcing is slowly but surely becoming an integral part of auditing, as practised by many companies all over the UK. Therefore, by choosing to outsource internal audit, you can gain the following:

Gain Expert Insights

Your staff will, therefore, get access to experienced auditors who possess specialised knowledge across industries.

Improve Compliance

A thorough professional internal audit outsourcing provider will be updated with the latest regulations and ensure adherence to UK GAAP and IFRS.

Increase Efficiency

By outsourcing auditing to your partner, your internal resources will be free to focus on client advisory and customer services.

Enhance Objectivity

When an independent third-party auditor audits your client, there will be no question of bias. As a result, this will improve your credibility and that of your clients among their stakeholders.

Internal audit outsourcing is not just cost-effective instead, it’s a strategic move to enhance your audit process and service quality and competitiveness. Outsourcing Internal Audit Services has its pros and cons but overall it is worth giving a shot.

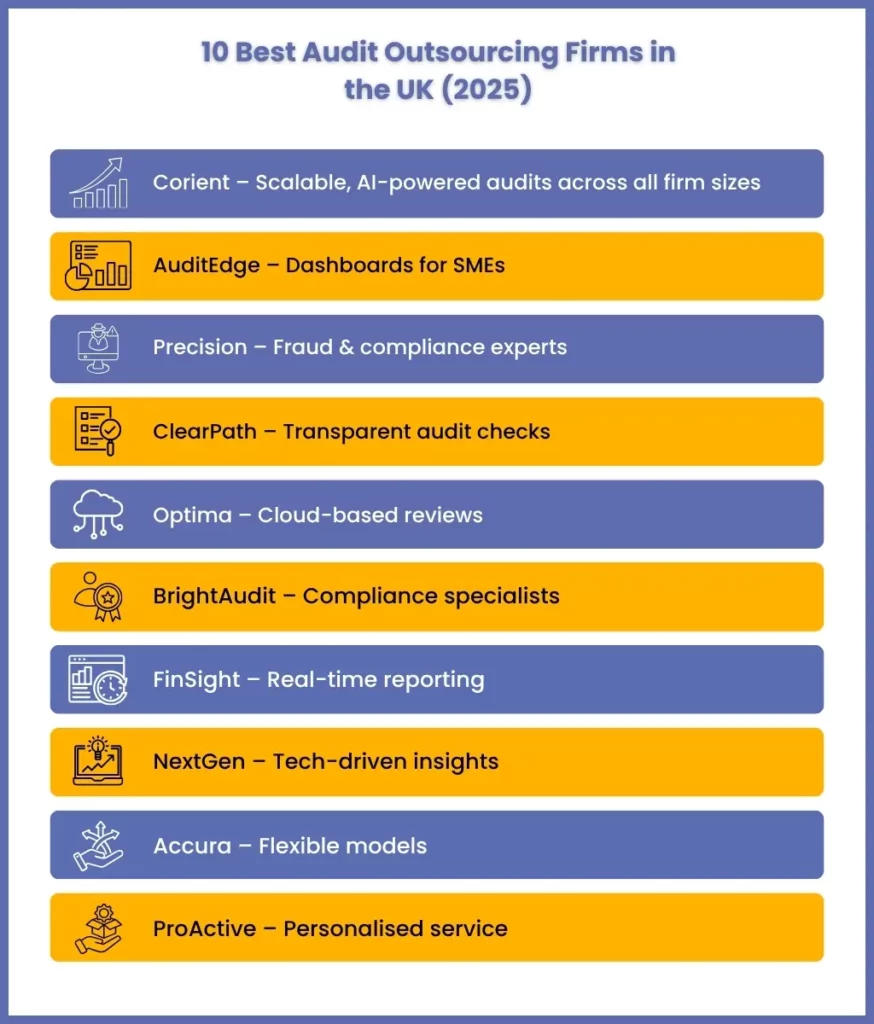

10 Best Internal Audit Outsourcing Companies in the UK

Yes, you will find numerous internal audit outsourcing companies in the UK market, but to make it easy, we have selected the top 10 for you. Take a look.

1. Corient – The Preferred Choice by Established Practices

Corient has positioned itself as a leader among audit outsourcing providers by offering tailored solutions for practices of various sizes. Under its internal audit outsourcing services, risk assessments, operational audits, compliance reviews, and automated reporting dashboards are provided.

Additionally, Corient has also gained proficiency in operating advanced analytics and AI-driven tools, enabling practices to detect anomalies and inefficiencies more quickly. Its internal audit services can be scaled as per demand to cater to single audits or multiple ones.

Along with audit outsourcing services, Corient offers:

- Year-End Accounts Outsourcing

- Bookkeeping Outsourcing

- Payroll Outsourcing

- Management Accounts Outsourcing

- VAT Outsourcing

- Corporation Tax Services

2. AuditEdge Solutions

AuditEdge is focused on serving SME accounting firms, offering internal audit support, control testing, and risk analysis. Moreover, it also provides dashboards to track the audit progress and highlight areas of concern.

3. Precision Audit Services

Precision Audit Services provides comprehensive internal audit support, encompassing compliance checks, operational audits, and fraud detection. Their teams specialise in providing tailored solutions as a result, firms receive highly customised audit support.

4. ClearPath Auditing

ClearPath Auditing’s services focus on transparency. As a result, combines manual checks with automated tools for efficient reporting. In addition, it ensures timely communication throughout the audit cycle.

5. Optima Audit Solutions

Optima audit solutions cater to mid-sized firms, delivering risk assessments, financial statement reviews, and internal control evaluations. Moreover, they will provide regular updates through cloud dashboards.

6. BrightAudit UK

BrightAudit specialises in compliance audits for accounting practices. Hence, they can highlight anomalies and potential risks for quick resolution.

7. FinSight Auditors

FinSight offers scaled-up audit services, including process audits, compliance checks, and fraud risk assessments. As a result, they prioritise real-time reporting for better decision-making.

8. NextGen Internal Audit

NextGen provides technology-enabled audit services, integrating cloud tools and dashboards for SME practices. As a result, they focus on efficiency, accuracy, and actionable insights.

9. Accura Audit Services

Accura Audit Services specialises in compliance, operational reviews, and risk assessments. Therefore, their flexible engagement models suit firms looking to outsource ad-hoc or recurring audit work.

10. ProActive Audit Solutions

ProActive delivers end-to-end internal audit services, including risk assessment, compliance monitoring, and reporting. Therefore, they are known for personalised service and a client-focused approach.

How to Choose the Right Internal Audit Outsourcing Partner

When choosing an internal audit outsourcing partner, consider the following factors. These are:

- Experience and Expertise: The provider must possess the necessary experience and expertise in accounting standards, regulations, and your client’s business.

- Technology and Reporting Tools: Make sure you partner with a provider that provides its audit services using the latest tech such as cloud dashboards, automated checks, and analytics platforms. This will ensure efficiency.

- Compliance Knowledge: Your audit outsourcing partner must be familiar with and up-to-date on the latest UK GAAP, IFRS, and regulatory updates to ensure compliance with relevant standards.

- Flexibility: Whether it can scale services according to your workload and client needs.

- Support and Communication: Is a dedicated account manager available for you, along with timely updates, which are key to smooth collaboration.

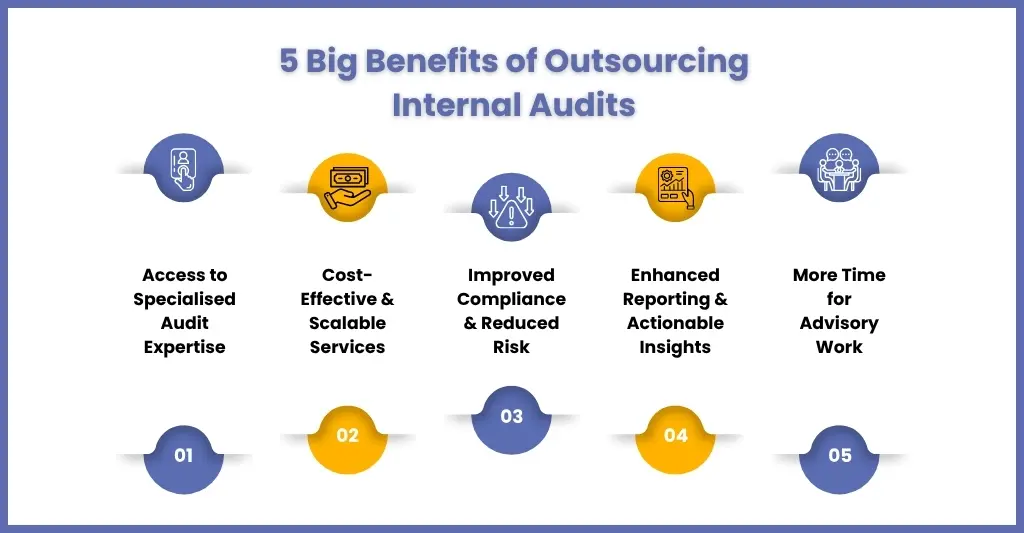

Benefits of Working with the Best Audit Outsourcing Firms

Partnering with a top-quality internal audit outsourcing firm will unlock a wealth of benefits for your practice, extending beyond simple cost savings. Here’s how your practice can benefit:

Access to Specialised Audit Expertise

An outsourcing audit provider will give you immediate access to experienced auditors with deep knowledge of multiple industries and compliance standards. Furthermore, these experts will identify risks and inefficiencies and conduct audits to the highest standards. As a result, such expertise helps maintain credibility and foster client trust.

Cost-Effective and Scalable Services

Outsourcing the audit will reduce the need to hire, train, and retain additional audit staff. Additionally, through audit outsourcing, you can scale up and down based on workload and seasonal demands, and pay only for the audit services you use. Hence, such flexibility will help you in managing costs while ensuring your clients receive complete and timely audit coverage.

Improved Compliance and Reduced Risk

A professional audit outsourcing firm will always stay updated with the latest UK accounting standards and best practices. Therefore, by utilising this expertise, you can minimise errors, non-compliance, and missed deadlines, thereby reducing the risk of legal disputes and financial penalties.

Enhanced Reporting and Actionable Insights

Moreover, professional audit providers always use advanced tools and dashboards to analyse financial data and monitor key metrics. As a result, they produce precise and accurate audit reports that help your clients make informed decisions. As a result, the insights from these audit reports will help identify cost-saving opportunities, improve processes, and pinpoint areas where corrective action is needed.

More Time for Advisory and Client-Focused Work

By outsourcing routine audit tasks, internal teams can focus on higher-value activities, such as financial advisory services, strategic planning, and managing client relationships. Consequently, this shift enables accounting practices to enhance service quality, strengthen client engagement, and ultimately grow their business, while ensuring that audits are conducted efficiently and accurately.

Frequently Asked Questions (FAQ)

Internal audit outsourcing involves hiring an external firm to conduct audits, risk assessments, and compliance reviews. Therefore, it is beneficial because it provides expertise, improves objectivity, and reduces internal resource burden.

Costs vary by engagement size, complexity, and frequency. UK firms typically pay between £500–£2,000 per audit for small clients, with scalable packages for larger or ongoing projects.

Key activities include risk assessment, operational audits, compliance checks, fraud detection, financial statement review, and reporting findings with recommendations.

Outsourcing Internal Audit is the practice of hiring an external third-party service provider like Corient to perform some or all the functions traditionally handled by an in-house internal audit department.

Yes, it is characterised by heavy workloads, numerous deadlines, and time pressure, internal auditing is considered a stressful job.

Conclusion

Outsourcing internal audits is a strategic decision that can enhance efficiency, compliance, and client satisfaction for UK accounting practices. Moreover, partnering with a trusted provider allows firms to leverage advanced tools, specialised expertise, and scalable solutions. Therefore, by choosing the right internal audit outsourcing partner, accounting practices can focus on growth, advisory services, and delivering exceptional client outcomes in 2025 and beyond.

For your practice, Corient will be the ideal choice for outsourcing internal audits. Since 2011, we have developed specialisation in audit services that will streamline the auditing process, removing the burden from your auditors related to time, expenses, and workforce. In addition, we have a team of highly trained, qualified, and experienced professional auditors dedicated to processing audit working papers.

Don’t risk your reputation by committing errors in audits for your clients. Connect with us and schedule a complimentary consultation.