In-House Payroll vs. Outsourcing: Which One Is Right for Your Practice

- Benefits of In-House Payroll for UK Practices

- Benefits of Outsourcing Payroll for UK Practices

- Key Factors to Consider Before Choosing In-House Payroll vs. Outsourcing

- When Should UK Accountants Consider In-House Payroll?

- When Should UK Accountants Consider Payroll Outsourcing?

- How to Choose Between In-House Payroll and Outsourcing?

- People Also Ask

- Final Thoughts: Making the Right Payroll Decision for Your Practice

Countless accounting practices in the UK are in a dilemma between in-house payroll vs outsourcing. The dilemma is which one of these is right for their accounting practice? The answer is not that simple; it depends on multiple factors like the volume of your work, the availability of resources, and the control you want to have.

Both these methods have their advantages and disadvantages. Before you even decide to select one, it’s essential to assess your practice’s unique needs and resources to make the right decision.

In this blog, we will compare in-house payroll vs outsourcing, exploring what each brings to the table, key factors to consider, and when each option is the best fit for your practice.

Benefits of In-House Payroll for UK Practices

Almost all accounting practices have managed their clients’ payroll through an in-house payroll process. Under this process, you are managing the payroll of your clients internally through accounting staff. Despite numerous challenges in the UK accounting world, in-house payroll is holding its ground, thanks to the benefits it offers.

These benefits are:

Complete Control Over the Payroll Process and Payroll Data

One of the significant advantages of in-house payroll is the control over sensitive payroll data of your employee’s clients. With complete control, you have the freedom to fine-tune your payroll services to meet your clients’ needs.

Through in-house payroll, you will get to control:

- The level of access to sensitive employee payroll data, such as salaries, benefits, and bonuses

- Communication with HMRC

- Control of payments and payslip printing

- Scheduling of payroll with the ability to make changes whenever required

Through in-house payroll, you can monitor the payroll process daily, safeguard accuracy, and make swift changes as needed.

Customisation To Meet Client Requirements

With complete control over the payroll process, you will be in a position to tweak the process as per your clients’ requirements, which means your accounting staff will have a lot of work to do. Through in-house payroll management, you will provide the process flexibility in dealing with immediate requests from your clients, changes in UK tax laws, and HMRC payroll regulations.

Savings in Cost

Yes, in-house payroll needs investments in the best payroll software and training for your accounting staff. However, there are ample opportunities to save costs when you have a decent number of employees to handle a manageable number of clients. If your practice is mid-sized, this will be a viable option without incurring outsourcing fees.

Immediate Access to Payroll Information

With in-house payroll, your team can quickly access up-to-date payroll information whenever needed. This is especially helpful for managing employee inquiries, issuing pay slips, and reviewing payroll reports.

Benefits of Outsourcing Payroll for UK Practices

Under payroll outsourcing, you will be delegating specific payroll responsibilities to a third-party payroll outsourcing service provider. Here are some of the benefits of payroll outsourcing:

Time Saving

Outsourcing payroll involves delegating a significant portion of recurring and non-core activities to a payroll service provider. This way, you will save time to concentrate on accounting services and client advisory.

Access to Experts

Your accounting staff may lack certain specialised accounting requirements, which can be fulfilled quickly through payroll outsourcing. A specialist payroll service provider has a team of experts whose specialisation will give you fresh insights into payroll management. You can choose which aspects of payroll you want to outsource according to your specific requirements.

Reduces Compliance Issues

Payroll outsourcing service providers employ accountants who are well-versed with UK tax laws and HMRC payroll regulations and stay updated on the changes. They will ensure that your payroll is compliant with the latest regulations, thus saving your clients from heavy penalties. See professional payroll service providers resolve complex payroll challenges.

Reduces Errors

One of the significant issues in payroll processing is the persistence of human errors in payroll calculations, including tax filings, deductions, and benefits. Outsourcing will reduce that risk by automating the process and personally handling tax submissions to HMRC, thus minimising the risk of penalties or missed deadlines. For additional tips, explore how reducing payroll errors can help protect your practice.

Scalability

As your clients grow, their need for accounting services will also increase, particularly during month-ends and year-ends. Scaling up involves recruiting new staff and infrastructure, a process that will take time.

Instead, through outsourcing payroll, you will get the flexibility to scale up and down as per the payroll volume without the need to hire and fire staff or upgrade in-house payroll systems.

Key Factors to Consider Before Choosing In-House Payroll vs. Outsourcing

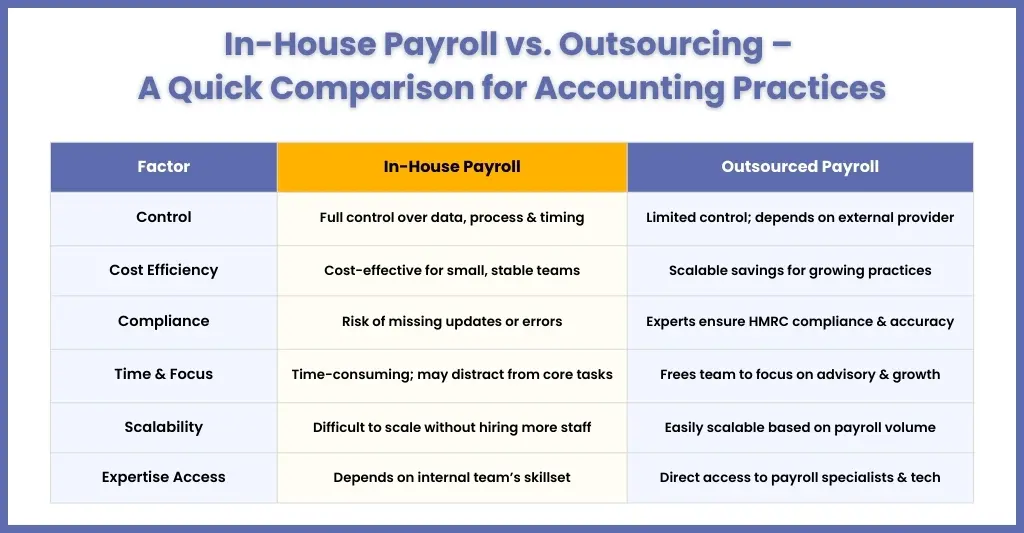

Multiple factors will influence your choice, either towards in-house payroll or outsourcing. We will only consider some key factors, which are:

Practice Size

If your accounting practice or your clients are in an expansion mode, then you will find outsourcing beneficial and efficient. Otherwise, handling the payroll in-house will be the cost-effective solution, along with complete control over the process.

Payroll Complexity

If your clients are increasingly demanding to handle their complex payroll calculations, multiple pay grades, and commissions, then it’s time to outsource payroll. To understand these risks better, check out this blog on expert advice for transforming payroll challenges.

Resource Availability

Do you have the resources to handle additional payroll work from your clients or the expertise to handle increasingly complex UK payroll regulations? Depending on the answer, you will have to select between in-house payroll and outsourcing.

Budget

Consider your practice budget and how much you can invest in staff recruitment, training, and infrastructure for in-house payroll. If not, then the option of outsourcing is always open.

When Should UK Accountants Consider In-House Payroll?

In-house payroll will be considered a viable option if you are facing the following situations.

When Your Practice Is Small or Has Fewer Employees

If you are running a mid-sized practice with fewer employees handling small clients, then in-house payroll handling will be cost-effective. Outsourcing payroll may speed up the process, but it will drain your resources.

When You Need Full Control Over Payroll

If your clients are uncomfortable or do not permit the sharing of their sensitive payroll data to a third-party service provider, then you will have to continue with in-house payroll. Through it, you will have direct control over the payroll process and data, thus reducing the chance of data breaches.

When You Have the Resources to Manage Payroll Internally

Only when you have a skilled payroll team that can handle multiple compliances related to HMRC payroll and the latest UK accounting standards can you consider in-house payroll. Also, if you have the resources to get the required software in-house, payroll becomes practical and cost-effective.

When Should UK Accountants Consider Payroll Outsourcing?

There are clear signs that indicate it’s time to outsource payroll. These signs are:

Your Practice Is Growing

When your client expands, you will need to develop your staff to handle the additional workload. Indeed, it is an expensive proposition, but through payroll outsourcing services, you can scale up your capacity immediately without the need to hire new staff. So, you are saving time and money.

When You Need Expertise

HMRC payroll regulations and UK accounting standards are already complex and will be for the foreseeable future. To stay compliant with the ever-changing laws and regulations, you will need an experienced expert, which you may lack. However, professional payroll service providers have experts who will work like your extended team, reducing the pressure on your in-house team.

When You Want to Focus on Core Services

Payroll is a highly time-consuming task, and as the volume increases, you will likely become overwhelmed, leaving you with no time for other important accounting work. If your staff is facing such a situation, then outsourcing can be their saviour. It will free them from payroll work, allowing them to focus on high-value services such as tax planning, financial advisory, and business consulting. Scaling up your accounting practice through outsourcing can be achieved without compromising on the payroll quality and processing speed.

How to Choose Between In-House Payroll and Outsourcing?

Now you might find yourself in a tough spot between choosing in-house payroll and outsourcing. It’s a challenging situation in which many practices have found themselves, and in such situations, you will need to consider your unique requirements. To help you have a quick guide:

- Consider in-house payroll if you have fewer employees, handle clients with low payroll volumes and are uncomfortable sharing their payroll data with others. If you have the resources to handle payroll in-house without sharing personal data with third parties, then consider it.

- Go for outsourcing payroll: If your accounting practice is growing, dealing frequently with complex payroll regulations and if you are interested in saving time while not compromising on quality, outsourcing is a must. Payroll outsourcing will scale up your capacity to process additional payroll, provide the necessary expertise to deal with regulations and minimise payroll compliance risks.

People Also Ask

When you outsource payroll, you will be giving your clients access to specialised expertise and an automated payroll process, thus reducing errors and non-compliance risk.

Under payroll outsourcing, a professional service provider will handle all the tax deductions, filings and submissions and also deal with the HMRC on your behalf. They have excellent knowledge of the latest tax laws and regulations, thus reducing the risk of penalties and incorrect submissions.

In-house payroll ensures that access control for sensitive employee data is with you, and you will be responsible for handling, storing, and sharing it. It is crucial for secrecy and data security.

It depends on what suits you better. The decision between in-house and outsourcing relies on several variables, including payroll requirements, skills, and budget.

Final Thoughts: Making the Right Payroll Decision for Your Practice

Both in-house payroll and outsourcing have their respective benefits, which is why practices in the UK have faith in both. If you have to choose one, then your decision must be based on your requirements and the resources you have to fulfil the requirements. In-house payroll provides greater control over data and processes, while outsourcing offers access to expertise, reduces risk, and saves time. So, evaluate your needs, consult with experts and make the right decision for high-quality.

Thinking of outsourcing your payroll? Partner with Corient. Established in 2011, we have established a reputation for providing outsourced payroll services that have saved numerous practices from incurring extra staff expenses. Our payroll experts are proficient in PAYE RTI, Auto-enrolment and in specialised software like Xero, Payroll Manager, SAGE Payroll, IRIS and others. Also, we manage your communications with HMRC.

If you need guidance or are looking for a reliable payroll outsourcing partner, feel free to contact us for expert assistance.