What Percentage of Companies Outsource Payroll and Why It’s Rising in 2025?

- The Shift Toward Payroll Outsourcing in 2025

- How a Payroll Provider Makes a Difference

- Key Statistics: What Percentage of Companies Outsource Payroll in the UK

- Benefits of Payroll Outsourcing for Modern Businesses

- Signs Your Clients Should Consider Payroll Outsourcing

- Why 2025 is the Right Time to Switch to Payroll Outsourcing

- Choosing the Right Payroll Provider for Your Clients

- Frequently Asked Questions (FAQ)

- Conclusion

There was a time when outsourcing payroll was considered a cost-cutting measure; however, that is no longer the case. In 2025, deciding to outsource payroll services is regarded as a strategic decision that can be made for your clients, regardless of their size. The demand for payroll outsourcing is rising, especially among business owners who are your clients. We can support this with numbers from CIPD Payroll Insights 2024, which show that over 52% of UK companies now outsource payroll, and this figure is expected to exceed 60% by late 2025.

To ensure that your clients do not miss out on the benefits of payroll outsourcing, we have prepared this blog. Here, we will discuss key reasons why this trend is rising across the UK. We’ll walk through updated statistics, real-world benefits, and how you, as an accounting practice, can support your clients in making a smooth transition. Let’s dive in it.

The Shift Toward Payroll Outsourcing in 2025

You must have received multiple requests from your clients for assistance in staying compliant, efficient, and tech-savvy; this is because several factors in the UK accounting industry are putting them under pressure. With the introduction of real-time reporting, complex pension schemes, and rising penalties from HMRC, payroll has become a high-risk task not just for your clients but also for your practice.

With limited time to attend to complex payroll regulatory demands, practices are increasingly turning towards professional service providers offering accounting outsourcing services. These service providers utilise technologies, such as AI, to configure software solutions tailored to clients’ specific needs, thereby making payroll processes more efficient and effective. This rising trend reflects a broader shift toward automation and expert-led financial functions across the UK.

How a Payroll Provider Makes a Difference

To stay competitive in the fast-growing accounting market of the UK, many accounting practices have started offering multiple value-added services in their accounting offerings. However, such value-additions are costly and time-consuming, making it difficult to implement in-house. Therefore, to improve performance and reduce risks for your clients, you should consider outsourcing payroll.

Here’s how an outsourced payroll provider adds value:

Expert Compliance: Your clients will have easy access to trained and experienced professionals who are well-versed in the latest UK accounting standards, HMRC regulations, and tax codes, thereby reducing the chances of penalties.

Technology-Driven Accuracy: The latest AI tools and accounting software are expensive to purchase and install, which your clients can access easily via outsourcing payroll providers. Through these tools, you can help your clients in reducing human errors and ensure timely submissions.

Time Savings: Handling payslips and RTI filings is a time-consuming process, which in turn slows down the process for your clients. Instead, you can quicken the process by outsourcing payroll.

Flexible Support: Whether your client has 5 employees or 5,000, payroll service providers offer scalable payroll solutions that can accommodate their requirements.

Key Statistics: What Percentage of Companies Outsource Payroll in the UK

Here’s what is happening in the UK payroll outsourcing landscape:

- Over 60% of companies are going to outsource payroll by the end of 2025 (CIPP).

- 38% of accounting firms now offer outsourced payroll as a bundled service to their clients (AccountingWeb UK Survey 2024).

- These numbers demonstrate the increasing reliance on outsourced payroll to manage compliance, speed, and scalability in a changing business environment.

Benefits of Payroll Outsourcing for Modern Businesses

These days, your clients are demanding multiple value-added services while conducting their payroll, from fast and accurate payroll processing to full compliance. Such value-additions cannot be provided by you alone; payroll outsourcing can step in for you. Nowadays, accounting practices are increasingly relying on payroll outsourcing to provide more value to their clients due to the benefits it offers.

Full-Compliance

One of the major benefits of payroll outsourcing is that a professional payroll service provider will always keep a tab on the latest changes in the accounting standards and payroll regulations, thus saving your clients from hefty fines and legal hassles.

Reduced Overhead Costs

There is no need to buy new technology, hire additional staff, or provide them with regular training to keep them updated on the latest regulations, as you can obtain all this through a payroll service provider. This way, you will save considerable costs on payroll operations and pass on the benefit to your clients.

Improved Confidentiality

Through payroll outsourcing, you will gain access to secure, GDPR-compliant platforms, thereby giving your clients confidence that their confidential data, including employee personal details, is safe and secure.

Faster Turnaround

When payroll tasks, such as monthly payroll, bonuses, and tax submissions, come in high volumes, it increases the complexity and the time spent on them. These tasks can be handled efficiently and accurately through payroll outsourcing using AI tools, thereby benefiting your clients.

Employee Satisfaction

Through a payroll service provider, you can ensure the timely and accurate generation of payroll slips, which will go a long way in maintaining and increasing your clients’ employees’ trust and morale.

Signs Your Clients Should Consider Payroll Outsourcing

If your clients experience any of the following, then it’s time to explain to them that outsourcing their payroll tasks might be the next step. Here are some key indicators that suggest whether payroll outsourcing is necessary.

- High payroll error rates or compliance concerns

- Increased HR workload with no dedicated payroll team

- Late RTI filings and auto-enrolment issues

- Rising software and training costs

- Employee complaints about delayed payslips

As an accounting practice responsible for handling your client’s payroll, it is your responsibility to identify these signs early. By detecting these signs early, you can help position your practice as a trusted advisor offering payroll solutions.

Why 2025 is the Right Time to Switch to Payroll Outsourcing

We have encountered situations where practices are facing demands from their clients to provide efficient, fast, and accurate payroll services but lack confidence in outsourcing payroll. To better explain to your clients, we have listed certain factors that will help you understand why it is ideal to switch to payroll outsourcing in 2025.

Tighter HMRC Regulations

HMRC regulations are already complex, and there is no indication that the complexity will decrease soon. Additionally, these rules will be enforced strictly, leading to increased penalties for payroll errors. Hence, it is essential to switch to payroll before it is too late.

Rising Demand for Remote Solutions

These days, your clients will be more open to remote solutions, mainly if they are operating on hybrid models; this makes cloud-based payroll essential. The problem is that high-tech solutions cannot be easily provided for a typical accounting practice. That’s why practices take assistance from payroll service providers to give their clients access to remote solutions.

Cost Efficiency

Handling payroll in-house for multiple clients means recruiting, training, and maintaining a large team, which leads to rising costs that ultimately fall on your clients. Additionally, your clients will not receive the benefits of fast, accurate, and full-compliant payroll services. By switching to outsourcing, you can offer cost-effective payroll service to your clients.

Security and GDPR Compliance

Reputable providers invest heavily in cyber protection and encrypted platforms, giving you and your clients peace of mind that their sensitive data is secure.

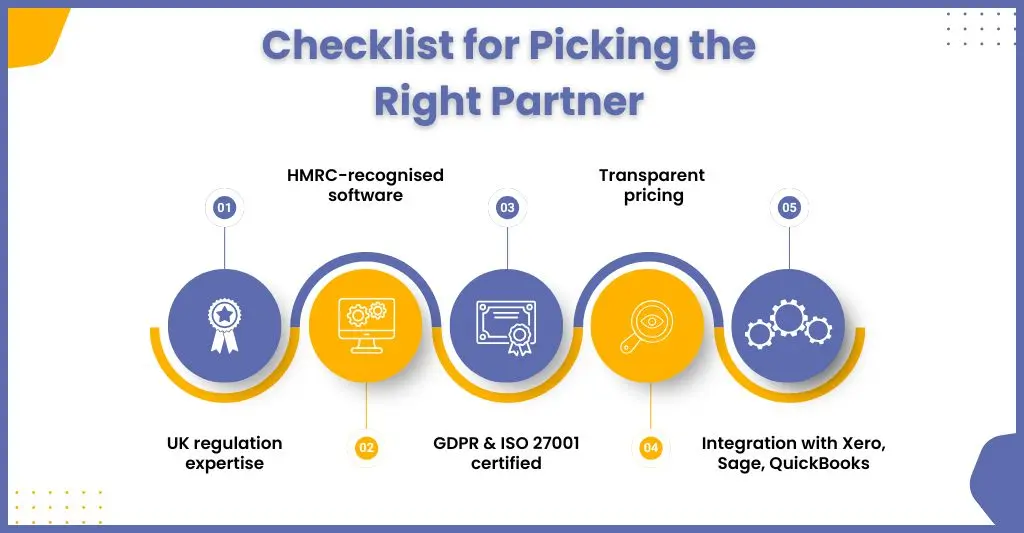

Choosing the Right Payroll Provider for Your Clients

If you are setting out to find a top payroll service provider that can fulfil your clients need. You must first understand your client’s requirements to help you narrow down to a select few. Then comes some more important aspects to factor in, which are as follows:

Strong Experience UK Regulations

When selecting a payroll service provider, ensure it has extensive experience in UK payroll and a thorough understanding of HMRC regulations, pension auto-enrolment requirements, statutory sick pay, and other local nuances.

HMRC-Recognised Payroll Software

The provider must use an HMRC-certified payroll software; this ensures smooth Real Time Information (RTI) submissions, automatic calculation of National Insurance contributions, PAYE, and compliance with current tax codes. By utilising the best payroll software, you can help your clients by simplifying year-end reporting and updating tax codes.

GDPR Compliance and ISO 27001 Certification

Since you will be giving access to the sensitive personal data of your clients’ employees, you must ensure that it is stored and used securely; therefore, robust data security measures are compulsory. Select a service provider that complies with the UK GDPR and, ideally, holds ISO 27001 certification.

Transparent Pricing

Avoid providers with vague pricing structures or hidden charges. The right payroll partner should offer transparent, itemised pricing, whether they charge per payslip, per employee, or on a flat monthly rate.

Integration with Bookkeeping or Accounting Platforms

Integration saves time and eliminates manual data entry errors. Leading payroll providers offer seamless integration with platforms like Xero, Sage, QuickBooks, or FreeAgent, allowing payroll journals to be directly pushed into your clients’ books. This also enables real-time financial insights, automatic reconciliation, and a smoother year-end accounting process.

Frequently Asked Questions (FAQ)

Yes, outsourcing payroll is safe, provided you select a trustworthy and dependable provider. Most professional payroll service providers adhere to strict security protocols to safeguard sensitive financial data. Here are some key things to consider:

Data Security: Ensure the provider uses encryption and complies with industry standards for data protection (e.g., GDPR, SOC 2 Type II).

Reliability: Check the provider’s standing by analysing the reviews and speaking to their current clients.

Compliance: A reputable payroll provider will be well-informed about UK tax laws, labour laws, and other legal requirements to ensure compliance.

Support: Look for a provider that offers customer service so you can get help if any issues arise.

That depends on the payroll service provider, but ideally, a professional service provider should not take more than 2 to 4 weeks to process.

If your clients are facing the issues listed below, it is time for them to consider a payroll provider. Let’s check those signs:

Growing complexity

Increased risk of errors

More time consumption

Non-compliance concerns

Payroll compliant from employees

Lack of expertise

Outsourcing payroll allows you to leverage the specialised expertise of professionals proficient in managing complex payroll tasks.

To select the best outsourcing partner for your accounting practice, you will need to ask the following questions.

a. What is their accounting team size?

b. Do they have the systems and technology to perform the accounting tasks successfully?

c. Does the price involve fixed fees, hourly charges, or performance-based incentives?

d. What steps need to be followed for getting the outsourced team up to speed on processes and regulatory requirements?

e. Do they have open lines of communication in case of a query or need of assistance?

f. Do their accountants have to required expertise to resolve your issues?

g. Ask the provider about their services and whether they can accommodate your practice needs and future requirements based on changing UK accounting market?

h. What is the culture of the outsourcing provider teams? Is it a good fit for your firm?

Conclusion

So now, if someone asks you, what percentage of companies outsource payroll in 2025? The answer is clear: over 60% and rising. The demand for cost savings, compliance requirements, and the need for efficiency from your clients are driving this shift. For your accounting practice, it is a golden opportunity to expand services, offer more value to clients, and stay ahead in a competitive market. For that, you will need to consider payroll outsourcing by selecting the best payroll service provider for your clients.

Speaking of the best, we would like to mention Corient, which is fast gaining the trust of both practices and businesses in the UK. This trust has been established by offering tech-savvy and HMRC-compliant payroll services. Additionally, we offer a range of accounting services, including bookkeeping and year-end services, as well as support for corporation tax and VAT. If you need to inquire more about our services, please write to us using our website contact form. Our executive will get in touch with you soon.

Looking forward to a long-term association.