Understanding Financial Statement: Types, Examples and Importance

You must have noticed your clients being extra attentive regarding their financial statements, and rightly so. Financial statements are the backbone of every business’s financial health; without them, making informed decisions will be impossible. Even compliance and future business plans depend on an accurate financial statement. For this reason, accounting practices need to have a perfect knowledge of these important documents and their value-added qualities.

In this blog, we will understand the fundamentals of financial statements, the types of them you need to be aware of, and their importance in your client’s success. We will also explain how to prepare these documents, provide real-life examples, discuss common mistakes that must be avoided, and discuss the benefits of expert help in making financial statements. No matter if you are an expert in accounting or not or looking to refine your knowledge, this guide on financial statements will be handy.

What is Meant by Financial Statement?

Financial statements mirror the true state of your client’s business. In essence, businesses or accounting practices prepare these reports to detail a company’s financial activities and health. Government regulators and investors rely on these statements to assess tax obligations, make investment decisions, or approve financing, highlighting their critical importance.

Financial statements for businesses include a balance sheet, profit and loss statement, cash flow statement, and statement of changes in equity. Non-profit organisations also need to prepare these financial statements.

Different Types of Financial Statements

Financial statements are a collection of multiple documents that are different but still linked to each other. They are vital for maintaining efficiency and transparency in business. As an accounting practice, you must have repeatedly dealt with and created these documents for your clients. So, let’s elaborate on these financial statements.

Balance Sheet

A balance sheet is a familiar document that provides a summary of your client’s assets, liabilities, and shareholders’ equity at a specific time and date. Let’s understand what it includes.

1. Assets

- Cash and Cash Equivalents: These are liquid assets, such as certificates of deposits.

- Accounts Receivable: These are money owed by your client’s customers for the products and services sold to them.

- Inventory: These are goods that your client is holding and intends to sell during the course of business. Finished, half-finished, and raw materials can be classified as inventory.

- Prepaid Expenses: These are costs paid in advance before they are due and are considered an asset because the value has not been recognised.

- Property, Plant, and Equipment: Capital assets owned by your client’s business and offer long-term benefits. This includes heavy machinery or buildings used for manufacturing.

- Investments: While not used in any operations, investments are considered assets and are held for speculative future growth.

- Trademarks, Patents, Goodwill, and Other Intangible Assets: Such assets cannot be touched but have significant long-term economic benefits for your clients.

2. Liabilities

- Accounts Payable: These are the bills generated due to business operations. Under accounts payable come bills, rent invoices and raw materials.

- Wages: Wages apply to the staff who have worked.

- Notes Payable: These instruments record official debt agreements, including payment schedules and amounts.

- Long-term Debt: It includes sinking bond funds, mortgages, and other loans that are due in their entirety in more than one year.

3. Shareholders’ Equity

Profit and Loss Account

Unlike the balance sheet, an income statement, also called profit and loss, covers a wide range of time, usually a year. It provides details of revenues, expenses, net income, and earnings per share during that year.

The primary purpose of the income statement is to convey details of profitability and the financial results of business activities; however, it can be very effective in showing whether sales or revenue is increasing when compared over multiple periods, which provides valuable information about the success of operations to executive and management.

The main objective of an income statement is to show the profits and other financial results due to your business activities. However, this statement can also show the growth of sales or revenues compared to previous periods, thus showcasing success. Profit and loss statements are used to attract new investors and maintain transparency with existing ones.

Cash Flow Statement

The cash flow statement showcases how cash is earned and spent, complementing the balance sheet and profit and loss statement. However, that does not mean it is less important.

Through cash flow statements, investors will understand the flow of cash, where it is coming from, and how it is being spent. Only cash flow statements can provide insight into whether your client is on solid financial footing.

Why Financial Statement Is Important for Your Client’s Business

Your clients are eager to get their hands on the financial statements you prepared, and rightly so. Through these financial statements, your clients get a clear picture of their financial health and identify areas where they are going wrong.

There are other reasons that make financial statements very important for your clients. They are as follows:

Promoting Informed Decision-Making

With financial statements in hand, your clients will understand which aspect of their business is giving them profits and areas that are causing losses. Even your accounting practice, armed with valuable information from the financial statements, can better advise your clients, which will help them make informed decisions.

Helping in Staying Compliant

As you stay updated with the latest accounting standards and regulations, you ensure compliance with all HMRC rules while preparing these statements. So, directly or indirectly, you are helping your clients stay compliant in the eyes of HMRC and Companies House.

Enabling Investments

Professionally prepared financial statements present accurate data in a clear and easy-to-understand format. Your clients can then use these statements to showcase their achievements to their stakeholders, thus creating transparency and confidence. They will also be used to attract and generate trust among new investors, thus helping them secure new investments for their business.

Measuring Performance

An accurately prepared financial statement will always accurately show your client’s financial performance. These statements can be compared with the previous ones and with established benchmarks, thus enabling your clients to establish where they are lacking and accordingly take corrective steps.

Material for Future Planning

Along with analysing past performance, financial statements also give your clients enough data to forecast the future. The data presented in the financial statements always points towards a trend, which can be identified through proper data analysis. You can highlight these trends to your clients, which will help them get better prepared.

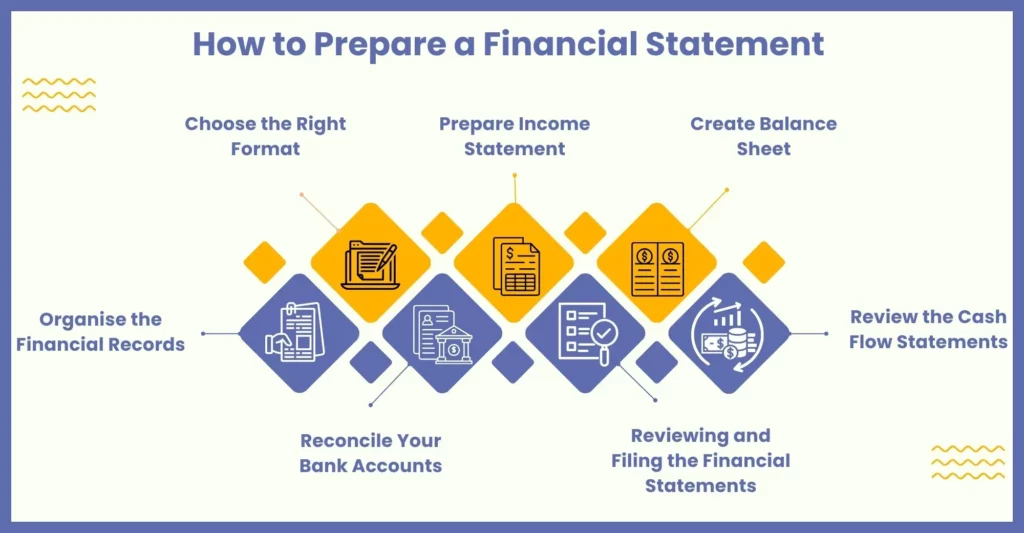

How to Prepare a Financial Statement

Preparing financial statements is a crucial but complicated task that businesses are increasingly assigning to accounting practices for the sake of accuracy and compliance. The reason for preferring accounting practices to make financial statements is simple: expert accountants of practices will do accurate calculations and follow the latest accounting standards and HMRC regulations.

To simplify the process further, we have prepared a list of steps to help you navigate the process of preparing financial statements with greater confidence and clarity.

Organise the Financial Records

First, you will have to gather all your client’s financial records in an orderly manner. Make your clients aware of keeping their records, such as receipts, invoices, bank statements, and so on, in an orderly manner. This will save time and quicken the entire process.

Choose the Right Format

Select a format that is easy to understand and aligns with the latest UK accounting standards (FRS 102). In this, you can get help from the latest accounting software, which will offer templates. Granted, buying and operating accounting software such as QuickBooks and Xero require investments, training, and experience you may lack. In such situations, you can access these tools via year-end outsourcing services offered by accounting outsourcing service providers.

Prepare Income Statement

Also known as a profit and loss statement, it provides a detailed description of your client’s revenues and expenditures for an accounting period. This document is important because it will determine the profitability of your client’s business. It will also help your clients understand their revenue generation and cost structures, which is valuable information for tax planning and improving your business strategy.

Create Balance Sheet

A balance sheet will show you the position of your client’s business assets, liabilities, and equity at any time. By preparing a balance sheet, you can make your client aware of what it owns and owes, thus giving them a clear picture of their financial health. While preparing a balance sheet, consider all the assets, liabilities, and equity because any mistake or discrepancies will lead to issues down the line.

Review the Cash Flow Statements

The cash flow statement shows the cash inflows and outflows of your client’s business, thus showing how well your client manages its cash. A robust cash flow is vital for meeting the requirements of a business in terms of investment and other obligations. Reviewing the cash flow statement, you can identify discrepancies beforehand and advise your client to make course corrections.

Reconcile Your Bank Accounts

Bank reconciliation is important to ensure that the financial statements prepared align with your client’s bank accounts. Regularly reconciling your clients’ business accounts helps you quickly identify errors and fraud and take corrective steps to resolve them.

Reviewing and Filing the Financial Statements

Once you have completed preparing the financial statement, just give it one last thorough review. This review ensures that the statements are prepared according to all the guidelines and accounting principles. Many accounting practices have incorporated this step in their process and have been able to identify errors that would have cost their clients dearly.

Once this step is completed, you can proceed to file the statements with HMRC if your clients have given you the authority to do so on their behalf. It’s important to file these statements before the deadline; otherwise, your client will face penalties and interest.

Now, we have noticed a situation where accounting practices are finding it difficult to handle the reviewing and filing process due to its time-consuming and complex nature and are outsourcing it. Therefore, don’t hesitate to avail yourself of year-end outsourcing services if preparing, reviewing, and filing statements have become burdensome.

Benefits of Using Professional Help for Financial Statements

Due to cost and time factors, businesses are finding it increasingly convenient to get their accounting work done through an accounting practice rather than doing it in-house. However, with so much responsibility, practices find it difficult to do justice to multiple aspects of accounting work, such as preparing financial statements.

Financial statement preparation requires expertise and time to tackle the increasingly complex calculations, accounting standards, and regulations, which are in short supply. For this reason, accounting practices are increasingly turning towards outside professional help from accounting outsourcing service providers, and it has worked wonders.

Here’s why professional help makes a difference:

Accuracy and Compliance

The accounting outsourcing service provider has a team of expert accountants who understand the latest accounting standards, software tools, and compliance requirements set by the HMRC. These experts will help ensure the statements meet the accounting standards and are HMRC compliant.

Time-Saving

Completing a financial statement requires considerable time and resources, and the complexity of the regulations has worsened matters. Therefore, practices have decided to outsource the work. By outsourcing financial statement work, you will be better positioned to focus on other important accounting tasks for your clients.

Strategic Insights

A professional outsourcing service provider always has a team of experts who possess a wealth of knowledge, which can provide your practice with the necessary insights to help you advise your clients in an informed way.

Better Decision-Making

A professional service provider provides accurate and fully compliant financial statements prepared by experienced accountants. Such well-prepared statements will help your clients better budget, plan, and forecast.

Audit Readiness

HMRC audits of financial statements must be expected and can stress you out if you are not compliant with the standards and regulations. However, a professional service provider will prepare these statements keeping accounting standards and regulations in mind. The result will be clean and organised records, which will ease the entire audit process.

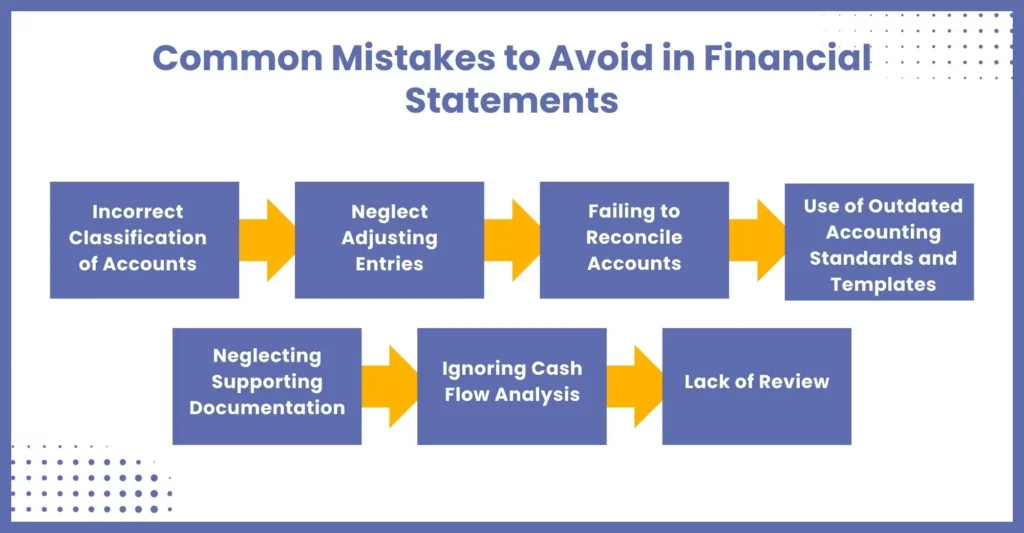

Common Mistakes to Avoid in Financial Statements

Mistakes can be made while preparing financial statements for your clients. After all, it is a task filled with numerous complex calculations, maintaining standards and compliance, and following deadlines. The problem is that these mistakes can cost your clients dearly in cost, not to mention the damage it will cause to your practice’s reputation.

To avoid such a situation, we have taken the liberty to prepare a list of common mistakes that will undoubtedly occur while making statements and must be avoided at all costs. Let’s get started:

Incorrect Classification of Accounts

It may look like a joke, but there have been instances where some accounting practices have misclassified income as capital or liabilities as expenses. Such misclassification will result in incorrect financial reports and decisions. Therefore, ensure consistency in the classification of assets, liabilities, income, and expenses.

Neglect Adjusting Entries

Errors in year-end adjustments like accruals, prepayments, and depreciation can lead to inaccurate profit numbers and tax liabilities. Hence, it is important to conduct a thorough review of the ledgers before finalisation.

Failing to Reconcile Accounts

Lack of daily reconciliation of bank statements will lead to discrepancies, which will affect the accuracy of bank statements. Such discrepancies will be hard to track, thus bringing disrepute to your practice. Hence, reconciliation must be conducted daily to identify and rectify errors.

Use of Outdated Accounting Standards and Templates

Ignoring the latest FRS 102 standard while preparing financial statements will only lead to compliance issues. Therefore, following the latest UK GAAP requirements and selecting accounting software that will offer you multiple template options to meet the newest accounting standards is essential.

Neglecting Supporting Documentation

Lack of documentation for journal entries will create problems during audits or HMRC reviews. Therefore, you must back every entry with documentation and actively coordinate with your clients.

Ignoring Cash Flow Analysis

Many practices today prioritize profit and loss statements and balance sheets but often overlook the cash flow statement. We want to remind you that the cash flow statement shows the cash inflows and outflows of your client’s business, thus showing how well your client is managing its cash. By reviewing the cash flow statement, you can identify discrepancies beforehand and advise your client to correct course.

Lack of Review

We understand your urge to complete the financial statements as soon as possible to meet the filing deadlines, but that does not mean you do not conduct reviews. Such quality checks are essential in identifying errors, thus saving you from reputational damages.

Now, we understand that preparing financial statements and conducting quality checks is time-consuming, which you want to avoid. In that case, you can avail of the year-end outsourcing services offered by service providers and get the financial statements and reviews done quickly, thus giving you quality and saving time.

Conclusion

Understanding financial statements is fundamental for any accounting practice aiming to support its clients’ growth and compliance. From guiding better decisions to ensuring accurate tax submissions, these statements clearly show a business’s financial journey. By getting professional help from an accounting outsourcing service provider, you simplify compliance and add real value to your client’s operations.

Speaking of professional help, you will find multiple service providers offering eye-grabbing packages to attract you, but none has created an impact like Corient. Since 2011, Corient, through its tech-savvy accounting service, has gained the trust of countless accounting firms. We’ve transformed how many of your competitors create financial statements—and we’re ready to do the same for you. Please write down your requirements and doubts on our website contact form, and our executive will contact you as soon as possible.

Looking forward to a bright partnership!