Payment of Corporation Tax: Deadlines, Penalties, and How to Pay

Big respect to your accounting firm for handling the responsibility of corporation tax on behalf of your client’s. Knowing how vital corporation tax compliance is for them, they have placed this important responsibility in your able hands, which shows they have faith in your experience. The reason for such handing over of corporation tax responsibilities is the increase in complexities and the lack of time to handle it.

However, it has created a situation where you get a high volume of corporation tax responsibilities. Also, there is no relaxation in corporation tax compliance from HMRC, which has made the process time-consuming and resource-intensive. You will have to incorporate some important changes to quicken your corporation tax service process. While there are multiple aspects of corporation tax to look into, the least attention is paid to the corporation tax payment. In this blog, we will explore how to streamline your corporation tax services by elaborating on corporation tax, due dates, penalties, and payment procedures. Let’s begin.

What is Corporation Tax in the UK?

Before discussing the penalties, deadlines, and payment mechanisms, let’s clarify the corporation tax in the United Kingdom. Corporation tax is a tax paid by businesses on their annual profits, and the rates vary based on the amount of profits made. All limited companies based in the UK, foreign companies with UK branches, and certain clubs and co-operative associations, such as sports clubs and community groups, must pay corporation tax.

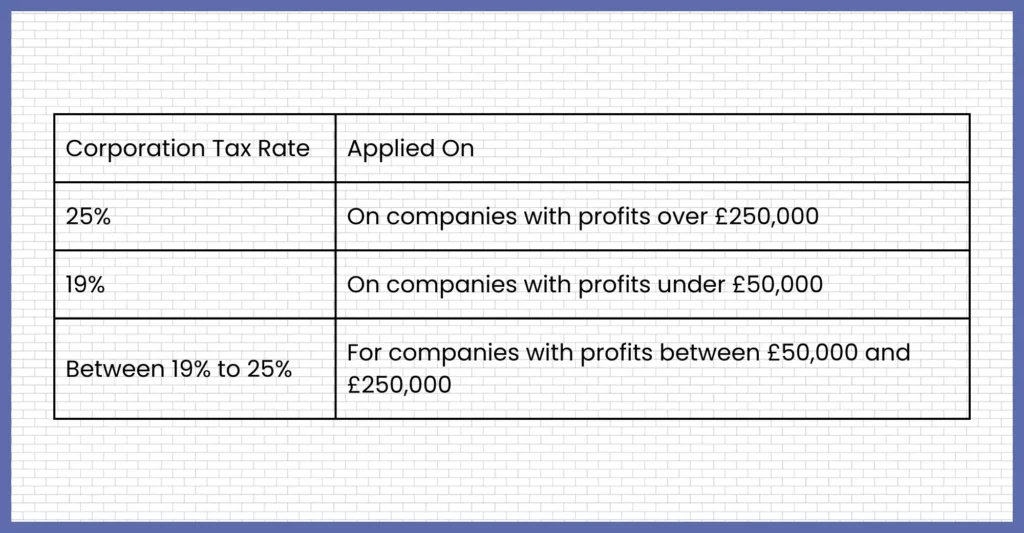

Here are the current corporation tax rates in the UK:

When is the Due Date for Corporation Tax Payment?

Are your clients confused about their due dates for corporation tax payments? We are sure they are seeking your help. The due date is 9 months and 1 day after the end of the accounting period, so please make a note of it.

Let’s explain it more simply:

If the financial year of your client ends on 31 May 2024, you’ll need to:

- File the annual accounts with Companies House by 28 February 2025

- Pay the corporation tax due to HMRC or tell them that no payment is due by 1 March 2025

- File a company tax return for this financial year by 31 May 2025

Corporation Tax Late Payment Penalties: Consequences of Missing the Deadline

None of your clients will be interested in paying corporation tax penalties for missing the deadline. Hence, it is important to keep track of the deadline first. Regarding penalties involved in late payment of corporation tax as of 25 February 2025, HMRC’s late payment interest rate for Corporation Tax is 7.00%. This rate is calculated as the Bank of England base rate plus 2.5%. It’s important to note that, starting 6 April 2025, this rate will increase by 1.5 percentage points, making the new rate the Bank of England base rate plus 4%. Therefore, if the base rate remains unchanged at 4.5%, the late payment interest rate will rise to 8.5% from April 2025. Ensure your client’s Corporation Tax payments are made on time to avoid these interest charges.

How to Pay Corporation Tax?

Before your clients even think of paying corporation tax, they will have to go through a time-consuming process of meeting certain obligations. Here, you will play a very important role in managing the entire process on behalf of your clients so that, in the end, there is no hassle when it comes to payment of corporation tax.

The process is as follows:

Gather the Relevant Data

Start by collecting relevant financial records from your clients, such as profit and loss statements, balance sheets, and so on. Also, ensure that deductions, allowable expenses, and reliefs are accounted for, minimising tax liability.

Calculating Corporation Tax Liability

Calculate the corporation tax due based on your client’s taxable profits and apply any available tax reliefs, for example., R&D tax credits to reduce tax burdens

Preparing and Filing the Corporation Tax Return (CT600)

You will have to complete the CT600 form and submit it electronically to HMRC via the online portal on behalf of your clients. Plus, keep an eye on the submission deadlines (usually 12 months after the end of the accounting period) to avoid penalties.

Inform the Client of the Tax Due

Inform your clients about the amount due and the payment deadline. The deadline is 9 months and 1 day, so they are ready for it.

Assisting with Payment Setup

If your client authorised it, you can assist them in setting up direct payment. However, if you are unable to offer this service, you can avail yourself of the corporation tax outsourcing service and cover for it.

You must pay corporation tax through:

- Bank transfer (Faster Payments, CHAPS, BACS)

- Direct debit

- HMRC’s online payment system

- Corporate credit/debit card (with processing fees)

Handling Payment Deadlines and Reminders

It is your responsibility to track upcoming deadlines and send reminders to your clients to avoid payment delays. Furthermore, you can advise your clients on payment strategies to improve cash flow.

Handling HMRC Correspondence and Compliance

Expect your clients to trust your service by giving you the responsibility to handle HMRC inquiries, audits, and compliance checks on their behalf. You can seek assistance from corporation tax outsourcing services from service providers and ensure quality for your clients.

Another important point to remember is that corporation tax must be paid either fully or in instalments, depending on your client’s profits.

Taxable profits of up to £1.5 million

As per the current rules, if your clients’ taxable profits are up to £1.5 million, pay corporation tax by 9 months and 1 day after the end of your accounting period.

Taxable profits are between £1.5 million and £20 million

For those of your clients whose profits for an accounting period are at an annual rate of more than £1.5 million. Pay corporation tax electronically in four instalments for a 12-month accounting period, three instalments for a less than 12-month period.

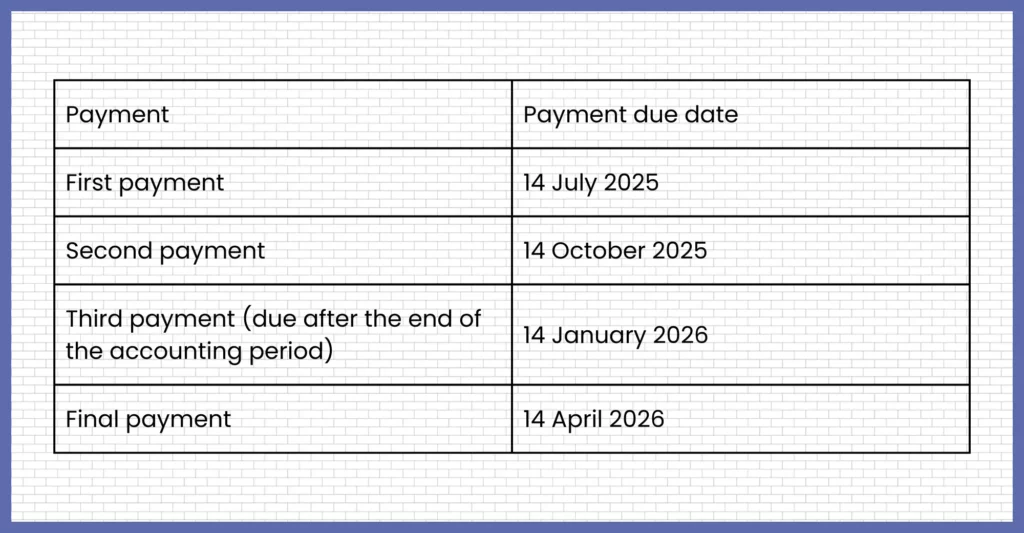

If your client’s accounting period is from 1 January 2025 to 31 December 2025. The four installment schedules will be as follows:

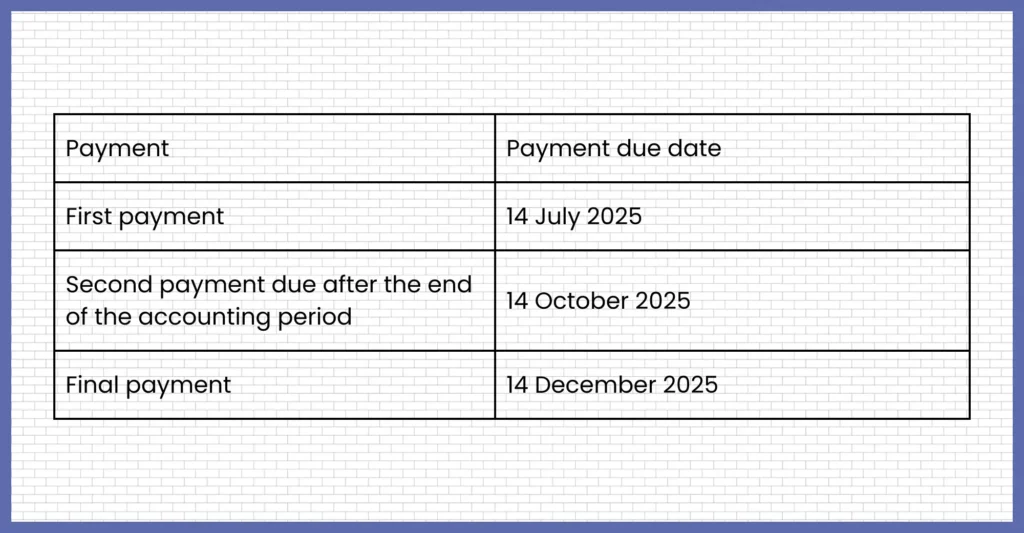

If your client’s accounting period starts from 1 January 2025 to 31 August 2025. The three corporation tax installment schedule is as follows:

Taxable profits are more than £20 million

If your client’s profits exceed £20 million annually for an accounting period starting on or after 1 April 2019. They must pay corporation tax in four equal installments.

If your client’s accounting period is from 1 January 2025 to 31 December 2025. The installment payments will be on the following dates.

Frequently Asked Questions (FAQ)

Payments can be made through online bank account transfers, such as Faster Payments or CHAPS (Clearing House Automated Payment System).

Yes, you can go through the pay agreement, which allows more time to pay through instalments.

Your client must submit a company tax return to inform HMRC about the corporation tax refund due and the preferred payment method. Adding the client’s bank details to the return ensures HMRC automatically processes the refund directly into their bank account.

The HMRC will ask you to propose ways for your client to pay their tax bill as quickly as possible. The regulator will expect you to propose a realistic and affordable payment plan.

Conclusion

Corporation tax is a vast ocean of procedures and regulations. Following them requires time, technology, and expertise, which is not your client’s cup of tea. That’s why they have placed their trust in your accounting firm. However, providing relief to your client, especially in corporate tax payment, is increasingly bogging you down. We have created this guide so that you don’t have to stress about corporation tax payment deadlines, penalties, and how to pay. Thus helping you concentrate on offering the best client services.

However, the corporation tax payment process can still tie you down since it is time-consuming. To avoid such a situation, you can outsource completely or specific aspects of corporation tax responsibility to an accounting outsourcing service provider. Speaking about service providers, have you tried the services of Corient, which is gaining considerable respect among accounting firms?

Established in 2011, we have made our name by offering tech-savvy and professional accounting services to accounting professionals based in the UK. Besides corporation tax services, our bookkeeping, payroll to audit, and year-end services have given our clients a good accounting experience. Write to us through our website contact form to understand our services in detail or clarify your doubts. Our executive will get in touch with you as soon as possible.

Best of luck and looking forward to a strong partnership.