Year end closing is a critical period for every accounting firm, marking the end of a year’s financial activities and the start of a new fiscal year. We understand this period is full of stress as you will be chasing HMRC deadlines, chasing tax savings, and handling urgent work on behalf of your clients.

Year-end closing also increases workload; after all, there are around 5.49 million enterprises in the UK, accounting for more than 99% of all UK businesses. Most of them will need an accounting practice to keep them HMRC-compliant. It’s good that your practice will be in high demand, but there are drawbacks.

Such a high workload has created a situation in which 8 out of 10 accountants are experiencing stress and will need support to get the year-end job done. No wonder year-end closing often means late nights, messy spreadsheets, and firefighting instead of strategic work.

In this guide, we will streamline and create a step-by-step approach to achieve a perfect year end close.

What Is Year End Closing?

Year end closing is a process of reviewing, reconciling, and verifying financial transactions and records of the past financial year and preparing financial statements. Unlike month end closing, year-end involves a complete review of all financial transactions and adjustments made throughout the year, which includes:

- Income, expenses, assets, liabilities and equity changes

- Accruals, depreciation, bad debt provisions and tax adjustments

The objective of year-end closing is to ensure the financial statements accurately reflect the economic picture to your clients.

Understanding the Year End Closing Process

To easily understand the year end closing process, we have divided it into four stages.

Pre-year-end planning

- Agreeing on deadlines, information requirements, and responsibilities with clients

- Reviewing director/shareholder remuneration, dividends, and tax planning options

- Checking key thresholds (VAT, associated companies, capital allowances, etc.)

Data collection and clean-up

- Ensuring all transactions are recorded

- Chasing missing invoices, bank statements, loan documents, and payroll reports

- Fixing obvious coding errors and mispostings before you get to the review stage

Review and adjustment

- Performing reconciliations (bank, debtors, creditors, VAT, PAYE, pension, loans)

- Posting year-end adjustments (accruals, prepayments, depreciation, bad debt provisions)

- Reviewing unusual balances, variances, and trends

Reporting and filing

- Producing final accounts and management commentary

- Preparing and filing tax returns (e.g., CT600, Self-Assessment)

- Communicating results and recommendations to clients

The better you control each stage, the smoother the Year-end closing becomes, for both your firm and your clients.

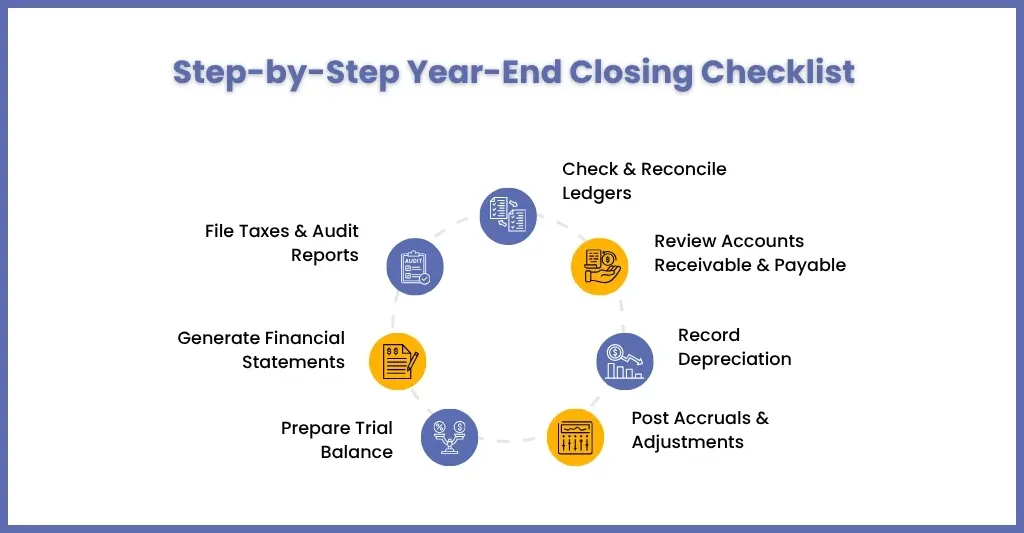

The Year End Closing Process — Step-by-Step

Most professional outsourcing firms, like Corient, follow the year-end closing process outlined below. However, if you are planning to do it by yourself, then the steps listed below must be followed:

Check and Reconcile Ledgers

Do a comprehensive review of your client’s ledgers to confirm that every transaction is recorded correctly and accurately reflects the financial reality. Under it, you will need to check the ledger entry with bank statements, invoices, and receipts. Any inconsistencies must be corrected with priority.

Check Accounts Receivable and Payable

Conduct a review of accounts receivable to identify doubtful debts and make provisions if found. Likewise, verify all the entries in accounts payable to ensure all expenses and liabilities are accounted for. Thus, showing your clients’ actual financial position: what they owe and what they own.

Depreciation of Fixed Assets

Take a stock of the fixed assets, conduct calculations, and record depreciation for the year. This is essential for reflecting the wear and tear over time, which will affect the balance sheet and income statement.

Accruals and Adjustments

Follow accrual accounting for recording end-of-year accruals for incurred expenses and revenues earned but not yet received. These expenses include utility bills, interest on costs, and service revenue delivered but not billed. Such a step will show the actual economic activity of your client’s business during the year.

Start Preparing Trial Balance

After making all the adjustments, start preparing the trial balance to ensure that all debits and credits balance. A trial balance is the foundation of financial statements, and confirms that your clients’ books are balanced and ready for the next fiscal year.

Prepare Financial Statements

Based on the prepared trial balance, you can now generate the financial statements: the profit and loss statement, balance sheet, and cash flow statement.

Check Tax Compliance

Check whether your clients’ tax accounts comply with UK tax laws and HMRC regulations, and prepare for tax return filings. By accurately and timely filing their taxes, your clients will avoid penalties and interest.

Conduct Audits

Conduct audits of the financial statements and documents of your clients to ensure their observance of UK accounting standards. You can either push your clients to conduct the audits internally or have neutral auditors conduct them on their behalf.

Common Challenges in Year End Closing

We all agree that year end close is an essential aspect of financial management, but it has its share of challenges that can complicate the process. Let’s understand some of those common challenges:

High Time Consumption

The year end close is a time-consuming, high-pressure process. You will need to prepare financial statements quickly for your clients to meet HMRC filing deadlines. In such a rush, mistakes happen, which will be costly for your clients.

Complexity of Adjustments

Adjustments under year end can be complex and will require experienced accountants who understand the UK accounting standards and regulatory requirements. Aspects such as depreciation and tax provisions require complex calculations that are time-consuming and error-prone.

High Volume of Data

You might face issues reconciling data for clients with large transaction volumes throughout the year. Maintaining accuracy requires a significant number of resources and effort.

Resource Constrain

Demand for skilled accountants rises during the year end but the UK market is already facing a talent shortage. This will put additional stress on your existing staff.

Technological Challenges

Modern accounting tech has made the year end process simpler and quicker, but it has also created new challenges. Problems such as software limitations, system issues, and data integration issues have hindered the process. Without experienced hands, it will lead to more problems.

Compliance with New UK Accounting Regulations

UK accounting standards and tax laws are continually evolving, making it a challenge to stay up to date and compliant with the latest requirements.

Best Practices to Simplify Year End Closing

The challenges mentioned above, while doing year end close for your clients, can be negated by adopting certain best practices. These best practices are designed to streamline the process and ensure efficiency and effectiveness.

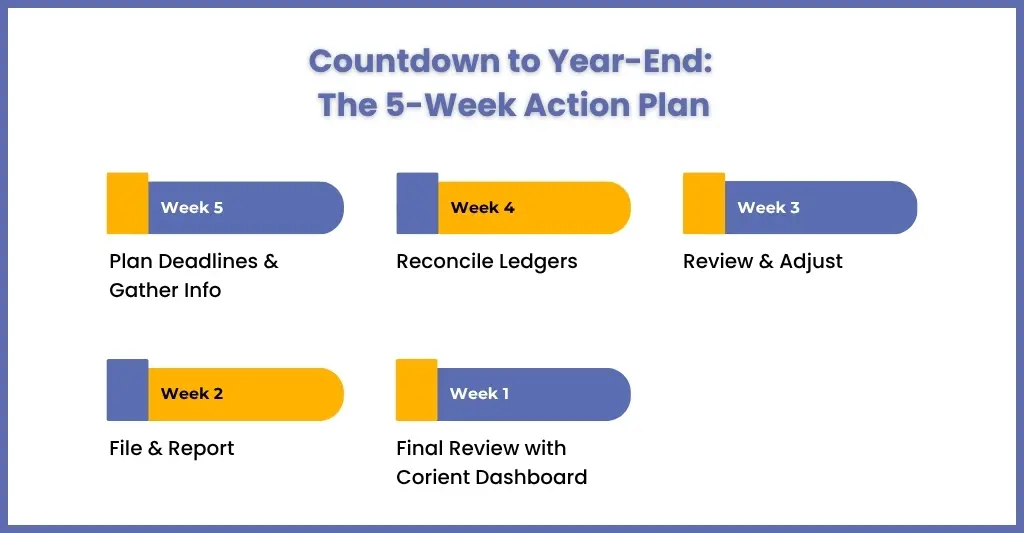

Start Early

Start the year end close process well before the deadlines so you have ample time to conduct reviews and make adjustments without rushing. Such early starts will allow you to analyse documents thoroughly and resolve issues without the pressure of deadlines.

Work Together with Clients

There should be seamless communication among you, your clients, and their departments during the year-end close. Such strong communication will avoid confusion, clear doubts, and resolve issues. It will speed up the process and ensure accuracy in timelines.

Leverage Technology

Use the latest tech to transform your year end close process. It will reduce human input, thereby reducing the risk of manipulation and errors and increasing visibility of financial data. Real-time access to financial information helps in quickly spotting and addressing discrepancies.

Document All Processes

Keep a record of all the procedures followed while doing year end close, which includes adjustments and reconciliations made. Such a detailed record will help you in future closings and serve as a reference point.

Outsource Year End Close

Many accountants are right now burdened with multiple compliances and accounting work, which makes outsourcing year end work attractive. Outsourcing year-end work will help you in focusing on other accounting work while a professional outsourcing provider like Corient will handle year-end, ensuring efficiency and compliance with deadlines.

How Corient Simplifies Your Year End Closing

Corient through its year end outsourcing services, can help you to punch above your weight, but not by managing year end close through spreadsheets, sticky notes, and long email chains. Here is how we will help you:

- All the year end procedures will be standardised for your clients.

- The task assigning, setting of due dates, and tracking of progress will be handled in one place.

- Offering centralised communication to reduce the wastage of time.

- Dashboards let you check your clients’ year end status and spot bottlenecks.

- Freeing you up from admin and time-consuming year end work towards a high-end advisory role for your clients.

Corient will give you access to tools and talent that will help you nail year-end close without additional investment.

FAQs — Year End Closing Essentials

1. Can outsourced accounting teams handle my year end close securely?

Of course, they can partner with a professional outsourcing accounting service provider. Always look for a partner that offers the following:

a. Secure GDPR-compliant systems

b. Clear security policies in the document

c. Use your existing accounting tools and systems so that control is in your hand.

Corient checks the above list, making it easier for you to assign, track, and review year-end work securely.

2. How long does the year end closing process take?

There are multiple factors that affect the time taken for the year end closing process, such as.

a. The size and complexity of the client

b. How tidy the bookkeeping is during the year

c. How quickly clients respond to queries

3. How can automation help in speeding up year end closing?

Automation helps in various ways to speed up the year end closing. Such as:

a. Reducing or eliminating manual data entry

b. Sending your clients automatic updates for missing documents or approvals

c. Pre-populating checklists and workflows based on client type

d. Highlighting discrepancies instead of you checking manually and identifying it

Automation will not replace you but free you up for other value adding activities like advisory and customer services.

4. What is a year-end closing?

The year-end close ensures that transactions for the year are properly cut off at the beginning and end of the year, that the financial situation is accurately represented, that the liabilities are complete, and that the assets presented are at the proper value.

Conclusion

It is folly to think that the year end close will be a quiet time of the year for accountants based in the UK, especially when millions of businesses require year-end services. It means that the work pressure on you will not go down anytime soon.

However, that does not mean that the year end tasks will be a long sleepless night for you. With the right process, you can:

- Safeguard your clients from HMRC penalties and compliance surprises

- Reduces your stress and prevents burnout

- Turn year-end data into better decisions, pricing, and advisory opportunities

Corient will help you in achieving the same. We have helped numerous accounting firms in achieving year end close within deadline, without additional investment. Instead of fighting a rear-guard battle when the year end deadline is close, you can choose to move towards the year-end season in full control.

If you are ready to make year end closing smooth for you and your clients then it’s an ideal time to explore Corient. Connect with us and explore our services.