Spring Cleaning Your Workflow for Accountants: Prevent Breakdowns Before They Happen

- What is a Workflow for Accounting Firms?

- Key Areas Where Workflow for Accountants Often Break Down

- Benefits of Workflows in Accounting

- Best Tools and Software to Support Workflow for Accountants

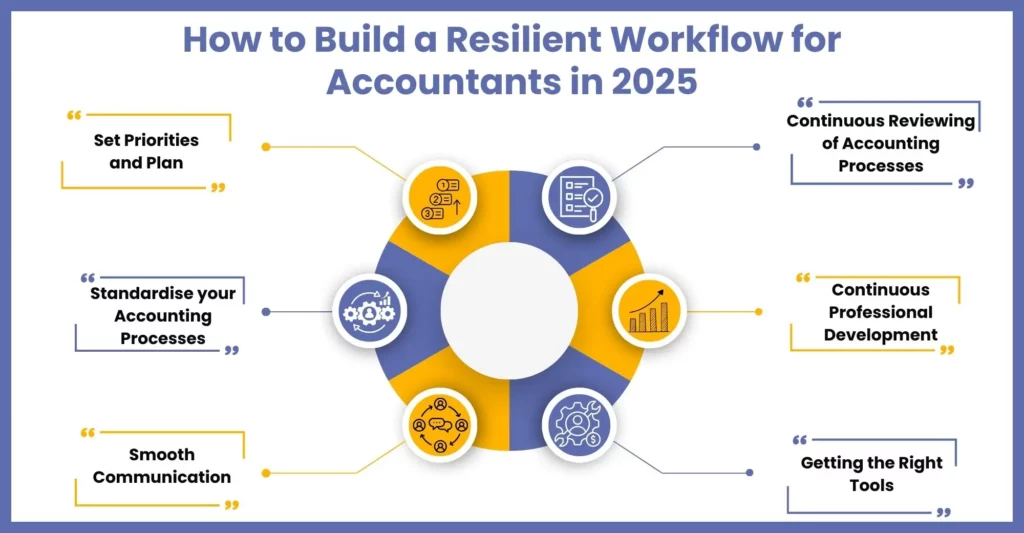

- How to Build a Resilient Workflow for Accountants in 2025

- How Corient Helps Accounting Firms Streamline Their Workflows

- Conclusion

The success of an accounting firm is not because they have some magic tricks up their sleeves. Instead, they have invested time, money, and effort in improving their workflows. Our experience with countless accounting firms has made us realise that most accountants’ workflows have come into existence on an ad-hoc basis to meet certain requirements at a specific time. Most of these workflows are not in use at all, and they need some serious upgrades.

However, creating an ideal workflow for accountants is not magic. It requires considerable research about how your accounting firm operates, its strengths, and where improvement is needed. Such creation does not happen overnight, and it requires periodic reviews and updates of your workflows as and when required.

Most accounting firms have started taking their workflow seriously and have invested in making regular updates. The results are encouraging: maximum output and streamlining of processes without downsizing the staff. To achieve this result, we have prepared an accounting workflow guide where we will explore multiple innovative ideas to manage your accounting workflows more effectively. Let’s dive into it!

What is a Workflow for Accounting Firms?

To explain in a simpler way, workflows are the steps used to execute and complete tasks faster. Interchangeable with the term processes, an accountant’s workflow is a tool used to facilitate the accounting process.

Workflow will always highlight the following in an accounting firm:

- The sequence of events

- Decision points

- The responsible employee

The workflow will showcase the steps in a clear format (checklist or workflow chart) for everyone in the accounting firm so that it is easy to understand and execute accurately and efficiently.

Key Areas Where Workflow for Accountants Often Break Down

Breakdown of workflow is a possibility you cannot ignore, especially when an accounting practice handles high-volume periods like year-end or tax season. However, there are certain areas where a lack of attention will increase the frequency of workflow breakdowns. These areas are as follows:

Manual Data Entry and Repetition

Certain accounting tasks are repetitive and can slow down the whole process, such as invoice entry, bank reconciliations, and expense categorisation. These repetitive tasks have a high potential for human errors like duplication or incorrect data addition. Such errors have the potential to disrupt the workflow and waste valuable time that would have been invested in value-adding advisory or analysis work.

Lack of Communication Between Your Accounting Team and Clients

We have often noticed that one major reason for workflow disruptions is the lack of ample communication between the accountant team and your clients. Lack of communication or delayed responses from your clients leads to delays in exchanging documents, views, or clarifications. Also, a lack of internal communication among multiple teams, such as bookkeeping and audit, will lead to workflow breakdown.

No Centralised Document Management System

Without any centralised document management system, all the documents related to your clients will be scattered throughout the email, desktop, and cloud folders. In such situations, retrieving past records becomes difficult and will cause serious problems during the audit.

Undefined Processes

Without any fixed SOPs, every accountant will start working in its own way, thus impacting recurring tasks like month-end close or year-end reporting. The lack of fixed processes will lead to knowledge gaps that occur when accountants are on leave or exiting.

Benefits of Workflows in Accounting

Behind every successful accounting practice is a well-thought-out and constantly updated workflow. Thanks to the benefits it offers, workflows have become an essential component in the smooth functioning of an accounting practice. Let’s understand what you gain:

Increased Efficiency

Workflows help establish an organised structure for your accountants, who will just have to follow the workflow each time. This way, workflows help your accountants and your firm streamline the work, reduce time spent on repetitive tasks, and complete the tasks more efficiently. In short, the workflow will be your time-saving tool.

Improved Accuracy

When a workflow is standardised, it reduces the chances of mistakes and inconsistencies in the accounting process. Once the guidelines and workflow template are agreed upon, tasks can be performed consistently. Workflows will improve the accuracy of specific accounting tasks like payroll dispensing by reducing the risk of human error.

Boosting Productivity

Workflows will boost your productivity by reducing manual work and streamlining the entire accounting process. In short, workflows will help your accountants in focusing on value-added activities. Automated workflow tasks, such as data entry and report generation, will give your accountants the time to concentrate on strategy, providing business advice and valuable insights to your clients.

Reduced Risk

Workflows will bring consistency to your accounting practice by fixing procedures and guidelines. Once the guidelines are fixed, your accountants will only have to follow them. This way, they will comply with regulations and industry standards and reduce the risk of penalties and reputational damage.

Faster Scalability and Growth

By implementing workflows, you are making your accounting firm capable of scaling up its services. Following a standardised process helps in onboarding and training new members quickly, resulting in capacity enhancement. A well-defined workflow in accounting also provides a foundation for process improvement and optimisation.

Effective Task Management

Workflows help improve task management and resource allocation. Due to a fixed workflow, you are in a position to understand which task will require how much time. Accordingly, accountants can prioritise, assign resources, and meet client deadlines without compromising on quality.

Best Tools and Software to Support Workflow for Accountants

With labour shortages starring every accounting firm in the UK, it is time to get more work done with fewer resources; it’s time to invest in tools and software that support accounting workflows. These tools will help navigate labour shortages, streamline your workflows and help provide better services to your clients.

You would not like to be the odd person out because, according to the 2022 Practice Excellence Report, an analysis of over 1,000 accounting firms worldwide, the highest-performing firms are those that use workflow automation. Such automation can be achieved through the best tools or software.

Here are some of the best software to support accounting workflows.

- Karbon

- Jetpack Workflow

- Canopy

- TaxDome

- Aero Workflow

- Pixie

- OfficeTools

- CCH iFirm Practice Manager (Wolters Kluwer)

- ClientTrack/Clear Biz

How to Build a Resilient Workflow for Accountants in 2025

The accounting profession is evolving rapidly. From regulatory updates like MTD to emerging tech like AI, accountants in 2025 need workflows that can adapt, scale, and withstand disruption. This guide explores how to build a resilient workflow that keeps your practice efficient, compliant, and stress-free.

The accounting profession in the UK is experiencing rapid change, and we expect that to continue in 2025. With regulatory updates like MTD and emerging tech like AI continuously influencing the accounting world, the workflow will need to adapt, scale, and withstand pressure. Let’s explore how to build a resilient workflow that will tackle the challenges of 2025.

Set Priorities and Plan

When creating a workflow, always start with high-priority tasks for your accounting firm. One way to do this is by identifying crucial deadlines for each task and then creating a comprehensive plan to decide the timeframe for each task. You can utilise workflow management software for better management and real-time workflow tracking for your accountants so that nothing is missed. If you lack the training or are unwilling to invest in the software, you can avail the services of an accounting outsourcing services provider and get access to the software without buying it.

Standardise your Accounting Processes

Multiple accounting tasks, such as bookkeeping, tax preparation, and financial reporting, are recurring and will require a standardised approach. Such standardisation can be achieved by creating clear guidelines and workflow templates, thus maintaining consistency and reducing the chances of errors. Through standardisation, it is possible to simplify the training and recruitment process, thus reducing onboarding time.

Continuous Reviewing of Accounting Processes

No workflow is full-proof, so continuous monitoring and quality control are required to identify and rectify errors before they become serious. Steps must be taken to create guidelines for review and quality control to ensure accuracy and thorough consistency. Taking feedback from your accountants will further improve the workflow and enhance the quality of work.

Smooth Communication

Clear communication is essential for running workflows smoothly and making them more resilient. Establishing effective communication between your accountants and your clients must be your priority. Encourage regular meetings among your accountants and with your clients, so workflow-related issues can be resolved, and updates and clarifications can be made. Clear communication can prevent many misunderstandings.

Continuous Professional Development

The accounting industry is going through some rapid changes due to updates in regulations and new technologies, thus making your existing workflows outdated. To keep your workflows relevant in 2025, you must encourage continuous professional development in your firm and among your accountants. Your accountants must keep themselves well-informed about the latest happenings in the accounting industry. Also, new steps must be taken to bring in new training methods, knowledge, and skills to adapt the workflows to the current accounting market.

Getting the Right Tools

It will be right to say that accounting practice management software and accounting automation through tools have revolutionised workflows in accounting. That’s not all; the Internet of Things and AI are going to further revolutionise workflows in your accounting firm. Hence, it is important to invest in the digital skills of your accountants and in tools such as accounting practice management software to become more flexible, intelligent, and secure.

Investing in, integrating, and training on tools like accounting practice management software is important but an expensive proposition that you might be tempted to avoid. But we have a solution: getting the benefits of these tools through accounting outsourcing services offered by service providers. Take a look at the top 10 benefits of outsourcing accounting and understand how outsourcing will benefit you.

How Corient Helps Accounting Firms Streamline Their Workflows

Multiple accounting firms find it challenging to handle the talent shortage and the advent of new technologies alone. This has been affecting the quality of workflows, and to handle such situations, accounting practices are placing their faith in accounting outsourcing service providers.

You want speed, accuracy, and scalability from a service provider, and the good news is that Corient offers all these qualities. Accounting firms are increasingly trusting us to handle their important accounting tasks, and we will help you streamline your workflows. Here’s how we will help.

Workflow Automation for Repetitive Tasks

Manual processes slow down the entire process and increase the chances of human errors. At Corient, we will identify routine but manual tasks and automate them. Automating tasks like bookkeeping entries, bank reconciliations, invoice processing, and payroll runs will free up your valuable time, which can be reinvested in advisory and growth planning.

Dedicated Teams for Specialised Functions

Corient has specialised teams that offer tailored accounting services, such as year-end accounts, VAT submissions, management accounts, and accounts payable/receivable. These services will enable you to scale your operations without worrying about recruitment, training, or compliance risk.

Real-Time Dashboards and KPI Tracking

We will offer your dashboard tools to monitor your turnaround times, pending tasks, client deliverables, and staff productivity.

Software Expertise

Our team has gained expertise in operating multiple accounting software programs, such as Xero, QuickBooks, Sage, IRIS, and more. We will ensure smooth integration with your system without wasting time.

Custom Workflow Mapping

We do not follow a cut-and-paste model when it comes to creating workflows. Instead, we identify the bottlenecks and design a custom workflow that meets your practice’s goals.

Secure, ISO-Certified Operations

As an ISO 27001-certified company, we prioritise data security, confidentiality, and compliance. You get a reliable partner safeguarding your clients’ information while ensuring consistent, high-quality output.

Seamless Communication & Governance

A dedicated team of accountants will stay connected with you and share daily/weekly reports, thus ensuring no communication gap. These reports can be shared with your clients, keeping them satisfied.

While performing your accounting task, if you see the following signs regularly, it’s time to improve your workflow. Those signs are:

Recurring errors in financial reports

Missed deadlines

Lack of standard operating procedures

High staff turnover

Lot of manual work

Communication gaps

Unsatisfactory client experience

Under a standard workflow for accountants there must be a series of repeatable steps that will ensure compliance, accuracy, and efficiency. Here is what a workflow should be for an accountant.

Client Onboarding

Bookkeeping & Data Entry

VAT Management

Payroll Processing (If applicable)

Monthly or Quarterly Management Accounts

Year-End Compliance

Tax Planning & Advisory

Ongoing Communication & Support

Workflow Review & Automation

Workflows are steps used to execute and complete tasks faster. Interchangeable with processes, in an accounting firm, workflow is a tool used to facilitate the accounting process.

Your workflow has five phases: Collect, Process, Organise, Review, and do. You need to know the best practices and tools for each phase.

Accounting practice management software and accounting automation tools have revolutionised workflows in accounting. These tools will make your accounting practice more flexible, intelligent, and secure.

Conclusion

In conclusion, we guarantee you one thing: You will not find a single accounting practice that has achieved success without researching, creating, and then implementing a workflow. These workflows can be made with the help of experts or using tools like accounting practice management software and automation tools. Through workflows, practices have achieved scalability, reduced risk, and increased profitability.

It’s valid that researching and creating workflows takes time, but with the help of automation tools and outsourcing services from professional service providers, things can move faster. Corient offers these services and multiple accounting practices in the UK have placed their trust on us. Our proficiency in advanced tools and experienced team have streamlined processes for multiple firms, and we can achieve the same for you. Please write down your queries and requests on our website contact form, and our executive will connect with you shortly.

Looking forward to an exciting association.