Top 10 Tax Outsourcing Companies UK Accounting Firms Should Know in 2025

Understandably, your practice faces multiple challenges in the form of evolving UK accounting standards and regulations, which cannot be handled in-house. No wonder many are drifting towards outsourcing. According to a recent survey, nearly 68% of UK accounting practices now utilise some form of outsourcing to enhance their service delivery capabilities.

The shift towards outsourcing is solid; however, the sheer number of outsourcing companies in the UK makes selection overwhelming. Every company has its unique characteristics, and you will need to select one that manages your peak workloads and allows you to focus on strategic advisory services.

In this blog, we have taken the liberty of listing down 10 tax outsourcing companies that you should consider partnering with in 2025. Let’s start:

Why UK Firms Rely on Accounting Outsourcing Services

The UK accounting environment is steadily becoming complex due to evolving tax regulations, rising client expectations, and tighter deadlines. To stay compliant and competitive, you will have to rely on accounting outsourcing services. The benefits offered by outsourcing services make practices more efficient and sustainable for growth.

Here are some of the significant benefits

Cost Efficiency

Recruiting and training an in-house staff for every accounting task, such as payroll, bookkeeping, and tax preparation, is an expensive and time-consuming endeavour. Through outsourcing services, you can avail professional accounting services tailored to your requirements.

The accounts outsourcing services will reduce your costs associated with salaries, benefits, software subscriptions, and training. This allows you to divert resources toward high-value client services.

Access to Expertise

Professional outsourcing providers employ teams of specialists who are experienced in handling UK tax laws, regulatory requirements, and UK compliance standards. By partnering with such a provider, you will gain access to a wide range of specialised skill sets and expertise, which you would otherwise have to maintain in-house at great expense.

With the help of your outsourcing partner, you will be able to process tax returns, VAT filings, and other accounting tasks in a timely and accurate manner with complete confidence.

Scalability

Your clients’ accounting workload will fluctuate according to peak periods, such as year-end, VAT return deadlines, or tax season. An outsourcing partner can handle this workload by offering flexibility as demand fluctuates. With the help of outsourcing, you can manage these seasonal surges without the need for additional hiring.

Focus on Core Services

When your outsourcing partner handles all your routine accounting work, you will be spared with time and resources for high-value advisory services and strategic planning. Such a shift will not only impress your clients but also position your practice as a trusted one delivering beyond compliance.

Top 10 Tax Outsourcing Companies for UK Accounting Firms

The UK accounting world is flooded with numerous accounting outsourcing companies, but only a few have secured a spot in the top 10. These outsourcing firms have gained expertise and experience in various practices and are worth trying out. These firms are:

1. Corient

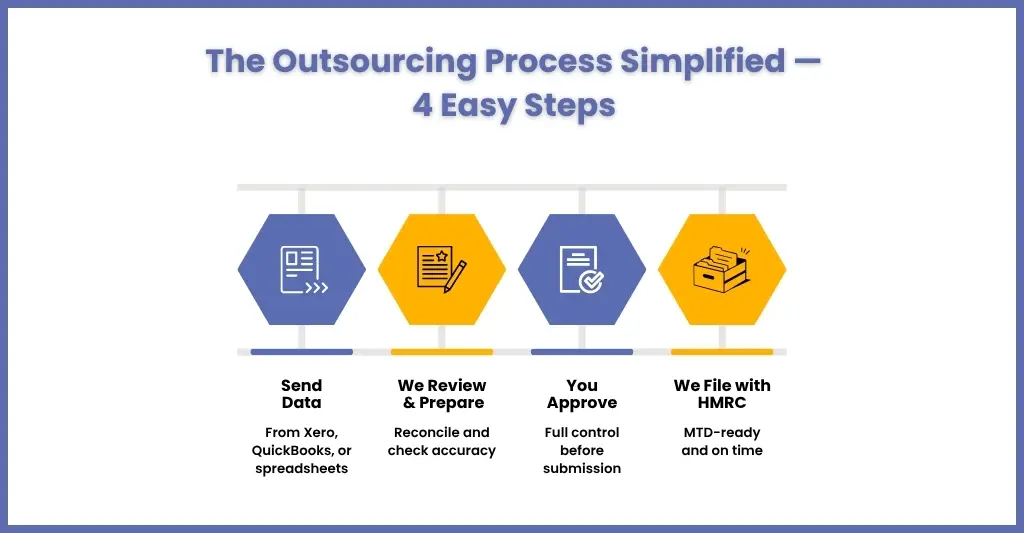

Corient is one of the most reliable outsourcing service providers you will find in the town. It offers its services to individual accountants as well as large accountancy companies. Based on its experience with clients, it has tailored its accounting outsourcing services to handle the increased workload. Whether they pertain to traditional accounting functions, such as Payroll, Year-End Accounts, and Management Accounts, or more specialised compliance needs, including Liquidation processes, Making Tax Digital, and others.

Corient’s services are fully compliant with the latest UK accounting standards, GDPR, and HMRC regulations. Worth trying out.

Services include:

- Year End Accounts Outsourcing

- Bookkeeping Outsourcing

- Payroll Outsourcing

- Management Accounts Outsourcing

- Offshoring Services

- Corporation Tax Outsourcing

- VAT Outsourcing

- Making Tax Digital

- Audit Support Service

2. Integra Global Solutions UK

It is an accounting outsourcing service provider with deep experience across multiple industries, offering services tailored to demand.

3. Affinity Outsourcing

Affinity Outsourcing is respected among accounting practices in the UK for its expertise in a range of outsourcing accounting services, taxation expertise, and wide support.

4. Stellaripe

One of the leading accounting outsourcing practices, Stellaripe fills the skill gap of multiple accounting firms and is MTD-ready. It allows firms to focus on client relationships, thus improving overall profitability.

5. AccountsAid

AccountAid provides essential support to accounting practices in tax filing and computation, bookkeeping, and payroll. Making it ideal for those who want to outsource less complex and repetitive accounting tasks.

6. Avonmead Accountants

Avonmead possesses strong human capital and prioritises technology and efficiency. It offers a range of services, including bookkeeping, tax, cloud accounting, back-office outsourcing, management reporting, and business plans.

7. Exuberant Global

Exuberant Global offers comprehensive tax outsourcing services, covering VAT, corporation tax, Self-Assessments, and more. They position themselves as an “extended team” for accounting practices.

8. Doshi Outsourcing

Doshi Outsourcing specialises in delivering high-quality work to accounting firms at reduced costs and enhanced efficiency.

9. Unison Globus

Unison Globus offers a wide range of outsourcing services, including bookkeeping and payroll, of high quality that reduces costs and improves efficiency.

10. Boutique Specialist: Eccoux

Eccoux is a boutique outsourcing partner focused exclusively on serving accountancy firms. They offer white-label support across bookkeeping, year-end accounts, payroll and compliance, including tax work.

Benefits of Choosing Professional Tax Outsourcing Companies

Hiring a professional tax outsourcing service provider by your side will be a decision that will bring long-term benefits to your practice. Here are some of the key benefits to look for:

Expertise

A professional outsourcing company will provide you with access to highly skilled teams with expert knowledge of UK tax laws, regulations, and compliance standards. By leveraging expertise, you can handle complex accounting tasks, maintain accuracy, and reduce those errors that lead to penalties.

Efficiency

Outsourcing firms will handle routine activities such as data entry and reconciliation efficiently, thus freeing your staff for advisory work, which in turn will increase your productivity.

Compliance

A professional outsourcing service provider consistently monitors UK tax regulations and their updates, which can be a challenge for accounting practices. They monitor and update changes on your behalf, such as Real-Time Information (RTI) requirements and changes in corporation tax, VAT, and payroll rules. Maintaining compliance will reduce the chances of regulatory penalties and reputational damage.

Cost Savings

Recruiting and training in-house staff for accounting work is a time-consuming and expensive proposition. However, it can be avoided through outsourcing by gaining access to experts without the need for recruitment, salaries, or purchasing software subscriptions. The cost saved can be diverted towards client service and advisory.

Scalability

The accounting requirements of your clients and seasonal demand will fluctuate, and only a professional service provider can handle it seamlessly. This benefit is particularly helpful during periods of high self-assessment returns during tax season or when managing a growing client portfolio. Such flexibility ensures quality without additional hiring or overloading your teams.

How to Select the Right Tax Outsourcing Partner

When choosing a tax outsourcing partner, consider the following factors:

- Experience: Select a provider with a proven track record in delivering tax outsourcing services to UK accounting firms.

- Compliance: Assess the provider’s knowledge of UK tax laws and regulations.

- Technology: Partner with a provider that uses technology to streamline the process.

- Support: Verify the provider’s track record in offering dedicated support to address any issues.

- Cost: Check out providers that offer flexible pricing options, so you stay within budget.

People Also Ask

Tax outsourcing service providers offer a wide range of services, which include tax preparation, Self-Assessment, corporation tax, VAT returns, and advisory support.

Yes, only if you are dealing with reputed outsourcing companies. They consistently implement data security measures to protect from breaches and comply with GDPR.

Always consider a service provider that offers expertise in UK tax laws, technology, all-around support, and flexible pricing. Ask for a trial to assess their quality.

Outsourced accounting encompasses a wide range of financial services. At its core, it is the delegation of a company’s accounting tasks to external specialists.

Conclusion

Outsourcing has a lot to offer in the form of benefits, only if you crack the code of identifying and partnering with the right tax outsourcing company. By doing so, you will be able to leverage their expertise, ensure compliance, reduce costs, and focus on delivering high-value advisory services to clients.

Speaking of choosing the best, we can confidently say that Corient will be an ideal choice for you. We are equipped to handle all your monthly or quarterly VAT returns, as well as annual self-assessment tax returns, along with a comprehensive range of services designed to ease the administrative burden. Our team consists of senior tax professionals and qualified accountants who are dedicated to this task.

Simplify tax season with Corient, your trusted outsourcing partner. Connect with us and book your free consultation today and see the difference.