Top 10 Offshore Companies to Consider in 2025 (UK)

The only thing constant in the UK accounting landscape is the constant changes. To stay updated with these changes, you will require innovative solutions to enhance efficiency, reduce operational costs, and access specialised expertise. One of the strategies is offshoring.

By partnering with offshore companies, you can gain access to global talent tools, streamline your accounting operations, and focus on your core activities. However, selecting the right offshore partner among multiple options is a daunting task. In this blog, we will explain why offshoring companies are vital and highlight the top companies that specialise in offshoring.

Let’s get started

Why Practices Choose Offshore Companies

Many of your competitors have already made a strategic decision to offshore. This decision has been made for multiple valid reasons. Some of them are:

Cost-effectiveness: Most offshoring companies operate in countries with low labour costs, allowing them to hire qualified experts at a fraction of the cost. This, in turn, reduces their service costs.

Access to Expertise: Many offshoring providers have developed expertise in specific fields. Therefore, you will gain access to in-depth industry knowledge and specialised skills that are difficult to locate and recruit in the UK due to cost and availability factors.

Scalability: You cannot separate an offshoring provider from flexibility, as they must be able to adjust to their client’s accounting demands. This way, practices will not be required to recruit new employees

24/7 Operations: Because most of the offshoring companies operate in different time zones, you can enjoy 24/7 operations, which results in quick query resolution, constant running of the accounting process, and higher productivity.

Focus on Core Activities: With routine accounting tasks handled by professional offshoring providers, the practice can concentrate fully on strategic initiatives and customer service activities.

Best 10 Offshore Companies in the UK

Through offshoring accounting, you can scale your accounting operations, access global expertise, and cut expenses without having to deal with the hassles of recruiting and training new employees. Cost-effectiveness and access to specialised skills are the main reasons why 62% of UK accounting firms intend to increase their reliance on outsourced services over the next three years, according to a 2024 ACCA survey.

Below, we highlight the top 10 offshore companies to consider in 2025.

Corient

Corient has built a reputation for delivering comprehensive, tailored solutions for accounting practices in the UK. Our offshoring team will work as an extension of your team, allowing you to train them for your operations. We are comparatively cost-effective compared to our competitors, even with access to our renowned experts.

Our professionals are adept at integrating into your firm’s culture and workflows, enhancing your service offerings. You can scale your operations up or down with ease, supported by a team that understands the intricacies of UK accounting practices.

Whether it’s standard accounting work or customer services, our offshoring services are always at your service.

Under our offshoring services, we offer to our clients:

- Year-End Accounts Outsourcing

- Bookkeeping Outsourcing

- Payroll Outsourcing

- Management Accounts Outsourcing

- Tax Outsourcing Support

- Corporation Tax Outsourcing

- VAT Outsourcing

- Audit Support Service

- Advancetrack

The goal of this offshoring company is to rapidly integrate with practice operations and enhance their capabilities without compromising service quality.

Advancetrack

The goal of this offshoring company is to rapidly integrate with practice operations and enhance their capabilities without compromising service quality.

AcoBloom International

Made its name among accountants by offering the Co-Sourcing model for accounting firms as a very effective offshoring solution.

Doshi Outsourcing

It has an offshore office in India, which offers high-quality services on time through its qualified professionals.

Samera Global Offshoring

Partnering with Sameera will give you access to qualified, UK-trained accountants, making your practice simple, secure, and scalable.

Stellaripe Services

They will work according to the SLAs and budget agreed upon with them, regardless of where their accountants are based.

Intelligent Outsourcing

With an offshore office based in the Philippines, it offers an alternative to go on a global scale.

Dot (Digital Outsourcing Technology)

Dot will support you by serving as the global growth conduit in offshoring and bringing together a fusion of technology with professional individuals.

Valuecent

Valuecent offshore staff will work like an extended team of a practice without straining your budget.

Anandram Sarda & Associates

To offer the best offshoring accounting services at competitive rates, it provides its services in India at a competitive hourly rate.

How to Select the Right Offshore Partner

Selecting the appropriate offshore partner is essential if you want to maximise the benefits of offshoring. The success of your outsourcing strategy depends on your choice of offshore partner. You must take into account the following elements in order to select the best one:

Knowledge and Specialisation

Verify the provider’s track record of providing the particular services you require. Check its familiarity with the most recent UK accounting standards as well.

Infrastructure and Technology

Learn about their technical capabilities, such as their proficiency with automation tools, cloud platform usage, and data security protocols, before making a decision.

Cultural Harmony

Since the offshoring provider will be located abroad, you must make sure that offshoring provider understands your communication style, language, and culture. All this is essential for productive cooperation.

Flexibility and Scalability

Choose an offshore provider who can expand its services in response to shifting accounting requirements and on demand.

Citations and Credibility

To evaluate a provider’s performance and dependability, always look at case studies, industry reviews, and customer testimonials.

People Also Ask

Yes, offshoring is legal. However, it’s essential to ensure that the offshore company complies with all relevant laws and regulations, including data protection and tax laws.

Popular destinations for offshore incorporation include India, the Philippines, and Eastern European countries, known for their skilled workforce and cost-effective services.

Offshore bookkeeping services enable businesses to offload time-consuming financial tasks to skilled professionals abroad, allowing in-house teams to focus on priority tasks.

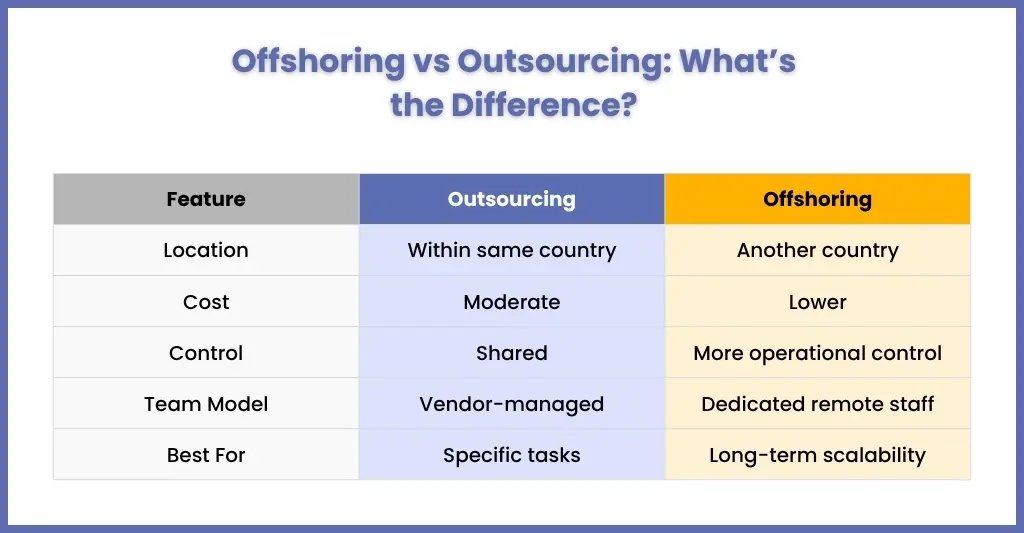

Offshoring involves delegating accounting and financial tasks to a team located in a different country, typically one where labour costs are significantly lower.

Offshore accounting is the practice of outsourcing a company’s accounting and financial functions to a third-party firm or individual accounting professionals located in another country.

Conclusion

Offshoring is an opportunity not just to lower your costs but to increase your efficiency and scale up to meet your clients’ specialised accounting demands. To gain the maximum benefit from it, you will need to carefully select and partner with the best, such as Corient.

Since 2011, Corient has built its reputation by offering tailored offshoring solutions that meet the specialised accounting demands of a wide range of accounting practices. Our accounting services will give you access to top-tier talent at less than 50% of the cost of hiring local professionals.

Reduce the workload and compliance pressure on your accounting team and explore the offshoring experience of Corient. Connect with us and schedule a consultation.