Top 10 Accounting Outsourcing Companies in UK for 2025

Every UK-based accounting practice will unanimously agree with us that running an accounting practice in the UK has become tough. We say with authority because we know how difficult it has become to fulfil compliance requirements, client demands, and resolve payroll woes. However, on the brighter side, practices have found solutions that have become their lifesaver in the form of outsourcing. That’s where outsourcing companies in the UK come into play.

It is through outsourcing that you will stay on top of your game in the competitive UK accounting market and get a piece of the pie from this growing market. In this blog, we will understand why many of your competitors trust in accounting outsourcing. Also, to maximise its benefits, we will help you select the best outsourcing company.

Let’s start with why outsourcing accounting is attractive.

Why UK Businesses Are Turning to Outsourced Accounting Services

In 2025, the accounting landscape in the UK is evolving consistently in the regulations, tech, and procedures, making it essential for you to modernise to stay relevant. Previously, outsourcing was used by large accounting firms, but with changing times, it has become a lifeline for accounting practices of all sizes and individual accountants. Here’s what’s driving this shift:

Saving Cost Compared to In-house Hiring

Hiring and maintaining a full-time accounting team will be a costly proposition for you and many practices, due to salaries, pensions, training, sick leave, and recruitment fees that quickly add up. On the other hand, payroll outsourcing costs are comparatively low and stable due to predictable pricing structure; you can select an outsourcing partner accordingly based on charges, which can be per hour, per file, or on a monthly retainer.

Many practices have found value in this benefit, and by switching to outsourcing services offered by professionals like Corient, you will see up to 40% in savings.

Spares Time High-Value Advisory Work

Routine accounting tasks, such as payroll processing, bank reconciliations, or data entry, are essential, but they don’t directly generate revenue. By outsourcing these tasks, you will be reducing the burden on your accountants and giving them time to focus on high-value advisory roles, like tax planning, strategic forecasting, or client relationship building. In short, more time = more billable hours and happier clients.

Immediate Access to Skilled Professionals

When you choose a professional outsourcing partner, you will gain immediate access to certified experts in UK payroll, VAT compliance, accounts finalisation, and more. No need to spend a long time searching or hiring experts, no training expenses and related delays. Whether it’s year-end accounts crunch or daily accounting and bookkeeping, the outsourced team comes ready to work with UK compliance and accounting software skills.

Flexible Engagement Models

Does your client tend to throw surprise work, or are you looking for help during the busy season? Outsourcing providers have got you covered with their tailored plans that will scale their support up or down based on demand. Whether it’s a one-off VAT return or long-term staff augmentation, you stay in control.

HMRC and MTD-Compliant Technology

Professional outsourcing providers use fully compliant cloud-based systems integrated with accounting software you already use, like Xero, QuickBooks, Sage, IRIS, and FreeAgent. That means seamless data flow, real-time collaboration, and peace of mind that your submissions meet Making Tax Digital (MTD) and HMRC filing standards.

In short, UK practices are turning to outsourced accounting not just to cut costs but to operate smarter, scale faster, and deliver more value to clients.

The Top 10 Accounting Outsourcing Companies in the UK

Let’s go through some of the top performers in the field of accounting outsourcing in the UK. These performers are:

1. Corient Business Solutions

Corient has been the first choice for over 200+ accounting practices by offering up-to-date accounting services. Since 2011, Corient has been based in Coventry, and has built its reputation as a reliable accounting outsourcing service provider with a strong ground presence in the UK accounting market. Accountants old and new are placing their trust in our top-notch accounting services, from bookkeeping to year-end accounts services.

Our accountants are well-versed in the latest UK accounting standards, MTD compliance requirements, local laws, AI tools and are experts in the use of Xero, QuickBooks, TaxCalc, and Sage. The result is an accounting service that is compliant, accurate, and follows the latest UK accounting standards.

Strengths:

- ACCA-certified accountants

- Fully compliant with UK GDPR and ISO 27001 for data security

- Well-versed in the latest UK accounting standards, MTD compliance requirements

- Strong ground presence in the UK accounting market

- Experts in the use of Xero, Sage, QuickBooks, and TaxCalc

- Global presence in the USA, UK and India

Our Services:

- Bookkeeping Outsourcing Services

- Payroll Outsourcing Services

- Year-end Accounts Outsourcing Services

- Corporation Tax Outsourcing

- VAT Outsourcing

- Management Account Outsourcing Services

2. QX Accounting Services (QXAS)

QXAS has built a reputation by providing scalable solutions to accounting practices that deal with high volumes and need high-end accounting talent and custom workflows.

Strengths:

- Accountants are trained in UK GAAP and FRS standards

- Dedicated client managers based in the UK

- Offers tech-enabled service delivery with built-in review stages

3. AdvanceTrack Outsourcing

AdvanceTrack offers good quality control and the capacity to scale up when required. When it comes to data security, it provides ISO 27001 certification. Here you will get fully compliant accounting services.

Strengths:

- Technology stack integrates with IRIS, Digita, CCH

- Strong UK presence with secure workflow processes

- Custom reporting dashboards and workload visibility tools

4. Entigrity

By maintaining a perfect combination of control and flexibility through dedicated staff, Entigrity has gained the reputation of reliability among the accounting practices in the UK.

Strengths:

- Hire dedicated staff in tax, audit, bookkeeping, and more

- Fully customisable onboarding process

- UK data protection standards and GDPR protocols

5. Stellaripe

Stellaripe has been focused on offering quality accounting services with dedicated support through its UK-trained and experienced accountants, thus giving a personal touch to practices.

Strengths:

- Expertise in monthly management accounts

- Personalised service with UK-trained client managers

- Ideal for firms transitioning to advisory services

- Transparent communication practices

6. Initor Global

Initor Global is known for making outsourcing smooth through cloud integrations and automation.

Strengths:

- Fast delivery quality on bookkeeping, year-end, and tax prep

- Compatible with Sage, Xero, FreeAgent, and QuickBooks

- Excellent reporting automation and workflow tools

7. QAccounting

QAccounting has been in the business of offering tailored services to practices of all sizes. It has made its name by making firms compliant with the latest HMRC regulations and adding value by providing advisory services.

Strengths:

- UK-based team with deep tax planning and advisory skills

- Supports IR35 compliance requirements, personal tax, and limited company accounts

8. OSOME UK

For those accounting firms that handle Amazon sellers, Shopify stores, or remote-first startups, OSOME will be an ideal match.

Strengths:

- App-driven, paperless accounting with real-time dashboards

- Strong in online seller integration (Amazon, Etsy, eBay)

9. Outbooks UK

With teams based in both the UK and India, Outbooks offers cost-effective and wide-ranging outsourcing services.

Strengths:

- Bookkeeping, VAT, payroll, and final accounts support

- Can provide dedicated teams or ad hoc project assistance

- Well-established presence in UK outsourcing market

10. Mazars Outsourcing

Mazar Outsourcing has built its reputation by offering robust accounting services to all large accounting practices, making it an ideal choice for many.

Strengths:

- End-to-end outsourcing

- Risk-managed compliance with internal audit support

- Detailed performance reporting

What Services Do These Accounting Outsourcing Companies Offer?

Blame the increasingly competitive UK accounting market or complex HMRC regulations, accounting practices cannot take on these challenges alone and need a strategic partner. That’s when outsourcing companies come into the picture; they have not just limited themselves to providing basic accounting solutions but expanded to offer end-to-end accounting solutions.

Services offered by outsourcing partner companies have helped firms to increase efficiency, reduce costs, and maintain compliance while freeing up resources to focus on client growth.

Here’s a deeper look at the services you can typically expect:

Bookkeeping

Under bookkeeping services, the day-to-day financial tracking and banking reconciliations are taken care of. Through this service, accurate accounting and bookkeeping is achieved, thus reducing surprises during the tax period.

Payroll Processing

Outsourced payroll processing will handle PAYE, RTI submissions, pension auto-enrolment. Through payroll outsourcing services, you can ensure your clients avoid fines, save admin time, and provide timely payroll with full HMRC compliance.

VAT Returns

Under VAT returns services, MTD-compliant VAT filing and reconciliation are taken care of, thus eliminating last-minute stress around quarterly deadlines.

Year-End Services

Under year-end accounts outsourcing services, teams will take care of your statutory accounts, HMRC filings and preparation of working papers. Our services will reduce potential bottlenecks during tax season and help you stay on top of submissions even during high volumes.

Audit Support

Risk assessments, internal control testing, and sample selections can stretch your team to the limit, but by using audit outsourcing services, it can be avoided. By using audit outsourcing services, you can give your audit team crucial support during tight deadline without compromising on quality.

Management Reporting

If you are into giving advisory services to your clients, then management account services will be beneficial for you. Through outsourced audit services, forecasting, KPIs, and preparing monthly Profit and loss statements and balance sheets will be taken care of, allowing you to focus entirely on being a strategic advisor to your clients.

People Also Ask

Outsourcing can reduce operational costs by 30 to 40%, free up staff for advisory services, improve turnaround time, and ensure compliance with UK regulations like MTD and HMRC standards.

Absolutely. Most providers offer modular outsourcing; you can choose to outsource only VAT, payroll, or bookkeeping, depending on your firm’s current load.

Yes. Leading providers like Corient, QXAS, and IRIS-certified teams use MTD-compatible software and submit directly to HMRC on your behalf.

When it comes to top outsourcing firms in the UK in 2025, practices prefer Corient, QXAS, and AdvanceTrack.

Demand remains high for skilled finance and accounting professionals as we move further into 2025.

Corient focuses entirely on giving accounting outsourcing services to accounting practices and accountants based in the UK. However, indirectly, it offers its bookkeeping, payroll, management accounts, VAT, and Audit services to all businesses via accounting practices.

Conclusion

In conclusion, we would like to say that accounting services will find it tough to survive in the UK accounting market without the expertise of a professional accounting outsourcing company. It’s better to learn from others mistakes and partner with one and stay on top of your game. Remember to select the best and professional outsourcing partner to enjoy the full benefits of outsourcing.

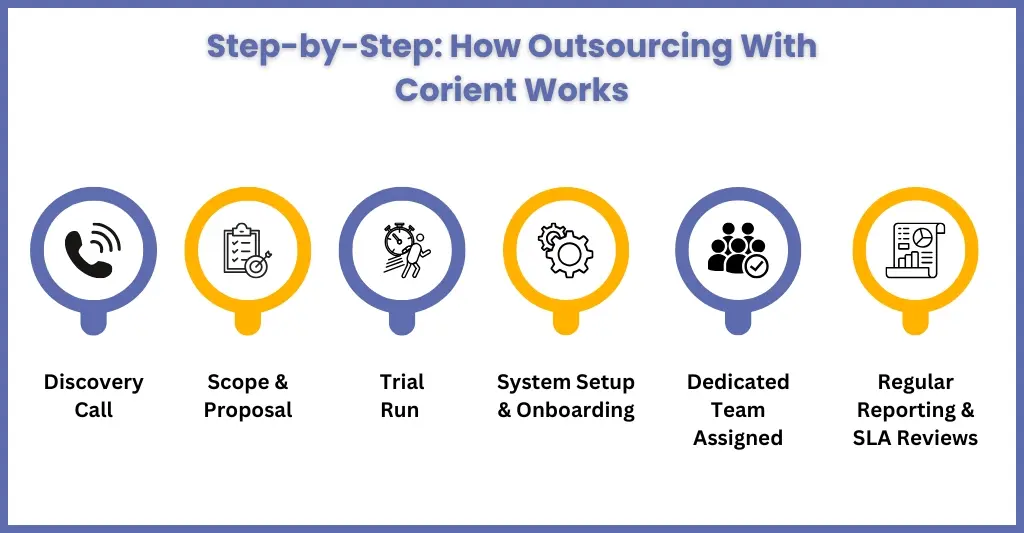

Speaking about professional outsourcing, we are sure you have heard of Corient, which is gaining significant popularity among accounting practices in the UK. Since 2011, we have been helping practices streamline their accounting services through our outsourcing services. Whether you need year-end help, handling payroll, VAT-only support, or a dedicated accounting team, Corient can help you.

So, are you ready to explore our accounting outsourcing service? Connect with us on our contact form and get a free trial.