P11D Benefits – Maximise Tax Efficiency and Compliance

Every employer strives to motivate its employees to get the best output from them, and one of the multiple ways to achieve that is by offering employee benefits. But that’s just a part of the story. Along with giving benefits, your clients, who are employers, are responsible for reporting these benefits accurately. That’s where the P11D form comes in the picture. For employers in the UK, filing P11Ds accurately is not just a compliance task; it is an ideal way to become tax efficient and avoid costly penalties.

However, each year, we have noticed businesses struggling with the time-consuming and complex nature of reporting benefits. Any mistakes in reporting benefits such as company cars, insurance, and so on will attract HMRC’s attention. For this reason, employers find it ideal to get P11Ds done through accounting firms like yours, but the story doesn’t end there.

Increasingly, we are getting requests from accounting firms for assistance in helping them with their P11D tasks. The reason for such requests is the same as that faced by employers: they are time-consuming and complex. The only difference is the scale of the challenge. For this reason, we have created this guide to simplify everything you need to know about P11Ds. We have covered everything from what P11D is, why it matters, how to file it, and how to save even more time through outsourcing.

Let’s get going.

What is a P11D and Why It Matters for UK Employers

Many employers think their job ends once the payroll is done, but that’s not the case when dealing with P11Ds. A form used in submitting benefits given by employers, P11Ds are submitted to the HMRC by the employer or by your firm on their behalf. These P11Ds must be submitted for each employee who receives benefits. These benefits could be company cars or vans, private healthcare, or season ticket loans, to name a few.

The benefits shown on the form will allow HMRC to review the employee’s tax affairs and check whether the correct tax amount is paid. It also allows them to update an individual tax code for the following year so that regular tax deductions will be closer to the expected overall liability.

These forms must be submitted without fail by 6th July every year. You, on behalf of your clients, are also required to complete and return the P11D(b), which calculates employer Class 1A national insurance contributions due on certain benefits. Failure to submit these forms will lead to penalties of £100 per 50 employees for each month. Interest on penalties will be charged if you’re late in paying to the HM Revenue and Customs.

This shows you how much P11D filing matters to your clients. Helping them with it offers them a value-added service and keeps them stress-free.

File a P11D with Confidence – Avoid Penalties

HMRC is on the hunt for employees who do not file P11Ds before the deadline, and you will not want that for your clients. Hence, if you are handling P11Ds for your client employers, ensure they file P11Ds by 6th July every year. If the P11Ds are not filed even after 19th July, then fines of £100 per month per 50 employees will be imposed.

P11Ds filed contain mistakes, your clients will face fines; however, this can be avoided if a satisfactory explanation is provided to HMRC. If HMRC believes you acted carelessly, deliberately misled them, or attempted to conceal true liabilities, the penalties for mistakes could be 30%, 70%, or 100% of the owed tax. After April 2026, the self-assessment tax return will replace the P11D form.

Understanding P11d Benefits – A Guide for UK Employers

For those stressed out with implementing P11D, there is some good news: P11D will become extinct. Yes, you heard it right, but that will happen in April 2026, so there is a one-year wait. Till then, let’s understand the benefits of P11D.

It is essential to understand that filing P11Ds is not about just filling forms, it also requires proper implementation which will give immense benefits to your client’s. These benefits are as follows:

Stay Compliant, Avoid Penalties

One major benefit of P11D is avoiding HMRC penalties once they are filed on time and accurately. Any errors or late filing of P11D will lead to fines and interest charges.

Increasing Employee Satisfaction

When you correctly report the benefits in kind on behalf of your client employers, it’s their employees who get clarity on their tax obligations and help them value their perks.

Increasing Financial Transparency

Through accurate P11D reporting, you help your clients in keeping their financial records straight, thus making them more responsible in the eyes of HMRC and its employees.

Plan Tax-Efficient Benefits

P11Ds will help your clients determine which benefits are taxable, thus enabling them to design better and more cost-effective reward packages for their staff.

Helps in Being in the Good Book of HMRC

Consistently sending accurate P11Ds before the deadline to the HMRC builds trust and lowers the risk of additional scrutiny from them.

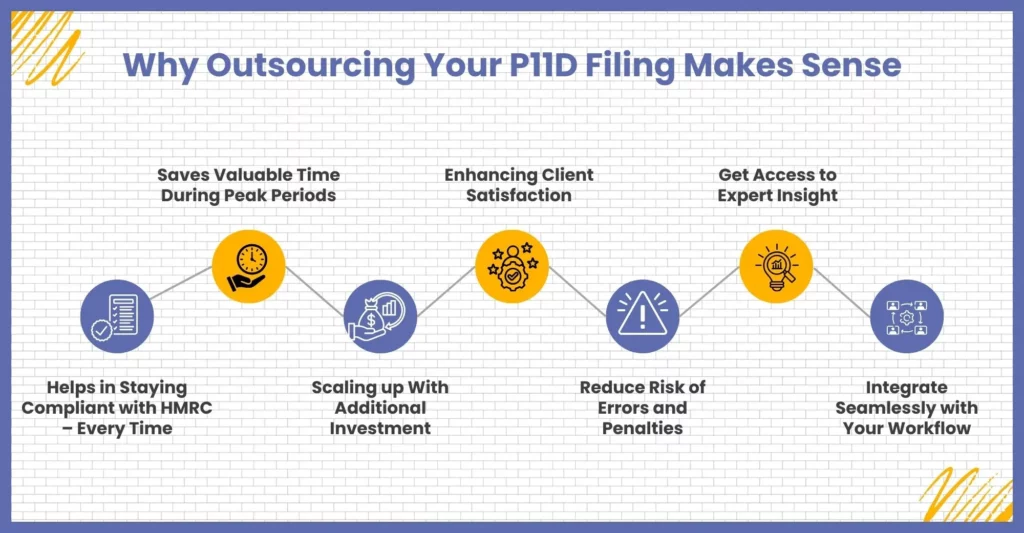

Why Outsourcing Your P11D Filing Makes Sense

We can imagine how burdensome it is to be saddled with P11D submissions for multiple employer clients. This is time-consuming and error-prone and gets worse during peak seasons. We wish we could have said that things would get better, but that’s not the case due to HMRC requirements getting stricter and increasing demand for accuracy. Such situations make a case for you to outsource your P11D filing, bringing much-needed efficiency and peace of mind.

Here’s why outsourcing your P11D filing makes sense:

1. Helps in Staying Compliant with HMRC – Every Time

A professional outsourcing provider will always stay updated with the latest P11D regulations, thus ensuring that your submissions meet the HMRC compliance standards. With assistance from your outsourcing partner, there will be no doubts about compliance, and penalties due to late or incorrect filings will be a thing of the past.

2. Saves Valuable Time During Peak Periods

When the 6th July P11D deadline comes near, you will already be overstretched managing P11Ds for multiple clients. Plus, you cannot neglect other important accounting functions of your clients, which are equally important. Outsourcing this work will give you the time to focus on higher-value client advisory and strategic tasks instead of getting bogged down with P11D forms and related data.

3. Scaling up With Additional Investment

By choosing a professional service provider offering payroll outsourcing services, you can scale up and handle hundreds of P11Ds anytime. Therefore, you will achieve this without additional infrastructure costs or the hiring or training of additional staff.

4. Enhancing Client Satisfaction

Professional payroll outsourcing services will speed up turnaround and ensure error-free submissions for your employer clients, strengthening your reputation as a reliable and well-organised practice. Hence, choose the best payroll outsourcing company for maximum client satisfaction.

5. Reduce Risk of Errors and Penalties

Multiple benefits, such as private medical insurance, loans, etc., are complex in nature, and costly mistakes can happen. However, when a specialist handles your P11D, their experience and training will ensure that things are done accurately, thus reducing the risk of errors and penalties.

6. Get Access to Expert Insight

Many professional payroll outsourcing providers employ experts to provide valuable insights to their clients, thus helping them better manage employee benefits. Such insights add high value to your service offering.

7. Integrate Seamlessly with Your Workflow

Any professional and experienced outsourcing provider will ensure that their team is in synch with your team. Such smooth integration is achieved through secure data portals and integration with your existing software. Hence, such integration will establish a smooth workflow.

Frequently Asked Questions (FAQ)

Some of the common P11D benefits that need to be added are:

1. Company Car/Fuel

2. Company vans (provided for personal use)

3. Private medical insurance

4. Employer loans over £10,000 (where no/low interest charged)

5. Professional/Private memberships

6. Accommodation

7. Pecuniary bills paid by employer

8. Shopping or hospitality vouchers

9. Non-business entertainment expenses

The final date for filing P11Ds for employees is 6 July every year.

Yes, every employer is required to complete a P11D for each employee who is receiving taxable expenses or benefits.

P11Ds must be filed by 6th July otherwise, fines will be imposed of £100 per month per 50 employees.

Conclusion

This guide aims to help you understand the importance of P11D, its deadlines, and how to gain the maximum out of it. P11D task is an important but time-consuming task that someone else can easily do. That’s why your employers have placed the responsibility on your shoulders but now the situation is becoming increasingly complex. For this reason, accounting practices are increasingly handing over P11D tasks to payroll outsourcing firms, and for the sake of efficiency, accuracy and client satisfaction, you must follow suit.

Speaking about outsourcing firms, accounting practices are increasingly placing faith in the rising Corient for handling P11D and other accounting responsibilities. Coming into existence in 2011, Corient has created a loyal base of accounting firms by offering reliable and tech-savvy accounting services. Our payroll, bookkeeping, corporation, and VAT services have provided valuable insights to our clients, thus increasing their productivity. We can do the same for you; write down your doubts and questions on our website contact form, and our executive will contact you as soon as possible.

Good luck, and looking forward to contacting you soon.