National Insurance Contributions – What You Need to Know in 2026

- What Are Class 1 National Insurance Contributions?

- What Are Class 1A National Insurance Contributions?

- What Are Class 2 National Insurance Contributions?

- What Are Class 3 National Insurance Contributions?

- How Do I Check My National Insurance Contributions?

- Why National Insurance Contributions Matter

- How Is National Insurance Paid in the UK?

- What If You Overpay or Underpay National Insurance?

- NIC Rates & Thresholds for 2025–26

- Frequently Asked Questions (FAQ)

- Conclusion

National Insurance Contributions (NICs) are a significant part of the UK tax system; after all, they are the UK’s second-largest tax. Employees and self-employed individuals pay it on their earnings, and employers pay it on the earnings of those they employ. Unlike income tax, NICs are not charged on income from other sources such as savings, pensions or property.

In the 2025–26 tax year, several changes to NIC thresholds and rates are impacting both employers and individuals. In this blog, we’ll break down the different NIC classes, explain how to manage contributions and outline what accounting professionals should know.

What Are Class 1 National Insurance Contributions?

Class 1 National Insurance Contributions (NICs) apply to employees and employers on earnings from employment. The PAYE system automatically subtracts these contributions from wages based on an employee’s salary.

Who Pays Class 1 NICs?

The responsibility of paying class 1 National Insurance is with the following:

- Employee NICs: Paid on earnings above the Primary Threshold.

- Employer NICs: Paid on earnings above the Secondary Threshold.

Specific key points to remember:

- Typically affects employees aged 16 to State Pension age.

- The National Insurance Rates vary depending on earnings limit and NIC thresholds.

What Are Class 1A National Insurance Contributions?

The Class 1A NICs are paid only by employers on employee benefits-in-kinds. These benefit’s-in-kind are as follows:

- Company cars

- Private medical insurance

- Interest-free or low-interest loans

- Gym memberships or other non-cash perks

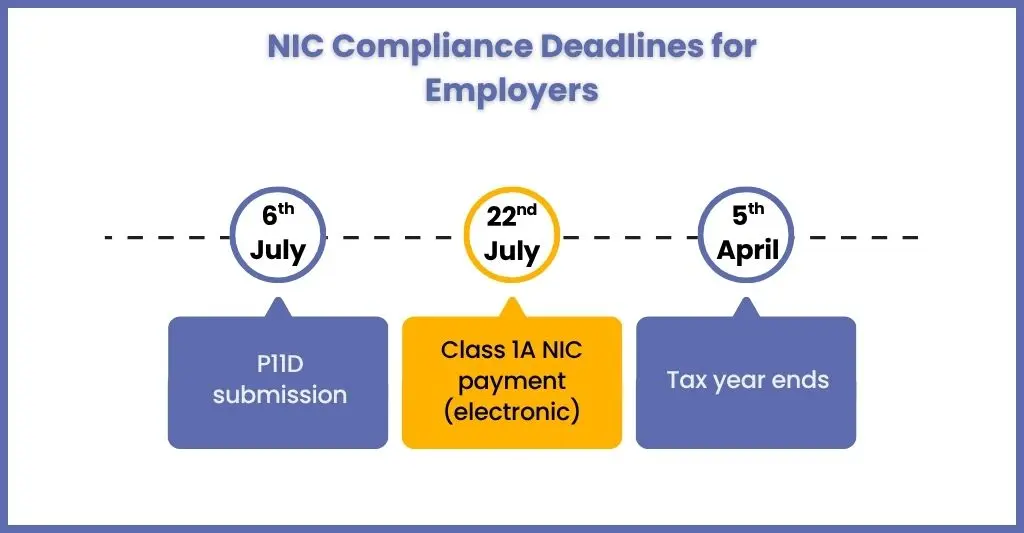

These contributions are paid at a flat percentage rate on the value of benefits and must be reported via P11D forms, usually due by 6 July following the tax year. The payment deadline for Class 1A NICs is 22 July (if paid electronically). Class 1A NICs are calculated annually and reported via Form P11D (to declare employee benefits) and Form P11D(b) (to report and calculate the Class 1A NICs due).

What Are Class 2 National Insurance Contributions?

The Class 2 NICs apply to self-employed individuals whose profits exceed the small profits threshold (SPT). Until recently, Class 2 NICs were compulsory for those earning above a set threshold. As of April 2025, the government will abolish Class 2 NICs for most self-employed individuals, but these contributions will still play a critical role in State Pension eligibility.

What Are Class 3 National Insurance Contributions?

People make Class 3 NICs voluntarily to fill gaps in their National Insurance (NI) records. These contributions help ensure eligibility for certain state benefits, most notably the full State Pension. They can make voluntary contributions for the past 6 years, with the deadline on 5th April each year.

Unlike Class 1 or Class 2 NICs, Class 3 is not tied to employment or self-employment. Instead, it’s a way for people to maintain or boost their contribution record if they haven’t earned enough in a given year to qualify for a full contribution.

How Do I Check My National Insurance Contributions?

Taking a glance at the NICs is essential for understanding your client’s entitlement to State Pension and other UK benefits. Whether your client is employed, self-employed, or has gaps in their working history, by reviewing their NI record, you can ensure everything is up to date.

To check your client’s NICs, you can use the National Insurance record online method using HMRC’s digital services.

Here’s how you do it:

- Visit the HMRC National Insurance record page.

- Sign in to your Personal Tax Account

- View the records, where you will get to see the number of qualifying years on record, any gaps in contributions, whether you can make voluntary contributions (Class 3), and your current State Pension forecast

Why National Insurance Contributions Matter

National Insurance Contributions are not just a payroll deduction. It is a path for ensuring long-term financial security. Therefore, individuals, employers, and your team alike need to understand NICs clearly for sound financial planning and compliance.

NIC helps in the following matters:

Builds Entitlement to the State Pension

The NIC record of your client will determine whether it will qualify for the basic or new state pension. Your client will need 10 qualifying years to get any State Pension and 35 qualifying years to receive the full State Pension. Missing out on contributions or incomplete years can reduce your client’s retirement income, which is why accuracy and timely payments are a must.

Access to Essential State Benefits

You can gauge the importance of National Insurance Contributions (NICs) from the fact that many UK welfare benefits directly tie to your NIC record, including:

- Maternity Allowance

- Jobseeker’s Allowance

- Bereavement Support Payments

- Employment and Support Allowance (ESA)

By failing to contribute adequately, your client will be disqualified from these safety nets when they’re most needed.

Ensures Compliance for Employers

It’s a legal obligation for employers to pay accurate NICs because any inaccuracies will lead to cascading problems such as:

- HMRC penalties and interest

- Damaged employer reputation

- Payroll corrections and administrative headaches

Accounting firms play a vital role in ensuring their clients are fully compliant with the latest rates, NIC thresholds, and reporting duties. For further refinement in service quality, practices are utilising payroll outsourcing services provided by outsourcing partners.

Helps Individuals Fill Gaps in Employment

If your clients have been unemployed, on parental leave, ill, or living abroad, they can fill contribution gaps and protect their benefits by using voluntary NICs (Class 3). As an accounting practice, you can guide your clients to understand and act on these options to secure their future entitlements.

Financial Planning and Retirement Readiness

NICs affect how much clients will receive from the state in retirement, which impacts how much they need to save privately.

Enhancing the understanding of your client of NIC implications helps in:

- Guide pension planning

- Assess the value of topping up contributions

- Plan transitions to self-employment or part-time work

How Is National Insurance Paid in the UK?

NICs are paid in multiple ways based on your client’s employment status. Whether your clients are employed, self-employed, or making voluntary contributions, the process ensures regular, accurate payments into the UK’s welfare system. Here’s an in-depth look at how they pay NICs:

Here’s how NICs are collected:

- Employees: Through PAYE payroll deductions.

- Employers: Must pay employer NICs and Class 1A via payroll systems and P11D forms.

- Self-employed: Through the Self-Assessment tax return (Class 2 and Class 4).

- Voluntary contributors: Pay Class 3 via HMRC’s online portal or direct debit.

Make sure your payroll teams use the best payroll software which will automatically be updated with the latest rates and NIC thresholds each April.

What If You Overpay or Underpay National Insurance?

There can be an overpayment or underpayment of NICs. In that case, you can claim a refund. Such mistakes happen when your clients are changing jobs mid-year or have multiple jobs in hand.

You, on behalf of your client, can request a refund via HMRC and also review the annual NIC record for discrepancies. Additionally, you must pay attention to payroll miscalculations, late payments, and missed contributions, which cause underpayments. Penalties and interest may apply for late NICs. You can avoid this by conducting a mid-year or year-end payroll review for your clients.

NIC Rates & Thresholds for 2025–26

| NIC Class | Who Pays It | Rate | Threshold |

| Class 1 (Employee) | Employees | 8% (standard rate) | £12,570/year |

| Class 1 (Employer) | Employers | 13.8% | £9,100/year |

| Class 1A | Employers | 13.8% | N/A |

| Class 2 | Self-employed (Voluntary only) | £3.45/week | N/A |

| Class 3 | Voluntary | £17.45/week | N/A |

Frequently Asked Questions (FAQ)

You can log in to your HMRC personal tax account to view your full contribution history.

Class 1 is for employee earnings through payroll, while Class 1A is for employer-paid NICs on non-cash benefits.

Yes. HMRC can apply penalties and interest on late or underpaid NICs. Regular payroll audits can help prevent this.

The amount of National Insurance your client pay depends on your employment status and how much you earn. You can see rates for past tax years.

Each tax year (6 April to 5 April) that you pay or receive National Insurance Contributions counts as a qualifying year, provided you earn or receive at least the minimum amount. This amount changes every year.

Conclusion

It is essential to have a deeper understanding of National Insurance Contributions, which will enable you to guide your clients effectively. With changing rates, the abolition of Class 2 NICs, and new compliance challenges, accounting practices in the UK must be proactive. Whether it’s advising on voluntary contributions, correcting overpayments, or ensuring accurate payroll deductions your expertise can safeguard your clients’ financial future and ensure full compliance.

Furthermore, to enhance your understanding of NICs, consider consulting a professional service provider with considerable experience in handling these tasks, such as Corient. Through its payroll services, it has achieved the goal of relieving countless practices from the time-consuming NIC tasks. If you are interested in learning more about our services and achievements, you can use our contact form and connect with us.

Looking forward to seeing you soon.