Making Tax Digital 2026: Deadlines, Compliance Tips & Tools for UK

- Introduction

- What Is Making Tax Digital and Why Does It Matter?

- Making Tax Digital Deadlines and Key Dates for 2026 and Beyond

- How to Comply with Making Tax Digital

- Guidance for UK Accountants While Preparing for MTD?

- How to Prepare for MTD UK 2025/26

- MTD Case Study: Accounting Firm Handling a Manchester-Based Business

- Making Tax Digital Software and Tools

- How do outsourced tax preparation services handle Making Tax Digital requirements?

- Benefits of Making Tax Digital for Accountants

- Common Mistakes to Avoid During MTD Transition

- People Also Ask

- Conclusion: Embrace the Digital Shift

Introduction

Is Making Tax Digital-compliance giving you sleepless nights in 2026? Well, you are not alone. The Making Tax Digital (MTD) initiative was announced in 2015 and applied for VAT in 2019. Since then, it has generated significant ripples among UK accounting firms and the UK tax system, capturing the attention of accountants and accounting practices in the UK.

Designed to make the tax process more effective, efficient, and easier for taxpayers, MTD is reshaping how accounting practices maintain records and submit tax returns for their clients.

With MTD slowly becoming a compulsion in every aspect of the UK tax system, understanding its requirements and proactively getting ready for it is a must. In this blog, we break down the key deadlines, compliance tips, software tools, and practical advice to help you stay ahead of the curve.

What Is Making Tax Digital and Why Does It Matter?

Making Tax Digital is a UK government initiative aimed at fully digitising the tax system in the UK. The motive behind this initiative is to reduce errors, improve accuracy, and ensure timely tax payments by requiring businesses and individuals to maintain digital records and submit tax returns using compatible software.

As per HMRC statistics published in August 2025, approximately 42% out of 7 million taxpayers with income from self-employment or property will need to comply with MTD between 2026 and 2028.

MTD matters because:

- HMRC aims to close the tax gap caused by manual errors and outdated systems.According to HMRC’s June 2025 tax gap report, MTD for VAT is predicted to deliver more than £4 billion.

- MTD offers better transparency and real-time tax updates.

- It streamlines the overall tax process, saving time for your clients and your accountants.

Making Tax Digital Deadlines and Key Dates for 2026 and Beyond

It is essential to be aware of all key deadlines and milestones for MTD. Some of those key milestones are:

- April 2022: MTD for VAT became mandatory for all VAT-registered businesses.

- April 2026: MTD for Income Tax Self-Assessment (ITSA) will apply to self-employed individuals and landlords with income over £50,000. (subject to change)

- April 2027: MTD for Income Tax will apply to most self-employed individuals and landlords with qualifying income over £30,000. (subject to change)

- April 2028: MTD for Income Tax will apply to most self-employed individuals and landlords with qualifying income over £20,000. (subject to change)

In the future, MTD will also apply to corporation tax, with the exact details pending with HMRC. Your accountants need to monitor these updates, as they may signal a shift based on government policy or technological readiness.

How to Comply with Making Tax Digital

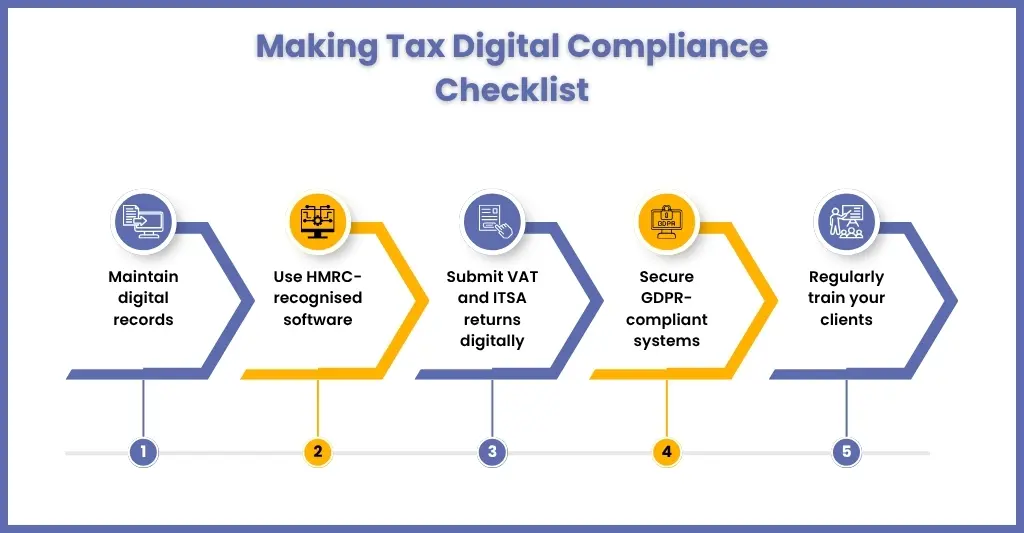

To stay compliant with MTD, you will have to follow a set of requirements that go beyond digitisation:

- Keep digital records: All VAT and income records must be in digital format, and to achieve this, you must use HMRC-compatible software.

- Submit tax returns digitally: All VAT and ITSA returns must be filed through MTD-compliant platforms, as manual submissions will not be accepted.

- Maintain data security and integrity: Your systems must be GDPR-compliant, secure, and regularly updated to protect sensitive financial information.

Guidance for UK Accountants While Preparing for MTD?

The UK tax system is undergoing a transition toward digitisation, and accountants will be at the forefront of it. However, it is essential to note that MTD isn’t just a compliance obligation; it’s also an opportunity to modernise services, strengthen client relationships, and streamline operations.

Here’s a detailed roadmap on how your accountants can proactively prepare for MTD:

Create Awareness Among Your Clients

Begin by raising awareness among your clients. It will be hard to believe, but you will find some of your clients who are entirely unaware of MTD compliance and its deadlines. Since you are looking after their accounting work, you will have to ensure that:

- You have explained the MTD on VAT, including mistakes to avoid, its phased implementation on ITSA, and future implementation on Corporation Tax.

- Explain how digital submissions are done and make them understand their importance.

- Make them aware of the penalties for non-compliance

You can create awareness among your clients through webinars, regular newsletters, and one-on-one consultations.

Audit Your Client’s System

Check if your clients are still using outdated or manual systems for record-keeping. This includes:

- Paper ledgers or Excel files are not integrated with bridging software

- Legacy accounting software that lacks MTD compliance features

- Businesses with disorganised or delayed record-keeping

Create a checklist for MTD readiness and offer a digital upgrade pathway, helping clients move to compliant cloud-based tools.

Offer Hands-On Training and Support

Giving training to your clients and their teams is vital. Even with the right software, a lack of understanding can result in submission errors or missed deadlines. Hence, consider:

- Hosting software onboarding sessions

- Creating step-by-step video tutorials or guides

- Providing ongoing tech support and troubleshooting

These activities will not only build trust but also ensure smoother monthly and quarterly workflows.

Streamline Your Practice’s Services

MTD implementation will be an opportune time to restructure your offering and make it more attractive. You can align your services with the MTD requirements, which include:

- Digital bookkeeping and real-time updates

- Quarterly VAT and ITSA filing

- Annual summaries and reconciliation

- Advisory services such as cash flow forecasting, tax planning, and financial strategy

By designing standardised digital packages, you reduce overhead, improve consistency, and make scaling easier.

Partnering with an Experienced Outsourcing Partner

For many UK accounting firms, the challenge isn’t understanding MTD, but the capacity to handle it. This is especially true during peak periods, such as tax season or year-end. But using MTD-compliant Corporation or VAT outsourcing services of a trusted outsourcing partner allow you to:

- Handle MTD submissions accurately and on time

- Support more clients without hiring additional staff

- Free internal teams to focus on high-value advisory and relationship-building work

How to Prepare for MTD UK 2025/26

The April 2026 deadline for MTD for Income Tax is approaching which leaves no room other than preparing for it. Here’s a guide to help you out:

1. Assess Your Client’s MTD Status (Q4 2025)

Conduct calculations of your client’s qualifying income, if it is more than 50,000 pounds in 2024/25, they will have to comply from April 2026. Give priority to clients by deadline (2026, 2027, or 2028).

2. Choose MTD-Compatible Software (Q1 2026)

Select a MTD-compatible software that has user friendly interface, HMRC API integration, bank feed automation capabilities, and cloud-based for security. Some of the software that offer these features are Xero, QuickBooks, and Sage.

3. Data Migration and System Setup (Q1-Q2 2026)

Need to take come crucial steps in managing the data, such as:

- Clean and categories all transactions accurately

- Configure bank feeds for automatic transactions imports

- Export old data from old systems

- Test the submission process in the HMRC test environment

4. Training and Testing (Q2-Q3 2026)

Conduct thorough training of your staff on the choosen software platform and develop standarised workflows for MTD submissions. Maintain constant communication with your clients.

5. Quarterly Update Schedule

Before you file MTD for VAT or ITSA keep your systems updated by following a quarterly update schedule. Under the updates, you must conduct data review before submission deadlines.

6. Ongoing Compliance Monitoring

To keep your clients compliant, it would be better to maintain digital records of all transactions. Do accounts reconciliations on monthly basis and monitor HMRC communications for updates.

MTD Case Study: Accounting Firm Handling a Manchester-Based Business

Client Profile:

An accounting firm is handling a Manchester-based independent retail business with annual turnover of £350,000, operating with manual bookkeeping and paper records.

The Challenge:

When MTD for VAT became compulsory in April 2022, business owner became very concerned about the following:

- Implementation costs and time investment

- Learning new technology

- Potential disruption to daily operations

- Data migration from years of paper records

The Solution:

Through an experienced accountant from an outsourcing firm and using Xero accounting software in a phased manner. It has achieved the following:

- Month 1-2: Software setup and data migration of the previous 12 months

- Month 3: Hands-on training sessions with the owner and bookkeeper

- Month 4: Parallel running of both systems to build confidence

- Month 5: First digital VAT submission with accountant support

The Results (After 12 Months):

- Time Savings: VAT return preparation time condensed from 2 days to 3 hours

- Accuracy Improvement: Zero HMRC errors or corrections (previously averaged 2 per year)

- Financial Visibility: Real-time access to cash flow and profit margins

- Growth: Recognised unprofitable product lines, leading to 15% profit margin improvement

- Confidence Boost: Owner now advocate for digital systems among fellow retailer

Making Tax Digital Software and Tools

To implement MTD successfully for your clients, you will need specific tools, such as MTD-compatible accounting software. Let’s have a look at these HMRC-recognised solutions used by other UK accounting firms:

- Xero: It is cloud-based, integrates with the MTD API, is user-friendly, and is ideal for mid-sized businesses.

- QuickBooks: Ideal for small clients, it has a highly user-friendly interface and excellent support for digital record-keeping

- Sage: This accounting software is strong on compliance

- FreeAgent: Ideal for accounting practices that serve contractors, freelancers, and small businesses.

How do outsourced tax preparation services handle Making Tax Digital requirements?

With HMRC’s Making Tax Digital (MTD) initiative turning the way UK businesses deal with taxes on its head, many accounting firms and business owners are looking to outsourced tax preparation services to help them out. But what exactly do these providers do to make sure they remain MTD compliant? Here’s what you need to know

1. They Use MTD Software That HMRC Approves

Good outsourcing providers use HMRC-recognised software that’s approved for MTD so they can submit VAT, income tax & corporation tax returns. This ensures digital records are kept up to date and submissions are filed electronically – just as HMRC want.

2. They Make Digital Record Keeping Effortless

MTD means businesses have to keep digital records of every transaction. Outsourced tax teams set up a system where data is captured and organised in real time, often linking directly into accounting tools like Xero, QuickBooks, or Sage.

3. They Handle MTD Submissions From Start to Finish

From collecting data, to validating it and submitting it to HMRC, outsourcing firms deal with the whole MTD process. That means the burden is off your team and the risk of late or wrong submissions is reduced.

4. They Give You Real-Time Reporting & Dashboards

Modern outsourcing services provide a clear view of tax liabilities, due dates and compliance status – even when the tax work is done elsewhere. This gives you full visibility over how things are standing.

5. They Keep Up With Changes To MTD

HMRC are constantly updating the rules on MTD – especially around Income Tax Self Assessment and the thresholds. Good outsourcing partners keep an eye on these updates and adjust their workflow so you stay compliant

6. They Keep A Record Of Everything

To protect you from HMRC queries or audits, outsourced providers keep secure backups of every digital submission, communication and calculation – just in case.

Benefits of Making Tax Digital for Accountants

Making Tax Digital was a compliance measure that accountants found burdensome, but it has instead opened up multiple opportunities for process streamlining and commercial benefits. You will discover that MTD has the catalyst for scaling smarter, serving clients better, and shifting from transactional work to advisory-led services.

Here’s a breakdown of the key benefits:

Fewer Errors

Manual bookkeeping is prone to human errors, such as duplicate entries, missed expenses, or incorrect VAT codes. MTD-compliant software automates much of this process:

- Data flows directly from bank feeds, invoicing apps, and digital receipts

- Real-time error-checking flags anomalies before submission

- Automated categorisation helps standardise entries across clients

Fewer instances of human intervention result in cleaner records, fewer HMRC enquiries, and greater confidence during year-end reviews and audits.

Save Time

Slowly, MTD is becoming a compulsion, and so is automation. Through automation, you can eliminate repetitive manual tasks, such as manual VAT input, client follow-ups for missing paperwork, and deadline reminders. With these works out, your accountants will have time for:

- High-value services like forecasting or tax planning

- Support more clients per staff member

- Deliver faster turnaround without sacrificing accuracy

Giving Better Insights to Your Clients

MTD requires regular data updates, quarterly for VAT and ITSA. This frequent reporting gives accountants real-time visibility into client finances:

- Identify cash flow issues early

- Spot opportunities for tax relief before year-end

- Offer proactive, data-backed advice

Rather than reactive number-crunching at the last minute, you can now become your client’s trusted financial guide year-round.

Recurring Revenue Opportunities

MTD has necessitated quarterly submissions, which has increased the demand for client support. What support your client required one year ago is now becoming a regular job. It is an opportunity to expand and introduce new services to your clients, such as:

- Monthly or quarterly service packages

- Tiered subscription models (e.g., Bronze, Silver, Gold)

- Add-on services like tax planning, budgeting, or MTD training

Such services will enhance cash flow and improve client retention.

Scalability

Digital workflows make it easier to manage a larger number of clients with the same internal team. With cloud-based tools, automation, and integrations:

- Your staff can manage more accounts simultaneously

- Onboarding new clients becomes faster and more consistent

- Remote teams or outsourcing partners can plug in without disruption

As your client base grows, you won’t need to increase headcount at the same pace, which will help keep margins healthy. These benefits can be further enhanced using the outsourcing accounting services offered by service providers.

Common Mistakes to Avoid During MTD Transition

Have you found any practice that has not made any mistakes during the MTD transition? We have not seen one, and since transitioning to Making Tax Digital (MTD) is a significant change, it cannot be taken lightly. Even after taking precautions, we have noticed that some practices unknowingly commit mistakes, some of which are very common.

To ensure a smooth MTD rollout in 2026 and beyond, we have listed some common mistakes to avoid and how to prevent them:

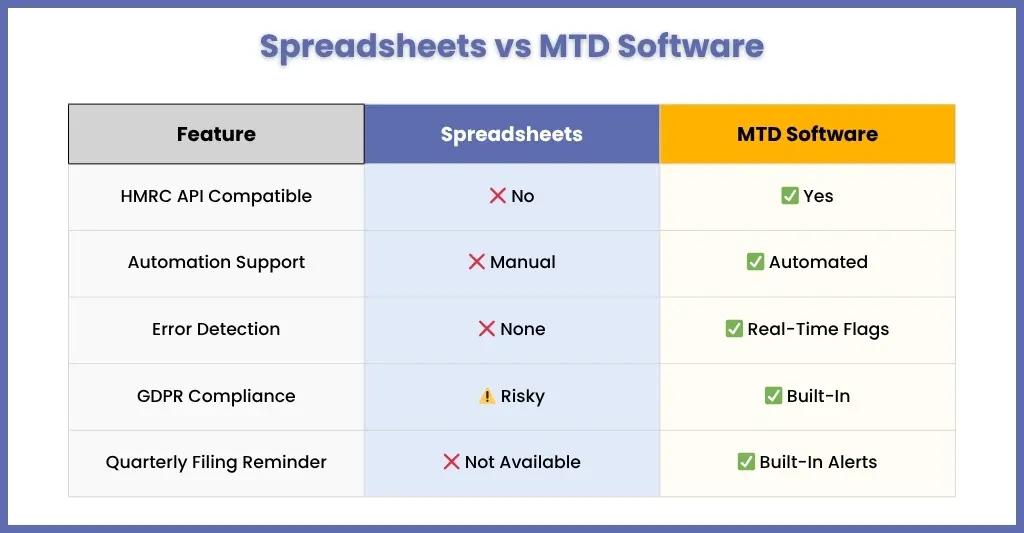

Relying on Spreadsheets

We have noticed some practices still relying on Excel or Google Sheets to track VAT returns and financial data. While spreadsheets can still play a role, they are not MTD-compliant. HMRC requires digital submissions via compatible software that connects directly through its API.

If you still insist on using spreadsheets than pair it with a bridging software. Ideally, we encourage clients to transition from spreadsheets to MTD-compliant accounting software, such as Xero and QuickBooks, for enhanced automation and reduced errors.

Delays in Client Communication

Doing last-minute MTD onboarding is a recipe for disasters like errors, missed deadlines, and frustrated clients. Hence, communicate to your clients about MTD and its compliance requirements well in advance.

By delaying communication, you reduce the time available for:

- Software onboarding

- Training sessions

- Data migration and clean-up

- Workflow testing

A well-informed client is far easier to transition smoothly.

Not Testing Software Workflows

Failing to test the workflows before switching to an MTD-compliant tool will result in:

- Failed submissions to HMRC

- Incomplete data transfer

- Frustration on deadline days

To avoid such a situation, you must conduct trial submissions, simulate client scenarios, and verify data flows correctly from source to HMRC.

Use of Outdated Systems

Old accounting systems lack cloud functionality or adequate security protocols for MTD. If you are still relying on outdated desktop software, it will lead to:

- Lead to data loss or access issues

- Put client information at risk (especially under GDPR)

Therefore, we suggest upgrading to an MTD-compliant platform, such as Xero, QuickBooks, or Sage Business Cloud, for long-term stability and scalability.

People Also Ask

HMRC created MTD to help make managing business taxes less complicated and more efficient. The motive is that having all your data on a digital system, in real time, gives you a fuller picture of your business’s tax responsibilities and a much easier way of managing them.

HMRC uses a points-based penalty system for late MTD VAT returns. Each missed submission earns one penalty point. If you crossed your penalty threshold (e.g., 4 points for quarterly submissions), you receive a £200 fine. After that, every additional late submission triggers an immediate £200 fine.

Yes, you can use spreadsheets only if you have bridging software. It is important to note that HMRC does not allow direct VAT submissions from Excel or other spreadsheet tools unless they’re connected to MTD-compatible bridging software that can transmit data via HMRC’s API.

Corient has mastered the art of offering end-to-end MTD-compliance services for effective implementation, including:

a. Client Segmentation & Onboarding: We help you identify which clients fall under MTD and prepare them accordingly.

b. Software Setup & Integration: Working with platforms like Xero, QuickBooks, Sage, and bridging tools to ensure seamless compliance.

c. Bookkeeping & Filing Support: From maintaining digital records to preparing and submitting returns, we manage it all.

d. Quarterly Monitoring & Reporting: You will receive regular updates and performance reports across your client base.

e. HMRC Compliance Assurance: Our workflows are GDPR and MTD-compliant, with strict quality checks at every step.

You’ll need to use Making Tax Digital for Income Tax if all of the following apply:

a. you’re a sole trader or a landlord registered for Self-Assessment

b. you get income from self-employment or property, or both

c. your qualifying income is more than £20,000

Corient’s outsourced tax preparation services follow Making Tax Digital (MTD) requirements by ensuring that all VAT returns and tax filings are submitted digitally to HMRC using MTD-compatible software. Our team ensures timely and accurate submissions, streamlining the process for clients while maintaining full compliance with UK regulations.

Conclusion: Embrace the Digital Shift

Making Tax Digital is now not just limited to compliance, as mandated by HMRC, but also presents an opportunity to introduce efficiency, transparency, and growth potential into your accounting practice. In this blog, we made an effort to simplify the importance of Make Tax Digital and how it can be implemented. Additionally, we focused on tools to streamline implementation and common mistakes to avoid.

Practices that prepare early will avoid compliance issues, win more trust from clients, and unlock long-term productivity gains. The sooner you modernise, the smoother will be the transition. Speaking of a smoother transition, we recommend opting for outsourcing as the path for MTD implementation. Among multiple service providers experienced in offering MTD-compliant services, Corient stands out brightly among them.

Established in 2011, Corient has made a name for itself by being one step ahead of others in incorporating processes and tools that make its services MTD-compliant. The result has been increased trust from clients, a reduction in their MTD-compliance burden, and a streamlining of the accounting process. Want to become MTD-compliant? Or need help in getting MTD- ready? Connect with us through our contact form and access to expert MTD compliance solutions for UK accounting firms.