HMRC MTD Income Tax Changes 2026 – What UK Accountants Must Know

The HMRC MTD Income Tax Changes 2026 are set to introduce fundamental reforms to the UK tax system. Initially announced in 2015, the Making Tax Digital (MTD) initiative began with VAT in 2019 and is now expanding further. Starting from April 2026, MTD for Income Tax Self-Assessment (ITSA) will become mandatory for sole traders and landlords earning over £50,000 annually, affecting around 1.7 million taxpayers across the UK.

The Make Tax Digital (MTD) initiative presents challenges and opportunities for accounting practices. Therefore, to overcome the challenges and capitalise on the opportunities, you will need to be familiar with everything about MTD. In this blog, we will discuss this topic, highlighting its impact, how to prepare for it, and who can assist you in its implementation.

Let’s get started.

Understanding the MTD for Income Tax Self-Assessment (ITSA) Reforms

If your clients are eligible for MTD for income tax self-assessment, then they are, or you can do the following things on their behalf:

- Maintain Digital Records: All records, especially income and expenses, will be stored in digital format using MTD-compliant software.

- Submit Quarterly Updates: Under MTD for Income Tax, self-assessment must be done every three months instead of once a year to the HMRC. From April 2026, the deadlines for the quarterly submissions will be 7th August, 7th November, 7th February, and 7th May.

- File an Annual Final Declaration: At the end of the tax year, a final declaration summarising the year’s financial activities must be submitted.

These reforms have been brought in to provide clarity on tax liabilities, reduce errors, and simplify the entire UK tax process.

Impact of HMRC MTD Income Tax Changes 2026 on UK Accountants

The introduction of MTD for ITSA will bring transformational changes to the way accounting practices in the UK operate. The goal of MTD is to simplify the tax process; however, it has unintentionally created some implications for your accountants. Let’s go through them:

Increased Workload

Quarterly reporting means more interaction with clients, keeping digital records, and submitting updates to HMRC. Unlike the self-assessment, which is done once a year, quarterly submissions require regular engagement with your clients throughout the year. Such reporting and maintenance of digital records demands enhanced organisational workflows and proactive management to ensure no deadlines are missed.

Need for MTD-Compatible Software

Under MTD, you will need to use HMRC-approved software for real-time data submission and record-keeping. It is crucial to select the right one for the sake of efficiency and accuracy. The software should integrate seamlessly with the existing accounting systems, automate calculations, and streamline the whole submission process.

Client Education

It is essential to educate your clients about MTD and its responsibilities. You must guide your clients on maintaining digital records, using MTD-compliant software, and submitting quarterly updates. By informing your clients (sole traders and landlords) about it, you will prevent errors and ensure full compliance. Maintain regular communication with your clients along with accounting practices.

Potential for Advisory Services

Yes, MTD will increase your accountant’s administrative burden, but it will also allow you to shift towards advisory services. MTD will automate calculations and data entry, allowing your accountants to focus more on providing insights on tax planning, cash flow management, and financial decision-making. Such a transition will create more revenue opportunities, add value to your clients and enhance your relationship with them.

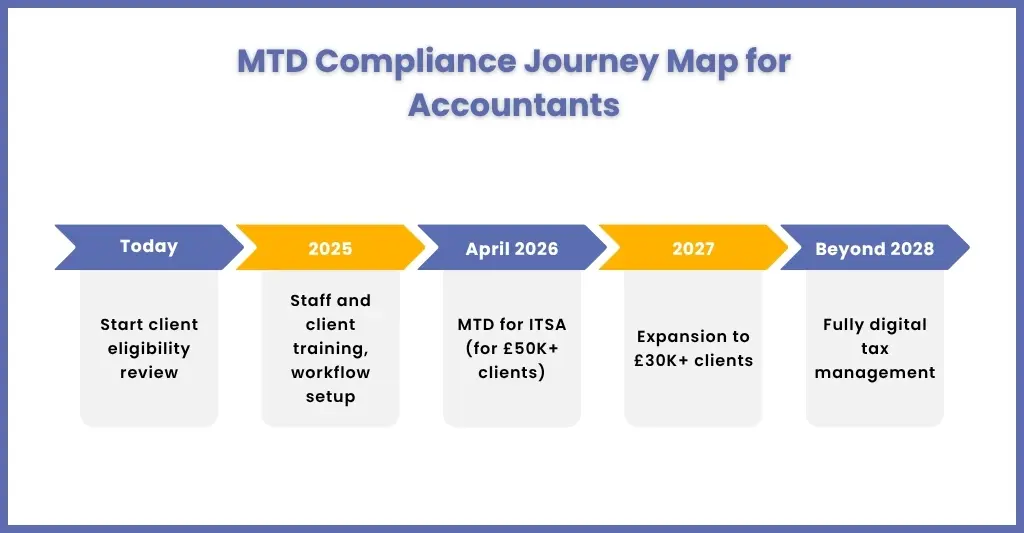

Preparing for HMRC’s 2026 MTD Income Tax Deadline

Now is the time to prepare your accountant and your clients for the 2026 MTD Income Tax, especially if they are eligible. To ensure a smooth process, you will need to:

Assess Client Eligibility

Start by listing down which of your clients will be eligible for the upcoming MTD Income Tax requirements and communicate this to your clients.

Select Compatible Software

Select the best accounting software that is MTD-compliant and meets your and your clients’ accounting requirements.

Train Staff and Clients

Create training modules for your accounting staff and clients on the new MTD process and software.

Establish New Processes

Start creating new workflows for quarterly submissions and final declarations.

Monitor Compliance

Keep a constant watch on all your clients regarding the following new accounting and MTD compliance requirements.

How These Changes Impact UK Accountants and Their Clients

Like MTD VAT, the MTD for ITSA is becoming compulsory soon, it is prompting accountants to foster a more open, flexible, and communicative relationship with clients. Maintaining such a relationship with clients is necessary because MTD mandates quarterly reporting, along with effective data management.

With robust communication, your clients will receive more timely insights into their tax position in real-time, enabling them to plan more effectively and reduce the likelihood of penalties.

Why Partner with Us for MTD Compliance?

Tuning yourself with the new MTD for ITSA compliance is easy. We wish it were a yes, but it’s not. We understand that it’s not your accountant’s expertise to maintain regular communication with your clients.

To put it simply, transitioning to MTD for Income Tax Self-Assessment (ITSA) in 2026 is a complex task which can be achieved only by partnering with a professional service provider. Corient can help ensure that your practice navigates this transition smoothly.

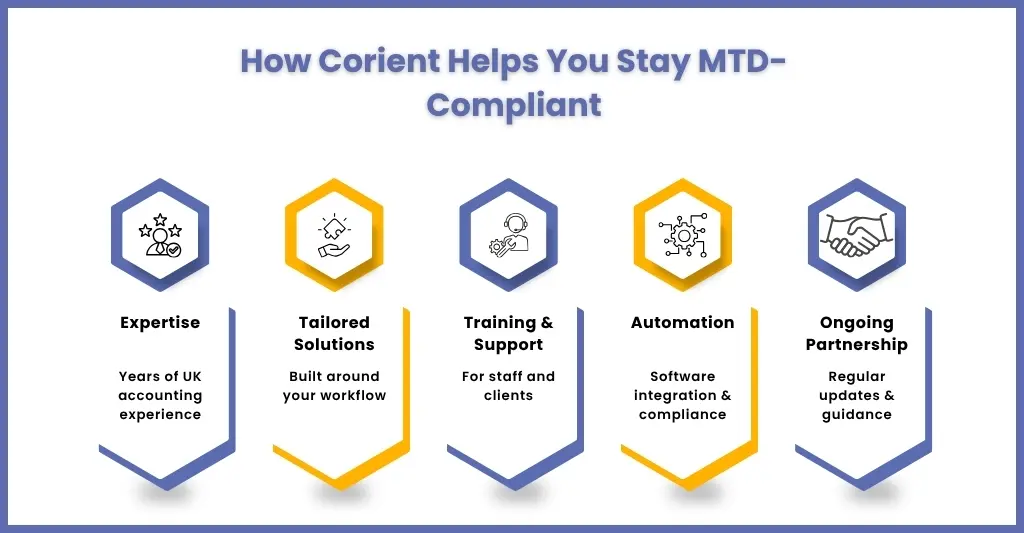

Here’s how we support UK accountants:

Expertise

Our accounting team has experience in handling MTD VAT and has deep knowledge of MTD regulations related to ITSA. Our accountants are familiar with the quarterly reporting requirements and the importance of managing digital record-keeping. We will provide you with the guidance through our accounting outsourcing services to keep your practice compliant and prevent penalties.

Tailored Solutions

Each practice has different requirements, and Corient is capable of offering MTD-compliant solutions tailored to your workflow, client base, and operational needs. This way, seamless integration is achieved with existing systems, simplifying the process.

Training and Support

To successfully adopt MTD, you will need to train your staff and your clients to understand the new process. This training can be provided by us, along with all-around comprehensive support, to ensure assistance when using new software or during quarterly reporting.

Ongoing Assistance

Our partnership extends beyond implementation. We offer all-around support to tackle any challenges, troubleshoot issues, and provide updates on regulatory changes. The assistance we provide will help with compliance, improve efficiency, and enable your accountants to focus on strategic advisory services.

People Also Ask

Under MTD, your clients will be required to maintain digital records of income and expenses related to their business or property income. These records are invoices, receipts, and bank statements.

MTD is already mandatory on VAT registered businesses and by 2026 it will be implemented in phases on Income Tax. The goal of HMRC’s MTD initiative is to digitise the tax system and make it more efficient and error-free.

MTD initiative will increase the workload in certain aspects like handling additional digital data and digital records, compliance monitoring and so on. An outsourcing partner like Corient will do this work for you so that you can focus on other accounting services.

Under MTD for Income Tax, sole trade businesses and landlords will require to maintain digital records and use HMRC-recognised software to manage, track and send updates to HMRC.

From April 6, 2026, individuals will need to comply with MTD measures if their annual turnover exceeds £50,000. Individuals with an annual turnover exceeding £30,000 will need to comply from April 6, 2027, while MTD for Income Tax will apply to individuals exceeding £20,000 annual turnover from April 6, 2028.

Digital VAT reporting under MTD offers multiple advantages for your clients. These advantages are:

a. Fewer errors and more accurate VAT returns

b. Real-time visibility of VAT obligations

c. Faster, smoother VAT filing

d. Better cash flow insights

e. Reduced risk of penalties

f. Improved efficiency for accountants and bookkeepers

Summing Up

The MTD Income Tax is coming in 2026, and it will change the entire UK tax landscape. For your accounting practice, these changes are more than just a compliance requirement; they are an opportunity to enhance client relationships and deliver greater value.

Practices that embrace these reforms early will stand out as forward-thinking and client-focused, gaining a competitive advantage in an increasingly digital tax environment. When you embrace it, you will get a competitive advantage in an increasingly digital tax environment.

Partnering with Corient ensures that your firm is fully equipped to handle the transition smoothly. We will assign a dedicated accountant to handle your MTD requirements, allowing you to focus on other accounting tasks. Our staff will assist you in selecting the ideal software to record, review, and file VAT returns digitally. Moreover, our staff is also certified and trained in QuickBooks and Xero.

Turn MTD compliance into an opportunity by partnering with Corient. Connect with us and get a free trial to check out our services.