Corporation Tax Outsourcing – Top 7 Companies to Consider in 2025

- Why Practices Are Choosing Corporation Tax Outsourcing in 2025

- Top 7 Corporation Tax Outsourcing Companies in the UK

- Choosing the Right Corporation Tax Outsourcing Partner

- Corporation Tax Services Typically Outsourced

- Why Corient is a Trusted Corporation Tax Outsourcing Partner

- FAQs on Corporation Tax Outsourcing

- Conclusion

Every accounting practice will understand the importance of maintaining accuracy and timeliness in corporation tax. With HMRC enforcing rules and deadlines tightly, accounting practices are finding it increasingly difficult to manage corporation tax for their clients in-house. In addition to this challenge, the growing client base, complex tax scenarios, and increasing demand for advisory services leave less time for meeting corporation tax requirements. All these challenges make corporation tax outsourcing a popular choice.

Corporation tax outsourcing is not just about saving money; it’s about smart work. Outsourcing will free your accountants and internal resources, improve efficiency, and ensure your clients get accurate and compliant services. In this blog, we’ll explore why more firms are outsourcing corporation tax, highlight seven outsourcing companies to consider, and share how Corient stands out as a trusted partner.

Why Practices Are Choosing Corporation Tax Outsourcing in 2025

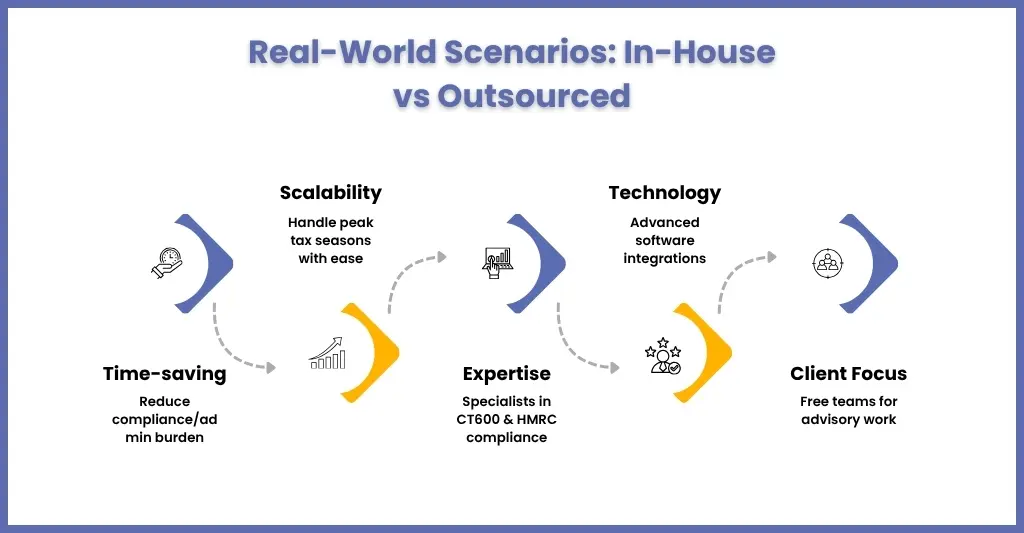

Many strong benefits are attracting practices to corporation tax outsourcing. We have listed down a few main ones, which are:

- Time-saving: By outsourcing corporation tax, you will be rescuing your accountants from heavy compliance and administrative burden

- Scalability: During tax seasons, the extra workload can be easily managed through outsourcing, eliminating the need to hire additional staff.

- Expertise: Professional outsourcing providers employ corporation tax specialists who are aware of the compliance requirements.

- Technology: Many outsourcing providers utilise the latest version of accounting software that seamlessly integrates with a wide range of practice management systems.

- Client focus: Rather than getting bogged down with multiple corporation tax compliance tasks, your accountant can now spend time on high-value advisory work.

Top 7 Corporation Tax Outsourcing Companies in the UK

1. Corient – For Professional End to End Support

Corient has established itself as one of the leading outsourcing partners for accounting firms in the UK by offering corporation tax outsourcing services. Established in 2011, our years of experience with multiple UK practices have enabled us to understand the exact requirements of HMRC, ensuring every submission is accurate and submitted on time.

The uniqueness of Corient lies in its expertise in working as an extension of your team. Whether you need help with CT600 preparation, tax computations, or HMRC correspondence, we will provide end-to-end support. We can handle multiple clients for you and their compliance, thus making time for other services. Our accountants are trained in the latest corporation tax rules beforehand.

Apart from the corporation tax outsourcing services, we offer:

- Year-End Accounts Outsourcing

- Bookkeeping Outsourcing

- Payroll Outsourcing

- Management Accounts Outsourcing

- VAT Outsourcing

In short, Corient isn’t just an outsourcing provider—it’s a long-term partner that helps UK accountants deliver better results for their clients.

2. TaxPro Outsourcing UK

It focuses on corporation tax returns for SMEs by offering affordable packages for practices that want straightforward compliance support.

3. LedgerPoint Services

Offers tax computation and iXBRL tagging services for accountants. This firm is ideal for digital compliance and MTD requirements.

4. AccuraTax Solutions

Known for offering personalised services, AccuraTax Solutions is ideal for small practices that need assistance in CT600 filings, adjustments, and HMRC queries.

5. FinTax Support

It offers corporation tax and bookkeeping outsourcing, thus helping in streamlining compliance and reducing turnaround times. This makes it ideal for practices that need quick reporting.

6. Prism Tax Outsourcing

Ideal for mid-sized accounting practices with a scaling option, this outsourcing firm helps with computations, allowances, and HMRC correspondence

7. ClearBooks Tax Support

A niche outsourcing provider that combines corporation tax preparation with cloud technology integration. ClearBooks helps firms automate parts of their compliance work while maintaining accuracy.

Choosing the Right Corporation Tax Outsourcing Partner

To get the maximum out of an outsourcing corporation, you will need to choose the right outsourcing partner.

While choosing an outsourcing partner, consider:

- Experience with UK Corporation Tax: A professional corporation tax outsourcing partner will have a full knowledge of the latest HMRC rules and processes, and select the one that possesses it.

- Data Security: Ensure GDPR compliance and secure handling of sensitive data. This will ensure your client’s data is safe and secure.

- Communication: A good outsourcing partner will always prioritise open and effective communication with you. That way, they can respond to queries immediately.

- Scalability: Check for the scaling capacity so that in the near future, they can scale up and down as per the needs of your clients

- Technology Integration: Select a partner that integrates seamlessly with your client’s existing accounting software and systems.

Corporation Tax Services Typically Outsourced

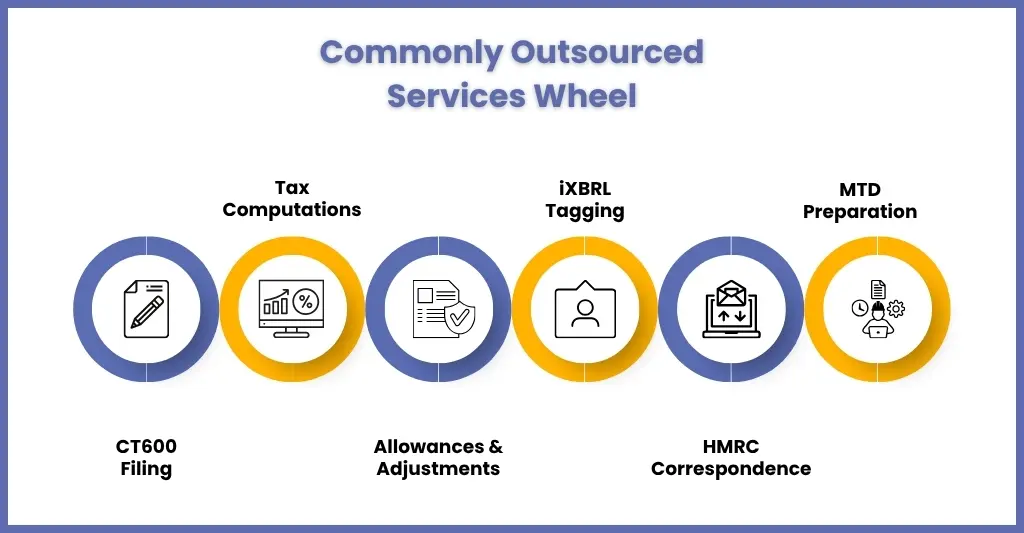

UK accounting practices often outsource routine and compliance-heavy corporation tax tasks, such as:

- Preparation and submission of CT600 returns.

- Corporation tax computations.

- Review of tax allowances and adjustments.

- iXBRL tagging and digital submissions.

- HMRC correspondence and compliance support.

- MTD preparation for corporation tax (when fully rolled out).

Why Corient is a Trusted Corporation Tax Outsourcing Partner

There are some strong benefits associated with Corient that make it highly trusted among UK accounting practices. These benefits are:

- UK-focused expertise: We have accountants with expertise in HMRC corporation tax rules and requirements.

- Accuracy and compliance: Our corporation tax outsourcing services are designed to be reliable, particularly in meeting deadlines.

- End-to-end services: We will cover everything from tax computations to HMRC correspondence.

- Secure systems: Our data security protocols and data storage infrastructure are GDPR-compliant and ISO-certified, ensuring your clients’ sensitive data remains secure.

- Scalable solutions: Our corporation tax services have the capacity to handle your small clients and scale up to handle clients with large transaction volumes.

- Dedicated support: Our accounting team will work as an extension of your practice, ensuring smooth collaboration and dedicated support when needed.

FAQs on Corporation Tax Outsourcing

These are tasks such as CT600 preparation, tax computations, iXBRL tagging, and HMRC submissions that are handled by an external provider instead of in-house staff.

Look for providers with UK-specific expertise, strong security practices, and the ability to integrate seamlessly with your firm’s systems.

Yes, provided you choose a partner with robust security systems, GDPR compliance, and transparent processes. Leading outsourcing companies invest heavily in data protection to ensure the security of your clients’ information.

Outsourcing allows your client to streamline their processes, improve service delivery, and reduce operational burdens.

Corporation tax is a tax paid by businesses on profits they make. The main rate, paid by businesses with profits over £250,000 during their accounting period, is 25%, while businesses with profits of £50,000 or less pay a rate of 19%.

Conclusion

Corporation tax outsourcing is becoming the wise choice for UK practices in 2025. It’s not just about saving time or reducing costs; it’s about improving efficiency, ensuring compliance, and allowing your accountants to focus on delivering real value to clients.

Among the many providers available, Corient stands out as a trusted partner with deep UK expertise, secure systems, and a client-first approach, meaning maximum benefits. If your practice is considering outsourcing corporation tax, Corient offers the support, scalability, and reliability you need to grow with confidence.

By choosing the right partner, your firm can navigate corporate tax compliance with ease, keep clients satisfied, and focus on what truly matters, ultimately helping businesses succeed. If you need assistance with corporation tax compliance, connect with us to get a free trial and make an informed decision.

Don’t risk errors or penalties in 2025. Book a free consultation with Corient and discover how our UK-focused corporation tax outsourcing can streamline compliance for your practice.