There is no better way to expand your accounting firm than getting new clients. It also sends a message that your services and expertise are in demand, giving you a chance to build long-term relationships. However, getting a client onboard is not as simple as it seems; it can get complicated if not handled properly. The process of onboarding involves collecting documents, setting expectations, ensuring compliance, and streamlining processes, which means there is a lot to manage.

To manage the client onboarding process a system must be designed for smooth client onboarding, this system will set the foundation for smooth collaboration, compliance, and client satisfaction. It doesn’t matter who your client is; by having a client onboarding checklist, you will ensure that nothing is taken for granted. This checklist will guide you right from the first step so that your onboarding process is quick, professional, and stress-free.

Let’s understand client onboarding in detail so you and your clients can enjoy a seamless experience.

What is Client Onboarding for Accounting Firms?

Client onboarding is a process of familiarising your new client with your accounting firm. The process starts with a meeting with your new client, where you will identify their needs. It is also an opportunity to fine-tune your client’s expectations, understand your client’s preferred communication style, and familiarise your firm’s operations.

The primary objective of client onboarding is to put your new clients at ease and give them a positive experience. It should make them realise they have made a good decision by selecting your accounting firm. When your clients send you an enquiry, you must set your client onboarding process into motion. With the best onboarding process, you can give your clients peace of mind and trust, which will help in building a strong and long-lasting relationship.

Importance of Client Onboarding in Accounting

The importance of client onboarding can be gauged from the fact that when done correctly, it will position your accounting firm to retain clients and become profitable. According to multiple researches, it takes an average of 60 days to get a new client onboard, and those who are experienced in the accounting industry complete their onboarding process in less than 30 days.

So, looking at the average time taken for onboarding, we can say that the shorter the duration of the onboarding process, the happier the client will be. It’s also in your interest to speed up the process; after all, with each passing day, the opportunity to earn profits will diminish.

When you have a good onboarding process, it creates a solid foundation based on which trust is built on both sides. Through this process, you get a clear picture of your client’s expectations, giving you an idea of how much resources will be needed and at what cost. It also helps your accounting firm understand the client’s business goals and motivation.

Onboarding is also a process where your team gets the opportunity to get acquainted with your client and vice versa. It is also an occasion to explain your accounting processes to your clients and ensure that they align with their accounting requirements.

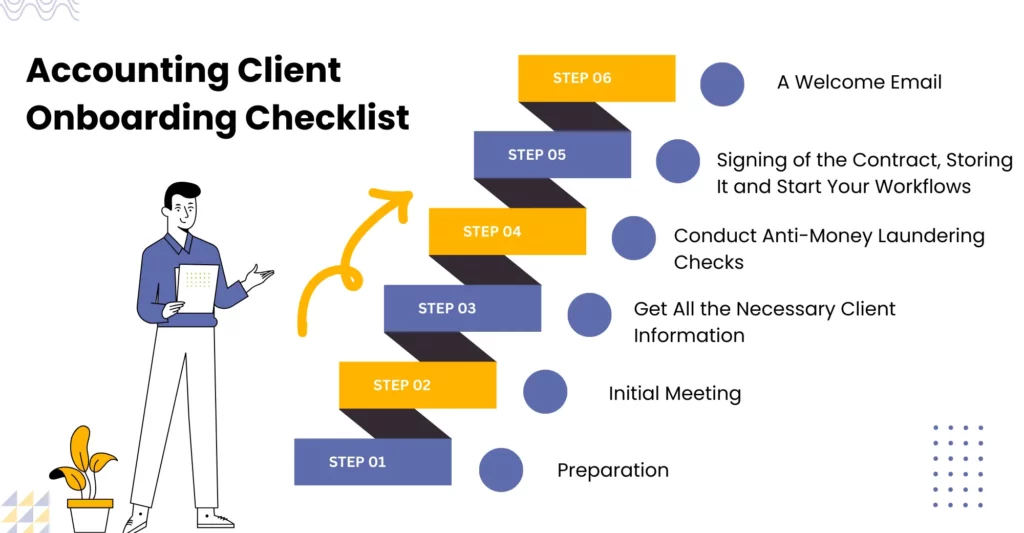

Accounting Client Onboarding: Steps to Follow

It’s important to get accounting client onboarding right from the first time to create a good impression on your clients, and the best way to do that is by having an effective client onboarding checklist.

The main function of the checklist is to gather all the relevant information from your clients, such as contact information, biographical background, business details, risk assessments, and reporting requirements. When these information sources are available, the onboarding process becomes smooth.

Here’s what you must implement to standardised your accounting client onboarding:

Preparation

Being proactive will be the key to your success, especially when multiple competitors are vying for new clients. Hence, it is important for you to grab the opportunities at once when a potential client contact you. Usually, a client will enquire about your services, and you will have to gather all the relevant information about them and their accounting requirements.

Initial Meeting

This step gives you a chance to introduce your accounting team to the potential client and showcase your service offerings and expertise. Depending on the potential client’s location and availability, the meeting could be face-to-face or online.

This initial meeting is to discuss your role and set expectations. Both will also decide on the preferred mode of communication for future work and the scope of accounting services you will provide. Ample time must be given for this initial meeting so that everything is covered and the client has enough time to ask questions and clarify their doubts.

Get All the Necessary Client Information

If things are moving forward, ask the potential client to send a list of important information for handling their accounts. These details are:

- Personal information, including the client’s name, business name and full contact details

- Access to their accounting software

- Access to online banking, loan accounts, credit cards

- Copies of prior tax returns

- Access to inventory records

Conduct Anti-Money Laundering Checks

All accounting firms in the UK must undertake Anti-Money Laundering (AML) checks on new clients before acting for them. This will usually come before a letter of engagement.

Signing of the Contract, Storing It and Start Your Workflows

With all the modalities between you and your client sorted, it is time to sign the contract; this contract must be stored on your client management software for future reference.

Once the contract signing is done, focus on the workflows to map job deadlines and assign task priorities. Doing this manually will be difficult, so seek the help of accounting practice management software. With this tool, you can automate tasks, especially recurring ones, and gain maximum visibility of all the job activity in your accounting practice.

A Welcome Email

A personal touch will go a long way in building a long-term relationship with your client. For instance, your practice’s branded email welcoming them will do the trick. Your welcome email must be in easy-to-understand language so that your client can understand the following steps, expectations, and the timeline of the project.

Additional Financial Information

Even after the onboarding your new client you may require access to your client’s financial information such as:

- Financial statements (specifically, income statements, cash flow statements, and balance sheets)

- Recent account reconciliations

- Prior tax returns

- Invoices

- Payroll information

Following these steps is essential, but we also understand that it can become burdensome to implement it fully. Hence, to reduce your accounting team’s work stress and enhance your client onboarding you must try accounting outsourcing services offered by professional accounting outsourcing service providers.

How Technology Can Enhance Client Onboarding

Client onboarding is not just a function for getting new clients. It is also an opportunity to develop long-term relations between your accounting practice and potential clients. However, leveraging automation, AI, and cloud-based solutions can further enhance client onboarding, reducing manual work and improving accuracy and efficiency.

Benefits of Technology in Client Onboarding

Automated Data Collection and Verification

Using AI-driven document verification, you can eliminate extensive paperwork and manual data entry by automating the data collection and verification process. This will reduce errors, speed up onboarding, and ensure full compliance with Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations.

Digital Identity Verification

Biometric authentication and e-signatures will streamline the entire onboarding process while maintaining security. Through digital identity verification, you can quickly identify the clients and reduce unnecessary paperwork and in-person meetings.

Automated Workflow and Task Management

You can use workflow automation tools to assign tasks, send automated follow-ups, and track progress. This ensures that no step in the onboarding process is missed and helps improve overall efficiency.

Integration with Accounting Software

Seamless integration with the best accounting software, such as Xero, QuickBooks, or Sage, allows for direct data migration and synchronisation. This reduces duplicate data entry and ensures client financial information is readily available for reporting and analysis.

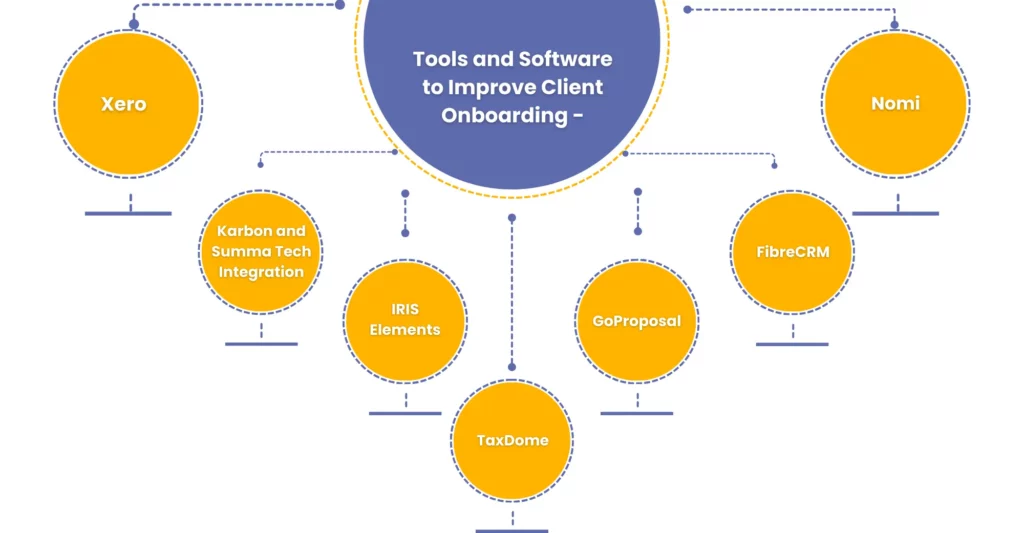

Tools and Software to Improve Client Onboarding

When used, specialised tools will enhance the client onboarding process for UK accounting practices. We are mentioning some of them that will streamline various aspects of client onboarding:

Xero

Xero HQ Ask: An ideal platform for requesting and securely getting client information and documents, ensuring efficient communication and data collection.

- Hubdoc: A tool to save time that goes into your clients’ document collection.

- Xero Practice Manager: Ensure secure storage and management of client information, thus ensuring a seamless onboarding experience.

Karbon and Summa Tech Integration

Integrating Karbon and Summa Tech will enhance your onboarding process by combining practice management capabilities with efficient client data collection and verification tools.

IRIS Elements

IRIS Elements offers a comprehensive client onboarding solution tailored for accountants:

- Proposal Manager: Create and deliver bespoke proposals that clients can accept with a single click.

- AML Compliance: Run essential Anti-Money Laundering checks and maintain critical compliance.

- Practice Management: Organise your practice, automate administrative tasks, and seamlessly integrate clients into your workflow.

TaxDome

TaxDome is an all-in-one practice management software that aids in client onboarding through:

- Secure document management

- Custom-built forms and surveys

- Client portal with secure messaging

- Unlimited e-signatures

- Synced email to keep communications in one place

GoProposal

GoProposal assists accounting firms in improving client onboarding by:

- Creating professional proposals and managing engagements

- Establishing transparent, consistent pricing

- Delivering compliance-driven engagement letters

- Offering AML features for speedy identity verification and performing KYC checks

FibreCRM

Developed specifically for accountants, FibreCRM’s onboarding solution covers key steps in onboarding a new customer and managing risk, including:

- Companies House integration

- Client data capture

- KYC & risk due diligence

- AML checks via SmartSearch, CreditSafe, or ID3 Global

- Professional clearance

- Engagement letters with e-signing

- Integration with practice management systems

Nomi

Nomi provides CRM software tailored for accountants and bookkeepers, featuring:

- Robust task management

- Automatic KYC checks

- Digital onboarding processes

- Client communication management

- Automated reminders

By using these tools in your onboarding operations, you can enhance the efficiency of your practices, ensure compliance, and provide a seamless onboarding experience for new clients.

People Also Ask

1. What onboarding process does Corient Business Solutions use for new accountancy firms?

Corient Business Solutions has an established onboarding checklist for new accountancy firms. The checklist is as follows:

a. Initial Meeting – Where you introduce your accounting team to the potential client and showcase your service offerings and expertise.

b. Get All the Necessary Client Information

c. Conduct Anti-Money Laundering Checks

d. A Welcome Email

e. Signing of the Contract, Storing It and Starting Your Workflows

Conclusion

By following the above-mentioned client onboarding checklist, you will be in a position to smoothen the onboarding experience of your new clients without compromising on compliance and laying a foundation for a long-lasting relationship.

It is also important to mention that the checklist can be reviewed and refined according to the evolving requirements of your clients and the accounting industry. However, it is understood that implementing the checklist and periodic review is a time-consuming process. To ease this pressure, we suggest you explore the option of outsourcing to a service provider.

While the UK is home to several reputed accounting outsourcing providers, Corient has been a rising star, especially among accounting practices. Since 2011, we have been helping practices streamline their accounting functions in every possible way. Along with client onboarding services, we also offer services ranging from bookkeeping, payroll, year end, corporation tax, and audit services. Please write down your requirements or doubts on our website contact form, and our executives will contact you as soon as possible.

Looking forward to a fruitful partnership.