You can get in touch with HMRC regarding Corporation Tax by phone, online or by post – the right approach will depend on the level of urgency and how comfortable you are with navigating their online services. Given that HMRC handles the tax affairs of more than 5.4 million businesses, handling tens of millions of phone calls every year, choosing the right route can be the difference between a hassle-free experience and a stressful one.

This guide will take you through each of the options: phoning up HMRC, trying to contact them online, and the postal route. We will take it step by step and explain what you need to have to hand beforehand to make the process as smooth as possible. We’ve written this specifically for UK accountants, company directors and practices who want straightforward help rather than a load of tax jargon, packed with real-world tips on How can I contact HMRC for corporation tax inquiries.

Key takeaways

- The main Corporation Tax helpline is 0300 200 3410 (or +44 151 268 0571 from abroad), open Monday to Friday, 8 am–6 pm (UK time).

- Have your 10‑digit Unique Taxpayer Reference (UTR) ready, as HMRC cannot tell you your UTR over the phone.

- For many routine tasks, your online business tax account is faster than calling, especially for filing, checking balances and making payments.

- You can still write to HMRC at “Corporation Tax Services, HM Revenue and Customs, BX9 1AX, United Kingdom” if you prefer post or need to send documents.

- Large or complex practices may have a dedicated HMRC Customer Compliance Manager for corporation tax issues.

You can contact HMRC for Corporation Tax inquiries by phone, online, or by post, and the best method depends on how urgent your query is and how comfortable you are with digital services. This UK‑focused guide explains each option in plain English so accountants, company directors, and freelancers can pick the right route with confidence.

How to contact HMRC for Corporation Tax in the UK

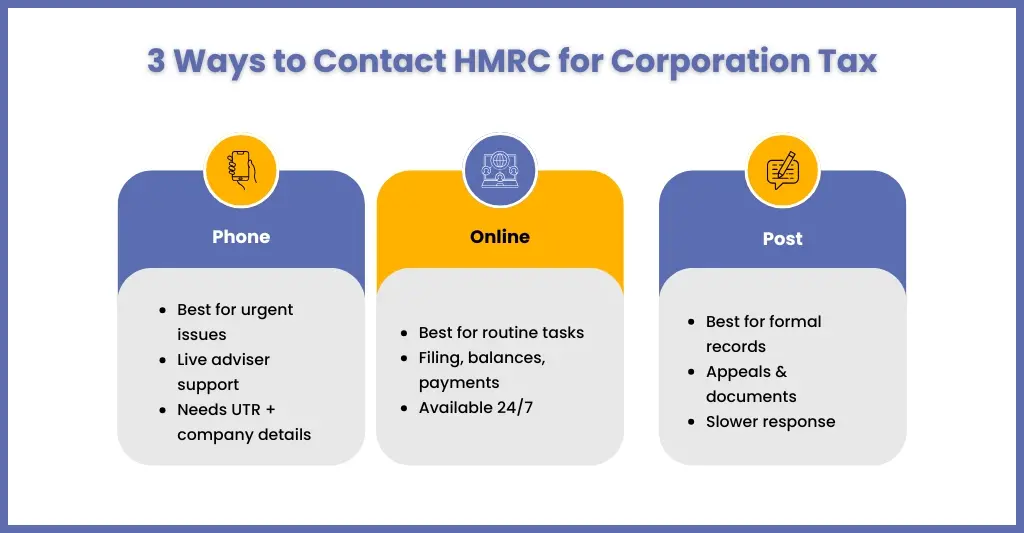

When it comes to Corporation Tax, HMRC gives you three main ways to get in touch: phone, online, and post.

A simple way to think about it is like choosing how to speak to your bank: call when it is urgent, go online for routine tasks, and write when you need a paper trail.

For UK accountants and practices, understanding which route to use saves time and stress.

It also helps you avoid back‑and‑forth with HMRC when a deadline is close or a client is worried.

HMRC Corporation Tax helpline numbers (UK and overseas)

The Corporation Tax helpline is the fastest way to get live help from a person when you have a problem that cannot wait.

You go through a short menu, then an adviser will answer and ask security questions.

Main Corporation Tax phone numbers

- UK Corporation Tax helpline: 0300 200 3410

- From outside the UK: +44 151 268 0571

- Opening hours: Monday to Friday, 8am–6pm (UK time)

- Closed: weekends and UK bank holidays

If you want to avoid long queues, calling earlier in the day, roughly between 8.30 am and 11 am, is usually better.

Many accountants plan their HMRC calls in this window to reduce waiting time.

Information you need before calling HMRC about Corporation Tax

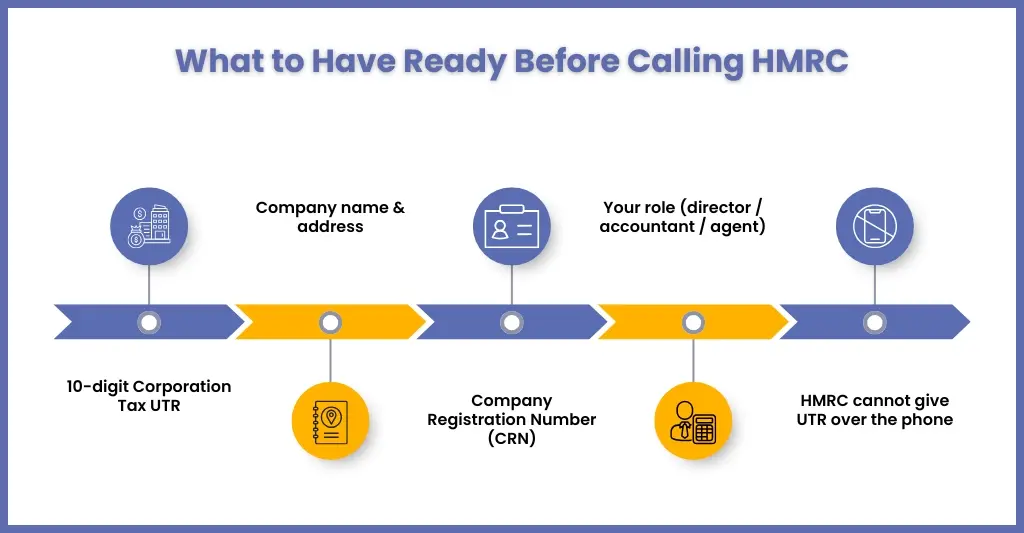

Calling HMRC about Corporation Tax is a bit like going through security at an airport – if you do not have the right details, you will not get through.

HMRC will ask questions to make sure they are speaking to the right person about the right company.

Have these details to hand before you dial:

- Your 10‑digit Corporation Tax Unique Taxpayer Reference (UTR)

- Company name and registered office address

- Company registration number (CRN)

- Your role (director, accountant, or authorised agent)

HMRC advisers cannot tell you your UTR over the phone.

If you have lost it, you usually need to check old HMRC letters, your business tax account, or your company’s records instead of relying on the helpline.

When to call HMRC about Corporation Tax

The phone is best when you need to sort something out quickly or when the online information does not make sense.

It also helps when a client is anxious and wants reassurance from HMRC directly.

You should consider calling HMRC if:

- A Corporation Tax payment is missing or showing incorrectly on your account

- You have a penalty or a late filing notice that you do not understand

- You are close to a deadline and unsure what exactly to file or pay

- An online service has an error, and you cannot move forward

For accountants, writing a summary before calling (“who, what, when, amount”) makes the conversation smoother.

It also helps the adviser give clear answers the first time rather than putting you on hold repeatedly.

Using your HMRC online business tax account for Corporation Tax

For many UK businesses, the online business tax account is the best starting point for Corporation Tax.

Think of it as a simple dashboard where you can see what HMRC sees.

Through your online account, you can:

- File your Company Tax Return (CT600) and upload accounts

- Check how much Corporation Tax you owe and when it is due

- View payments you have made and any repayments due

- Set up or change a Direct Debit for Corporation Tax

- Read secure digital messages and letters from HMRC

You sign in using your Government Gateway details.

Agents and accountants use their own online portals and client authorisations to access client Corporation Tax accounts.

HMRC digital assistant for Corporation Tax queries

HMRC also offers a digital assistant (a simple chatbot) on the GOV.UK website for common Corporation Tax questions.

It guides you through menus and can signpost you to the right web pages and forms.

The digital assistant can help with topics such as:

- Understanding accounting periods for Corporation Tax

- Changing company details held by HMRC

- How Corporation Tax repayments work

- Ways to pay Corporation Tax and how long payments take

While it will not give bespoke tax advice like an accountant, it is handy when you want fast, basic information late at night or at the weekend.

It can also help filter out simple queries so you only phone HMRC when you really need to.

When to use HMRC online services instead of calling

Online services are ideal when you know what you want to do and just need to get it done.

They save time for both you and HMRC.

Use your business tax account when you:

- Need to file a return or check if a return has been received

- Want to confirm how much Corporation Tax is outstanding

- Want a quick record of payments and due dates for your files

- Prefer to send messages digitally rather than by post

For small limited companies and freelancers, the online account often answers “how much” and “when” in minutes.

You can then call HMRC only if something still looks wrong.

HMRC postal address for Corporation Tax in the UK

Even in the digital age, the post still has its place for Corporation Tax.

It is especially important when HMRC requests that you send documents or when you require a formal paper trail.

Standard Corporation Tax postal address

Corporation Tax Services

HM Revenue and Customs

BX9 1AX

United Kingdom

Always include:

- The company’s 10‑digit Corporation Tax UTR is on every letter

- Company name and registered office address

- Company registration number (CRN)

If you are replying to a specific HMRC letter, always use the address printed on that letter, not the generic BX9 1AX address.

That helps your reply reach the right department faster.

Best practice when writing to HMRC about Corporation Tax

Treat letters to HMRC like professional client letters: short, clear, and focused on what you want to happen.

This makes it easier for HMRC staff to understand and action your request.

Good practice includes:

- Use plain English and avoid heavy jargon

- Put the UTR clearly at the top of each page

- Explain the issue and the outcome you are seeking in a few short paragraphs

- Number pages and include copies (not originals) where possible

- Keep your own copies and consider using recorded or tracked delivery

This approach is especially useful for appeals, complex technical issues and responses to enquiry letters.

It also helps if you later need to show that you contacted HMRC in good time.

Contacting HMRC for large or complex UK businesses

Some larger or higher‑risk businesses are allocated a Customer Compliance Manager (CCM) by HMRC.

This gives you a named contact rather than relying only on general helplines.

If your business has a CCM:

- They are usually your first point of contact for Corporation Tax matters

- They can coordinate complex questions across HMRC departments

- You may be able to communicate by phone, email or planned meetings

If you are unsure whether you have a CCM, check recent HMRC correspondence to the finance director or tax team.

Your external tax advisers can also help confirm whether a CCM has been assigned.

Extra HMRC support for people who need help

Not everyone finds phones or online forms easy.

HMRC offers extra help for people who have accessibility needs or personal difficulties.

Support can include:

- Relay and text services for those who cannot hear or speak on the phone

- Extra support teams for people struggling with forms, letters or payments

- In some cases, in‑person meetings or appointments

If you or your client needs this kind of help, explain the situation when you contact HMRC.

Staff can then direct you to the most suitable service.

Real‑life examples for UK accountants

Accountant fixing a missing Corporation Tax payment

An accountant sees that a client’s Corporation Tax payment has left the bank but is not showing in the HMRC account.

- First, they log into the business tax account to check the payment reference and dates.

- If it is still not there after a few days, they phone the helpline with the UTR and bank proof ready.

- If HMRC requests evidence, they send copies by post with a clear cover letter.

Large company with a complex Corporation Tax enquiry

A large UK group receives a detailed enquiry letter about transfer pricing and reliefs.

- The tax team contacts their Customer Compliance Manager using the details on previous HMRC letters.

- They agree on a timetable and format for providing information and documents.

- They follow up by post and, where offered, secure digital channels to share large files.

FAQs about how can I contact HMRC for corporation tax inquiries?

1. What is the main HMRC contact number for Corporation Tax?

The main number for Corporation Tax inquiries in the UK is 0300 200 3410, with opening hours usually 8am–6pm Monday to Friday, excluding bank holidays. From outside the UK you normally call +44 151 268 0571.

2. Can I email HMRC about Corporation Tax?

HMRC does not generally publish a standard email address for Corporation Tax queries due to security and confidentiality. Some larger or complex businesses may have email contact with a dedicated Customer Compliance Manager, but most companies should use phone, online services or post.

3. How do I contact HMRC online about Corporation Tax?

You normally contact HMRC online through your business tax account on GOV.UK, where you can file returns, check balances and send messages. You can also use the HMRC digital assistant for basic Corporation Tax questions and to find relevant guidance.

4. Where do I send Corporation Tax letters to HMRC?

For general Corporation Tax correspondence, you can write to: Corporation Tax Services, HM Revenue and Customs, BX9 1AX, United Kingdom. If you are replying to a specific HMRC letter, always use the address on that letter so your response reaches the correct team.

5. Do I need my UTR to contact HMRC about Corporation Tax?

Yes, you should always have your 10‑digit Corporation Tax Unique Taxpayer Reference when contacting HMRC, whether by phone or post. HMRC will not usually discuss detailed matters without it, and advisers cannot provide your UTR over the phone.

Conclusion: choosing the best way to contact HMRC for Corporation Tax

In this blog, we have tried to simplify how you can connect with HMRC to communicate your corporation tax inquiries. For quick questions or worrying about deadlines, the phone will do the job. For routine tasks such as filing returns, an online business tax account is the smartest and fastest way.

For UK accountants, freelancers and company directors, the safest approach is to start online, escalate to a call if you are stuck or it is urgent, and fall back on written correspondence when you need a clear, documented trail.

Still in need of assistance in handling your corporation tax queries? Get a capable Corporation tax outsourcing partner, like Corient, which will get the job done smoothly. We are an outsourcing company that handles corporation tax tasks for accounting firms and their queries with HMRC. Our services have successfully streamlined the entire corporation tax process for accounting firms.

To specify any special requirements, communicate on the contact form, and we can get your job done.