The Future of Offshore Accounting: Trends, Technology, and What Firms Need to Know

- Why Offshore Accounting is Becoming a Strategic Necessity

- Technological Shifts Driving Offshore Accounting

- Key Trends Shaping the Future

- Benefits for Firms Adopting Offshore Accounting

- The Next 5–10 Years of Offshore Accounting

- How Corient Supports Firms in Offshore Transformation

- Offshore Accounting FAQs

- Conclusion

Once regarded only as a cost-saving measure, offshoring accounting has undergone a rapid transformation, making its future bright. As a last resort, offshoring is proving to be a boon for practices seeking long-term investment to stay competitive in the UK accounting market. To put it straight, offshoring has turned into a strategic necessity for practices in the UK.

So how does transformation happen? It is a combination of advanced technologies, changing clients’ expectations, and the need for scalability that has made offshoring relevant. Let’s understand it in detail.

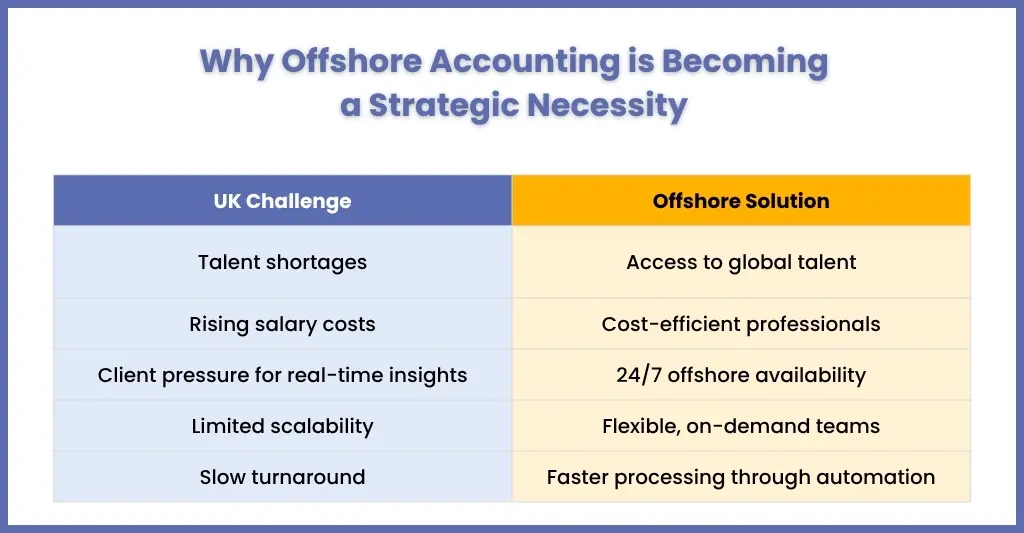

Why Offshore Accounting is Becoming a Strategic Necessity

In recent years, accounting practices have started facing rising challenges while performing their accounting tasks for their clients. These challenges, ranging from talent shortages to real-time insights from your clients, have made offshore accounting relevant. Let’s understand these challenges in detail.

Talent Shortages and Rising Costs

Like you, many accounting practices in the UK are facing talent shortages, which is slowing down services. Also, the talent available is quite expensive, placing an additional strain on your practice. Through offshoring, you can get access to a reasonably priced talent pool and overcome talent shortage challenges.

Client Expectations for Real-Time Services

To survive a fast-paced business market, your clients will rightfully demand faster turnaround and real-time financial insights. These rapid insights, available 24/7, can be provided by offshore accounting teams. These teams will help your clients with their queries rapidly and efficiently.

Scalability and Flexibility

Scaling up requires investments in hiring, training, and infrastructure costs, which can be avoided through offshore accounting. Apart from handling the increased accounting work from your clients, it also provides you with the flexibility to expand your accounting services and enter new markets.

Technological Shifts Driving Offshore Accounting

It’s a fair assessment that those technological advancements have made offshore accounting more efficient, accurate, and secure, enabling practices to deliver faster without quality compromises.

Innovations like Artificial Intelligence, ML and blockchain have made collaborations between in-house and offshore teams simple, while strengthening the financial data security. Let’s understand each of those technologies:

Artificial Intelligence (AI) and Automation

AI and automation have changed the way offshore accounting functions by restructuring routine tasks like data entry, reconciliation, and report generation. As per the 2025 survey of Accountancy Age, 81% of accountants report that AI boosts productivity, and 93% use AI in strategic advisory roles.

Cloud-Based Platforms

Cloud technology promotes collaboration between your in-house onshore team and offshore teams. It provides real-time access to financial data and documents, boosts efficiency, and reduces the risks associated with traditional approaches.

Blockchain for Enhanced Security

Blockchain technology offers enhanced security features, ensuring the integrity and transparency of financial transactions. Its implementation in offshore accounting can build trust with clients and regulatory bodies.

Transparency and data security have made offshore accounting more reliable. It offers more security features, thus ensuring integrity and transparency. The technology builds trust among clients and regulatory bodies for offshoring accounting.

Key Trends Shaping the Future

The changing client expectations and market shifts are pushing offshore accounting to evolve rapidly. There are some key trends that are changing the way how the job is getting done. By understanding these trends, you can stay ahead of the curve and use offshoring to your advantage.

Integration of ESG Reporting

Environmental, Social, and Governance (ESG) reporting is becoming a standard practice due to environmental awareness and responsibility. Hence, offshore teams are expected to collect data related to ESG, which reflects the growing importance of sustainable business operations.

Shift Towards Strategic Advisory

Right now, routine accounting tasks are being automated via AI tools and accounting software. This has opened a window for offshore accountants to take on more strategic advisory roles like financial forecasting and business consulting, adding greater value to client relationships.

Benefits for Firms Adopting Offshore Accounting

Adopting offshore accounting offers accounting practices a range of strategic and operational advantages that go far beyond simple cost savings.

Cost Efficiency

Reduction in overhead costs is one of the major attractions for offshoring. When you get access to skilled experts at a fraction of the cost, then you can maintain the quality of your accounting services without additional hiring. It will save your costs, which can be diverted toward client engagement, technology, and advisory services.

Access to Global Talent

Offshore accounting opens the door for you to access global talent. You will get multiple options to source specialised expertise for bookkeeping, tax compliance, auditing, and financial reporting. With the combo of AI in accounting and expert assistance, your practice can handle any complex client or accounting requirement.

Enhanced Service Delivery

Offshore teams often work across different time zones, thus enabling them to offer 24/7 support and increased turnarounds. Your clients will benefit from real-time insights, quick issue resolutions, and long-term trust in you.

Scalability

Professional offshore accounting firms can scale immediately to accommodate sudden work, seasonal demands, or clients’ business growth. Instead of investing in-house, your offshore partner will scale up and meet your needs without compromising on quality.

Focus on Core Competencies

When you offload a considerable number of time-consuming tasks to your offshore teams, you will be spared time to focus on other essential functions like strategic advisory, financial planning, and client relationship management. These tasks add value to your services and create an image among your clients as a forward-thinking and client-focused practice.

The Next 5–10 Years of Offshore Accounting

In the coming years, technology will further integrate offshore accounting with onshore operations. Firms will focus more on delivering high-value services like strategic financial planning and business consulting, while automation handles routine tasks. Those who embrace these advancements and invest in technology will position themselves strongly for long-term success.

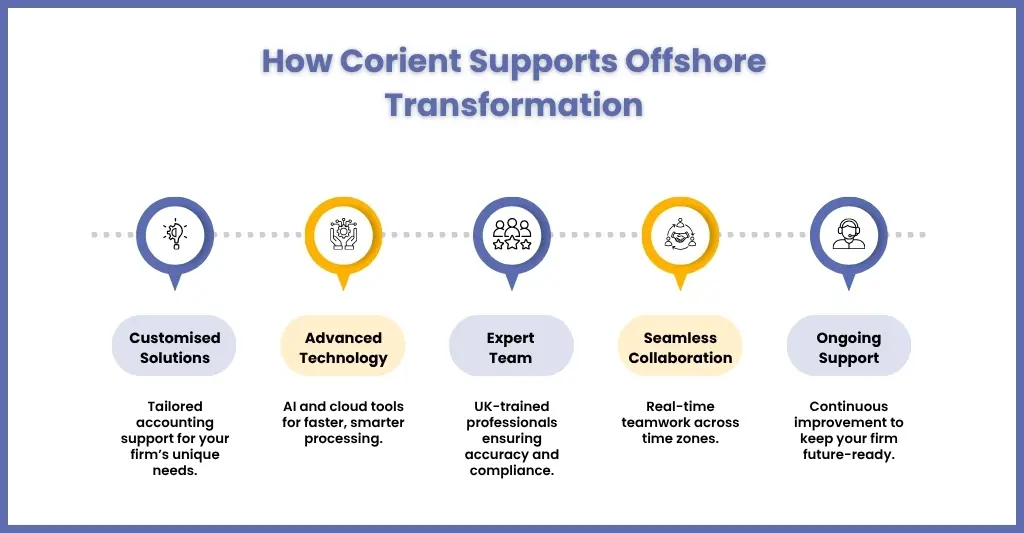

How Corient Supports Firms in Offshore Transformation

Among the top offshoring companies in the UK Corient stands out because we know that every UK-based accounting practice has unique accounting tasks and client needs to fulfil.

To satisfy these needs, we have designed our offshore solutions to help your practice become efficient, maintain compliance, and scale seamlessly using the latest tools and tech.

Here is how we are going to help you:

Customised Accounting Solutions

We will provide you with offshore accounting services that are designed to meet your unique requirements. From routine bookkeeping and VAT processing to comprehensive tax preparation and financial reporting, our solutions are open to clients of all sizes. Our tailored approach will match your in-house team and meet your client’s expectations.

Advanced Technology Integration

Corient has access to cutting-edge technology like AI-driven automation to streamline the accounting process. Through automation, manual errors decrease, accelerate data processing, and provide real-time insights. Also, cloud integration ensures both the onshore and offshore teams can collaborate efficiently across multiple time zones.

Expert Team

We have a pool of qualified professionals with deep expertise in UK accounting standards, HMRC regulations, and industry best practices. All our accountants are trained to handle accounting tasks accurately while ensuring regulatory compliance.

Seamless Collaboration

Our offshore team will work like an extended team, collaborate in real-time, and maintain clear communication. It will enable you to monitor progress, track deliverables, and maintain full control over client data without disruption.

Ongoing Support

Our services extend towards providing continuous support, process optimisation, and advisory services. This way, we can help your practice adapt to changing regulatory or technological requirements. This ongoing partnership ensures your offshore accounting operations remain smooth, efficient, and fully aligned with your strategic goals.

Offshore Accounting FAQs

Offshore accounting involves delegation of financial tasks, like bookkeeping and payroll, to a service provider based in another country to access specialised talent at low cost.

Offshore accounting will be associated more with increased automation, synchronisation with onshore teams, and a push towards offering advisory services.

Accounting is increasingly being influenced by automation which has helped handling tedious tasks.

Technology enhances the efficiency, accuracy, and security of offshore accounting by automating routine tasks, enabling real-time collaboration, and ensuring compliance with regulatory standards.

India: Known for its large pool of qualified professionals and cost-effective services.

Philippines: Offers strong English communication skills and cultural compatibility.

Poland: Provides a skilled workforce with expertise in EU regulations.

Malaysia: Features a growing number of finance graduates and competitive pricing.

Mexico: Emerging as a nearshore option for US firms seeking proximity and cost savings.

Conclusion

Offshore accounting is a viable alternative that offers easy access to technology and a flexible model, boosting your accounting efficiency, compliance, and scalability. By partnering with Corient, you will get the best out of offshoring, from customised services and automation of bookkeeping, payroll, and year-end tasks to access to experts. We will ensure that you get the maximum out of offshore accounting while maintaining the highest standards that your client expects.

Ready to scale smarter? Connect with us and book a free consultation with Corient today and discover how our offshore accounting solutions can help your firm grow.