Affordable Payroll Services for UK Accountants – Save Time and Money

- Why Affordable Payroll Services Are Essential for UK Accountants

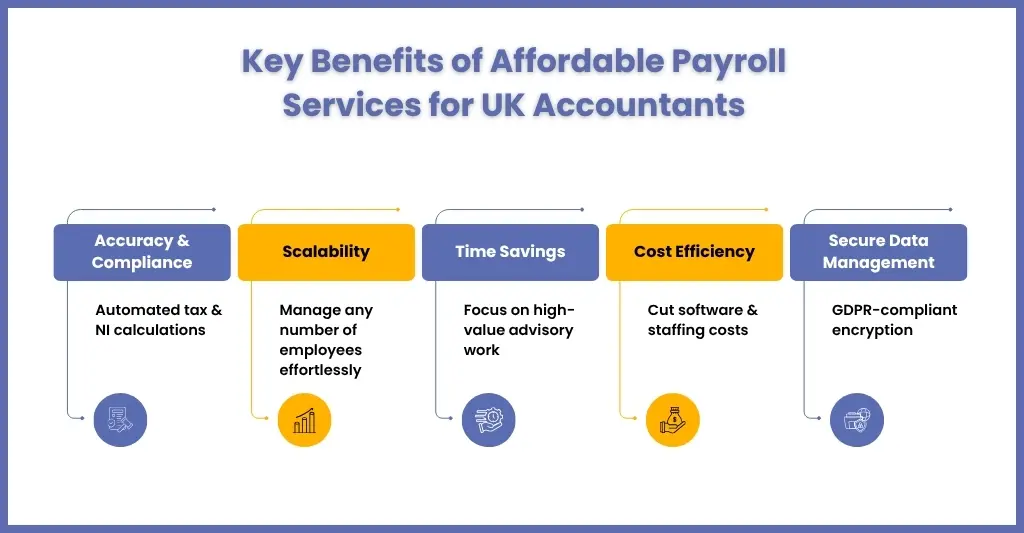

- Key Benefits of Affordable Payroll Services for UK Accountants

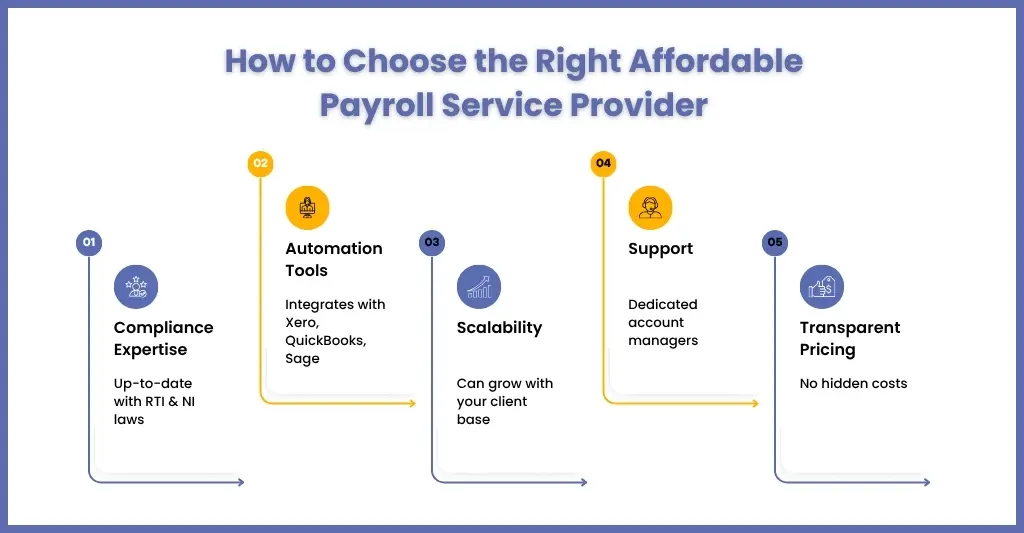

- How to Choose the Right Affordable Payroll Service Provider for Your Accounting Firm

- Common Challenges in Payroll Services for Accountants and How to Overcome Them

- FAQ: Affordable Payroll Services for UK Accountants

- Conclusion

Running an accounting practice in the UK means dealing with constant payroll compliance updates, HMRC filing deadlines, and client expectations. That’s why many firms now rely on affordable payroll services for UK accountants to save time, reduce errors, and stay compliant with HMRC payroll regulations.

Any mistakes, delays, or non-compliance during payroll processing will result in penalties, frustrated clients, and a waste of time. Payroll errors must be taken seriously, as recent HMRC statistics indicate that they are one of the top reasons small businesses face compliance issues, with fines averaging £1,200 per incident.

Handling these errors or preventing them through in-house resources is out of the question due to the complexities and costs involved with regard to resources. The only viable option you are left with is payroll outsourcing services. Through it, you can save time, reduce operating costs, and deliver error-free and compliant payroll for your clients, without lowering quality.

In this blog, we will explore the reasons why affordable payroll services are necessary, their benefits, how to select the right provider, and strategies for overcoming payroll challenges.

Let’s begin.

Why Affordable Payroll Services Are Essential for UK Accountants

Running payroll for your clients in-house is a resource-consuming exercise. It involves training your staff and that of your clients, subscribing to the latest and best accounting software, and staying updated and compliant with the latest UK regulations. These pain points can be addressed easily through payroll outsourcing services instead of in-house payroll. Here’s how they will achieve that:

Reducing Costs

A professional payroll outsourcing solution always offers a flexible pricing structure, making it accessible to all practices. You can access professional services and payroll expertise without incurring additional costs associated with hiring in-house staff or investing in expensive software. By paying only for the services availed, you can save and redirect the funds towards other high-value initiatives.

Saving Time

No reputable payroll outsourcing provider is offering payroll services without automation. Routine payroll tasks, such as payslip generation, tax calculation, and pension deductions, are time-consuming, and that’s why they are now automated. It has helped reduce human errors and speed up processing time. The result is timely payroll delivery, freeing up your human resources for client-focused services and advisory work.

Ensuring Compliance

UK payroll regulations are constantly changing, including Real-Time Information (RTI) reporting requirements, auto-enrolment obligations, and adjustments to tax thresholds. A professional and experienced payroll service provider employs payroll experts who will monitor all regular updates on your behalf and ensure your client’s compliance with them. This will save your clients from penalties or client dissatisfaction.

By adopting the best payroll outsourcing company, you can redirect your staff’s focus from routine processing to strategic client advisory services, thereby enhancing client satisfaction and driving business growth.

Key Benefits of Affordable Payroll Services for UK Accountants

Partnering your accounting practice with a professional payroll outsourcing service provider will unlock a range of benefits that extend beyond cost savings. Here are some of the benefits you will enjoy:

Accuracy and Compliance

Most payroll outsourcing solutions are automated, ensuring all calculations for tax deductions, National Insurance contributions, and pension allocations are accurate. This way, your accountant can reduce human error and stay compliant with HMRC regulations, Real-Time Information (RTI) reporting requirements, and auto-enrolment obligations.

Scalability

It does not matter if you are a client, an employee, or have five employees or hundreds; a professional payroll service provider will scale according to your needs. There is no requirement for hiring additional staff or investing in additional infrastructure. This flexibility, provided by your payroll outsourcing partner, helps you handle workload fluctuations with ease.

Time Savings

All professional payroll outsourcing providers have automated payroll tasks that consume a significant amount of time, such as generating payslips, performing tax calculations, and managing pension contributions. By freeing up time for your accountants, you can direct them towards high-value tasks such as advisory services, client engagement, and business development.

Cost Efficiency

Using the services of outsourced payroll providers, you can keep your in-house staff small and avoid the need for buying expensive accounting software. By only paying for the services availed, you can achieve cost savings while maintaining quality payroll processing.

Secure Data Management

The data security component has become a crucial aspect in payroll outsourcing, particularly with the increased digitisation. Respected payroll service providers place a high importance on data security, as they handle sensitive employee and client information.

To enforce data security, they implement robust, GDPR-compliant systems with encryption and secure cloud storage. With these measures, your client’s data remains safe from cyber threats, giving your clients and you peace of mind.

How to Choose the Right Affordable Payroll Service Provider for Your Accounting Firm

To enjoy all the benefits mentioned above, you will need to select a service provider that suits your needs. The right payroll service provider will streamline your payroll operations, freeing your team for advisory work. Here are some factors to consider while making choices:

Compliance Expertise

UK payroll regulations are constantly evolving, including Real-Time Information (RTI) submissions, auto-enrolment regulations, and National Insurance updates. An experienced service provider will always stay up-to-date with HMRC guidance, thus ensuring accuracy and compliance. Therefore, choose a provider that has a thorough understanding of UK payroll laws.

Technology and Automation

Modern payroll outsourcing services utilise the latest accounting software and AI tools to simplify payroll management. Hence, look for providers that offer:

- Automated calculations for salaries, taxes, and pensions.

- Real-time reporting dashboards for easy client and internal visibility.

- Seamless integration with existing accounting software and client management systems.

These AI tools reduce manual errors, expedite the process, and ensure that payroll tasks are completed on time.

Scalability

As your clients grow, so will their transaction volume, and a good payroll provider will provide you with valuable assistance in scaling up. Whether you handle payroll for ten or hundreds of employees across multiple clients, a professional provider can manage it without requiring additional staff or investment in new tools.

Support and Training

Every accounting practice requires support in handling complex payroll requirements, hence choose a provider that offers dedicated support via account managers, helplines, and onboarding assistance. Your team will also require training to understand specific new platforms that come with outsourcing, and support in training is essential from the provider. It will ensure smooth transitions and keep the payroll running smoothly.

Transparent Pricing

Yes, cost is an important factor in selecting a payroll provider. Select a provider that clearly displays its prices upfront, without any hidden fees. Prefer a provider that offers flexible pricing models and choose one that meets your budget. Transparent pricing also facilitates accurate forecasting of operational costs and effective planning for growth.

Common Challenges in Payroll Services for Accountants and How to Overcome Them

While working on payroll for your clients, you must have encountered multiple challenges. Understanding these challenges will help you tackle them better and further streamline your payroll process.

Manual Errors

Manual errors, such as incorrect tax deductions, miscalculated pensions, and inaccurate payslips, are a common challenge that arises from manual processing. Such mistakes will lead to penalties and client frustration.

How to overcome: Automate payroll calculations using payroll services. Such automation will ensure salaries, taxes, and contributions are calculated accurately every pay period, reducing errors and saving time for your accounting team.

Regulatory Changes

UK payroll regulations are constantly changing, including Real-Time Information (RTI) reporting requirements, auto-enrolment updates, and National Insurance threshold adjustments. Rightly so, it is challenging to keep track of these changes through your in-house teams.

How to overcome: Partner with a payroll service provider that will monitor and ensure compliance with regulatory updates. They achieve that through dedicated payroll compliance teams, thus reducing the risk of fines.

Time-Consuming Processes

Multiple payroll tasks are time-consuming, such as generating payslips, submitting RTI reports to HMRC, and preparing monthly and year-end reports.

How to overcome it: A Payroll service provider can streamline the entire process and handle repetitive and routine tasks. This way, your resources are freed up for advisory and client engagement.

Data Security Concerns

Payroll involves handling sensitive data of your clients’ employees, which includes bank information, personal details, and tax records. Any breaches will result in GDPR violations and reputational damages.

How to overcome it: Hence, select a service provider that follows GDPR compliance strictly and implements encrypted data storage practices.

FAQ: Affordable Payroll Services for UK Accountants

Affordable payroll services offer cost-effective pricing models, automation tools, and scalable solutions that reduce the need for additional staff or in-house software, making payroll management economical without compromising accuracy.

Yes. Reputable, affordable payroll services ensure full compliance with HMRC rules, including Real-Time Information (RTI) reporting, auto-enrolment, and accurate calculation of taxes and National Insurance contributions.

Outsourcing is often a cost-effective way to access top-tier talent and maintain agile business operations.

Yes, you will get affordable payroll pricing, especially if you choose a service provide that meets your requirements. Here’s is how you can find one:

a. Go for a packaged service with essential payroll features only

b. Compare prices with other service providers

c. Uses automated payroll software

d. Check for hidden costs

Conclusion

We understand the importance of ensuring timely, accurate, and compliant payroll for your practice. However, complexities in the UK accounting environment have made in-house solutions time-consuming and costly. This leaves you with the payroll outsourcing option, which not only saves your time and expenses but also allows your accountants to focus on high-value advisory services to your clients.

When it comes to payroll outsourcing, none can match the expertise of Corient and its payroll experts. Since 2011, Corient has made efforts in designing payroll services for practices of all sizes. With qualified staff, expertise in payroll applications, secure data handling, and scalable solutions, Corient ensures your firm can streamline payroll, minimise errors, and deliver exceptional client service, without breaking the budget.

Simplify payroll, reduce costs, and deliver 100% HMRC-compliant results with Corient’s affordable payroll services.

Connect with us and book your free consultation today.