10 Best Payroll Outsourcing Companies UK (2025 Edition)

Is the payroll responsibility of your clients becoming increasingly difficult due to frequent updates from HMRC, auto‑enrolment duties, and time spent reconciling pay runs? It is the same story for every accounting practice in the UK. However, this difficulty has led to the practice of outsourcing payroll. To get the maximum benefit from it, you will need to select one of the best payroll outsourcing companies in the UK.

It is a trend among your competitors to outsource payroll, in fact, it is helping them to stay competitive in the ruthless UK accounting market. Let’s understand why getting the best payroll company outsourcing services is important for your clients, and how to identify and get one.

Let’s get started.

Why Choose Top-Rated Payroll Services for UK Businesses?

To gain the maximum benefits from payroll outsourcing, you will need to choose a professional and experienced payroll outsourcing service provider. These benefits are as follows:

100% Compliance

A professional payroll outsourcing provider always keeps a tab on the latest happenings in the HMRC payroll regulations and incorporates the latest changes, thus maintaining 100% compliance with PAYE, RTI, National Insurance and pensions.

Saving a Lot of Time

A top payroll outsourcing firm will always stay a step ahead when it comes to incorporating the latest tech to quicken the payroll process, including AI tools. These tools have helped practices to conduct payroll accurately and on time.

Scalability

It does not matter if you are handling the payroll of 5 or 500 through outsourcing; it can be managed without expanding your staff or spending on overheads.

Data Security

Top payroll outsourcing providers follow the UK GAAP and Data Protection Act 2018, which ensures strict payroll data protection, including name, addresses, employee ID, and so on.

How to Identify the Best Payroll Outsourcing Company in the UK?

Here are some points that will help you in identifying the best payroll outsourcing service provider for your practice. These points are:

HMRC Recognition

Choose a provider that uses HMRC-recognised payroll software or is directly listed by HMRC as a compliant payroll processor. This ensures that RTI submissions, PAYE, NI, and pension auto-enrolments are processed without issues.

Cloud-Based Integration

Professional service providers always make an effort to seamlessly integrate with your accounting payroll software (e.g., Xero, QuickBooks, Sage). Such integration saves you from manual entry and simplifies reconciliation and payroll reporting.

Transparent Pricing Models

Find a service provider that offers clear pricing models, whether per pay run, per employee, or a fixed monthly fee and is flexible in its pricing. Such transparency from the service provider will avoid instances of hidden costs for setup, support, or year-end reporting.

Turnaround Time and Accuracy

Ask the service provider about their turnaround times for monthly payroll and how to handle last-minute changes. The best providers offer a 24 to 48-hour turnaround with 99.9% accuracy in pay runs.

Security and GDPR Compliance

No professional accounting provider will take payroll data security lightly. Hence, take a look at whether the provider has secure service portal, encrypted data transfer, and has GDPR protocols in place before you outsource your payroll.

UK-Based Support Team

Having a UK-based support team makes communication easier, especially during HMRC deadlines or P11D/P60 filings. It also ensures the provider understands local payroll intricacies.

Proven Track Record and Client Reviews

Before choosing an accounting outsourcing service provider, review their case studies, client testimonials, and online reviews. By reviewing them, you will gain insight into their experience, the solutions they have offered to their clients, and their plans.

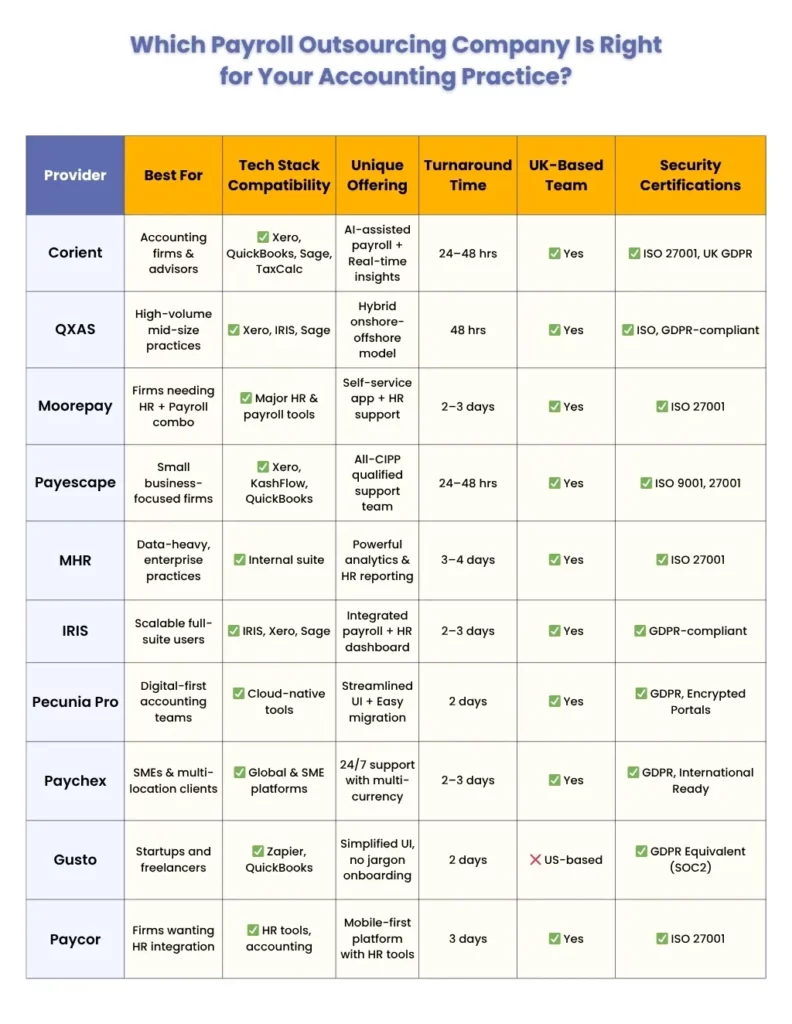

The 10 Best Payroll Outsourcing Companies in the UK

1. Corient Business Solutions

Corient has consistently been the first choice among 200+ accounting practices by offering up-to-date accounting services. Since 2011, Corient has built its reputation as a reliable accounting outsourcing service provider with a strong ground presence in the UK accounting market. Accountants old and new are placing their trust in our top-notch accounting services, from bookkeeping and payroll to year-end services.

Our accountants are well-versed in the latest UK accounting standards, MTD compliance, local laws, AI tools and are experts in the use of Xero, QuickBooks, TaxCalc, and Sage. The result is an accounting service that is compliant, accurate, and follows the latest UK accounting standards.

Strengths:

- ACCA-certified accountants

- Fully compliant with UK GDPR and ISO 27001 for payroll data security

- Well-versed in the latest UK accounting standards, MTD compliance

- Strong ground presence in the UK accounting market

- Experts in the use of Sage, Xero, QuickBooks, and TaxCalc

- Global presence in the USA, UK and India

2. QX Accounting Services (QXAS)

QX accounting service has considerable experience in supporting accounting firms based in the UK. It offers end-to-end solutions across bookkeeping, year-end accounts, tax, payroll, and audit.

Strengths:

- Dedicated offshore and onshore talent

- GDPR & ISO-certified payroll data security infrastructure

- Offers flexible models for success

- Proven track record with accounting firms

3. Moorepay

Moorepay has been at the top due to its high level of expertise, and it gives accountants access to it. The payroll specialist of Moorepay has helped countless accountants with HR payroll and tax matters. This helpful feature offers incredible support to companies, especially small businesses and those without an accounting team.

Strengths:

- Access to experts

- Smooth onboarding process

- Offers an employee self-service mobile app

- Integrates with the payroll system

4. Payescape

Payscape has designed payroll solutions that are ideal for practices handling accounts of small businesses. Multiple accounting practices that primarily serve UK small businesses use the services of Payescape.

Strengths:

- Ideal for practices handling accounts of small businesses

- Integrates with third-party accounting and payroll software

- All client services team members are CIPP qualified

- ISO 27001 and ISO 9001 certifications

5. MHR

MHR has significant computing power and will be able to process your payroll and give you access to detailed reports. The payroll services of this company are ideal for accounting teams that need to present their performance data to key stakeholders.

Strengths:

- Significant data-crunching capabilities

- Access to detailed reports

- ISO 27001 accreditation

- Comes with an integrated HR platform

6. IRIS

IRIS is a comprehensive payroll and HR software solution for practices handling clients of all sizes. With this service, you can manage payroll processes for your clients quickly and efficiently while ensuring accuracy and compliance with applicable laws.

Strength:

- Comprehensive suite of services

- Dedicated support team to assist with your HR and payroll needs

7. Pecunia Pro

Pecunia Pro is a cloud-based payroll service provider that offers a range of features and services. They have a name in helping businesses and practice in quickening the payroll process while maintaining accuracy and compliance with HMRC laws.

Strengths:

- Comprehensive range of services

- Secure online platform for easy payroll management

8. Paychex

Paychex is a highly respected payroll solutions provider specialising in small and mid-sized businesses. Their payroll services are scalable and utilise the latest technology.

Strengths:

- Scalable services that grow with your business

- 24/7 customer support

9. Gusto

Gusto is a modern cloud-based payroll solution provider focused on serving practices that handle the payroll of small to medium-sized businesses. With its customer-friendly user interface and service, Gusto helps streamline the payroll process with an emphasis on automation and ease of use.

Strengths:

- Excellent customer service with accessible support

- Constant innovations and updates to the service

10. Paycor

Paycor provides integrated HR and managed payroll services, making it suitable for practices that handle accounts of small and mid-sized companies. They offer modern and intuitive platforms that simplify the payroll process.

Strengths:

- User-friendly platform with strong mobile functionality

- Excellent customer service

People Also Ask

The best payroll outsourcing company for you will be the one that fulfils your payroll requirements. For instance, if you’re an accounting practice looking for flexibility and a UK-based team, Corient is a strong contender, praised for quick onboarding, cloud-based systems, and HMRC-aligned service.

When choosing a provider, look out for:

a. HMRC-recognised software for PAYE, RTI, pensions, etc.

b. CIPP accreditation or Payroll Assurance Scheme credentials

c. UK-based support teams that understand local tax rules

d. Flexible pricing models (per pay run, monthly retainer, etc.)

e. Data security (GDPR compliance, secure service portal)

f. Integration with accounting platforms like Xero, Sage or IRIS

g. Custom reporting & automation to reduce admin and errors

Yes, reputable outsourced payroll services in the UK are HMRC-compliant. Leading providers like Corient use HMRC-approved payroll software, keep up with UK payroll legislation, and ensure real time RTI submissions, pension auto-enrolment and accurate year-end reporting (e.g., P60, P11D).

Some of the best practices for outsourcing payroll are choosing a service provider that uses:

Use HMRC-Compliant Payroll Software

Staying updated with the latest payroll legislation

Implementing data security measures

Maintain clear communication with practices

Regular audits and proper record keeping

Regular training of staff

Choose a payroll company with proven UK payroll experience, strong HMRC compliance, secure data handling, and scalable technology. Reliable support, clear processes, and the ability to grow with your clients are more important than simply choosing the lowest-cost provider.

Final Thoughts: Choose the Best Payroll Partner for Your Business

The majority of accounting practices prefer to use the payroll outsourcing services offered by service providers, and you must have noticed above that there is no shortage of them. The right provider will not only reduce burden and risk but also free you to concentrate on strategic advisory work and nurturing client relationships.

If you are looking for a long-term partnership with access to expertise and excellent customer services then Corient should be your first choice. Our clients highly regard us due to our accounting services, including payroll, that meet their requirements.

Since 2011, we have focused on incorporating the latest tech, including AI and on updating to the latest UK accounting standards, thus giving our clients managed payroll services that are compliant and updated. Ready to switch to a trusted payroll partner? Get started with Corient via our contact form and let our executive explain about us in detail.