The Role of Payroll in Employee Retention: Why Timely and Accurate Payments Matter

The greatest strength of your client’s business is their highly experienced staff, and keeping them satisfied is vital. Keeping the staff happy is important for the survival and expansion of your clients, and one way to do that is by having an efficient payroll system. However, maintaining an efficient payroll system is too burdensome for your clients because they want accounting talent. For this reason, many businesses have placed their faith in accounting firms to handle their payroll responsibilities. However, that’s not the end of the story.

A survey conducted by Sellick Partnership has found that almost half of the accountants in the UK (49%) have changed their jobs in the past two years. Additionally, any of these accountants are not satisfied with their jobs, which makes it challenging for you to offer accurate payroll services and leads to employee retention challenges for your clients.

Therefore, to overcome this situation, you will have to understand the importance of employee retention and explore various options, including payroll outsourcing, that will help you improve your client’s employee retention.

Understanding Employee Retention

Your clients must focus on employee retention to make a business sustainable, productive, and profitable. High turnover rates will lead to additional recruitment costs, loss of expertise, and disruption in the workflow. Consequently, to retain productive employees, your clients must create a positive work environment, offer effective compensation through payroll services, and offer career growth opportunities.

The Role of Payroll in Employee Retention

An efficient and accurate payroll plays a very important role in employee retention by achieving the following results:

Timely and Accurate Payments Build Trust

Employees’ financial stability will depend on accurate payroll, and any salary delays or inaccuracies will only dissatisfy them. As a result, a well-managed payroll system will ensure the employee’s loyalty towards your clients.

Compliance and Transparency Enhance Job Security

A fully compliant payroll system will ensure minimum errors in tax deductions, pensions, and benefits, which can cause frustration. When transparency is maintained in following the regulations, employees feel more secure in their jobs.

Competitive Compensation and Benefits Drive Engagement

A structured payroll system that integrates bonuses, incentives, and overtime pay motivates employees to perform better. Likewise, access to benefits like health insurance, retirement plans, and reimbursements improves job satisfaction and retention.

An effective payroll system integrates bonuses, incentives, and overtime pay to motivate employees to perform better. When employees have access to health insurance, retirement plans, and reimbursements, their job satisfaction improves.

Payroll Flexibility Improves Employee Experience

Your clients’ employees expect flexibility in payment options, and a flexible payroll will ensure that through early wage access, salary advances, or direct deposits. Therefore, such initiatives will give your clients’ employees financial security.

Payroll Insights Support Career Growth

Payroll analytics can provide insights into salary progression, appraisals, and skill-based incentives. However, a structured payroll system aligns compensation with career development, making your client’s employees feel rewarded and valued.

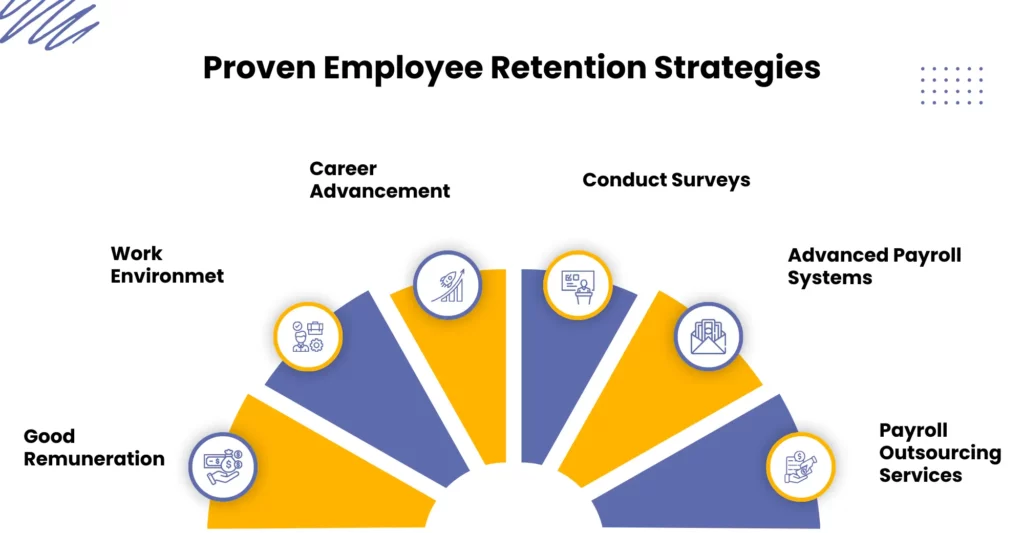

Proven Employee Retention Strategies

Your clients can maintain an effective workforce only through employee retention, which will reduce the costs associated with high turnover. There are many strategies through which your client and your accounting firm can maintain and increase employee satisfaction, thus helping them build a loyal and productive team. Some of those employee retention strategies are:

Good Remuneration

When your client offers good salaries, performance-based bonuses, and benefits, it automatically enhances the employees’ job satisfaction, motivates them to work better, and reduces the risk of them seeking opportunities elsewhere.

Work Environment

Along with financial incentives, employees will also appreciate a supportive and less stressful work environment. In fact, employees tend to stick to an organisation that offers work-life balance, flexibility, and career advancement.

Career Advancement

Your clients must focus on creating opportunities for your employees to grow by offering them mentorship programs and skill upgrade training, thus keeping them engaged. By conducting regular performance reviews and giving their employees constructive feedback, employees will understand their growth trajectory.

Conduct Surveys

Regular employee surveys and engagement assessments allow businesses to proactively address concerns and tailor retention strategies to meet workforce expectations.

Advanced Payroll Systems

An automated payroll system plays a vital role in strengthening employee retention efforts. When your clients invest in automated systems, they can effectively streamline payroll operations, thus ensuring transparency in compensation and benefits.

Payroll Outsourcing Services

Businesses usually do not handle payroll by themselves because it is a time-consuming and resource-intensive process; hence, they depend on accounting firms like yours to do the needful. However, these days, even accounting practices are facing challenges in offering effective payroll services due to complex payroll regulations, scarcity of talent, rising payroll operation costs, and so on. Therefore, payroll outsourcing services are being preferred by multiple accounting practices.

The payroll outsourcing cost is less compared to in-house payroll and your clients will get access to payroll experts. Through payroll outsourcing, your capacity is enhanced without compromising on quality. Hence, you ensure that your client’s employees get fast, accurate, and quality payroll services, thus keeping them in the good books.

The Impact of Payroll Errors on Your Client’s Employee Turnover

Payroll accuracy plays a major factor in employee retention, and when your client’s employee faces issues such as late payments, errors in tax deductions or missing benefits, it affects your trustworthiness in the eyes of your clients. In the UK, payroll regulations and employment laws are strictly enforced, and any payroll errors detected by regulators can lead to fines and reputational damages. Hence, you need to maintain accuracy and timeliness while offering payroll services.

Furthermore, frequent payroll errors will lead to unnecessary stress for your employees, leading to disappointment and anger against their employer. If they face repeated errors in salary payments or payroll deductions, expect them to raise questions regarding their employer and your practice’s credibility. Such errors will only increase turnover rates. Hence, to avoid this, you will have to proactively implement automated payroll systems, conduct regular audits, and stay updated with the latest UK payroll regulations.

By providing accurate and efficient payroll services, you can help your clients build back their employee’s trust and loyalty. By ensuring timely and accurate payments and all benefits are accounted for, you are not helping your client’s reputation but building your reputation for offering effective payroll services. You can build on your success by exploring the option of payroll outsourcing, which will give you access to payroll expertise and technology. Such expertise and payroll tech will enhance your capacity, speed up payroll processing, and save considerable time and resources without any quality compromise.

Employee Retention Metrics and How to Measure Success

Your client’s success in retaining their employees can be measured only by fulfilling specific employee retention metrics. By measuring these metrics, you can get an insight into turnover patterns, employee satisfaction, and long-term workforce stability. Since you will be handling the payroll responsibilities on behalf of your clients, you must have a better understanding of these retention metrics, thus helping your clients take advanced steps in reducing turnover rates.

Some of those key metrics which will need your attention are:

- Employee Turnover Rate: Calculates the percentage of employees leaving within a specific period.

- Voluntary vs. Involuntary Turnover: Distinguishes between employees resigning and those being let go.

- Average Tenure: This metric reflects how long your client’s employees are staying within the company.

- Retention Rate by Department or Role: It helps pinpoint areas where turnover is highest, allowing your clients to address specific challenges.

- Absenteeism and Employee Engagement Scores: These two metrics will help you better understand job satisfaction and potential retention risks.

How Outsourcing Payroll will Enhance Employee Retention

One of the most significant ways to satisfy your client’s employees is by ensuring they get their pay accurately and on time. Any mistakes in salary payments, tax deductions, or benefits processing can lead to financial stress and frustration among employees, increasing turnover rates. Currently, the situation is such that even experienced accounting practices like yours are finding it difficult to cope with the complexities of payroll regulations, thus increasing the risk of compliance errors, adding to your administrative burden and increasing inefficiencies.

However, by outsourcing payroll to a professional accounting firm, you can enhance accuracy, improve employee trust, and create a more stable work environment. Here is how outsourcing payroll will help in retaining your client’s employees:

Accuracy and Timeliness in Salary Payments

Outsourcing payroll eliminates errors and delays in salary processing, ensuring employees receive their wages on time and without discrepancies. Consequently, consistent and accurate payroll fosters trust, reducing dissatisfaction and the likelihood of employees seeking alternative job opportunities.

Compliance with UK Payroll Regulations

Payroll outsourcing providers stay updated with UK tax laws, pension schemes, and employment regulations, thereby helping businesses avoid costly mistakes and penalties. As a result, ensuring compliance with HMRC guidelines enhances employees’ confidence in their employer’s financial management.

Access to Employee Benefits and Incentives

Outsourced payroll services can efficiently manage pensions, bonuses, and other benefits, ensuring employees receive their entitlements without delays. A well-structured benefits package contributes to higher job satisfaction and long-term retention.

Reduced Administrative Burden for Employers

Handling payroll in-house can be time-consuming and error-prone. Outsourcing allows business owners and HR teams to focus on employee engagement, training, and retention strategies instead of payroll processing complexities.

Enhanced Data Security and Confidentiality

Payroll errors and data breaches can damage employee trust. Professional payroll service providers use advanced security measures to protect sensitive employee information, ensuring confidentiality and compliance with GDPR.

Scalability and Flexibility for Business Growth

As businesses grow, payroll management becomes more complex. Outsourcing provides scalable solutions, ensuring seamless payroll processing for an expanding workforce and supporting employee satisfaction and retention.

By outsourcing payroll, your practice can streamline operations, reduce errors, and build stronger employee relationships for your clients. UK accounting firms offering outsourced payroll services can help clients improve retention by ensuring financial stability, compliance, and efficiency, ultimately fostering a positive workplace environment.

Conclusion

Your clients depend on your payroll services to give the employees accurate pay cheques on time. Therefore, for this reason, we have prepared this guide so that you get a detailed understanding of how your accurate payroll services will help your clients retain the best of talent and put in a good word of mouth for your payroll services. Among the multiple strategies mentioned for employee retention, payroll outsourcing is worth exploring, and it is the talk of the town.

You don’t have to put in much effort as there are multiple accounting outsourcing service providers in the UK offering payroll outsourcing, and among them, Corient has created quite a name, especially among accounting practices. An established and dependable partner for multiple accounting practices in the UK, Corient has built its brand by offering accurate and fast payroll services. Furthermore, it has now expanded into bookkeeping, year-end, corporation tax, VAT, audit, and management account outsourcing services. As a result, our services have brought incremental and transformational changes for many practices, and we can achieve the same for you. For any doubts or further clarification, you can write down on our website contact form; our executives will get back to you shortly.

We wish you the best of luck, and looking forward to an expansive relationship.