DELEGATING THE CHALLENGES OF R&D CLAIMS

The numerous claims are made under the RD Tax Credit Outsourcing Scheme which continues to increase annually. Although the management and submission of R&D Tax Claims can be complex but it still remains one of the most effective ways for businesses to reduce their tax liabilities.

Don't allow the complexities to obstruct your ability to take on more R&D tax return work. Our RD Tax Credit Outsourcing Team is capable of handling everything from preparing R&D financials to technical reports. We also provide ongoing data review for your clients and proactively file claims throughout the year, ensuring you don't miss out on this opportunity

Our professional team utilizes secure cloud-based technology to make our working papers and supporting documentation accessible for your review. Corient Business Solutions is also open to utilizing your firm's document management systems to record our work if that is your preference.

Don't allow the complexities to obstruct your ability to take on more R&D tax return work. Our RD Tax Credit Outsourcing Team is capable of handling everything from preparing R&D financials to technical reports. We also provide ongoing data review for your clients and proactively file claims throughout the year, ensuring you don't miss out on this opportunity

Our professional team utilizes secure cloud-based technology to make our working papers and supporting documentation accessible for your review. Corient Business Solutions is also open to utilizing your firm's document management systems to record our work if that is your preference.

GDPR & Data Protection

Compliance with GDPR and ISO27001 is a Corient’s cornerstone, ensuring complete security to your client data and offering you peace of mind.

Our teams have extensive experience and certification in all major cloud-based accounting software, which we access from our secure servers. Alternatively, if you prefer, we can establish secure remote login arrangements to access your firm’s server. You can fully rely on our team of knowledgeable and experienced professionals to provide you with bookkeeping services as per your requirements.

Our teams have extensive experience and certification in all major cloud-based accounting software, which we access from our secure servers. Alternatively, if you prefer, we can establish secure remote login arrangements to access your firm’s server. You can fully rely on our team of knowledgeable and experienced professionals to provide you with bookkeeping services as per your requirements.

Business Tax Support

Scope of the work

You may rely on our skilled business tax support team to deliver the following services based on your requirements:

Our processes include

You are required to provide

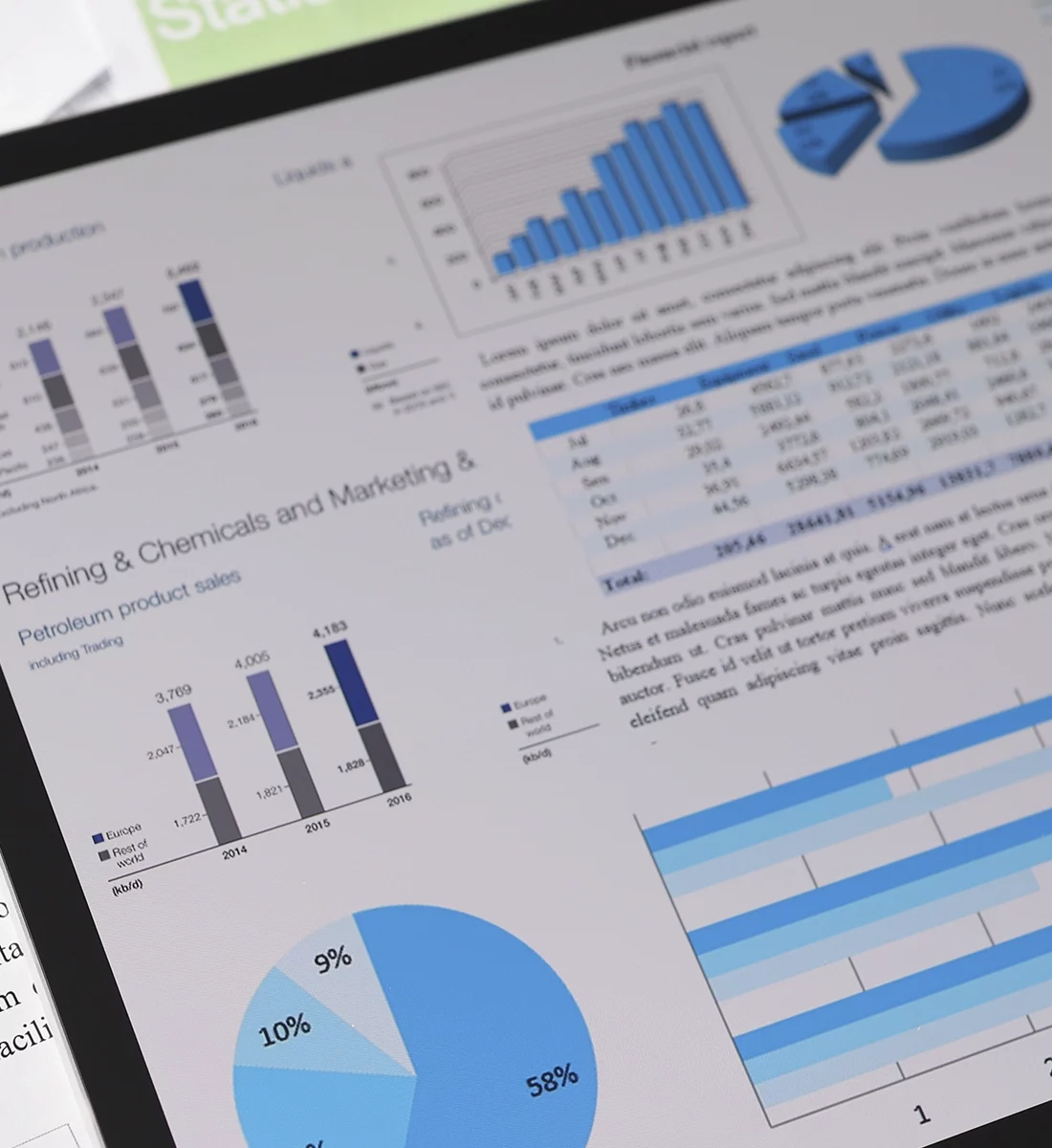

Reports generated

Our processes include

You are required to provide

Reports generated

Schedule a Call With Us Today

If you want to take your accounting firm to the next level and deliver effective R&D credit outsourcing services while decreasing costs. Use the form to drop us an e-mail or contact us on our +442476103333